Ether’s recent price rally may be due for a cooldown, as a surge in social media mentions — reaching levels of “extreme euphoria” — points to the potential for a near term correction, according to sentiment platform Santiment.

However, other indicators suggest Ether’s (ETH) rally may still have room to run, which has gained more than 50% over the past 30 days.

“Flashing warning signs” for Ether

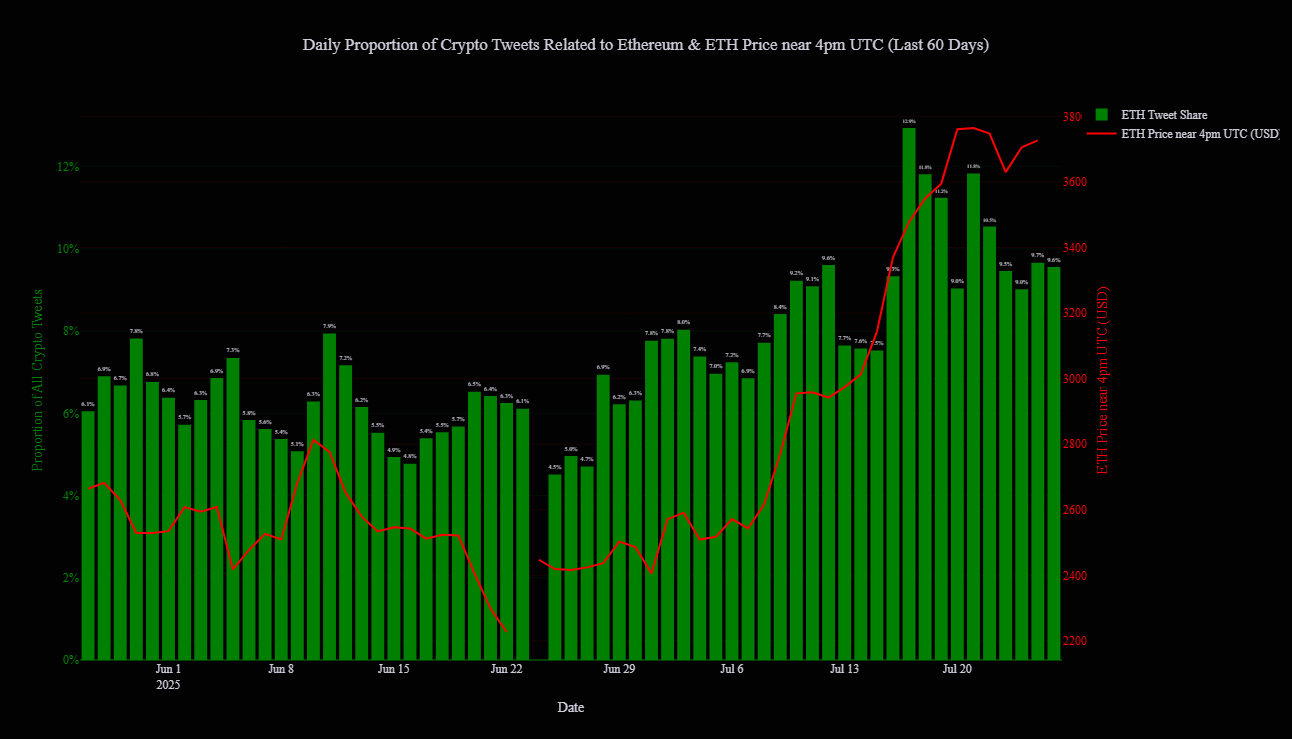

“Social metrics are flashing warning signs. Since early May, Ethereum’s price ratio against Bitcoin has surged by an incredible 70%,” Santiment said in a report on Friday.

“This has led to extreme euphoria and a massive spike in social dominance, which is often a red flag,” Santiment added.

The sentiment platform explained that when social dominance of a cryptocurrency spikes to “unusually high levels,” it signals the asset may be overvalued. “It suggests the asset is over-hyped and the trade is becoming crowded, increasing the risk of a price correction,” Santiment explained.

Ether is trading at $3,750 at the time of publication, up 51.84% over the past 30 days, according to Nansen. However, Santiment said it is also possible that the rally is not over just yet for Ether, as other indicators suggest the market hasn’t reached “peak frothiness.”

“Social dominance for memecoins is currently quite low,” Santiment said, pointing out that past market tops typically sees the opposite.

“A true marketwide top is often characterized by widespread, irrational speculation, and the absence of that could suggest this rally isn’t over,” Santiment said.

Ether treasury adoption may send price to new highs

Meanwhile, the recent growing corporate interest in Ether — including the recent large purchases from Sharplink Gaming and Bitmine Immersion technologies — could be the catalyst that pushes the asset to new highs, according to santiment analyst Maksim Balashevich.

Galaxy Digital CEO Michael Novogratz said on Thursday, “There’s not a lot of supply of ETH, and so I think ETH probably has a chance to outperform Bitcoin in the next three to six months.”

Related: ETH bulls target $9K: Does the data support the lofty price target?

Santiment issued a similar warning for Bitcoin (BTC) on Sunday.

Santiment analyst Brian Quinlivan said that nearly half of all crypto-related mentions on social media the previous week had centered around Bitcoin as it hit new highs, a level of dominance that may signal a local top and a potential short-term pullback.

“As Bitcoin’s market value crept above $123.1K for the first time in its 17+ year history, there was an equally historic social dominance spike,” Quinlivan said.

Magazine: Robinhood’s tokenized stocks have stirred up a legal hornet’s nest