- XRP breaks above the neckline as traders increased exposure with a 111% volume surge.

- Negative Funding Rates and rising NVT utility signal mixed sentiment despite a bullish setup.

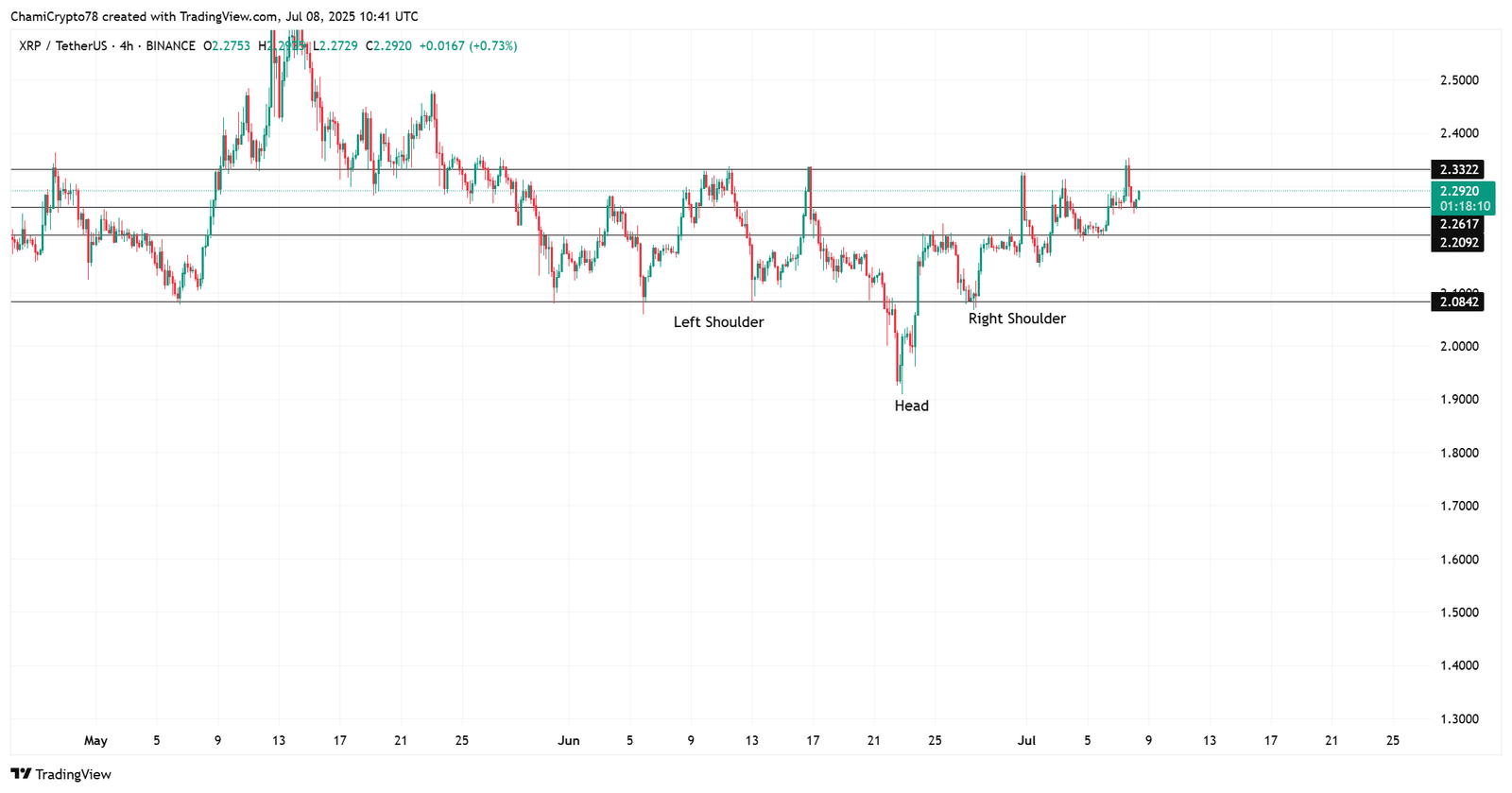

Ripple [XRP] has broken above the neckline of an inverted head-and-shoulders pattern, suggesting a potential trend reversal after weeks of consolidation. However, the recent pullback toward the neckline introduces an important test for bulls.

At press time, XRP traded at $2.29 after tapping a local high near $2.33. This retracement may serve as a classic support retest, often seen after breakout confirmations.

If buying momentum resurfaces around the neckline, the pattern could be completed successfully, offering traders renewed confidence in a possible bullish continuation.

Why are traders doubling down on XRP positions now?

Open Interest for XRP surged by 6.82%, reaching $5.02 billion, while trading volume exploded by 111.79% to $10.28 billion. These metrics indicate growing interest and confidence among derivatives traders.

Typically, spikes in both volume and Open Interest point to strong conviction behind price movements. This renewed activity suggests that many participants are betting on a sustained upside.

Moreover, increased volume following a pattern breakout often supports bullish continuation.

Therefore, market dynamics appear to favor the bulls, even though short-term corrections may still occur if sentiment wavers.

Is bearish sentiment still lingering beneath the surface?

Despite XRP’s bullish breakout, at the time of writing, the Aggregated Funding Rate across exchanges turned slightly negative, and was sitting at -0.004%.

This implies that short traders are paying to keep positions open, indicating a contrarian crowd betting on a pullback.

Historically, negative funding rates during rallies have often led to short squeezes, where short sellers are forced to buy back in.

Therefore, the skepticism reflected in the funding market could paradoxically act as fuel for further upside—especially if prices continue to defy bearish expectations.

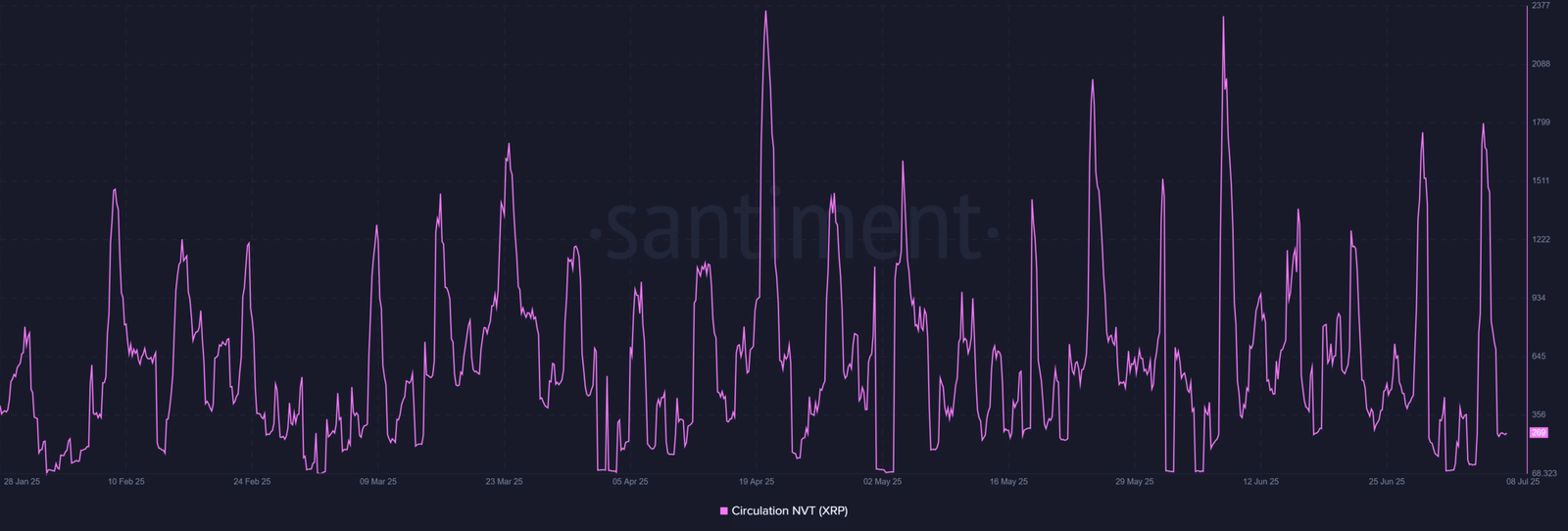

What does the NVT Ratio tell us about the growing utility?

XRP’s NVT Ratio also dropped sharply, reflecting a spike in transaction activity relative to its market cap. This shift suggests that network utility is improving, often a bullish sign from a fundamental perspective.

Lower NVT values typically indicate healthier blockchain usage, which can enhance investor confidence over time.

Therefore, the recent decrease signals that traders and users are engaging more actively with XRP, possibly influenced by broader adoption efforts or rising speculative demand. Such fundamentals may reinforce the strength of XRP’s recent technical breakout.

Is this the beginning of XRP’s broader recovery?

The breakout above the neckline and subsequent retest suggest a potentially healthy reversal structure for XRP. Increased derivatives activity and improving network utility offer solid support for bullish continuation.

However, the presence of negative Funding Rates and hesitation at resistance levels may keep traders cautious in the short term.

If the current retracement finds support and volume picks up again, XRP could confirm a new uptrend. Otherwise, failure to hold the neckline may invalidate the pattern and reignite bearish pressure.