Shares of Opendoor Technologies (OPEN) have skyrocketed more than 170% over the past five trading days after being crowned this season’s meme stock by traders on Reddit’s WallStreetBets.

Shares of the online real estate marketplace have seen an upsurge in speculative interest and trading volumes over the past month after gaining traction among traders on Reddit’s WallStreetBets — a community known for spotlighting meme stocks.

Previously a penny stock, Opendoor shares have soared more than 500% over the past 30 days, trading at $3.11 at the time of writing.

The surge in interest is underscored by a dramatic spike in daily trading volumes, which have climbed to more than five times the long-term average, according to Yahoo Finance data.

On Monday alone, approximately 1.9 billion Opendoor shares changed hands, based on FactSet data cited by CNBC.

With over 19 million members, the WallStreetBets subreddit is known for championing high-risk trading strategies, often targeting heavily shorted stocks with strong community backing — prime candidates for short squeezes.

The meme stock frenzy reached a fever pitch during the COVID-19 pandemic, fueled by record stimulus payments that enabled a wave of retail trading. Through platforms like WallStreetBets, stocks such as GameStop (GME) and AMC Entertainment (AMC) saw explosive gains, despite weak fundamentals.

GameStop’s meteoric rise even helped the company stave off potential bankruptcy.

Since then, GME has evolved into a significant Bitcoin (BTC) holder, raising billions to invest in the digital asset. The company now holds 4,710 BTC, ranking as the 17th largest publicly traded Bitcoin investor, according to industry data.

Nevertheless, Opendoor’s financials suggest a more stable foundation than many other meme stock favorites identified by WallStreetBets and others. In the first quarter, the company reported $1.2 billion in revenue — a 2% decline year-over-year but a 6% increase from the prior quarter. Notably, Opendoor also turned $99 million in gross profit.

Related: Memecoin $79B rally means capital has nowhere better to go: Exec

Meme stocks, crypto and S&P 500 rally

The resurgence of meme stock mania is unfolding alongside a record-breaking recovery in the US stock market and crypto’s ascent past a $4 trillion market cap for the first time — driven by a wave of renewed investor optimism following a volatile start to the year.

Analysts say the rally is underpinned by growing confidence in the economic outlook, easing inflation, expectations of interest rate cuts this fall and resilient corporate earnings, even in the face of mounting tariff-related risks.

Meanwhile, Bitcoin’s momentum is being fueled by institutional investors who, according to Jeff Mei, chief operating officer at crypto exchange BTSE, are taking a long-term view that the digital asset will continue to appreciate over time.

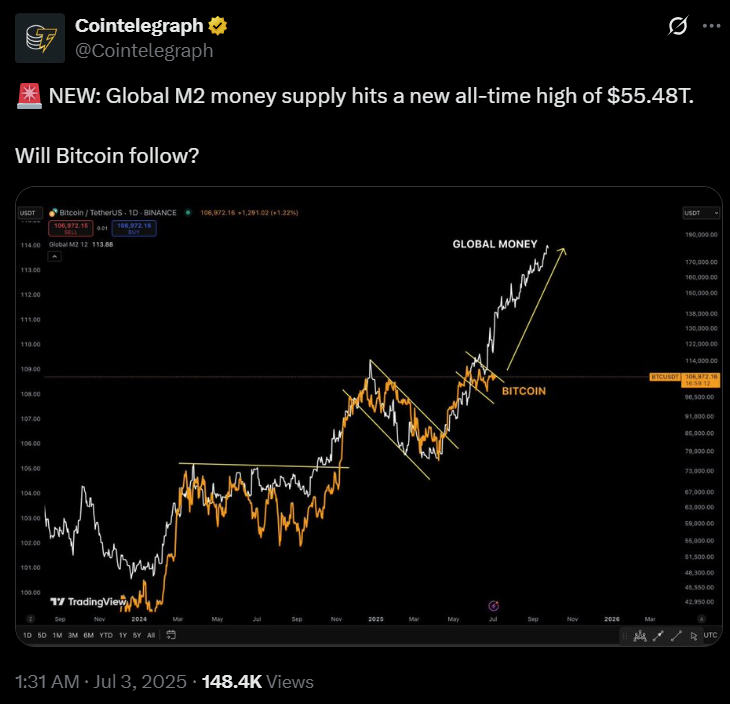

Stocks and crypto markets also appear to be closely tracking global M2 money supply — a correlation that first gained attention during the pandemic, with Bitcoin typically following global liquidity trends on a three- to six-month lag.

Related: Despite record high, S&P 500 is down in Bitcoin terms