Key Takeaways

- SUI surged 8%, nearing a breakout from a symmetrical triangle. Rising Open Interest, buyer dominance, and short liquidations suggest bullish momentum.

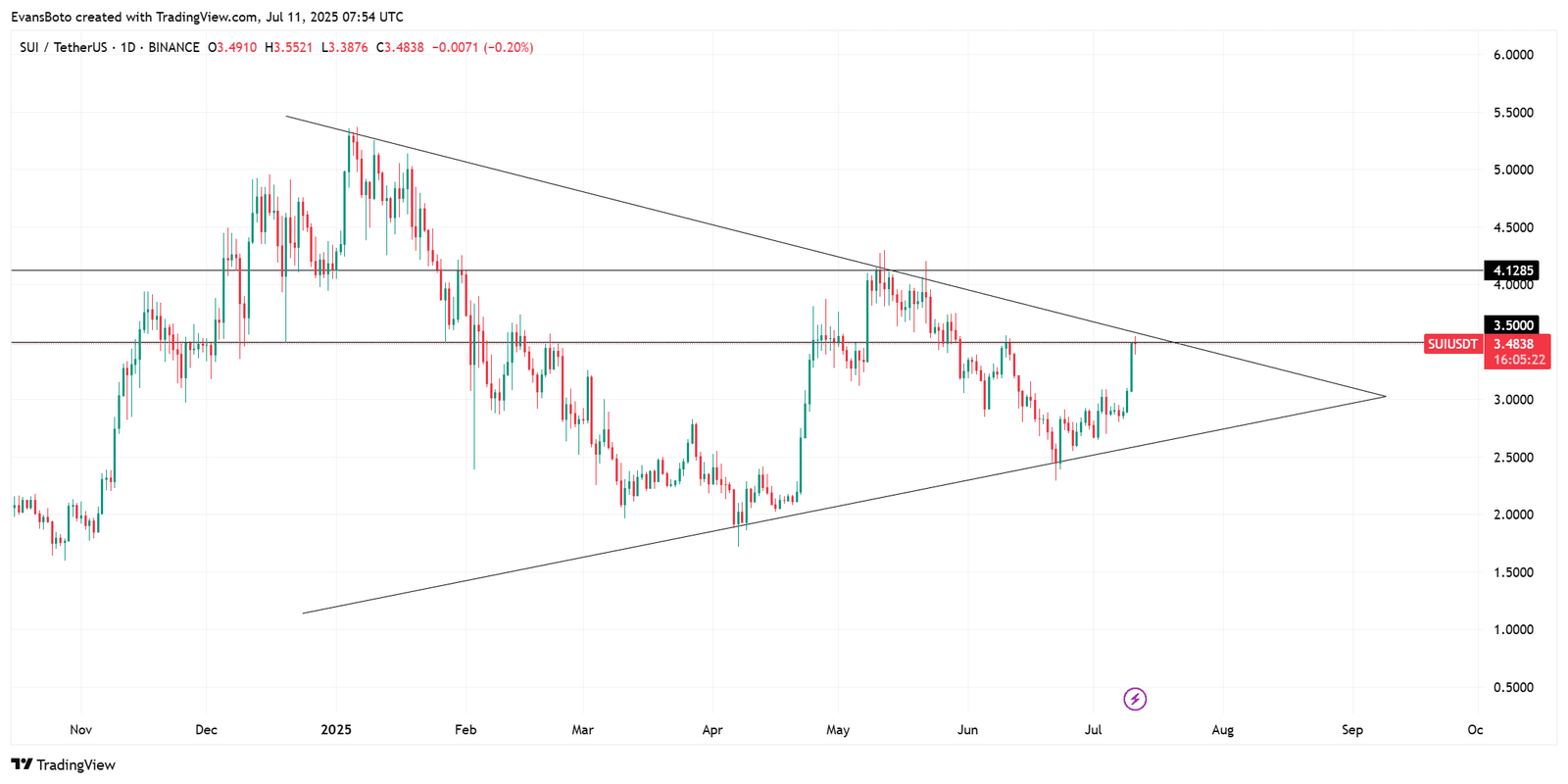

Sui [SUI] has been coiling within a symmetrical triangle for months, narrowing toward a potential breakout.

The network just surpassed 225 million total accounts, reflecting significant user growth and adoption. After testing lower supports repeatedly, buyers have gradually reclaimed higher lows.

At the time of writing, SUI climbed to $3.53, marking a 9.01% intraday gain. This move pushed the price closer to the triangle’s upper boundary.

A sustained breakout above $3.50 could trigger significant bullish momentum.

Therefore, the tightening price structure now puts bulls in a position to take control, provided volume and sentiment continue to align in their favor.

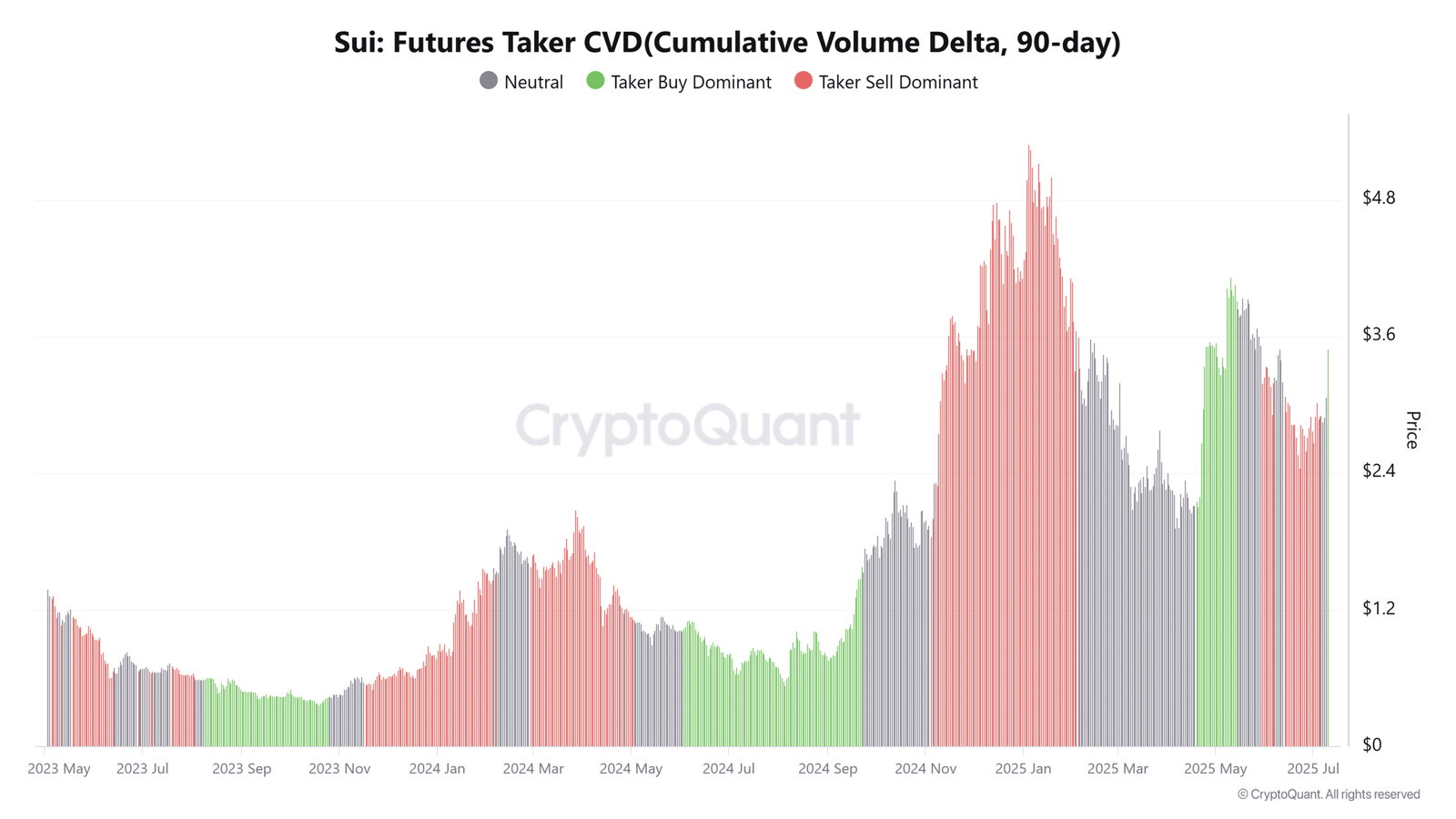

Is futures buyer pressure building toward a breakout confirmation?

Over the last 90 days, the Futures Taker CVD data has revealed dominant buyer activity, with takers consistently executing more buy orders than sells.

This cumulative buy-side aggression signals increasing confidence among derivatives traders. Notably, the aggressive taker action aligns with SUI’s rising price and strengthens the bullish triangle thesis.

Furthermore, this persistent buyer dominance could act as a strong support mechanism against short-term attempts to push prices lower.

If buyers continue to hold control, a breakout above the triangle could be imminent.

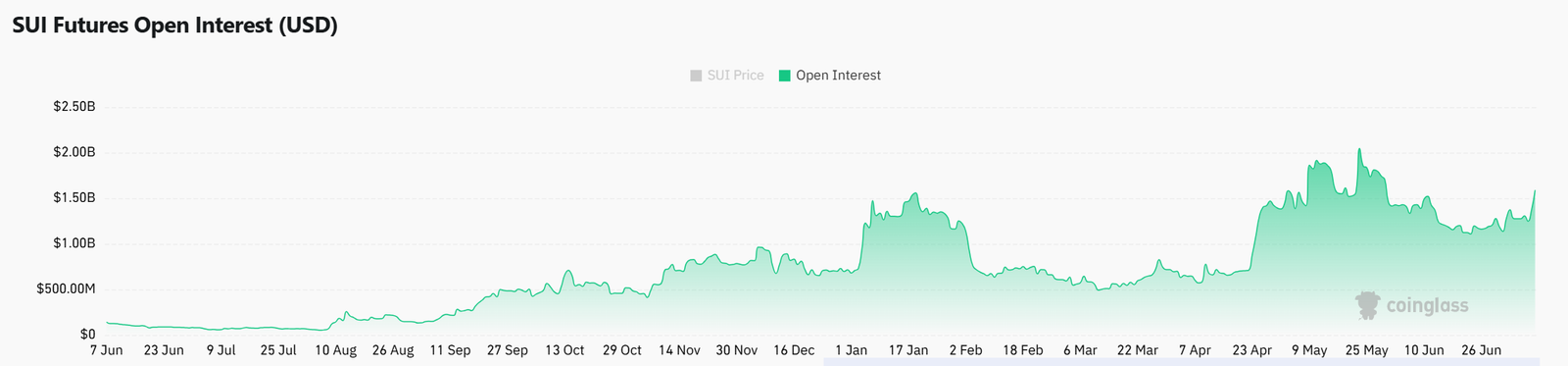

Will rising Open Interest push SUI into higher volatility?

Open Interest (OI) has increased by 12.67%, reaching $1.59 billion across derivatives markets. This jump in open contracts reflects greater participation and risk exposure as traders prepare for a directional move.

The rise in OI suggests that capital is entering the market with expectations of volatility, potentially from a triangle breakout.

Therefore, the combination of rising OI and bullish Taker CVD reinforces the probability of a continuation to the upside.

However, if bulls fail to follow through, leveraged longs could face heightened downside risk.

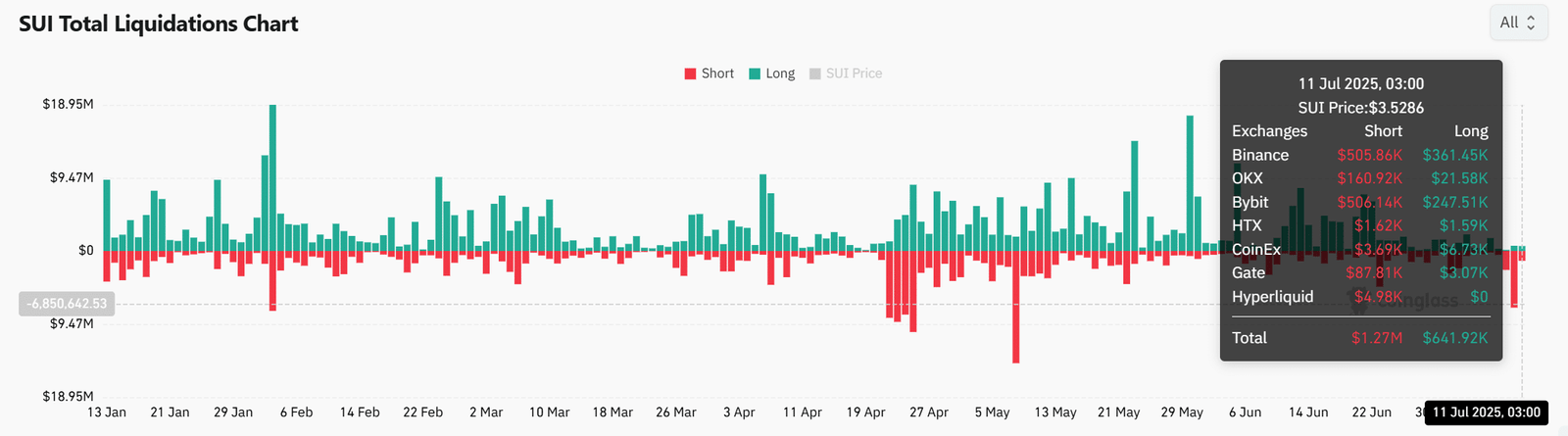

Are short traders in trouble as liquidations spike?

At press time, short liquidations reached $1.27 million, nearly double the $641.92K in long liquidations.

These spikes occurred across major exchanges such as Binance and Bybit, reflecting intense pressure on bearish positions. This imbalance shows that sellers are increasingly getting caught offside as the price climbs.

Moreover, short liquidations are often associated with rapid upward wicks, further driving bullish momentum.

Therefore, the recent liquidation trend adds fuel to the current rally and may trigger additional upside if shorts continue to unwind.

Will SUI’s breakout attempt finally hold above $3.5?

SUI’s current setup shows a tightening pattern, dominant buyer presence, rising OI, and short-side liquidations—all signs favoring a bullish resolution.

However, the breakout must be sustained above $3.5 to confirm a trend shift and avoid a fakeout.

If buyers maintain momentum, SUI could rally further, but failure to close above this key level may attract renewed selling pressure.