- Bitcoin CMI hits 0.55 as miners hold back, and long-term holders begin moving coins.

- Rising profits and stable RSI show Bitcoin remains calm despite looming volatility risks.

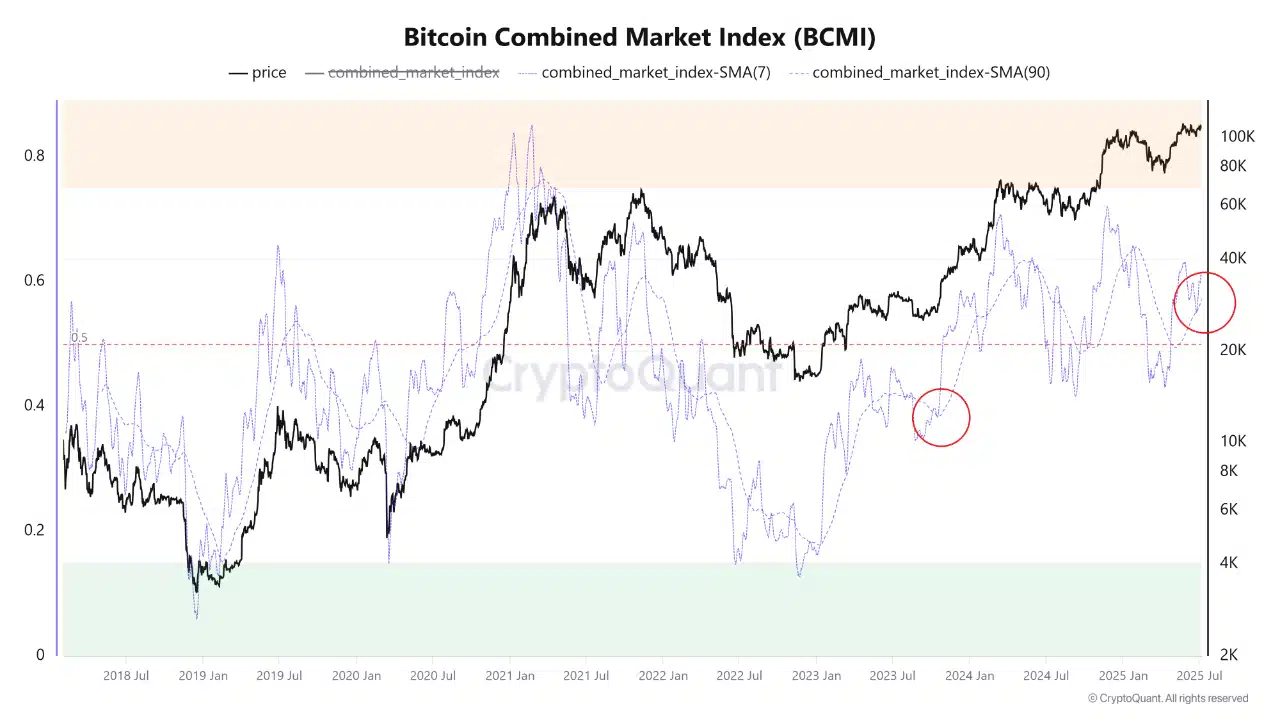

The Bitcoin [BTC] Combined Market Index (BCMI) has crossed the neutral 0.50 mark and sat at 0.55 at press time.

Historically, the 0.60–0.75 range is where 20–35% price shakeouts tend to strike, typically ahead of euphoric peaks.

Despite this momentum shift, the broader mood remains measured.

Fear & Greed hovered in the low-70s, MVRV near 2.0 and NUPL around 0.4 indicating that valuations are not yet overheated.

ETF flows and increased self-custody continue to mute on-chain spikes, creating a cautious but warming macro environment as momentum builds.

Source: CryptoQuant

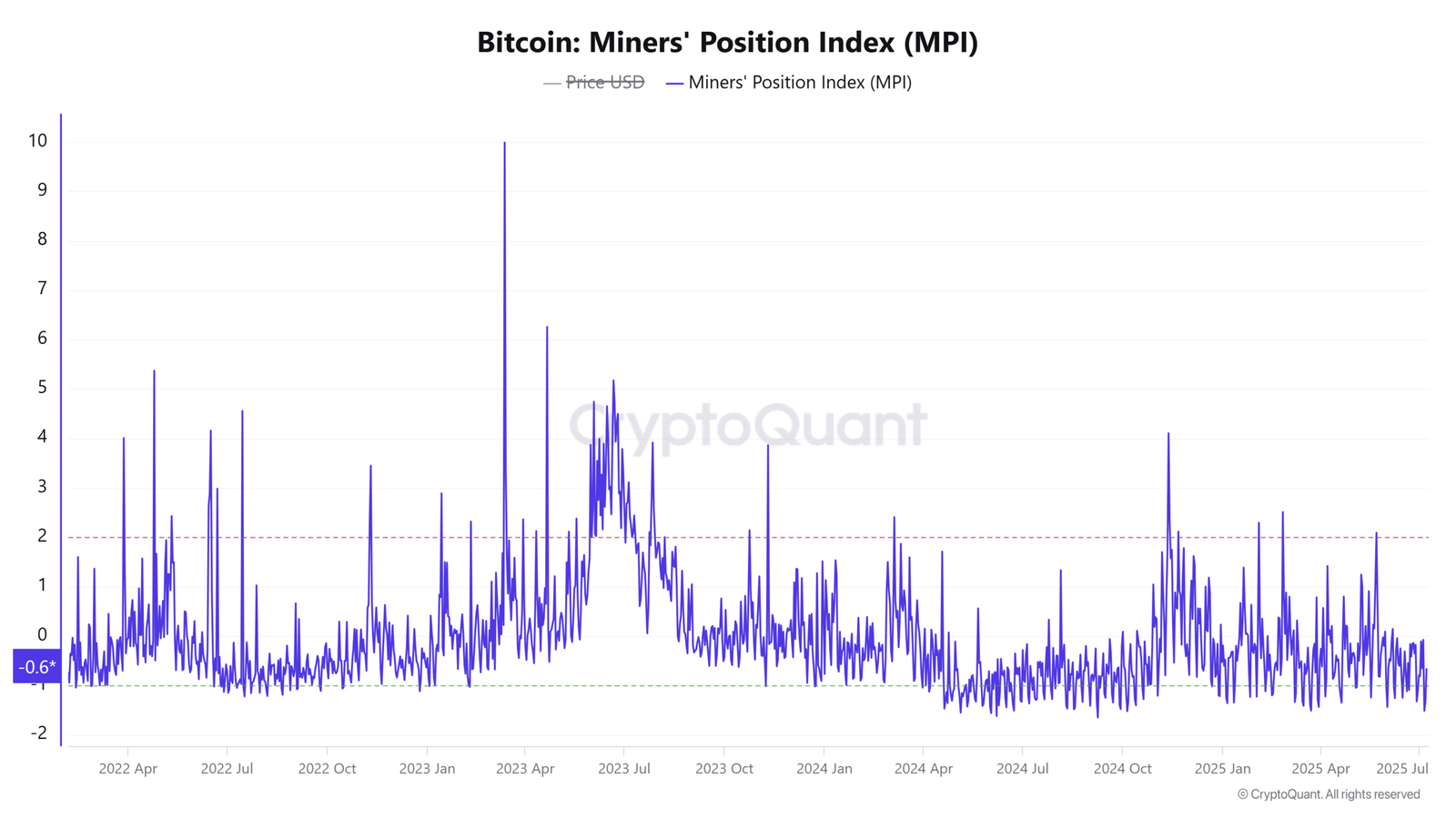

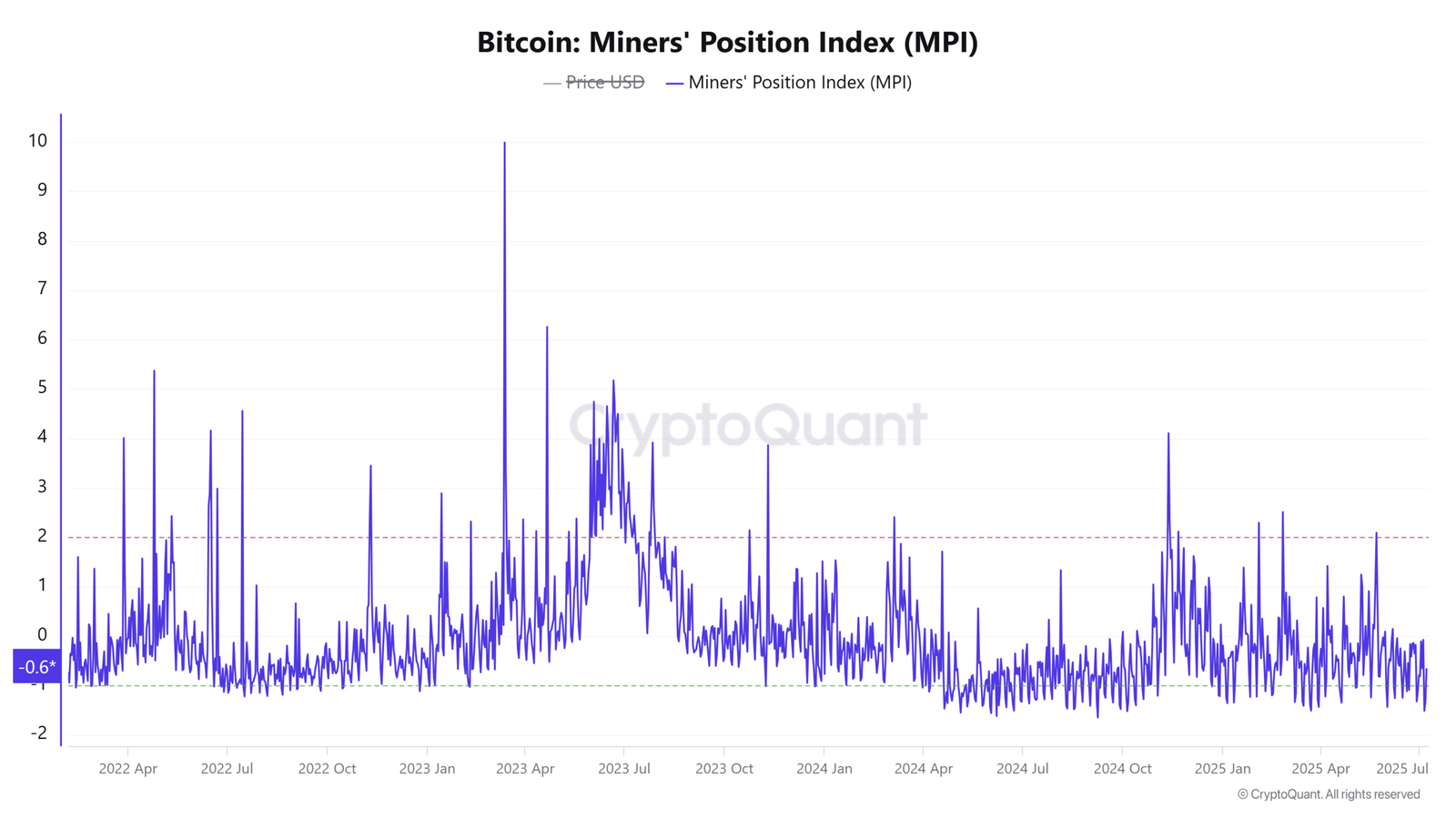

Can miner restraint still support Bitcoin?

Miners appear to be holding back from offloading coins, as the Miners’ Position Index (MPI) remained deeply negative at -0.66.

This behavior suggests a preference for accumulation or at least non-distribution, which typically aligns with bullish mid-cycle setups.

Interestingly, MPI surged 66.22% over the last 24 hours, hinting at growing pressure.

However, the metric remains below zero, confirming that miners have yet to exert significant sell pressure. As long as this restraint persists, Bitcoin’s uptrend could continue receiving indirect support from mining entities.

Source: CryptoQuant

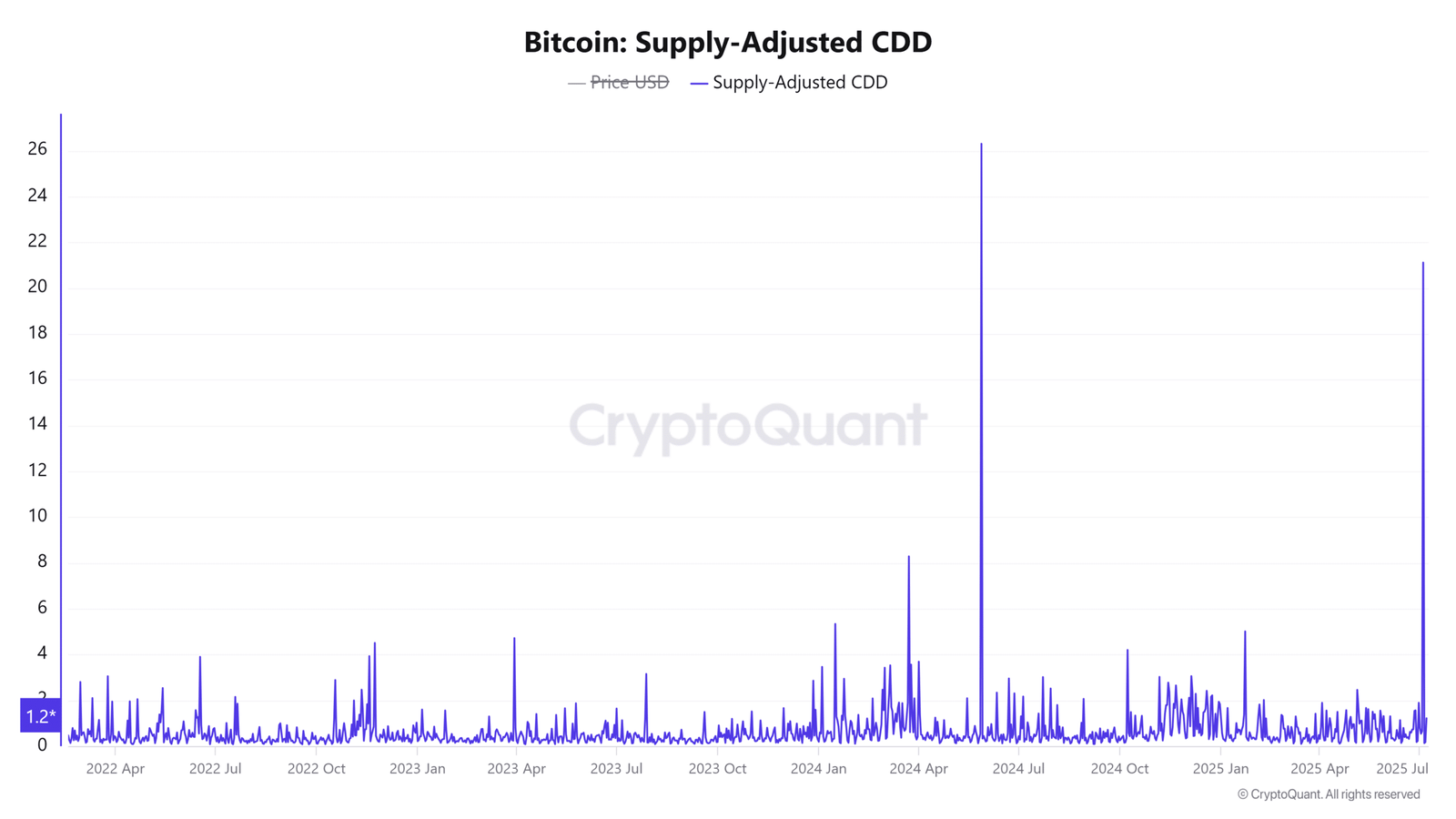

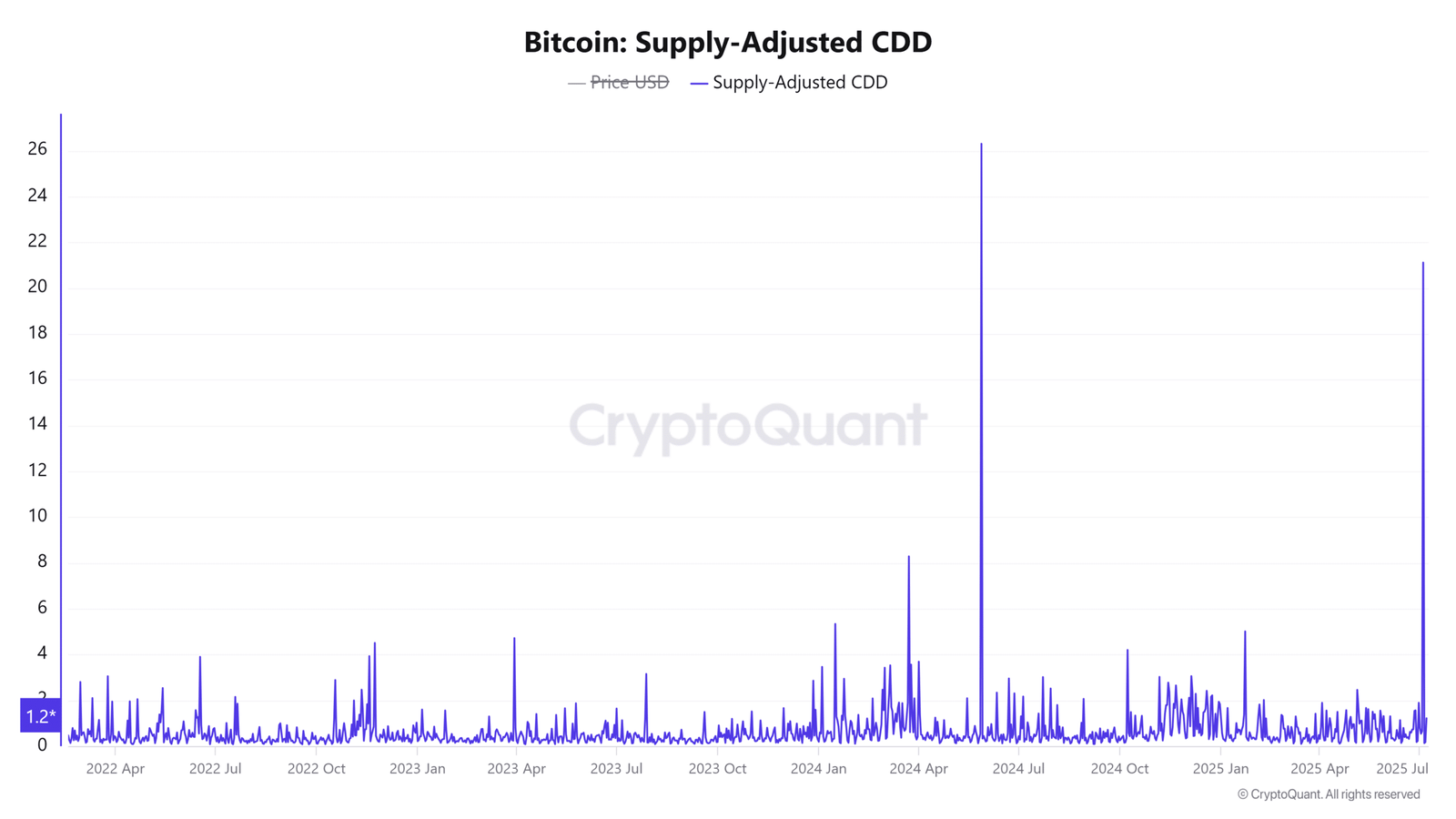

Dormant wallets awaken, but no mass exit yet

Coin Days Destroyed (CDD), when adjusted for supply, rose 10.34%, indicating that long-term holders have begun moving their coins.

This behavior, while subtle, often reflects shifting market psychology—possibly due to profit opportunities or macro signals.

While the move signals a change in sentiment, it hasn’t reached levels associated with widespread profit-taking. Market psychology appears to be shifting quietly, but not aggressively.

Source: CryptoQuant

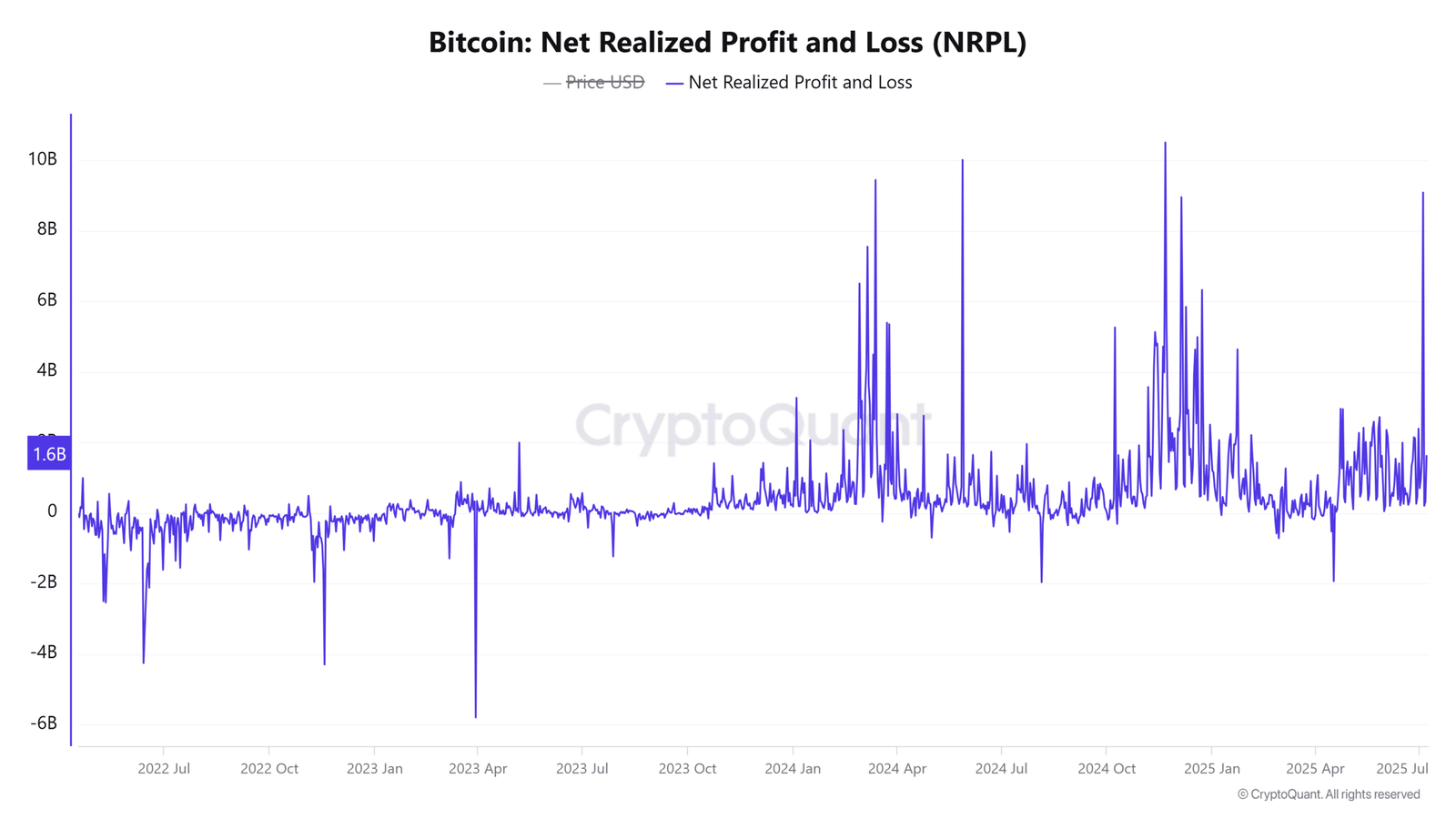

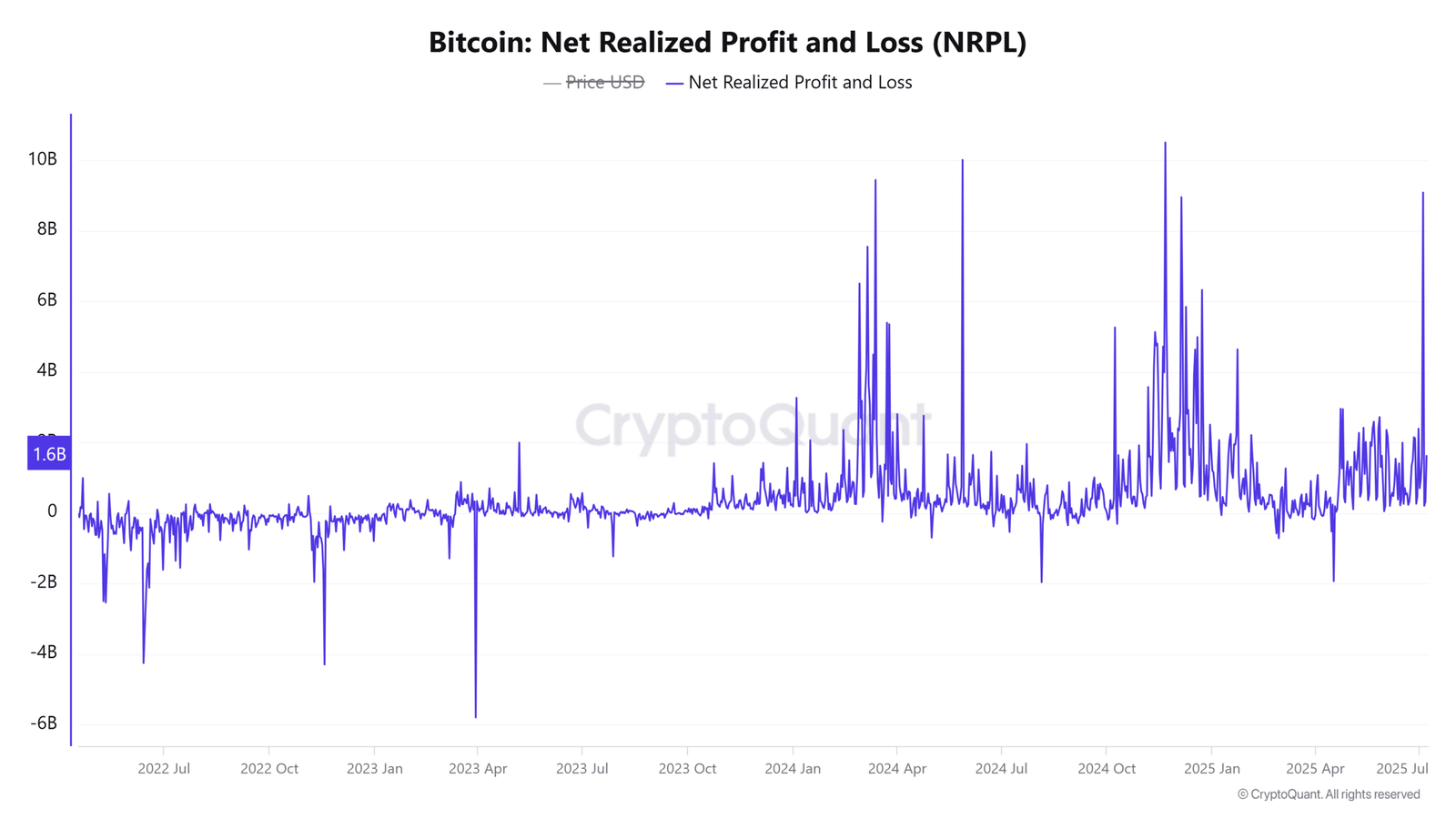

Are profits rising fast enough to signal a euphoric top?

Net Realized Profit/Loss (NRPL) rose 5.36% in 24 hours, hitting $95.84 million. This growth reflects improved profitability, though it remains far below historical extremes seen during peak rallies.

The data reinforces the BCMI’s mid-cycle reading, suggesting Bitcoin’s rally still has room to grow. That said, traders should keep a close eye on how fast profits compound, as euphoria could sneak in unnoticed.

Source: CryptoQuant

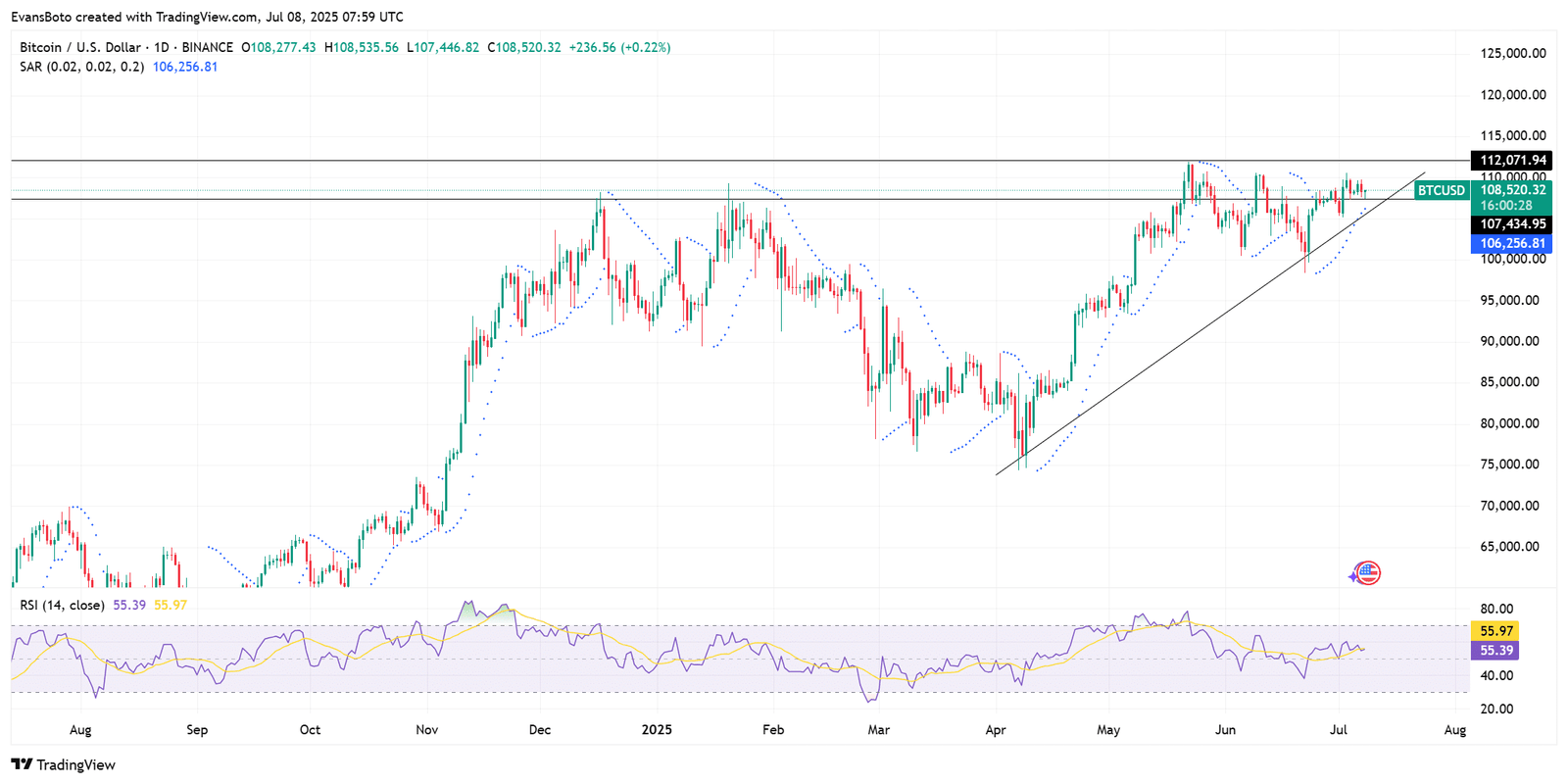

Is Bitcoin’s uptrend safe?

At press time, Bitcoin was priced at $108,520 and continued trading above its ascending trendline. Parabolic SAR dots stayed below price candles—validating a bullish bias.

RSI indicators hovered around 55, suggesting neither overbought nor oversold territory. This neutral stance, combined with the current price structure, highlighted that BTC remained technically stable — for now.

However, a close below $106,000 could threaten trend integrity. While momentum is intact, traders should watch for any breakdown that may disrupt this calm mid-cycle behavior.

Of course, the broader backdrop still favors upward movement.

Bitcoin’s BCMI sat at 0.55, signaling a warming mid-cycle. Miners are holding, long-term holders are nudging coins without rushing out, and profits are rising—gradually, not greedily.

Put simply, the setup remains intact. But if BCMI creeps into the 0.60–0.75 zone, the risk of a shakeout looms.