Crypto options trading is becoming more popular among traders who want flexible ways to profit in any market condition. Unlike regular buying and selling (spot trading), options let you plan your moves ahead and manage risk better. You don’t need to buy the actual crypto. Instead, you get the right to trade it later at a set price.

In this guide, we will review the 7 best crypto options trading platforms. We will also explain what options trading is, how to choose the best exchange, and the risks and benefits of trading crypto options.

List of the Top Crypto Options Trading Platforms

We have reviewed over 30 different best crypto options exchanges based on their fees, supported coins, options types, user interface, and more. Here is our list of the 7 best crypto exchanges for options trading:

- Binance: Overall best Bitcoin options trading platform

- Bybit: Best for flexible expiry options and portfolio margin

- OKX: Best for beginners using the simple options interface

- Deribit: Best for deep liquidity and advanced options tools

- HTX: Best for both European and American-style options

- Stryke: Best decentralized platform for short-term options

- Delta Exchange: Best crypto options trading app

Best Crypto Options Platform Comparison

| Platform | Option Types | Supported Coins | Options Trading Fees | Max Leverage |

| Binance | European-style | BTC, ETH, SOL, XRP, BNB, DOGE | 0.03% per trade

0.015% exercise fee |

125x |

| Bybit | European-style | BTC, ETH, SOL | 0.02% maker

0.3% taker 0.015% delivery fee |

100x |

| OKX | European-style | BTC, ETH | 0.03% maker/taker | 100x |

| Deribit | European-style | BTC, ETH, SOL, MATIC, XRP, PAXG | 0.03% maker/taker

(Capped at 12.5% of option price) |

50x |

| HTX | European & American-style | BTC, ETH | 0.02% maker/taker | 125x |

| Stryke | European & American-style | WETH, WBTC, ARB, $BRETT, $BOOP | 3-4% of options premium

+1% auto-exercise fee |

100x |

| Delta Exchange | European-style | BTC, ETH | 0.03% per trade | 100x |

Top Crypto Options Trading Platforms & Apps

1. Binance: Overall best Bitcoin options trading platform

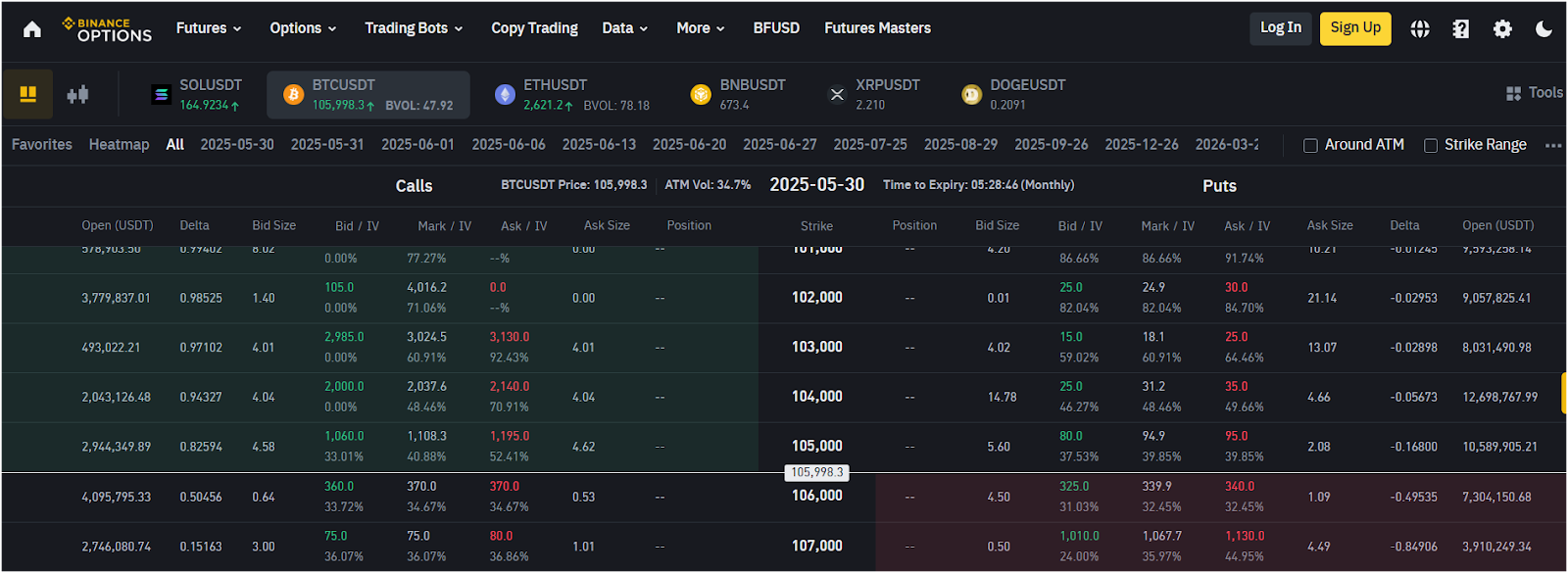

Binance is one of the largest cryptocurrency exchanges globally, serving over 250 million users since its launch in 2017. It’s the best crypto options trading platform due to its high liquidity and extensive features. Binance supports options trading for major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), XRP, Dogecoin (DOGE), and Solana (SOL). Its options are European-style, and they settle in USDT.

Traders can choose from various strike prices and expiration dates, ranging from daily to monthly. The platform’s interface suits both new and experienced traders. Beginners find it straightforward to use, while advanced users appreciate tools like TradingView charts, diverse order types, and detailed options data, including volume and implied volatility.

Binance offers competitive fees, charging 0.03% for trading and 0.015% for exercising options. Holding BNB can lower fees further. The platform also provides up to 125x leverage on perpetual futures contracts. Security is a strong focus, with measures like two-factor authentication, cold storage, and the Secure Asset Fund for Users (SAFU) to safeguard funds in extreme scenarios.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style | BTC, ETH, SOL, XRP, BNB, and DOGE | 0.03% per trade | 125x |

2. Bybit: Best for flexible expiry options and portfolio margin

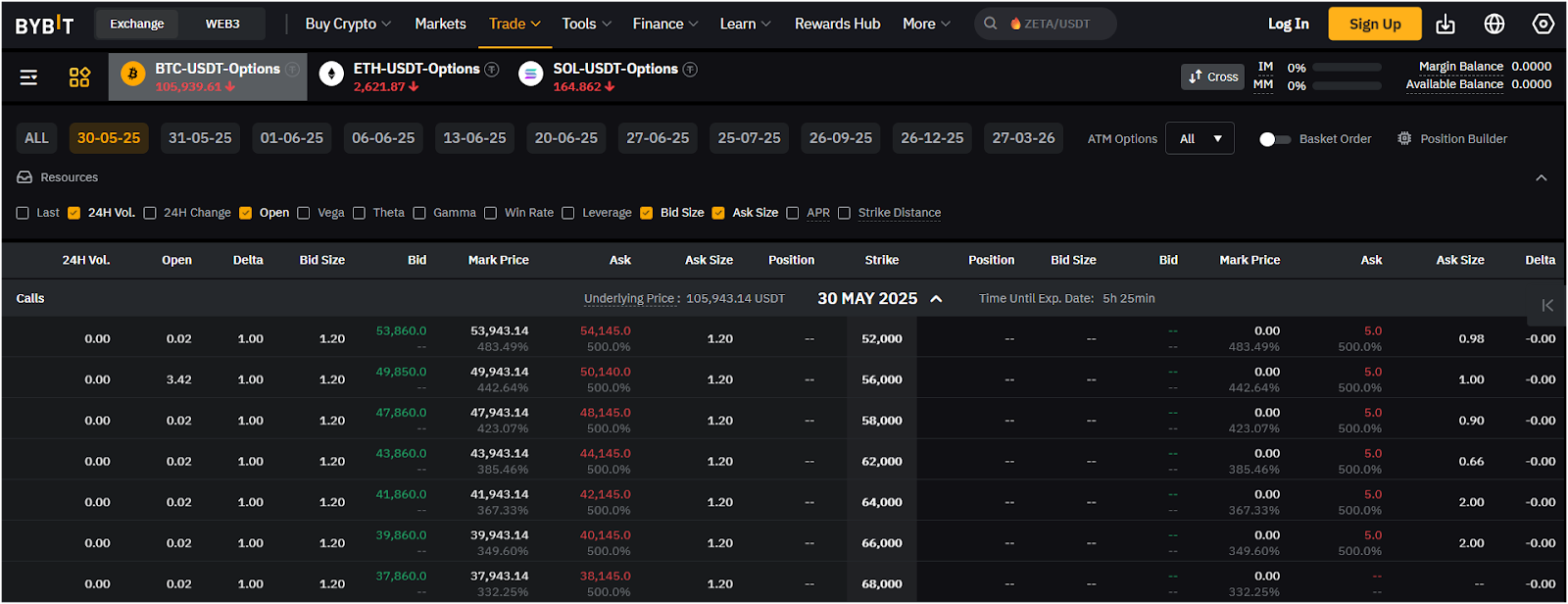

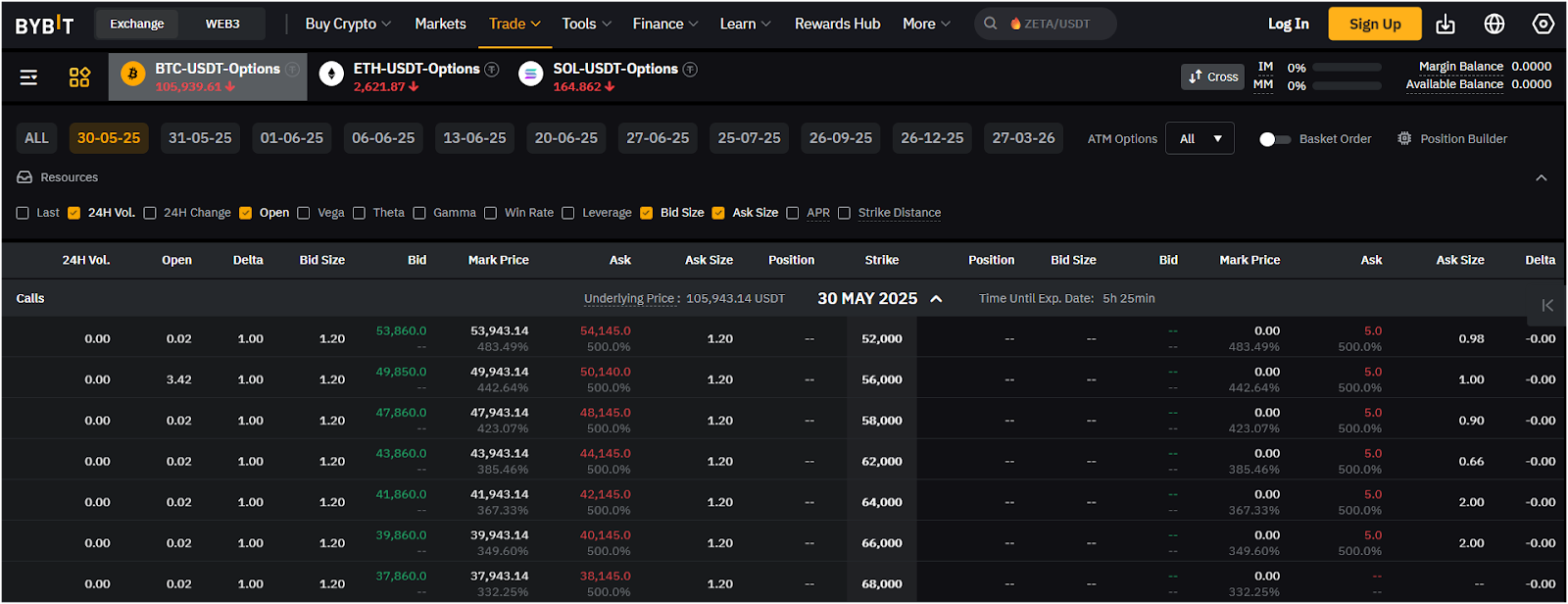

Bybit is another best crypto options trading platforms in the world with high trading volume. It offers European-style options, meaning you can only exercise them at expiration. It supports options for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), all settled in USDT. Bybit provides a wide range of expiration dates – daily, bi-daily, weekly, bi-weekly, monthly, bi-monthly, and quarterly.

For beginners, Bybit’s “Easy Options” interface simplifies trading with clear tools like “Option Explore,” while “Option Pro” caters to pros with detailed option chains and multi-leg orders. The platform also offers a demo trading mode, letting you practice strategies without risking real money. Plus, Bybit’s portfolio margin feature is a game-changer, letting traders use their entire portfolio to reduce margin requirements and boost capital efficiency.

Bybit’s not available in the U.S. due to regulations, but it operates in over 180 countries. It also supports spot trading, futures, and perpetual contracts. The platform’s fees are straightforward and low. Makers and takers pay as little as 0.01% to 0.03%, depending on trading volume, with a delivery fee of 0.015% and a possible 0.2% liquidation fee.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style | BTC, ETH, and SOL | 0.02% maker and 0.3% taker | 100x |

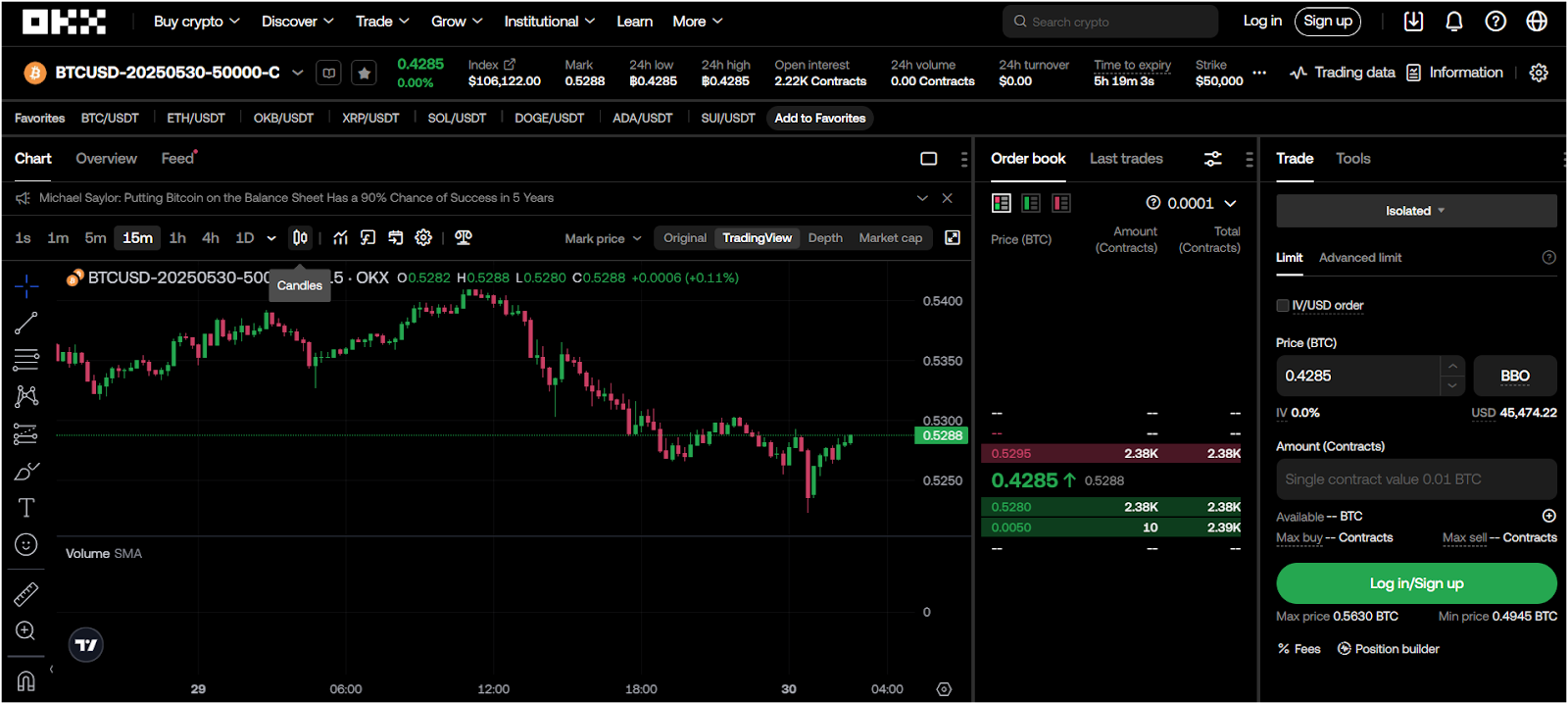

3. OKX: Best for beginners using the simple options interface

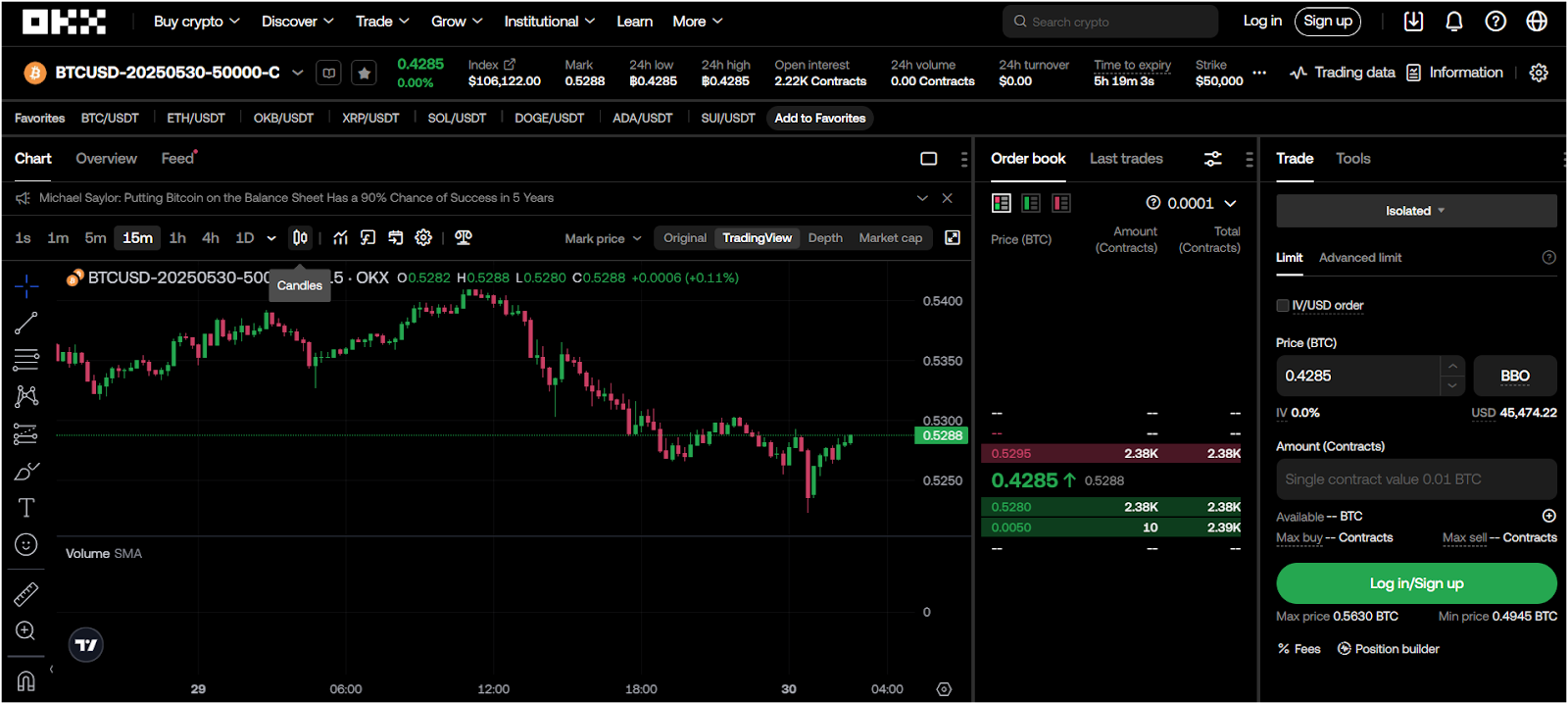

OKX is a top crypto exchange that’s great for options trading, especially if you’re looking for a platform that’s easy to use and secure. Founded in 2017 and rebranded from OKEx in 2022, OKX operates globally and is also available in the U.S. When it comes to options trading, OKX focuses on Bitcoin (BTC) and Ethereum (ETH), offering European-style options.

Their “Simple Options” feature is a standout, guiding new traders through the process with clear language and no confusing terms. You pick a coin pair like BTC/USD or ETH/USD, predict if the price will go up or down, and set a target amount. For experienced traders, the “Pro” mode offers advanced tools to dive deeper into strategies.

OKX provides real-time data, detailed charts, and a clean trading dashboard that helps in quick decision-making. The platform also shows the option Greeks, order book depth, and price trends clearly. This makes it easy to plan and manage risk. If you need help with strategy, there are tools to create spreads and complex options positions. You can also read an in-depth guide on how OKX is safe to learn about its security measures.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style | BTC and ETH | 0.03% maker/taker | 100x |

4. Deribit: Best for deep liquidity and advanced options tools

Deribit is a crypto exchange focused on options trading. It is known for offering Bitcoin and Ethereum options. It holds a major share of the global crypto options market, with about 80% for Bitcoin and 90% for Ethereum. In 2025, Coinbase bought Deribit for $2.9 billion, making it part of a trusted brand with plans to grow globally. But it’s still not available in the U.S. due to regulations.

It offers European-style options, meaning you can only exercise them at expiry. You can trade options on Bitcoin, Ethereum, Solana, XRP, MATIC, and gold (PAXG). Traders can use up to 50x leverage, which suits experienced users but is risky for new ones. Deposits are accepted in Bitcoin, Ethereum, USDC, and USDT, with options settled in the asset’s coin.

The platform provides tools like the Option Wizard. This tool helps you choose the best option strategy based on your price prediction. You need to input your expected price, timeframe, and risk level, and the wizard suggests a strategy. Deribit also offers a free options course and a test platform for practicing with fake funds, no KYC required.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style | BTC, ETH, SOL, MATIC, XRP, and PAXG | 0.03% maker/taker (Capped at 12.5% of the options price) | 50x |

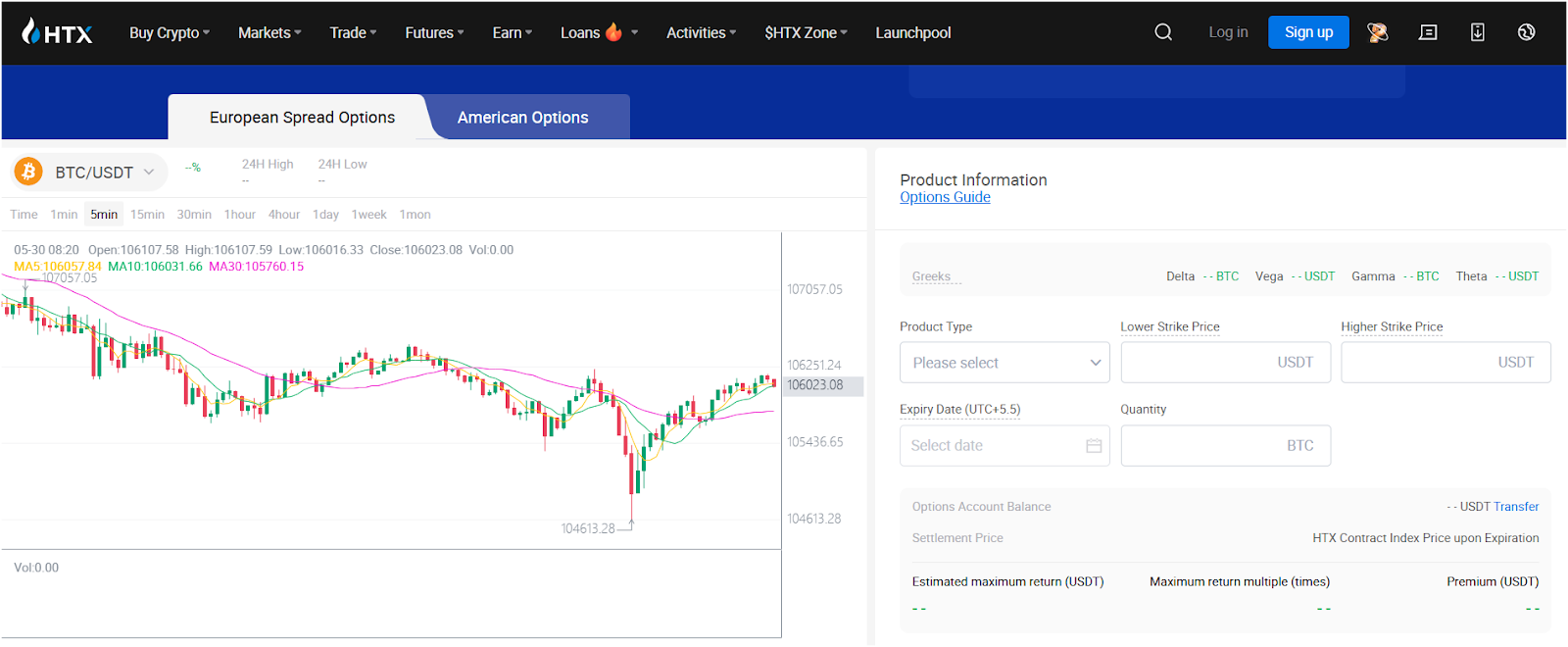

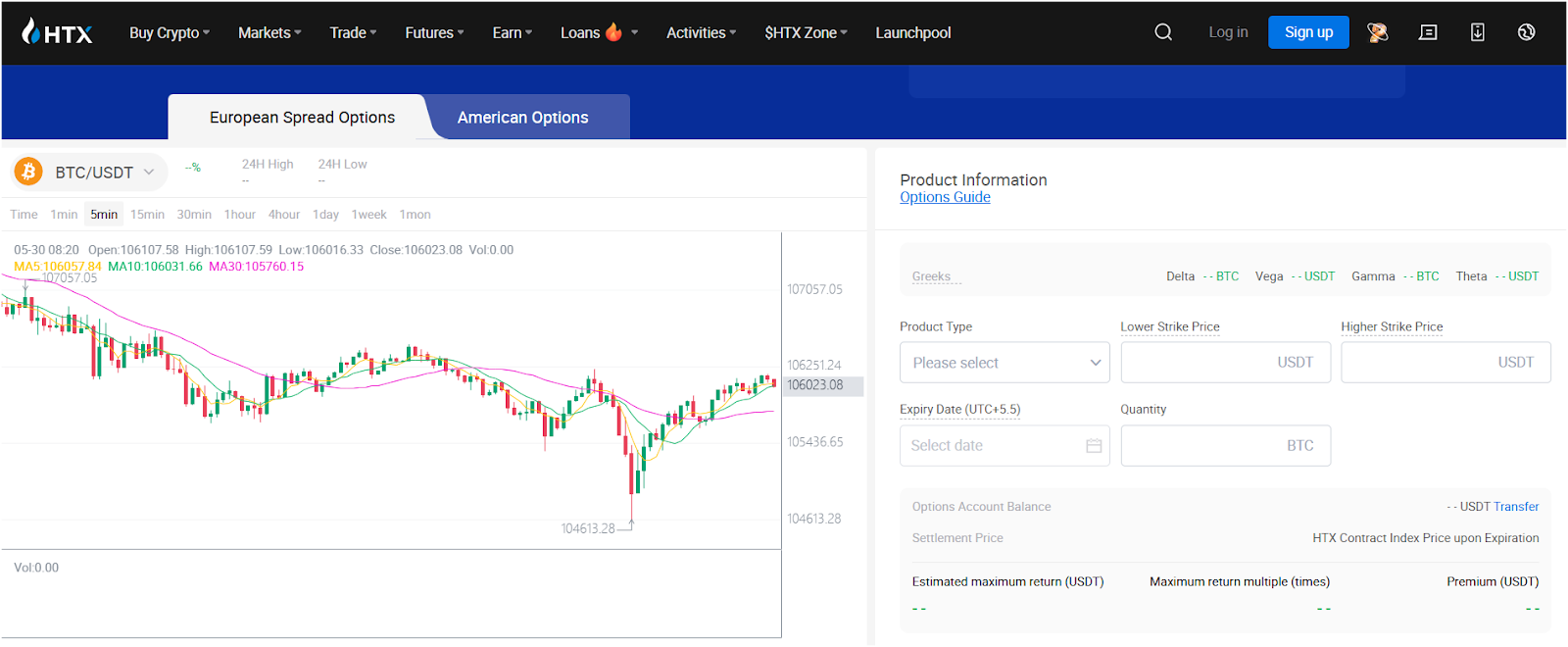

5. HTX: Best for both European and American-style options

HTX, formerly Huobi Global, is a Seychelles-based crypto exchange started in 2013, serving over 50 million users with a daily trading volume above $2 billion. It’s a top platform for crypto options trading due to its user-friendly features and variety.

HTX simplifies options trading, especially for beginners, with at-the-money options where the strike price equals the asset’s current price. This skips complex price-setting. It offers American standalone options, European option spreads, and OTC options. American options allow custom strike prices and can be exercised anytime before expiration, giving flexibility and liquidity. European spreads are more structured, while OTC options suit professionals like institutions for custom hedging or leverage.

HTX supports options for Bitcoin and Ethereum only. Its TradingView integration lets you trade options without switching platforms. It enforces Know-Your-Customer (KYC) and Anti-Money Laundering (AML) policies to comply with regulatory requirements. The platform employs security measures such as two-factor authentication and cold storage for most user funds. HTX is not available to users in certain countries, including the United States, due to regulatory restrictions.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style and American-style | BTC and ETH | 0.02% maker/taker | 125x |

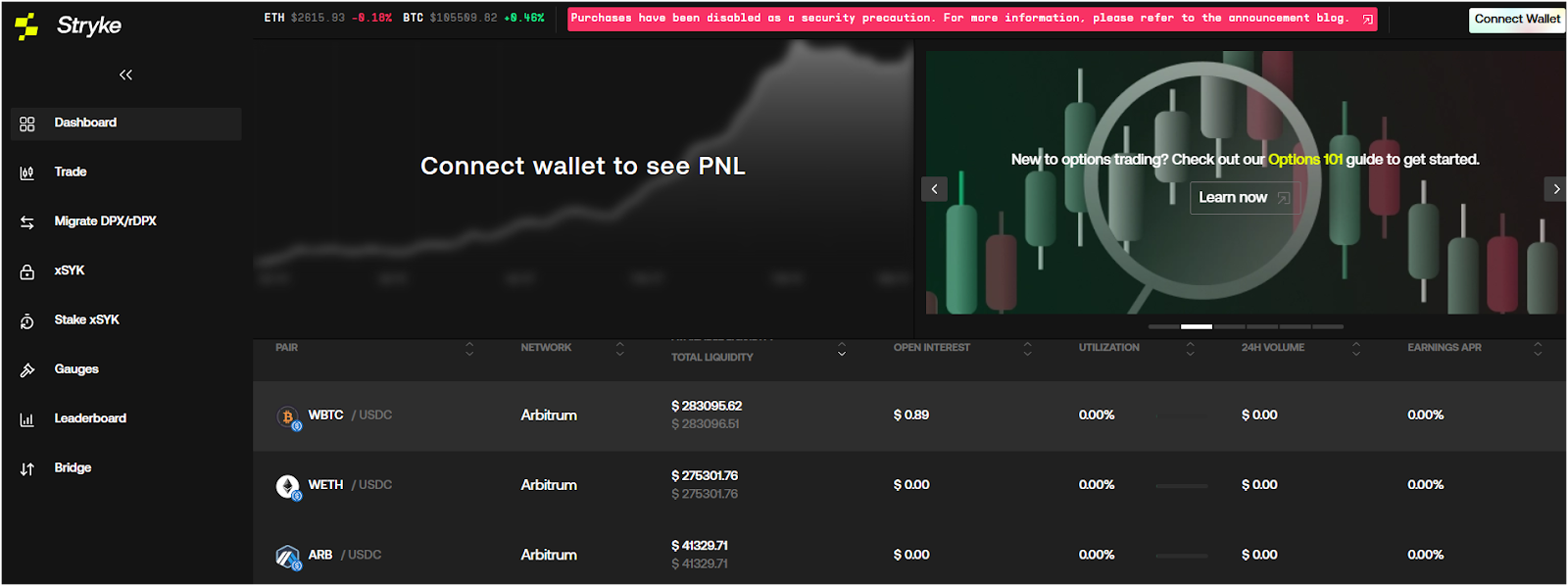

6. Stryke: Best decentralized platform for short-term options

Stryke is a decentralized crypto options trading platform built on Arbitrum, evolving from Dopex to focus on advanced options products. You can trade options on various tokens like WETH, WBTC, ARB, and memecoins such as $BRETT and $BOOP. Stryke supports both European and American-style options.

The platform uses a system called CLAMM (Concentrated Liquidity Automated Market Maker). This system helps in managing liquidity efficiently. It ensures that option buyers can find sellers easily, and vice versa. This setup aims to reduce losses for option writers and increase gains for buyers.

Stryke offers short-term options with expiration times of 1, 2, 12, and 24 hours. This feature allows you to take advantage of quick market movements. You can also use the Limit Exercise feature to automate your trades. By setting a target price, your option will be exercised automatically when the market reaches that price. The platform charges a fee of 3%-4% of the option premium at the time of purchase. If you use the auto-exercise feature, an additional fee of 1% of the profit (PNL) is applied upon exercise.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style and American-style | WETH, WBTC, ARB, and more | Up to 4% | 100x |

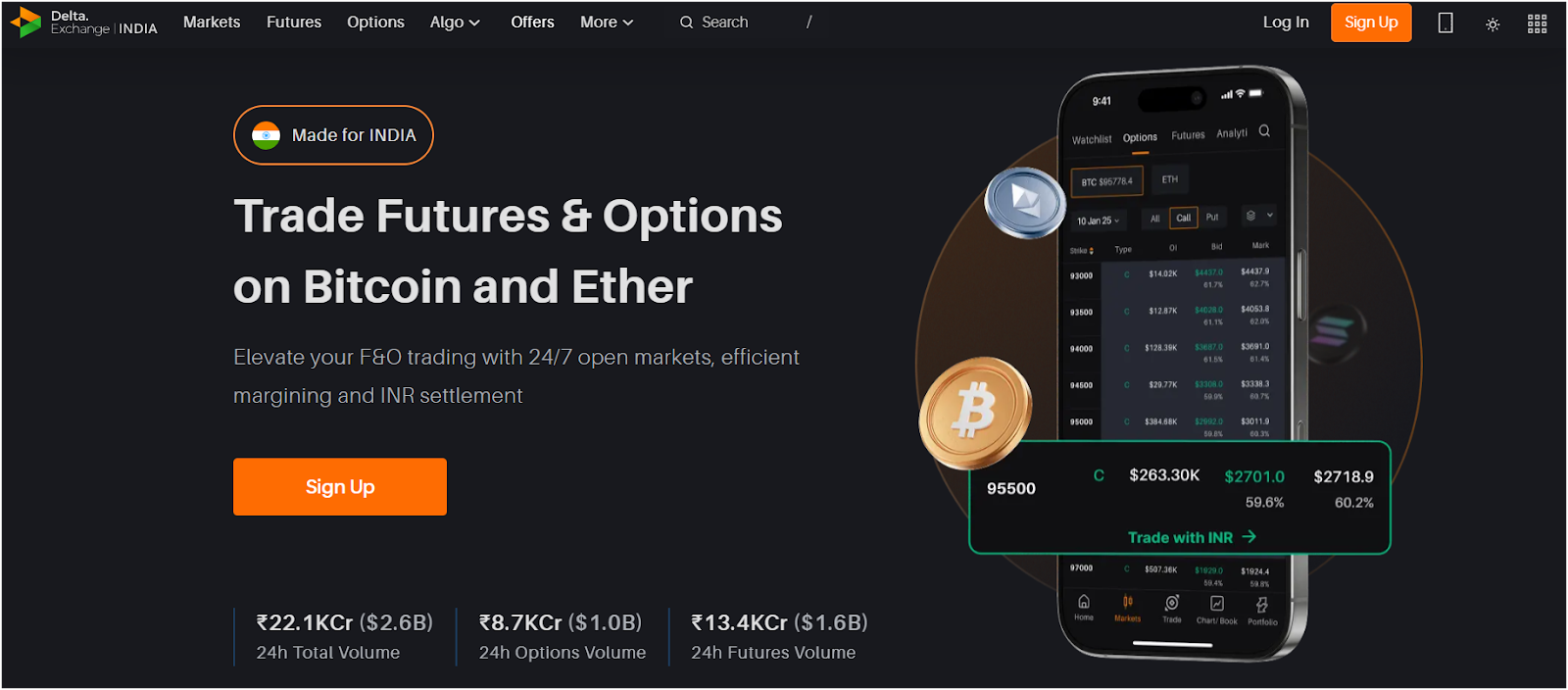

7. Delta Exchange: Best crypto options trading app

Delta Exchange is a top choice for crypto options trading, especially for traders in India and beyond. It offers European-style call and put options on Bitcoin and Ethereum, settled in USDT globally and INR for Indian users.

You can trade with flexible expiries – daily, weekly, monthly, or quarterly. The platform also has unique products like MOVE (straddle) contracts for betting on price volatility and option spread contracts (call and put spreads) for lower fees and better margin efficiency.

Security is solid, with multi-factor authentication and cold wallet storage for funds. Delta also offers a mock trading mode for beginners to practice without risking money, and its robo-trading feature lets you automate strategies.

| Type | Supported Coins | Options Trading Fees | Maximum Leverage |

| European-style | BTC and ETH | 0.03% per trade | 100x |

How to Choose The Best Crypto Options Trading Platform?

1. Security

Security is critical when selecting the best crypto options trading platform due to the risk of hacks and theft. Look for platforms with robust security measures. Two-factor authentication (2FA) adds an extra layer of protection by requiring a second verification step, such as a code sent to your phone. Cold storage, where funds are kept offline, reduces the risk of hacking. Encryption protects your data from being intercepted.

Platforms like Binance have a Secure Asset Fund for Users (SAFU) to cover losses in extreme cases. Check the platform’s history for past security breaches and how they were handled. Deribit, for example, has no major breaches, which is a positive sign. A platform with a history of unresolved security issues should be avoided.

2. Trading Fees

Trading fees directly impact your profitability, especially for frequent traders. Platforms charge fees differently, often based on whether you’re a maker (adding liquidity) or a taker (removing liquidity).

For example, Deribit charges 0.03% for both makers and takers, while OKX uses a tiered fee structure based on trading volume or token holdings. Additional fees, such as withdrawal or exercise fees, can apply. Bybit, for instance, charges a 0.015% delivery fee and a 0.2% liquidation fee. High fees can erode profits, particularly for small trades. Compare fee structures to find a platform that aligns with your trading volume and budget.

3. Payment Methods

The ability to deposit and withdraw funds easily is essential. Some best options trading platforms accept fiat currencies like USD or EUR through bank transfers, credit cards, or services like PayPal, while others only accept cryptocurrencies.

Also, be aware of conversion or gas fees when transferring cryptocurrencies, as these can add up. Coinbase simplifies fiat deposits but may not offer options trading in all regions. Choose a platform that supports your preferred payment method to minimize costs and complexity.

4. Available Cryptocurrencies

Not all platforms offer the same coins for options trading. Some only allow Bitcoin or Ethereum. Others give access to more coins like Solana, BNB, XRP, and more. If you want to trade options on different coins, choose a platform that has a wide list of supported assets.

Having more crypto assets gives you more trading choices. It also helps reduce risk because you don’t have to depend on just one coin. You can spread your trades over different assets. This is useful when one coin is too volatile. So always check the list of supported cryptocurrencies before you open your account.

5. Customer Support

Customer support should not be ignored. Problems can happen at any time – during deposits, withdrawals, or trades. You need a support team that answers quickly and gives clear help. Some platforms only use email, and replies can take hours or even days. Others offer 24/7 live chat, which is much faster.

Check if the platform has a help center or FAQ page. Read reviews online to see if users are happy with the support team. If many people complain about slow or unhelpful replies, you should be careful. Good customer support can save you time and money, especially during urgent situations. Choose a platform that gives support when you need it.

6. Accessibility

Some options platforms don’t work in certain countries. You should check if the platform is available where you live. Even if the website opens, that doesn’t mean it’s legal to use it in your area. They block users from specific regions because of local rules.

If the exchange is not allowed in your country, your account might get banned later. That means you could lose access to your funds. So before signing up, read the terms and check the list of supported countries. You should always use a platform that follows local rules and works legally in your region.

7. User Interface & Trading Tools

The user interface should be simple and easy to understand. If the platform is too complicated, you may make mistakes while placing trades. A clean dashboard with all the important tools helps you stay focused. You should be able to check prices, view charts, and place trades without getting confused.

Good platforms also offer trading tools like price alerts, technical indicators, and profit/loss calculators. These tools help you plan your trades better. Some platforms even have mobile apps, so you can trade while on the move. Try using the demo version if available. It will help you understand how the platform works before you trade with real money.

8. Liquidity of Crypto Assets

Liquidity means how easy it is to buy or sell an asset without changing its price too much. If a platform has low liquidity, it means fewer people are trading there. You might have to wait longer to complete trades. Also, you may get worse prices than expected.

High liquidity means faster trades and better prices. You should also check the trading volume of the assets you plan to trade. This information is often shown on the trading screen. If the volume is low, it’s better to avoid trading that asset. Always choose platforms with high liquidity for smoother trading.

9. Regulatory Compliance

Before choosing any platform, always check if it is regulated. A regulated platform must follow certain rules. These rules help protect your money and personal information. Platforms that have licenses from trusted authorities are usually safer. Some well-known regulators include the U.S. SEC, UK FCA, and Singapore MAS.

Unregulated platforms can shut down at any time. You may lose your funds and have no legal way to recover them. So, always go with a platform that clearly shows its license on the website. It’s better to stay away from platforms that hide this information or give vague answers.

10. Reputation

Lastly, check the platform’s reputation. You can find this by reading reviews on trusted websites or forums. Pay attention to what users say about customer support, fees, and withdrawal issues. A few bad reviews are normal, but too many complaints should be a red flag.

You can also check if the platform has been in the news for the wrong reasons. If there were a big hack or lawsuit, think twice before joining. Pick a platform that has been around for a while and has a clean history. A strong reputation usually means the platform takes its users seriously.

What is Crypto Options Trading?

Crypto options trading involves buying and selling contracts that give you the right, but not the obligation, to buy or sell a cryptocurrency at a specific price within a set timeframe. Think of it like a bet on where the price of a crypto, like Bitcoin or Ethereum, will go.

There are two main types: a call option lets you buy if you think the price will rise, and a put option lets you sell if you expect it to drop. These contracts have an expiration date and a strike price, which is the price at which you can buy or sell. You also need to pay a premium for this flexibility, like an insurance fee.

How Does Crypto Option Trading Work?

Crypto options trading lets you trade contracts based on cryptocurrency prices. Here’s how it works: you buy a contract, either a call (to buy) or a put (to sell), which gives you the right to trade a crypto at a set price (strike price) before the contract expires. You pay a premium for this contract, like a fee.

For example, if you think Bitcoin’s price will rise, you buy a call option. If Bitcoin hits your strike price before expiration, you can buy it cheaper and sell at the market price for a profit. If not, you lose only the premium.

Crypto Options Trading Vs. Traditional Options Trading

| Crypto Options Trading | Traditional Options Trading | |

| Underlying Asset | Cryptocurrencies like Bitcoin, Ethereum, etc. | Stocks, commodities, indices, or currencies (e.g., Apple stock, gold, S&P 500). |

| Market Hours | 24/7, as crypto markets never close. | Limited to stock exchange hours (e.g., 9:30 AM–4:00 PM EST for U.S. markets). |

| Volatility | High | Lower |

| Regulation | Lightly regulated or unregulated in many regions | Heavily regulated by bodies like the SEC or CFTC |

| Accessibility | Available on crypto exchanges (e.g., Binance, Deribit) with lower barriers to entry | Requires brokerage accounts with stricter requirements (e.g., margin accounts) |

| Liquidity | Lower liquidity | Higher liquidity |

| Risk Profile | Higher risk due to crypto’s volatility and less regulation | Moderate risk, mitigated by regulation and more predictable markets |

| Technology | Relies on blockchain and crypto exchanges, prone to hacks or technical issues | Operates on established financial systems with robust infrastructure |

Why Trade Crypto Options?

Crypto options trading is appealing for several reasons. First, it offers flexibility, you can profit whether crypto prices rise or fall without owning the actual coins. Second, it’s a way to hedge. If you hold crypto, options can protect against price crashes, acting like insurance.

Third, the potential for high returns is huge due to crypto’s volatility. A small price move can yield big profits if your prediction is right. Plus, you only risk the premium paid, not your entire investment, unlike spot trading. The 24/7 crypto market means you can trade anytime, unlike stocks. It’s also accessible – many platforms don’t require huge capital to start.

Types of Cryptocurrency Options

1. Call Options vs. Put Options

A call option gives you the right to buy a cryptocurrency, like Bitcoin or Ethereum, at a specific price, called the strike price, before or on the expiration date. Traders use call options when they believe the crypto’s price will rise.

For instance, if Bitcoin is trading at $40,000 and you buy a call option with a $42,000 strike price for a $500 premium, you can buy Bitcoin at $42,000 if it climbs to, say, $45,000, earning a profit after covering the premium. If the price doesn’t go above $42,000, you only lose the $500 premium, not the entire asset value.

On the other hand, a put option gives you the right to sell a cryptocurrency at the strike price before or on the expiration date. You’d choose a put if you expect the price to fall.

The main difference lies in their direction: calls bet on price increases, while puts bet on price decreases. Both limit losses to the premium paid, making them less risky than owning crypto outright, but they require accurate predictions in the volatile crypto market.

2. American Options vs. European Options

An American option allows you to buy or sell the underlying crypto, like Bitcoin, at the strike price any time before or on the expiration date. This flexibility is valuable in the fast-moving crypto market, where prices can spike or crash suddenly.

For example, if you hold an American call option for Bitcoin and the price surges two weeks before expiration, you can exercise it early to lock in profits, rather than waiting and risking a price drop. However, this freedom comes at a cost – American options typically have higher premiums because they offer more control.

In contrast, a European option restricts you to exercising the contract only on the expiration date, not before. This limitation makes European options less flexible, but they’re often cheaper.

3. Futures Trading vs. Options Trading

In crypto futures trading, you agree to buy or sell a cryptocurrency, like Bitcoin, at a set price on a specific future date, and you’re obligated to follow through regardless of the market price at that time.

Conversely, options trading gives you the right, but not the obligation, to buy or sell a crypto at a set price before or on the expiration date, and you need to pay a premium for this choice.

| Futures Trading | Options Trading | |

| Obligation | Must buy/sell at set price on expiration. | Right to buy/sell, not required |

| Risk | High, losses can exceed the investment. | Low, losses capped at premium |

| Flexibility | Fixed terms, no choice at expiration. | Can choose to exercise or not |

| Cost | Margin deposit, no premium | Upfront premium paid |

| Profit | Unlimited, but high loss risk | Profit minus premium, capped loss |

4. Binary Options

Binary options are a unique and simpler type of option, often called “all-or-nothing” options. With a Binary Option, you bet on whether the price of a cryptocurrency will be above or below a certain level at a specific time. There’s no strike price or exercising the option like in Call or Put Options. Instead, you predict the price direction.

For example, you might bet $100 that Bitcoin’s price will be above $50,000 in one week. If you’re right, you get a fixed payout, like $180, regardless of how much higher the price is. If you’re wrong, you lose your $100. The payout and loss are fixed, making Binary Options easy to understand but risky because you either win a set amount or lose your entire investment.

Benefits and Risks of Crypto Options Trading

Benefits of Crypto Options Trading

- High Profit Potential: Crypto options trading allows traders to make large profits with a small initial investment. By buying options, you can control a larger amount of cryptocurrency without owning it, which can lead to big gains if the market moves in your favor.

- Flexibility in Strategies: Options trading offers many strategies, like buying calls, puts, or spreads, to match different market conditions. Traders can profit whether the market goes up, down, or stays flat, depending on the strategy they choose.

- Limited Loss Risk: When you buy crypto options, your maximum loss is limited to the premium you paid for the option. Unlike owning cryptocurrency directly, where you could lose your entire investment if the price crashes, options trading caps your downside.

- Leverage Without Borrowing: Options provide leverage, meaning you can control a large amount of crypto with a small amount of money.

- Access to 24/7 Markets: Crypto markets operate 24/7, and options trading platforms often follow this schedule. This allows traders to react to market changes at any time, unlike traditional stock markets with set hours.

Risks of Crypto Options Trading

- High Volatility in Crypto Markets: Cryptocurrencies are known for rapid price swings, which can make options trading risky. Sudden market changes can lead to options expiring worthless or causing unexpected losses.

- Time Decay of Options: Options lose value as they approach their expiration date, even if the market doesn’t move. This “time decay” can erode the value of an option, especially if the market remains flat.

- Liquidity Issues in Crypto Options Markets: Some crypto options markets have low trading volume, making it hard to buy or sell options at desired prices. This lack of liquidity can lead to wider bid-ask spreads, increasing trading costs.

How to Start Trading Crypto Options?

Step 1: Pick a Trading Platform

First, you’ll need a platform to trade on. Not all crypto exchanges offer options trading, so you’ll want one that does, like Deribit, Bybit, or Binance (if it’s available in your area).

Look for a platform that’s user-friendly, has decent fees, and feels trustworthy. Most platforms let you start with a small amount, so you don’t need to go all-in right away. Just make sure the platform works in your country and has good security.

Step 2: Create an Account and Complete KYC

Once you’ve picked a platform, sign up for an account. It’s usually straightforward, just enter your email, set a password, and you’re in. Most platforms require KYC (Know Your Customer) to verify your identity. This means uploading a photo ID, like a passport or driver’s license, and sometimes a selfie or proof of address.

Step 3: Deposit Funds

Now it’s time to add money to your account. Most platforms let you deposit crypto (like Bitcoin or Ethereum) or fiat (like USD) via bank transfer, card, or other methods. Check the platform’s deposit options and fees, some charge more than others.

Start with a small amount you’re comfortable with, especially if you’re new. For example, deposit $50 or 0.001 BTC to test the waters. Make sure you double-check the wallet address when transferring crypto, one typo can mean lost funds. Once the money’s in, you’re set to trade.

Step 4: Start Options Trading in Crypto

Before jumping in, learn the basics of options. A call option bets the price will rise; a put option bets it’ll drop. Many platforms offer demo accounts, so practice there first with fake money to get the hang of it. When you’re ready, start with a small trade on a familiar crypto like Bitcoin.

Cryptocurrency Options Trading Fees

Premium Fees

A premium fee is the cost you pay to buy an options contract in cryptocurrency trading. When you purchase a call option or a put option, the seller of the option charges you this fee.

The premium depends on factors like the crypto’s current price, the strike price (the set price in the contract), and how long the option lasts. For example, if you buy a Bitcoin call option, you might pay a $100 premium upfront. This fee is non-refundable, even if you don’t use the option.

Withdrawal Fees

Withdrawal fees are charged when you transfer your cryptocurrency or cash out of a trading platform to your personal wallet or bank account. Each platform sets its own fee, which can vary depending on the cryptocurrency (like Bitcoin or Ethereum) or the payment method (like bank transfer). For instance, withdrawing Bitcoin might cost a small amount of BTC to cover network costs.

Transaction Fees

Transaction fees are costs you pay every time you make a trade, such as buying or selling an options contract. These fees are usually a small percentage of the trade’s value or a fixed amount per trade. For example, a platform might charge $1 per trade or 0.2% of the trade size. Some platforms charge fees for both the buyer and seller, while others only charge one side.

Inactivity Fees

Inactivity fees are charged by some platforms if you don’t trade or use your account for a long time, like several months or a year. The platform might deduct a small amount from your account balance to keep it active.

Spread Costs

Spread costs refer to the difference between the price you can buy an options contract for (the ask price) and the price you can sell it for (the bid price). This difference is how some platforms make money. For example, if a Bitcoin option has a bid price of $100 and an ask price of $105, the $5 spread is the cost you indirectly pay when trading.

Top 5 Crypto Options Trading Strategies

1. Covered Call

A covered call strategy is holding a cryptocurrency, like Bitcoin, and selling a call option on the same asset.

Thus, if the price of the cryptocurrency at expiration is still less than the strike price, then the option becomes worthless, and the seller retains the premium and the cryptocurrency. If it is more than the strike price, then the seller might have to sell the cryptocurrency at the strike price, but still gets the premium.

2. Protective Collar

A protective collar is a risk-management strategy used by investors holding a cryptocurrency, such as Ethereum, who want to protect against potential price declines. This strategy involves purchasing a put option.

In order to balance the put option premium, the investor sells a call option with a higher strike price, which allows another party to buy the cryptocurrency if the price goes up considerably. The proceeds from selling the call option partly pay for the cost of the put option. This strategy caps potential losses if the price of the cryptocurrency decreases while also limiting gains if the price goes up considerably.

3. Married Put

The married put strategy is holding an asset, for instance, Bitcoin, and at the same time acquiring a put option for the same value of the asset.

If the price appreciates, the investor profits from the appreciation minus the premium paid. If the price depreciates, the put option enables the investor to sell at the strike price, capping losses.

4. Bull Call Spread

A bull call spread is a strategy for investors who expect a moderate increase in a cryptocurrency’s price. It involves buying a call option with a lower strike price and selling another call option with a higher strike price, both with the same expiration date. The premium received from selling the higher-strike call option reduces the cost of purchasing the lower-strike call option.

If the cryptocurrency’s price rises to or beyond the higher strike price, the investor profits from the difference between the two strike prices, minus the net premium paid.

5. Long Straddle

A long straddle is an investment setup where traders acquire both a call and a put option for the same asset, using matching strike prices and expiration dates. This approach is designed to capitalize on strong price shifts in either direction. If the price of the cryptocurrency increases significantly, the call option earns profit; if it decreases significantly, the put option earns profit.

But the investor has to pay premiums on both options, and if the price does not move, both options will expire worthless, and the investor will lose the premiums. This is most appropriate during times of anticipated high volatility, like during key market events or news releases.

Conclusion

In a nutshell, choosing the best crypto options trading platform gives you more ways to manage risk and make profits in any market. It’s different from regular spot trading and needs more strategy. If you want the best platform, Binance and Bybit are top choices. They offer strong tools, low fees, and good support for both new and advanced traders.

Other good options trading platforms like OKX, HTX, and Delta Exchange also give you solid options with clear features. If you prefer decentralized trading, Stryke is worth a try.

FAQs

Where is the best place to trade crypto options?

The best places to trade crypto options are Binance and Bybit. Binance is best for overall features, high liquidity, and low fees. It supports top coins and offers advanced tools. Bybit is also great, especially for flexible expiry choices and an easy interface. It has both beginner and pro trading modes.

Where to trade crypto options in the US?

Crypto options trading is not available in the U.S. Options trading in the US is heavily restricted due to stringent regulatory requirements, particularly from the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Also, a possible best crypto exchange in the U.S. is Coinbase, which recently acquired Deribit. It may expand crypto options services for U.S. users soon.

Can you trade options for crypto?

Yes, you can trade options for cryptocurrencies. Crypto options let you bet on price movements without buying the actual coin. You can choose a strike price and expiration date. At expiration, the option can be exercised based on the market price. Two main types exist: call options (buy rights) and put options (sell rights).

Best crypto options exchanges for beginners?

For beginners, the best crypto options exchanges are Bybit, OKX, and HTX. Bybit has an “Easy Options” mode with a simple layout and demo trading. OKX offers a “Simple Options” feature with step-by-step instructions. HTX helps with at-the-money options and a user-friendly interface.

What’s the difference between spot trading vs. options trading?

In spot trading, you buy or sell cryptocurrencies instantly at current market prices. You own the asset directly and can withdraw or hold it. In options trading, you don’t own the asset. Instead, you buy a contract that gives you the right (not obligation) to buy or sell at a set price later.

Spot trading is simple and good for long-term holding. Options trading is more complex and used for speculation, risk control, or leverage.

What is an option premium?

An option premium is the cost you pay to buy an option contract. It’s the price of the right to trade an asset at a set strike price in the future. This fee depends on factors like market price, volatility, expiration time, and demand. The premium is paid upfront when you open the position. And, you won’t get it back unless your option becomes profitable.