The cryptocurrency ETF market has undergone a seismic shift in 2025, fuelled by regulatory breakthroughs, institutional adoption, and a maturing investor base. Once viewed as speculative and fringe, crypto ETFs—particularly spot Bitcoin ETFs—have become a central asset class for both traditional investors and digital-native portfolios.

With over $120 billion in assets under management (AUM) and massive inflows in just over a year, crypto ETFs have emerged as one of the biggest financial stories of the decade. But what’s really behind the boom? And what does it mean for the price of Bitcoin, Ethereum, and the broader digital asset market?

A Snapshot of Crypto ETF Landscape in 2025

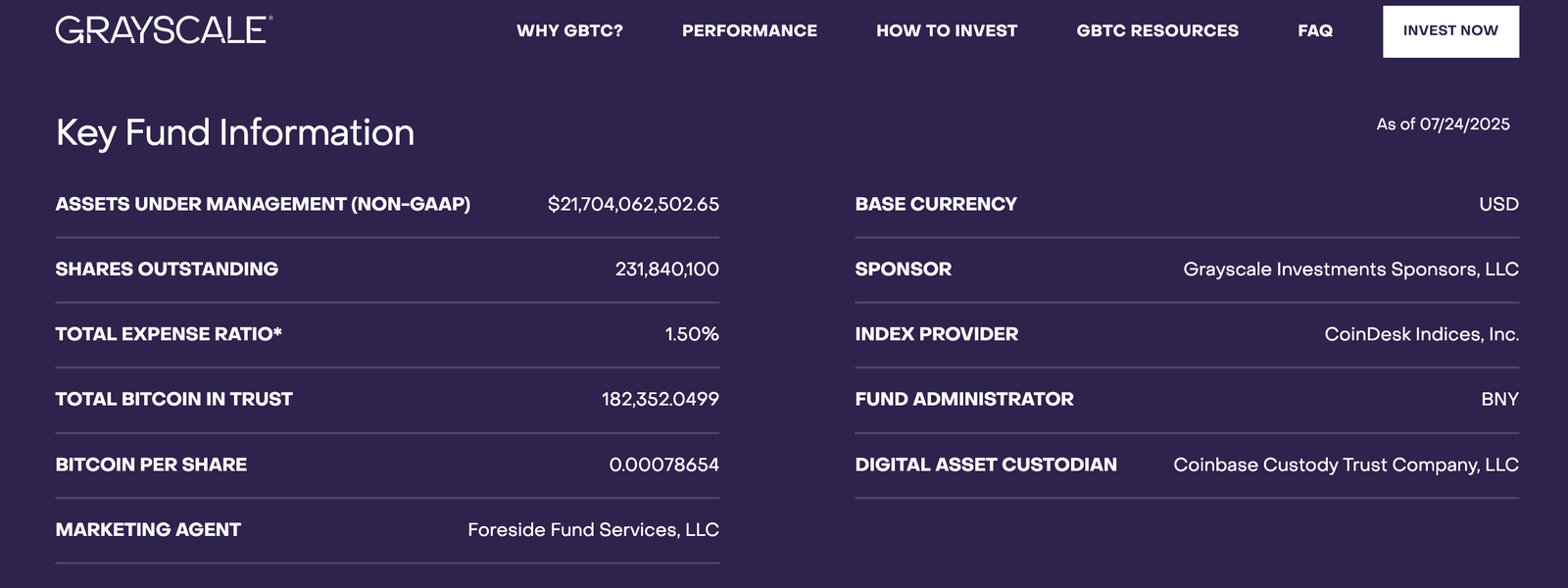

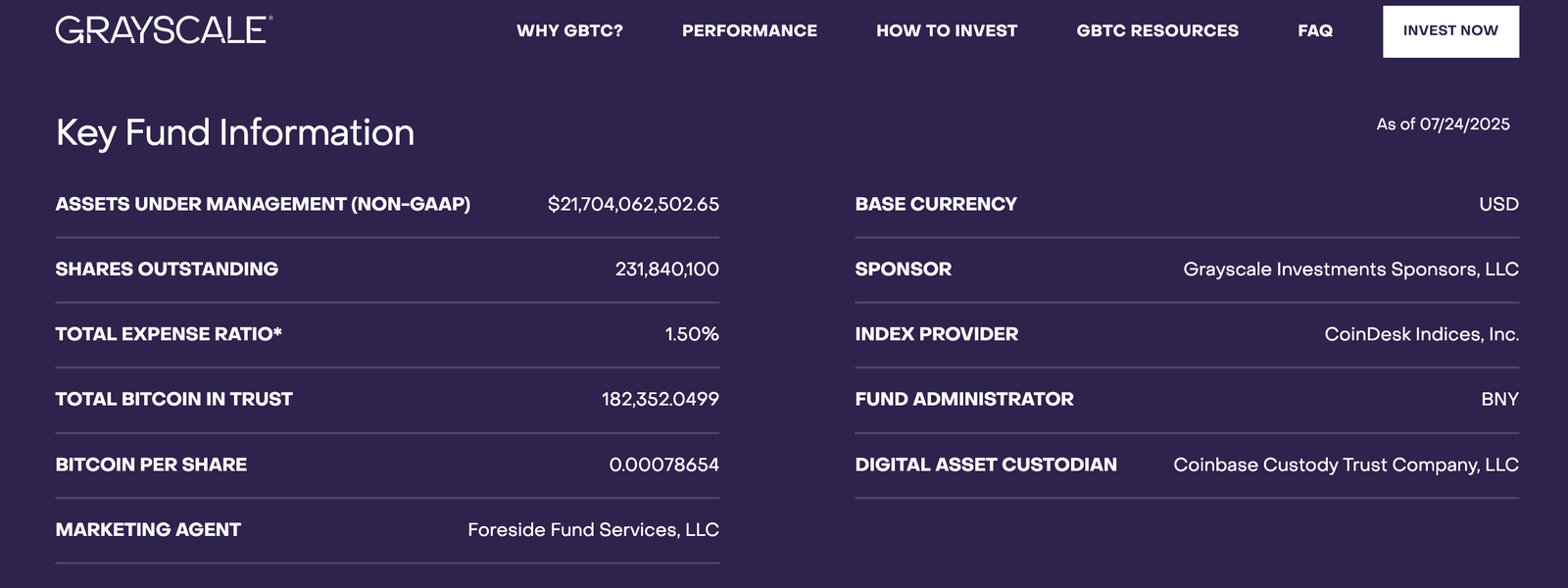

The rise of spot Bitcoin ETFs over the past 18 months has been staggering in both scale and velocity. BlackRock’s iShares Bitcoin Trust (IBIT) currently holds the top position with an AUM of over $76 billion, closely followed by Fidelity’s FBTC, which has an AUM of approximately $20 billion. Grayscale’s GBTC, despite its high 1.5% management fee, retains over $18 billion but has seen declining daily inflows due to competitive pressure. Meanwhile, low-fee entrants like Bitwise BITB and VanEck’s HODL are rapidly gaining traction with retail investors seeking cost-efficient exposure.

Daily inflows offer an even clearer picture of the momentum behind these funds. On July 17, 2025 alone, IBIT brought in nearly $395 million in new capital—more than the entire weekly inflow of the largest bond ETF at the time. In contrast, Fidelity’s FBTC saw zero inflow that day, which analysts attributed to a brief custody adjustment. Bitwise, Grayscale, VanEck and other firms recorded inflows ranging from $7 to $13 million, demonstrating consistent investor interest that extends beyond the two market leaders.

For more: 8 Best Bitcoin ETFs to Buy Right Now

| ETF Category | YTD Inflows ($B) | Average Return (%) |

| Spot Bitcoin ETFs | 74.2 | +52.5 |

| Ethereum ETFs | 11.3 | +46.2 |

| Crypto Baskets (Top 10) | 4.9 | +41.8 |

| Blockchain Equity ETFs | 7.7 | +22.4 |

Although Bitcoin remains the dominant asset, 2025 has seen the emergence of Ethereum ETFs, which are following a similar trajectory. Fidelity and ARK 21Shares launched spot ETH ETFs in Q2, quickly gathering $3.5 billion in AUM within the first three months. These funds, with average returns above 46%, are positioning Ethereum as the second pillar of institutional crypto adoption.

With Ethereum ETFs holding real ETH in custody, the same supply compression dynamics seen in Bitcoin are starting to take shape. Additionally, Ethereum’s staking yield—currently around 3.8% annually—gives ETH a unique appeal as a yield-bearing asset, which is not directly reflected in ETF products but contributes to long-term investor confidence.

Beyond single-asset funds, multi-asset crypto ETFs are beginning to gain traction, offering exposure to a basket of top digital assets like Bitcoin, Ethereum, and Solana. While these remain a small share of the market with less than $5 billion AUM, they represent a future growth segment as investors look for diversified crypto exposure.

The surge in crypto ETF adoption is not simply a retail phenomenon. Institutional capital now dominates crypto ETF inflows. Pension funds, hedge funds, and wealth managers are allocating to ETFs because they offer compliance with existing regulatory frameworks, audited custodianship, and seamless integration with traditional brokerage systems.

For more: The Impact of Bitcoin ETFs on BTC Price – Real Data Analysis

Key Drivers Behind the 2025 Crypto ETF Boom

Regulatory Clarity Opens the Doors

The single most important driver has been regulatory approval. After years of pushback, the SEC greenlit the first spot Bitcoin ETFs in January 2024. These ETFs hold actual BTC, unlike the futures-based funds that struggled with roll costs and tracking errors.

Source: SEC

Following the U.S. lead, Singapore, the UK, and Switzerland have also moved forward with frameworks for regulated crypto ETFs. This wave of international approval has legitimized digital assets as a core investment class.

Spot crypto ETFs now serve as the primary access point for institutions, bypassing the need for direct custody or offshore crypto exchanges.

Institutional Flows Fuel Price and Demand

Institutional investors—once skeptical of crypto—have begun embracing ETFs as a compliant, liquid, and transparent entry point.

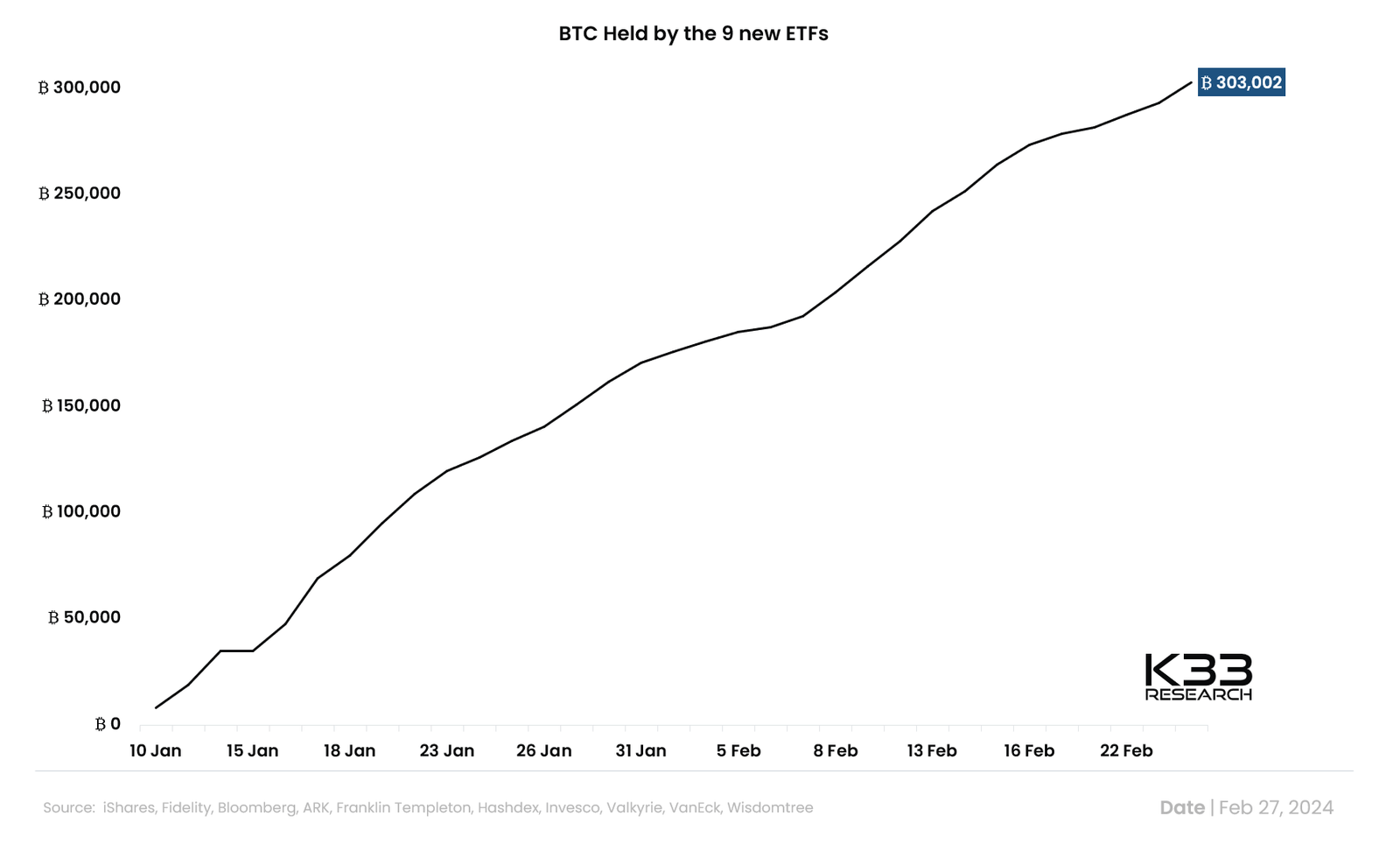

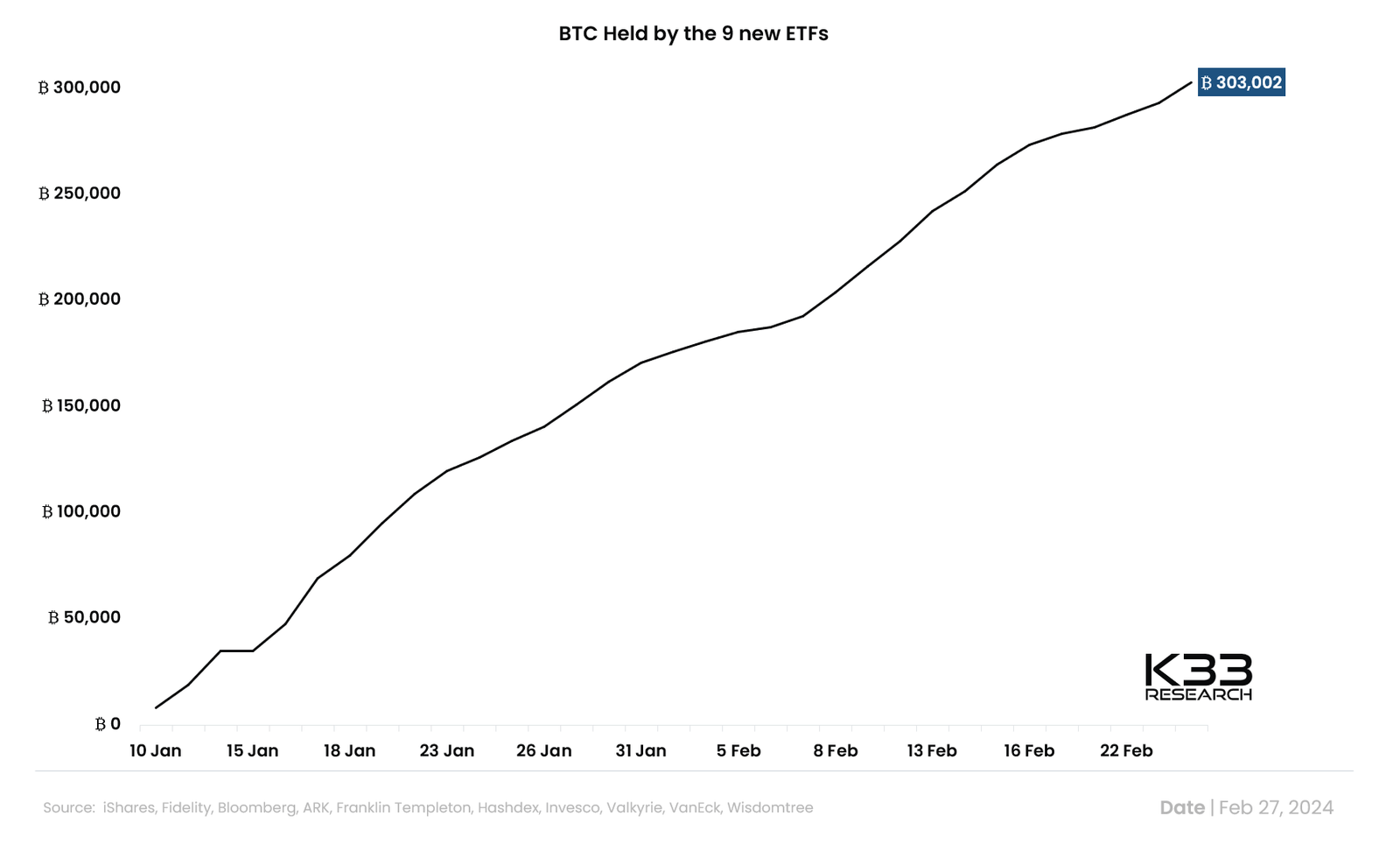

In just 18 months, spot Bitcoin ETFs have absorbed more than 300,000 BTC, representing over 1.5% of total BTC supply. Major inflows have come from:

- Registered Investment Advisors (RIAs)

- Corporate treasuries

- Pension and sovereign funds

- 401(k) platforms (via approved brokerages)

Source: K33 Research

These inflows are not short-term speculative bets but are increasingly part of long-term strategic allocations. According to JPMorgan’s Q2 2025 crypto report, ETF-driven demand accounted for nearly half of Bitcoin’s price appreciation in the first half of 2025.

Retail Reawakens, But More Educated

Retail participation has also rebounded, but with more sophistication. Unlike the 2021 bull run, investors in 2025 will favour regulated ETF vehicles over high-risk tokens.

Platforms like Robinhood, SoFi, and Fidelity have integrated Bitcoin and Ethereum ETFs into their tax-advantaged accounts, making crypto exposure as accessible as buying an S&P 500 ETF.

Bitwise’s BITB, known for publishing real-time BTC wallet holdings and proof-of-reserves, has attracted younger investors who demand transparency and blockchain-native accountability.

Bitcoin ETF Mechanics Create a Supply Squeeze

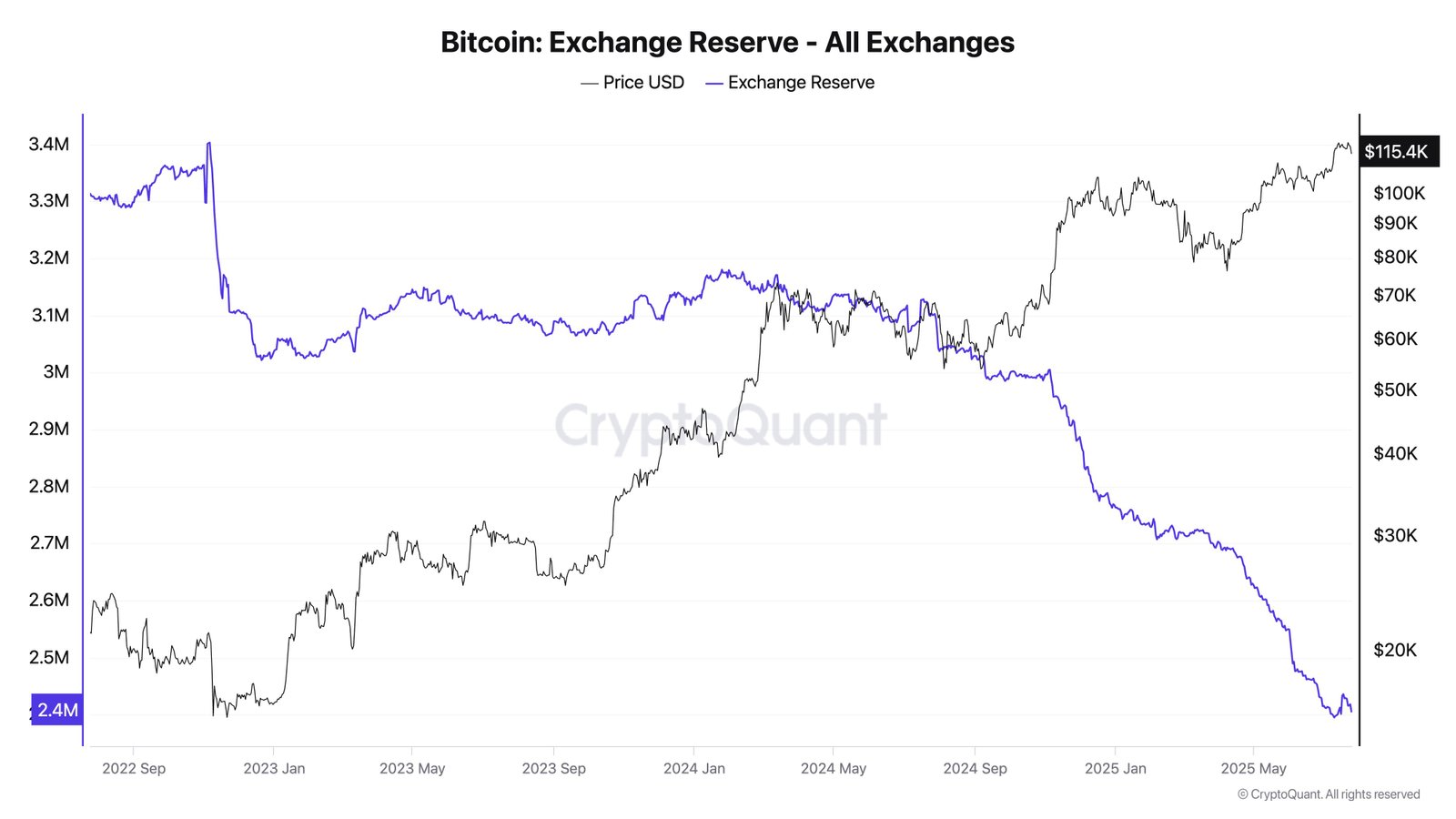

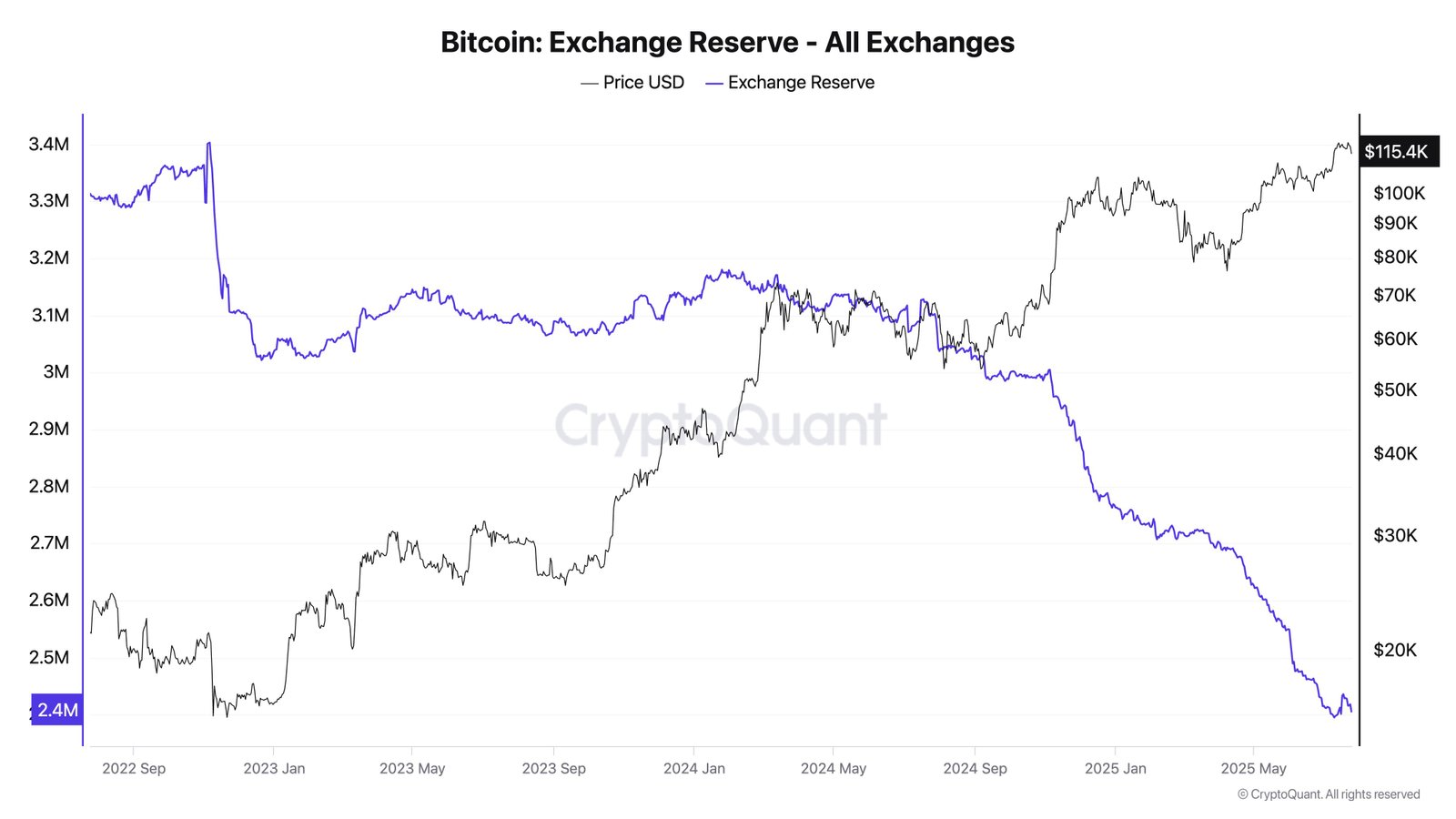

The operational design of spot Bitcoin ETFs contributes to supply-side pressure. Each time an investor buys ETF shares, the fund must acquire actual Bitcoin—removing it from circulation and locking it into cold storage.

Source: CryptoQuant

As these ETFs scale, the available float of BTC on public exchanges shrinks. This tight supply dynamic supports upward price momentum and reduces volatility caused by short-term speculators.

During the April 2025 market correction, while altcoins dropped sharply, spot Bitcoin ETFs continued to see inflows, indicating the growing role of these vehicles as stabilizers in the crypto ecosystem.

For more: Bitcoin ETFs Reach All-Time High with Over $41 Billion in Inflows

Dissecting Return Efficiency and Fee Dynamics

ETF investors in 2025 are more fee-sensitive and performance-focused than in previous cycles. That has made fee structure a crucial competitive differentiator. BlackRock’s IBIT charges a modest 0.12%, while Bitwise’s BITB holds at 0.20%. In contrast, Grayscale GBTC continues to charge a 1.5% annual fee, a legacy from its pre-ETF structure.

When measured in terms of return-to-fee efficiency, the differences are stark. IBIT, with a 12-month return of 54.5% and a fee of 0.12%, offers over 450 units of return for every 1% in fees. GBTC, by comparison, offers just 32 units per 1% fee. This ratio helps explain why GBTC, despite its size, has experienced persistent outflows since converting to an ETF.

Ethereum ETFs, though newer, are expected to face similar scrutiny. As these products mature and compete for inflows, investors will increasingly demand real-time transparency, lower fees, and integration with staking or yield-generating mechanisms—features currently lacking in most ETH ETFs.

Analyzing ETF Influence on Price Formation

ETF inflows are no longer passive. They actively shape price direction and investor behavior. In the past, Bitcoin’s price was heavily influenced by sentiment cycles on crypto-native platforms. In 2025, capital flows from ETFs have taken the lead.

A compelling analysis from Amberdata’s July 11, 2025 report titled “Spot ETFs: The Foundation of the Current Bull Run” underscores the structural significance of these inflows. According to Amberdata, spot Bitcoin ETFs are now major market movers, consistently supporting upward price momentum through cumulative inflows that tighten supply and enhance liquidity uncertainty. Structural demand from ETF capital flows now operates independently of sentiment swings, acting as a stabilizing force rather than a speculative driver.

Ethereum is following a similar path. While still more volatile than Bitcoin, ETH is stabilizing as ETF inflows deepen. The presence of Ethereum ETFs on institutional platforms has also reduced the dominance of offshore exchanges and increased the importance of regulated U.S. custodians.

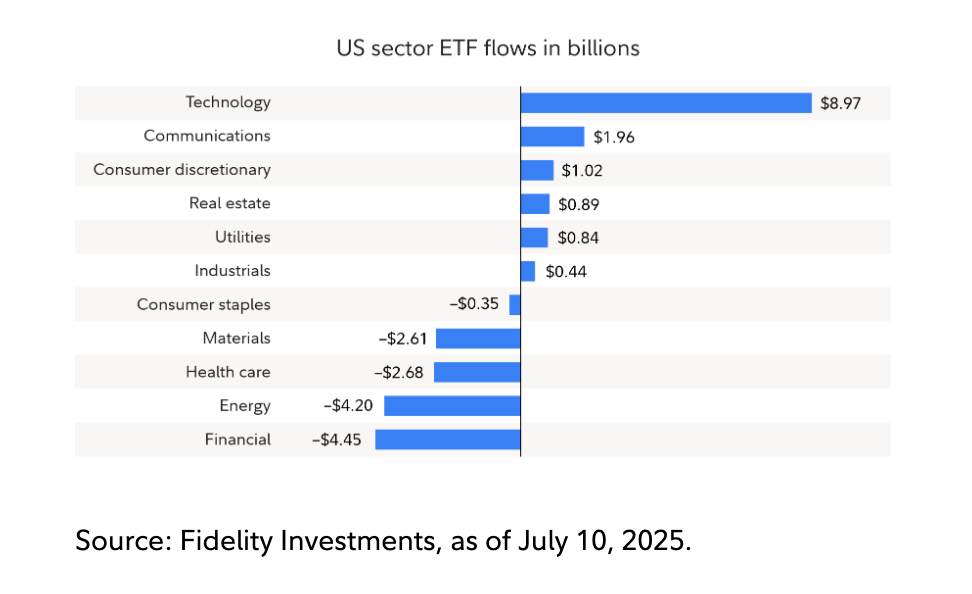

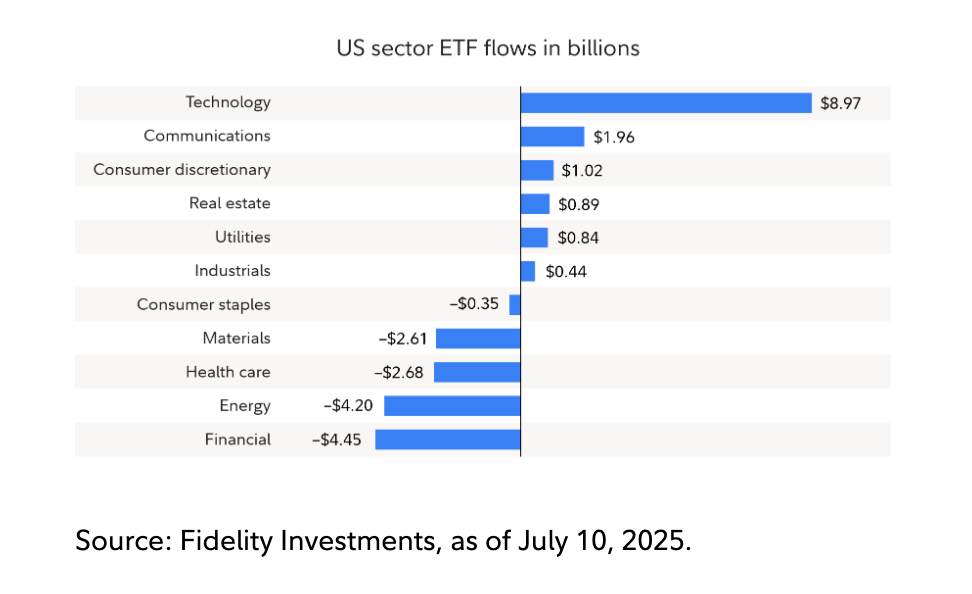

A Structural Shift in Investor Demographics

The 2025 ETF boom has brought new participants into the crypto ecosystem. Registered investment advisors (RIAs), pension funds, and family offices—previously hesitant to engage with crypto exchanges—now allocate to Bitcoin and Ethereum through ETF wrappers. For example, over 60% of new ETF inflows in Q2 2025 came from managed portfolios and retirement accounts. These investors are not looking for 10x gains. They are targeting low-volatility, inflation-resistant, diversifying assets—and they are doing so through regulated structures.

Retail behavior has also shifted. As mentioned above, platforms like Robinhood, Charles Schwab, and SoFi now offer Bitcoin and Ethereum ETFs alongside equity and bond funds, allowing younger investors to add crypto exposure without venturing into unregulated markets. This normalization of access is expanding crypto’s footprint across generational and institutional lines.

Crypto ETF Challenges and Considerations

The emergence of crypto ETFs has caused a blurring of boundaries between traditional finance (TradFi) and the realm of digital assets. For institutional investors, ETFs offer a way to gain exposure to crypto without the risks of self-custody, private keys, or unregulated exchanges. ETFs provide the crypto ecosystem with capital stability and introduce new sources of demand that were previously absent.

Despite their success, crypto ETFs face challenges that could shape their long-term evolution. One issue is the concentration of custody. Most major Bitcoin ETFs use Coinbase Custody (Prime or Trust) or Fidelity Digital Assets Services as custodians, raising questions about systemic risk. Another challenge lies in fee structures, as competition is forcing issuers to compress costs further, potentially reducing margins for ETF providers.

There is also an ongoing debate within the crypto community about whether ETFs undermine Bitcoin’s decentralized ethos. By concentrating ownership in large, regulated entities, ETFs could shift governance influence away from individual holders.

For more: Altcoin ETFs After Solana – XRP, ADA, AVAX Next in Line

The ETF-Led Transformation of Crypto

The boom in crypto ETFs during 2025 isn’t just a trend—it marks a permanent change in how digital assets are bought, held, and priced. These vehicles have become gateways for These include serious capital, tools for retirement planning, and building blocks for long-term portfolio construction.

The system now includes Bitcoin and Ethereum. They’re reshaping crypto and traditional finance from the inside out via ETFs.

The question now is not whether crypto ETFs will succeed. It’s how far their influence will reach—and what comes next in a market that’s finally found its bridge between code and capital.