Ethereum has recently seen a surge in institutional inflows, with multiple data points pointing to a structural shift in market sentiment. From record-breaking ETF inflows to significant outflows from centralized exchanges, ETH is regaining attention not only as a tech platform but as an institutional-grade asset.

In this article, we break down the key developments, provide source-based metrics, and explain what they mean for Ethereum’s price outlook and positioning in the broader crypto market.

Record-Breaking Inflows into Spot ETH ETFs

Recently, some signals from Ethereum spot ETFs show them an attractive topic that investors take a good care of. ETH ETFs have rapidly become a major magnet for institutional capital, and recent numbers are breaking records.

According to ChainCatcher, the week ending July 11, 2025, saw $908 million in net inflows into ETH ETFs — the highest weekly inflow since launch. This was the ninth consecutive week of inflows. So what does it mean from an investor point of view? It clearly shows sustained interest from institutional allocators.

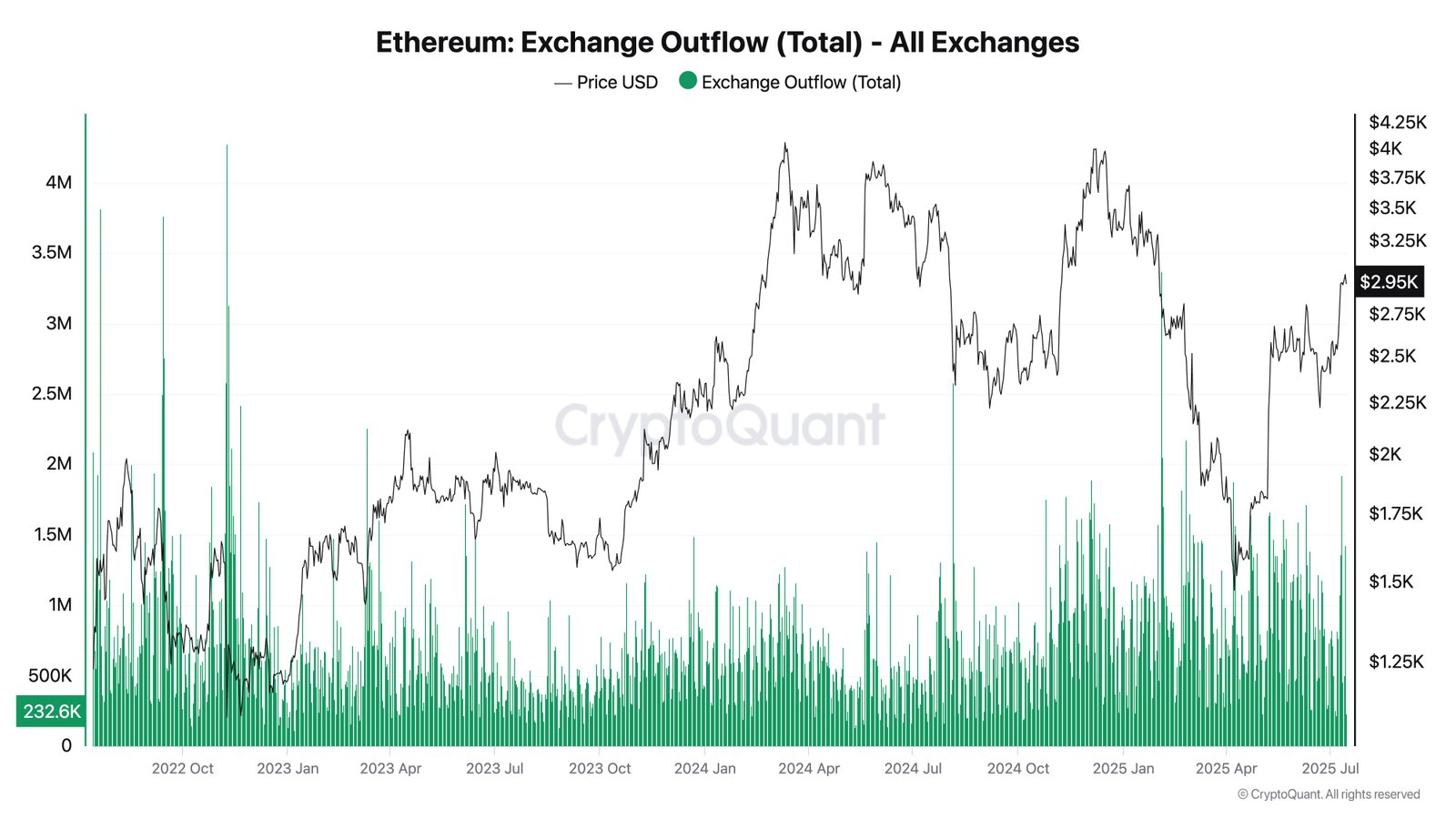

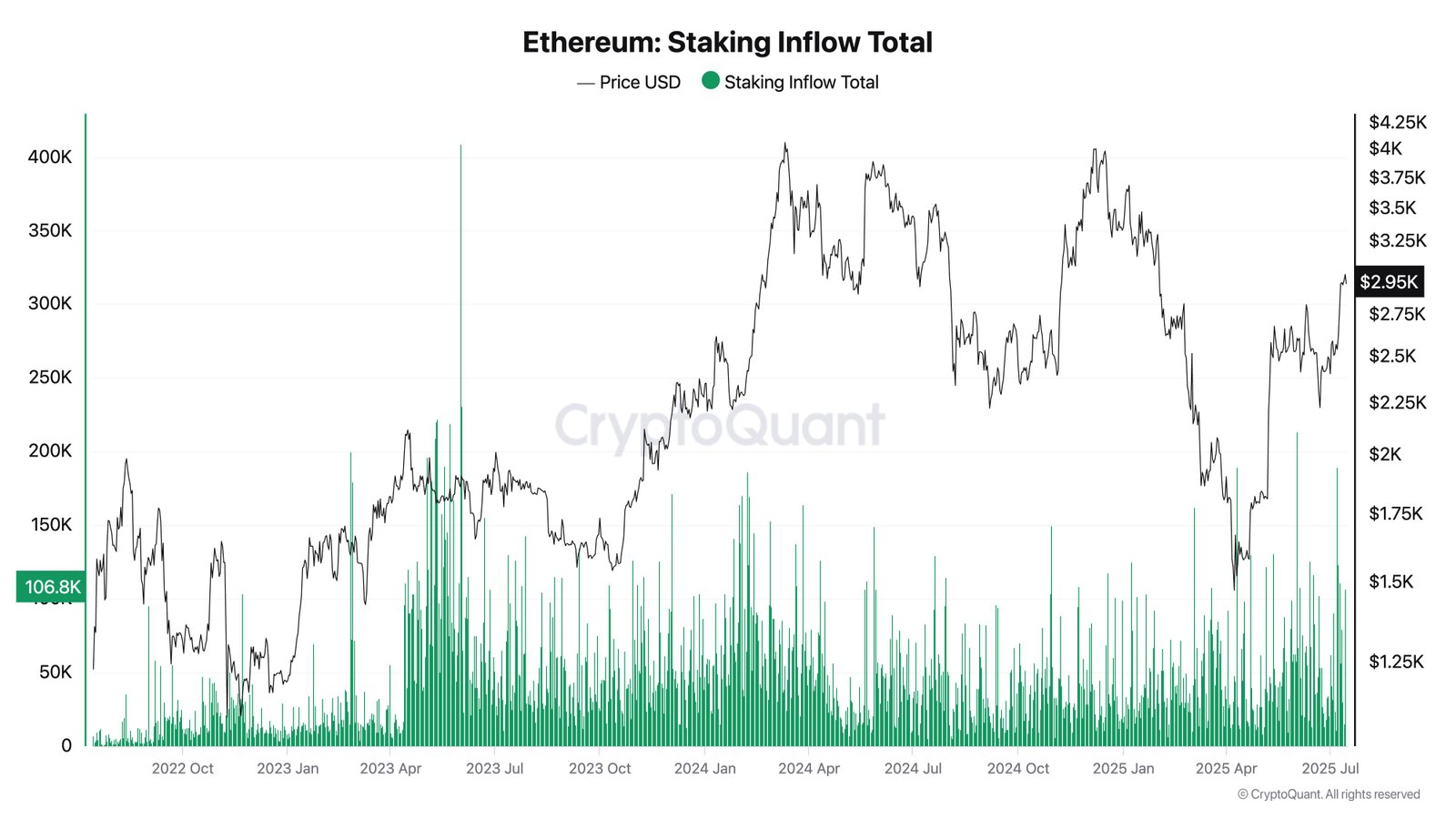

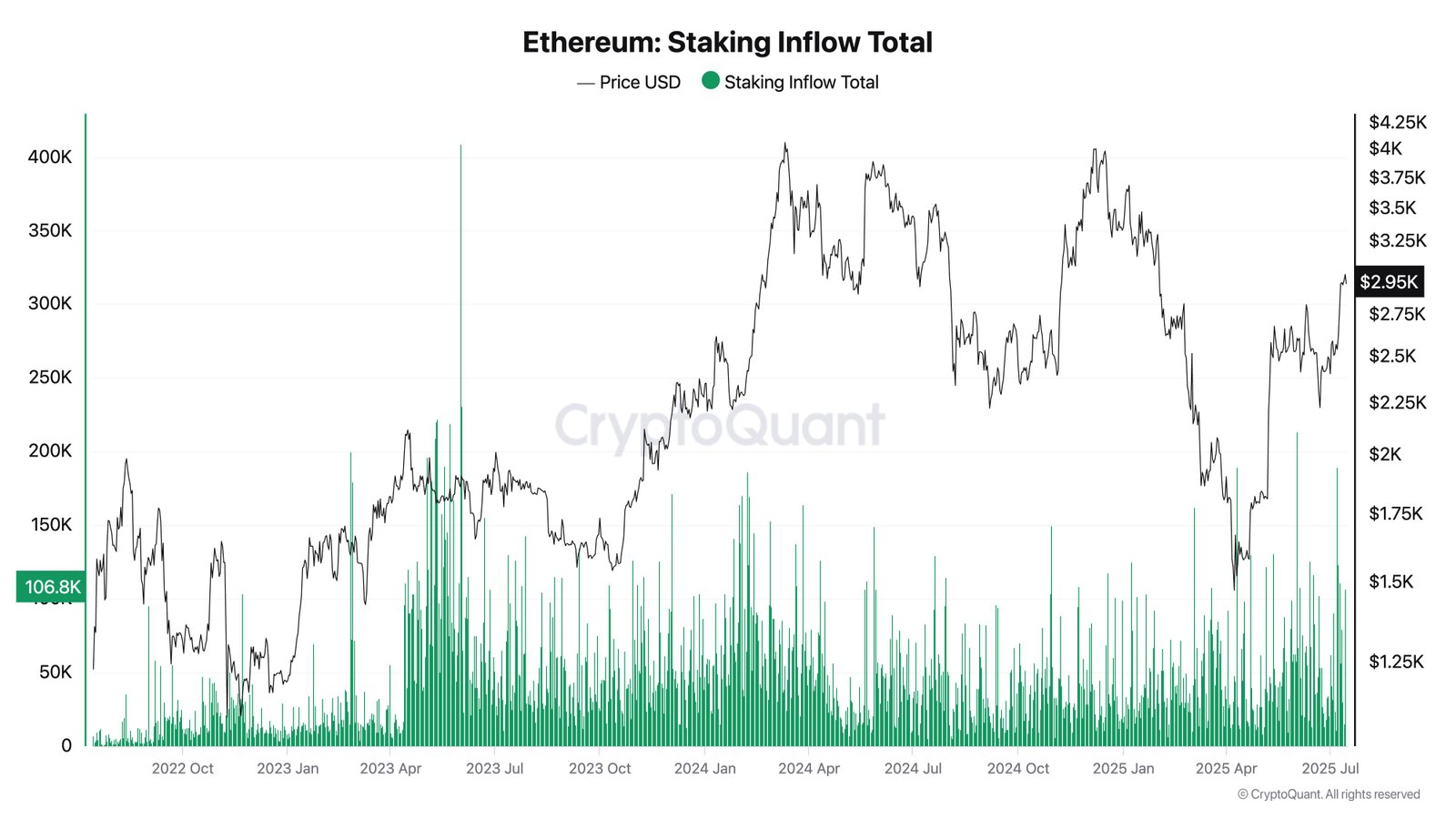

Source: CryptoQuant

Seeing from the data insights, institutional appetite for Ethereum is accelerating rapidly. In the week ending July 11, BlackRock’s ETHA ETF alone attracted $675 million in inflows, raising its total assets under management to $6.29 billion — making it the dominant ETH ETF by far. Fidelity’s FETH followed with a notable $87 million in net inflows during the same period.

Ethereum ETF again $19,000,000 $ETH inflow.

Fidelity keeps on buying Ethereum👇 pic.twitter.com/QqtSsrdupm

— Ted (@TedPillows) February 20, 2025

According to CryptoSlate data, the cumulative inflows into all Ethereum ETFs surpassed $5 billion on July 11 — a milestone reached in just 12 trading sessions, significantly faster than analysts had anticipated. This surge highlights Ethereum’s growing appeal among asset managers and its increasing role in institutional portfolio construction.

Source: CryptoQuant

From the chart above, the constantly increasing pace of ETH ETFs inflow means ETH is gaining serious traction as a programmable, institutional-grade asset. These figures are not just impressive. In fact, they show a deeper structural interest from asset retail/institutional investors and ETF allocators. With a weekly inflow rate of 1.6% of total ETF AUM, Ethereum is currently attracting more relative capital than Bitcoin ETFs, where flows typically hover around 0.8%.

For more: Altcoin ETFs After Solana – XRP, ADA, AVAX Next in Line

Centralized Exchange Outflows & Whale Accumulation

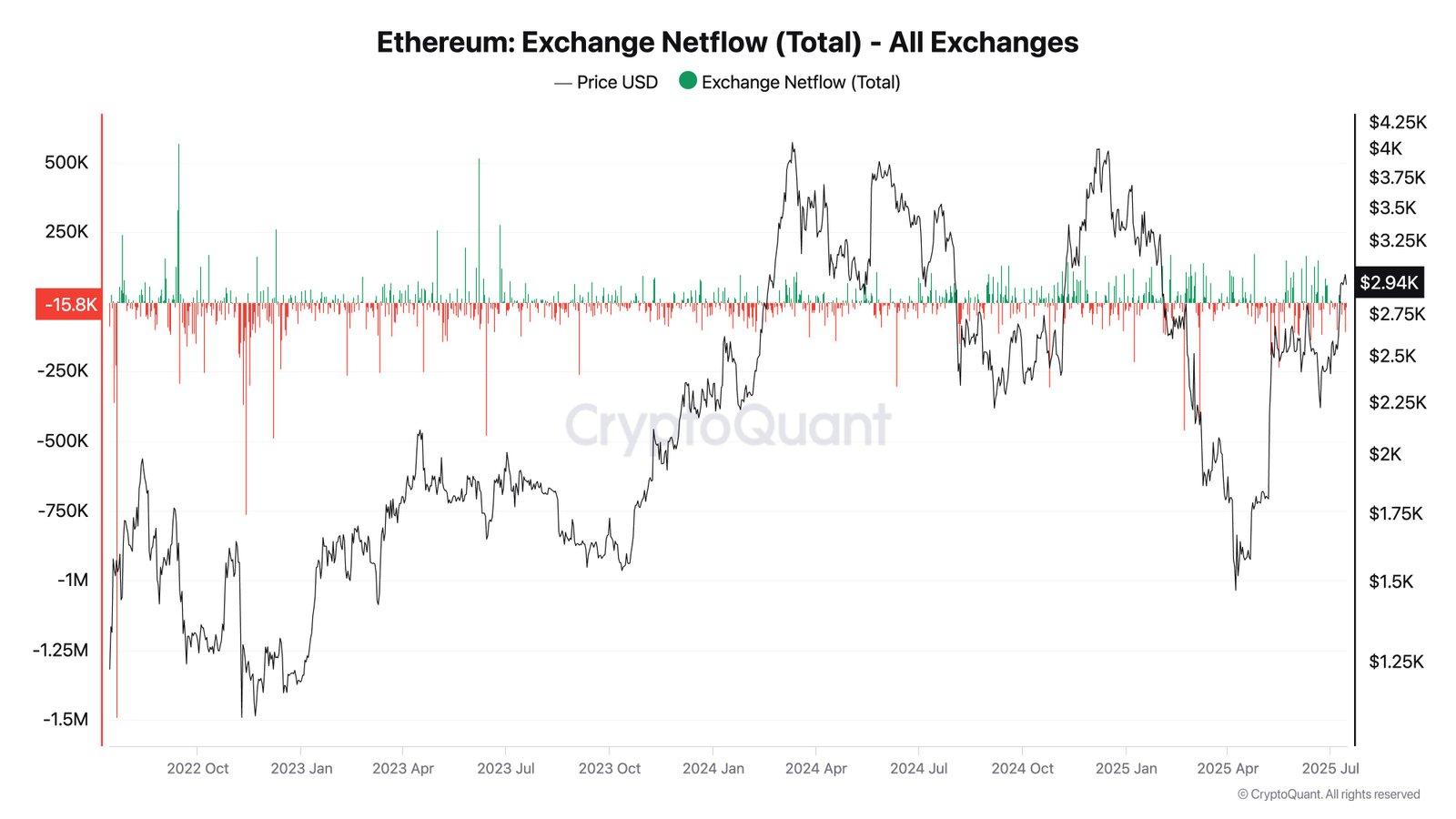

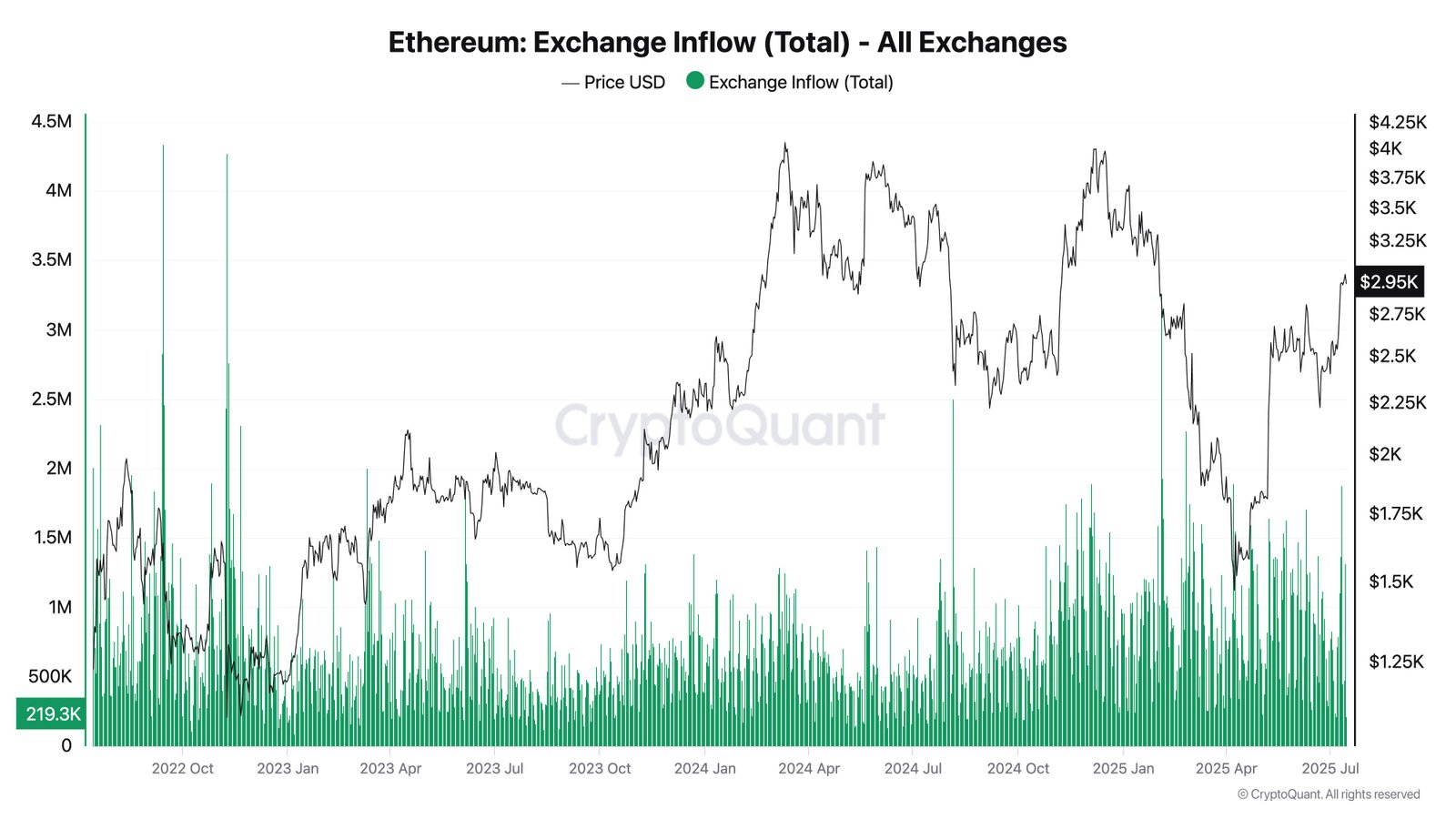

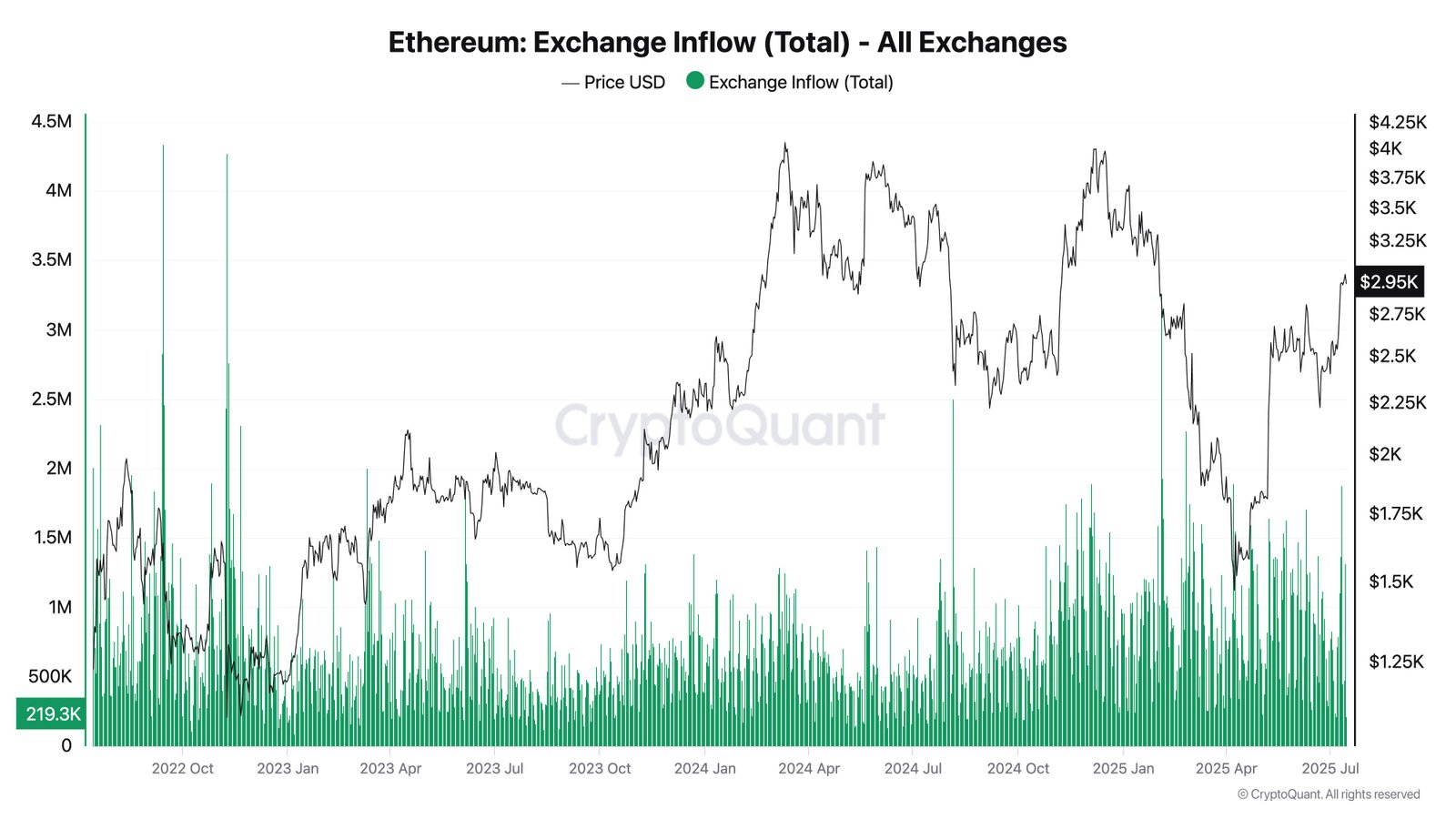

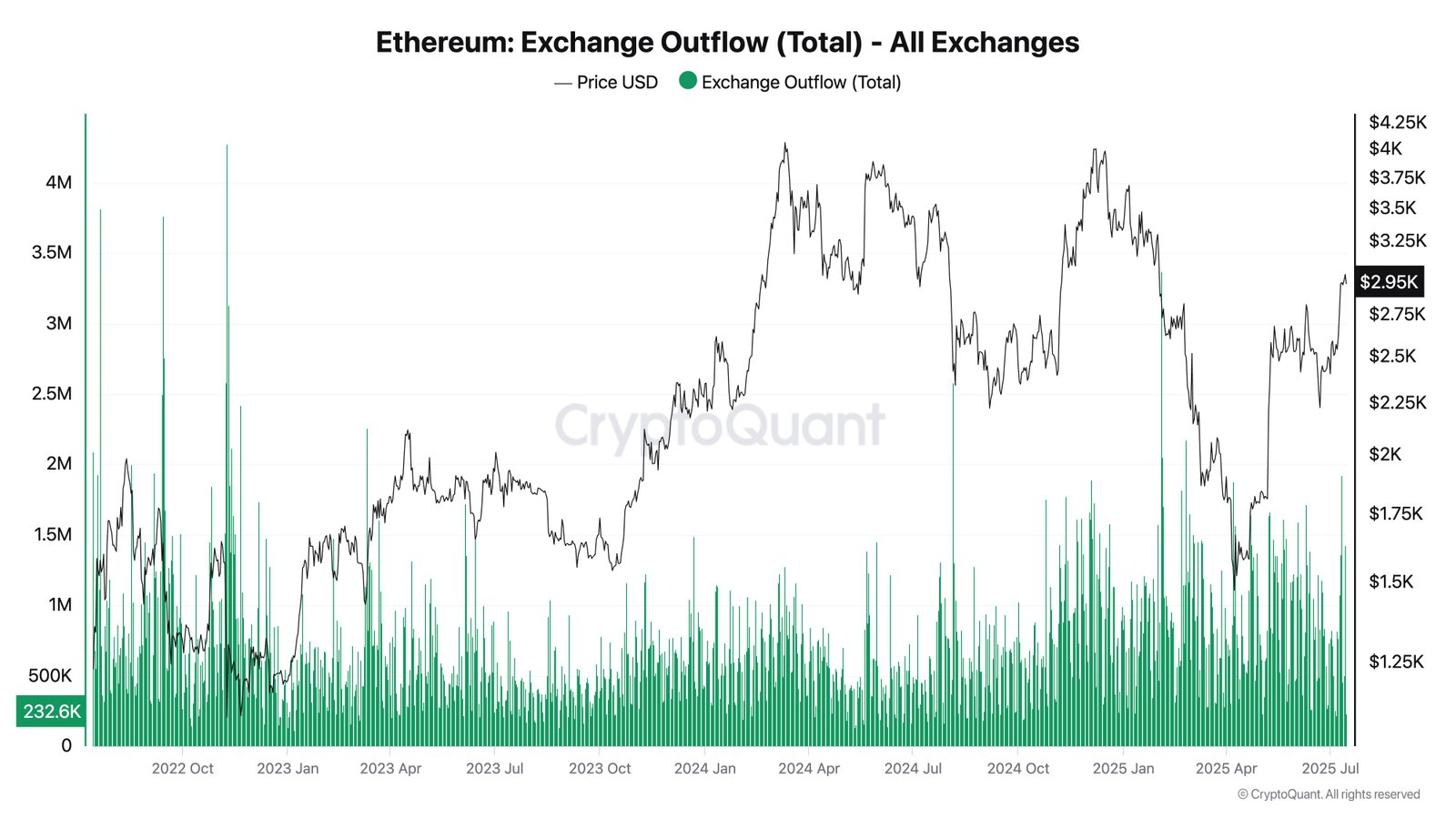

Take another look at ETF flows, Ethereum’s on-chain data reveals powerful signs of accumulation, particularly among long-term holders and large wallets. On July 11, $206 million worth of ETH was withdrawn from centralized exchanges, according to AINVEST — a classic indicator of long-term storage or staking behavior.

Blockchain data tracked by Bitget shows that a whale wallet (address 0x1fc7) withdrew 6,989 ETH (~$17.5 million) from Binance over a three-week period. Meanwhile, TradingNews reports that whales now collectively hold 26.88 million ETH, accounting for 22% of the circulating supply. Perhaps most strikingly, Glassnode recorded a single-day whale accumulation of 871,000 ETH, a level not seen since 2017.

Source: CryptoQuant

These accumulation patterns suggest that large holders or whales tend to act as long-term price setters. They are positioning themselves for future expectations of price appreciation, moving ETH off exchanges and into cold wallets or smart contracts — a behavior consistent with long-term conviction and reduced intent to sell in the near term.

Exchange outflows typically indicate reduced sell pressure. When exchange outflows increase while whale balances grow, it reflects conviction-based accumulation. This reduces circulating supply and adds upward pressure on price in the medium term. When combined with whale accumulation, it suggests large holders are preparing for a long-term price appreciation — and are removing ETH from venues where it could be sold quickly.

For more: Tokenized Stocks vs ETFs: Which One Wins in the Long Run?

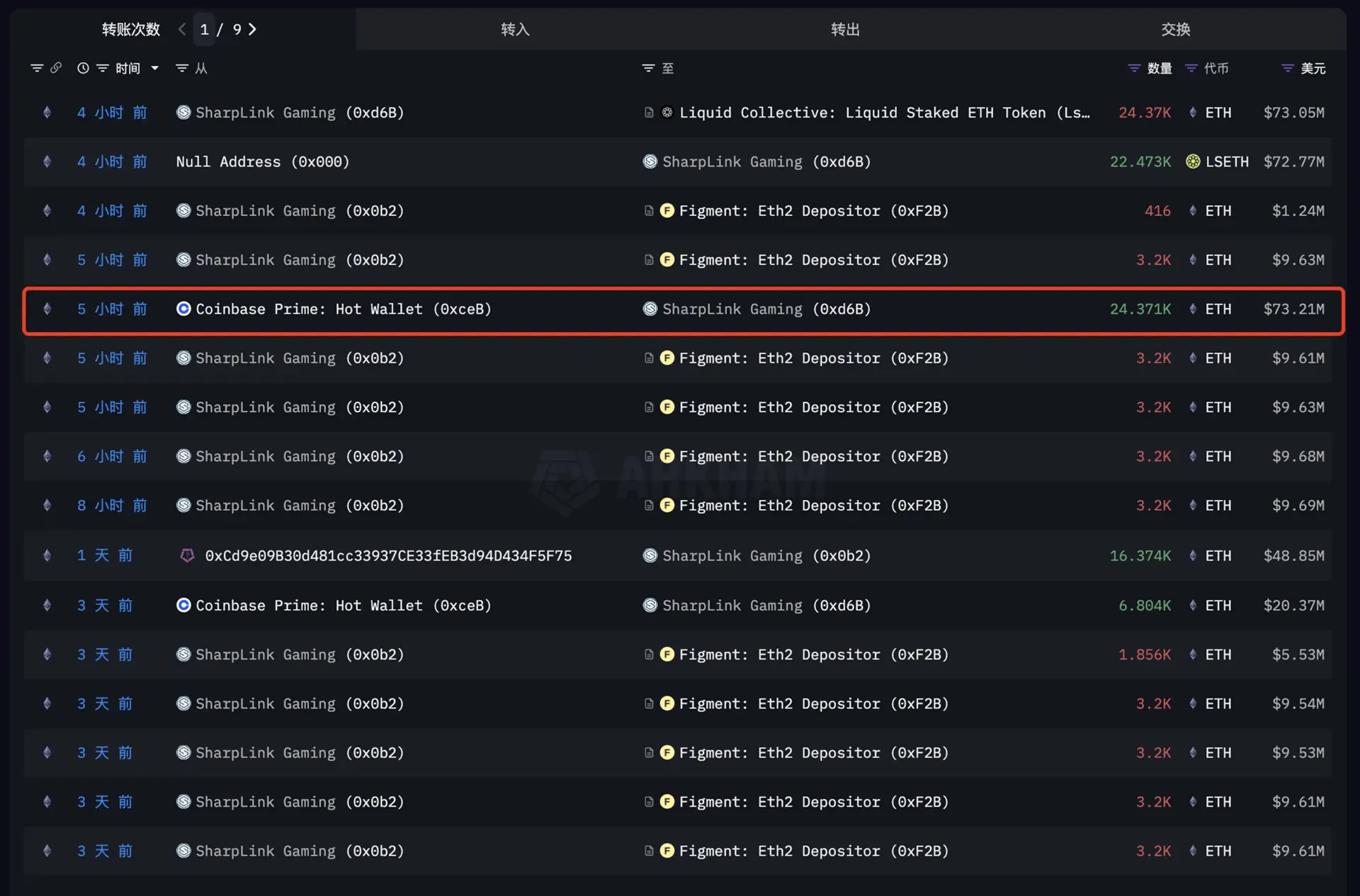

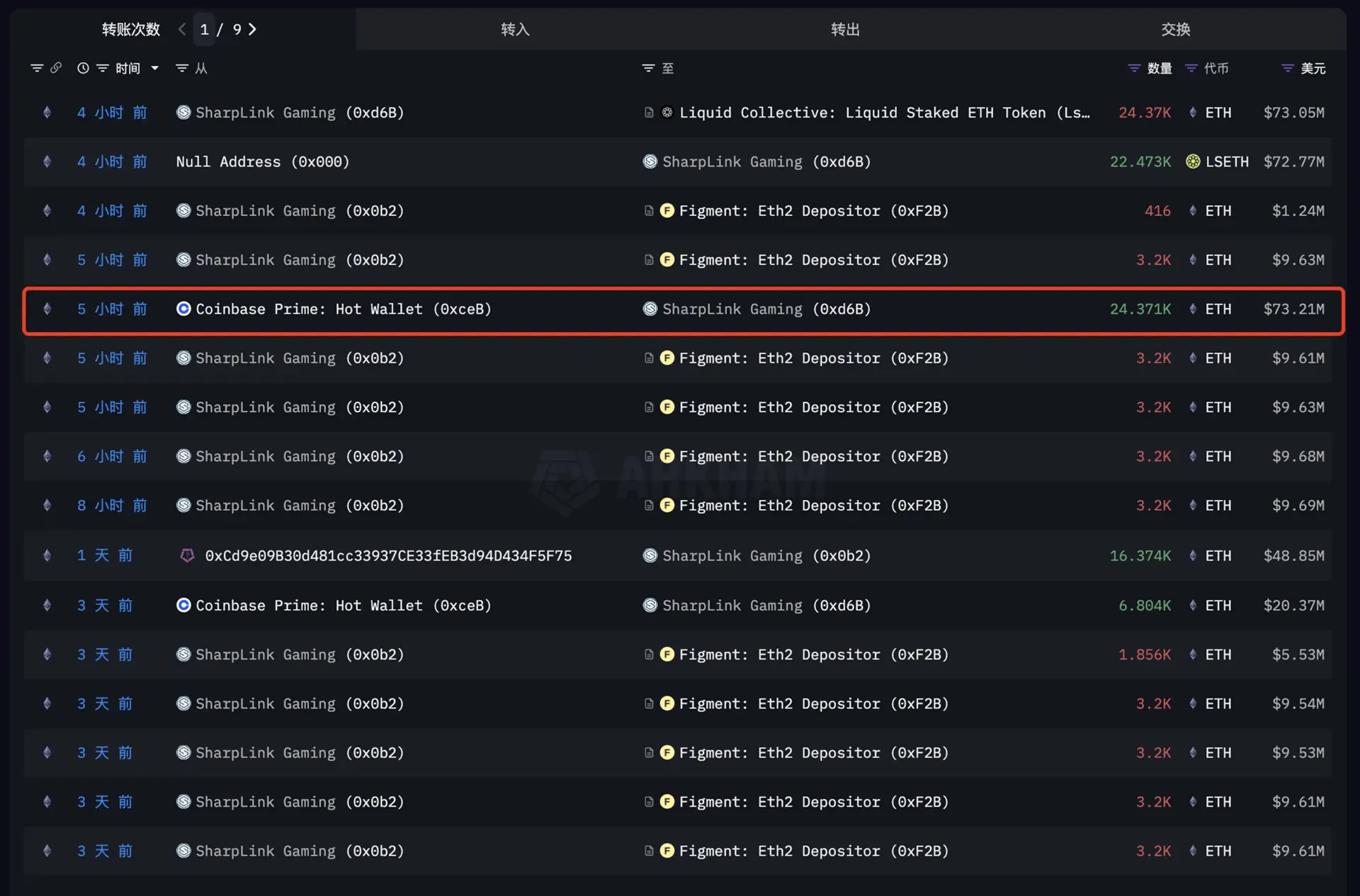

Source: Nansen

SharpLink Gaming has rapidly emerged as a major institutional player in Ethereum, now holding approximately 270,000 ETH—a total only exceeded previously by the Ethereum Foundation. Over just five days, it acquired 60,582 ETH (~$180 million) and added 16,374 ETH (~$49 million) in a single day via OTC and direct deals. With an average acquisition cost around $2,667–$2,695, SharpLink’s position now holds an unrealized gain of about $81–92 million. The firm leverages ATM equity financing to fund ETH purchases and earns staking rewards—approximately 3.5% APY, or roughly 220 ETH/month—enhancing capital efficiency. This aggressive accumulation strategy coincides with a 60% stock price surge last month and reflects a broader institutional trend treating ETH as a treasury asset, not just a speculative token.

Ethereum On-chain Key Metrics and Price Action

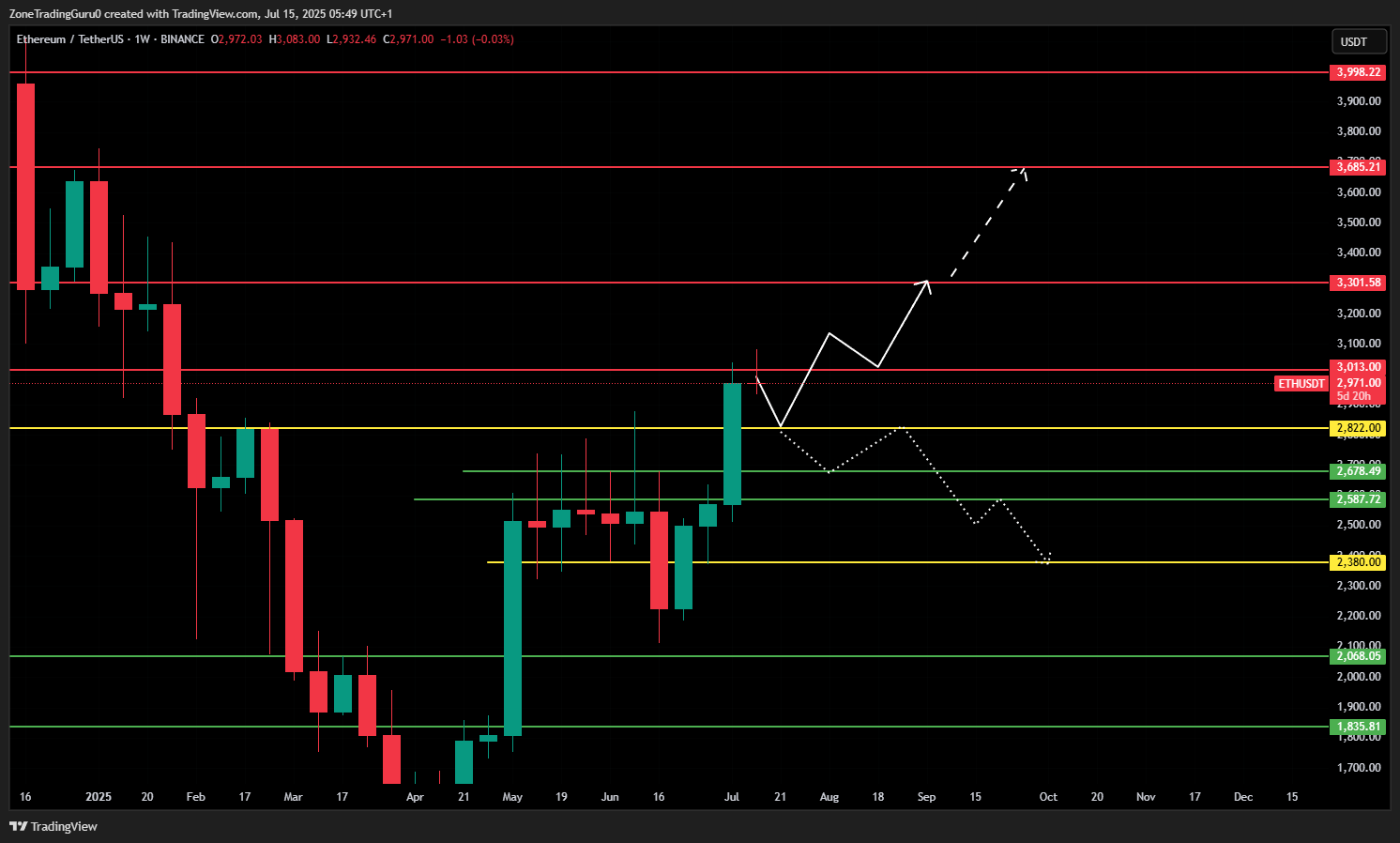

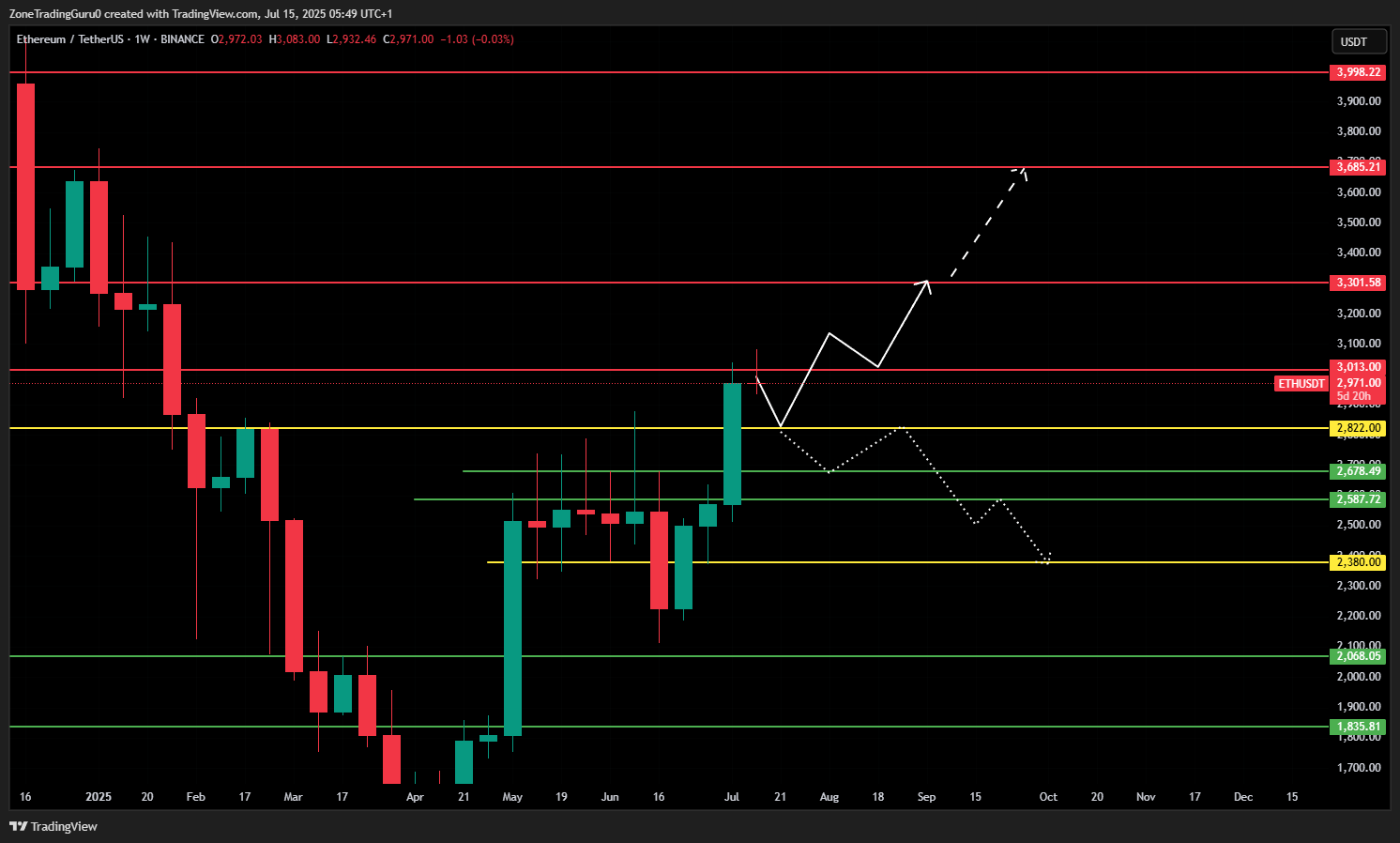

Ethereum has recently broken through the key resistance level at $2,822 and is now approaching another significant barrier at $3,013. At this stage, price action could unfold in two ways: ETH may pull back to retest support at $2,822 before continuing upward, or it may break through $3,013 directly.

If ETH successfully breaks above $3,013, the next major resistance levels to watch are $3,301.5 and potentially $3,685.2. However, if the breakout fails, the price could consolidate within the range of $2,822–$3,013, awaiting further market direction. A downside break of this range could push ETH toward the next support zones at $2,678 and $2,587, or in a more bearish scenario, down to the critical $2,380 key level.

Source: Tradingview

We could see the strong bullish signal from the on-chain perspective of ETH. On centralized exchanges, the amount of ETH held has fallen to its lowest level since 2018. What does it mean? This signals a significant reduction in sell-side pressure as more tokens are moved into cold storage or staked. According to CoinLaw data, over 3.8 million ETH has been withdrawn from exchanges, reinforcing the narrative of long-term accumulation.

Another signal that we should take a clear look into. From whales’ point of view, their activity further supports this trend. The number of wallets holding over 10,000 ETH have increased by 5–11% year-over-year, with a notable spike of 871,000 ETH accumulated in a single day—levels not seen since 2017. Additionally, on-chain cost-basis data reveals a major support cluster between $2,513 and $2,536, where approximately 3.45 million ETH is held.

This suggests that many investors are in modest profit and unlikely to sell at current levels. Ethereum’s network fundamentals are also strengthening: daily active addresses have risen by 16%, transaction volume has increased 12%, and nearly 30% of ETH supply is now staked. These metrics collectively reflect a tightening supply dynamic and growing confidence from both retail and institutional participants.

In summary, ETH is technically positioned near a decisive level, with on-chain fundamentals reinforcing a bullish outlook. Whether price action confirms the breakout or consolidates further, Ethereum is supported by a strong foundation of accumulation, utility, and long-term capital commitment.

Strategic Implications for Investors

What we’re witnessing may be the beginning of a multi-month capital cycle in which Ethereum becomes the central focus of institutional rotation away from Bitcoin and other risk assets. Several factors are driving this shift.

First, since the Ethereum upgrade to Ethereum 2.0 and the Pectra upgrade, Ethereum offers programmable yield powering decentralized finance (DeFi), liquid staking tokens (LSTs), and emerging restaking protocols.

Source: CryptoQuant

Second, staking is built into Ethereum’s protocol, enabling investors to earn native yield simply by holding ETH in validator networks. This makes it more capital-efficient in the long term.

Third, the regulatory landscape has become more favorable with the approval of spot ETH ETFs. This reduces uncertainty and legitimizing ETH in traditional finance circles.

Fourth, ETH is gaining share in ETF flows compared to Bitcoin. This signals that large institutions are rebalancing toward Ethereum in their crypto allocations. Supporting this, data from CryptoQuant shows that many whales are transferring ETH to cold wallets rather than deploying it in yield strategies. It shows a pattern typically seen in preparation for long-term holding. Collectively, these trends suggest that Ethereum is evolving from a speculative trading asset into a foundational financial layer of the digital economy. The capital inflow data is beginning to reflect that transformation.

| Metric | Recent Value | Interpretation |

| Spot ETF inflows | $900M+/week | Institutional conviction accelerating |

| Exchange outflows | ~$200M–$400M/week | Reduced sell-side liquidity |

| Whale holdings | 26.88M ETH (~22%) | Long-term accumulation peak |

| Price trend | Above all major EMAs | Medium-term bullish breakout setup |

| Volume | $44.7B/day | Broad participation resurgence |

As data shows, Ethereum is experiencing one of the strongest capital inflow cycles in its history. With ETF products gaining traction, whale wallets are accumulating at 2020 levels. With technical signals aligned, ETH appears poised for a structurally driven uptrend—not just another speculative spike.

If the current momentum holds and macro conditions remain favorable, Ethereum could retest its previous all-time highs—or even set new ones—in the coming months.