Key Takeaways

PUMP’s selling pressure was too high to prevent the steep price decline over the past week, but the token has found some support in the short term.

Pump.fun [PUMP] fell 8% at the start of Saturday, the 26th of July, but recovered those losses later in the day.

The memecoin launchpad token has been in a persistent downtrend within days of its launch on the 16th of July. A heavy sell-off by top holders saw PUMP fall below the Initial Coin Offering (ICO) price on the 22nd of July.

Pump.fun had deployed millions of dollars after the ICO to buy back PUMP tokens. The buyback plans were greeted with enthusiasm by the community. Previously, its accrued fees would be cashed out via Kraken.

This was decried by community members and labeled as “extractive” by crypto commentators. The buyback has deployed $19.6 million since launch, but the PUMP downtrend is not closer to ending.

In a post on X, analyst Cirrus observed that this $19.6 million in buybacks was only worth $7.6 million at current market prices.

Another market participant opined on Reddit that a $19.6 million buyback was too little for a $2.4 billion market cap asset, while another called the buybacks a “smart way” to pump prices before dumping from their personal wallets.

PUMP appears to have found short-term support

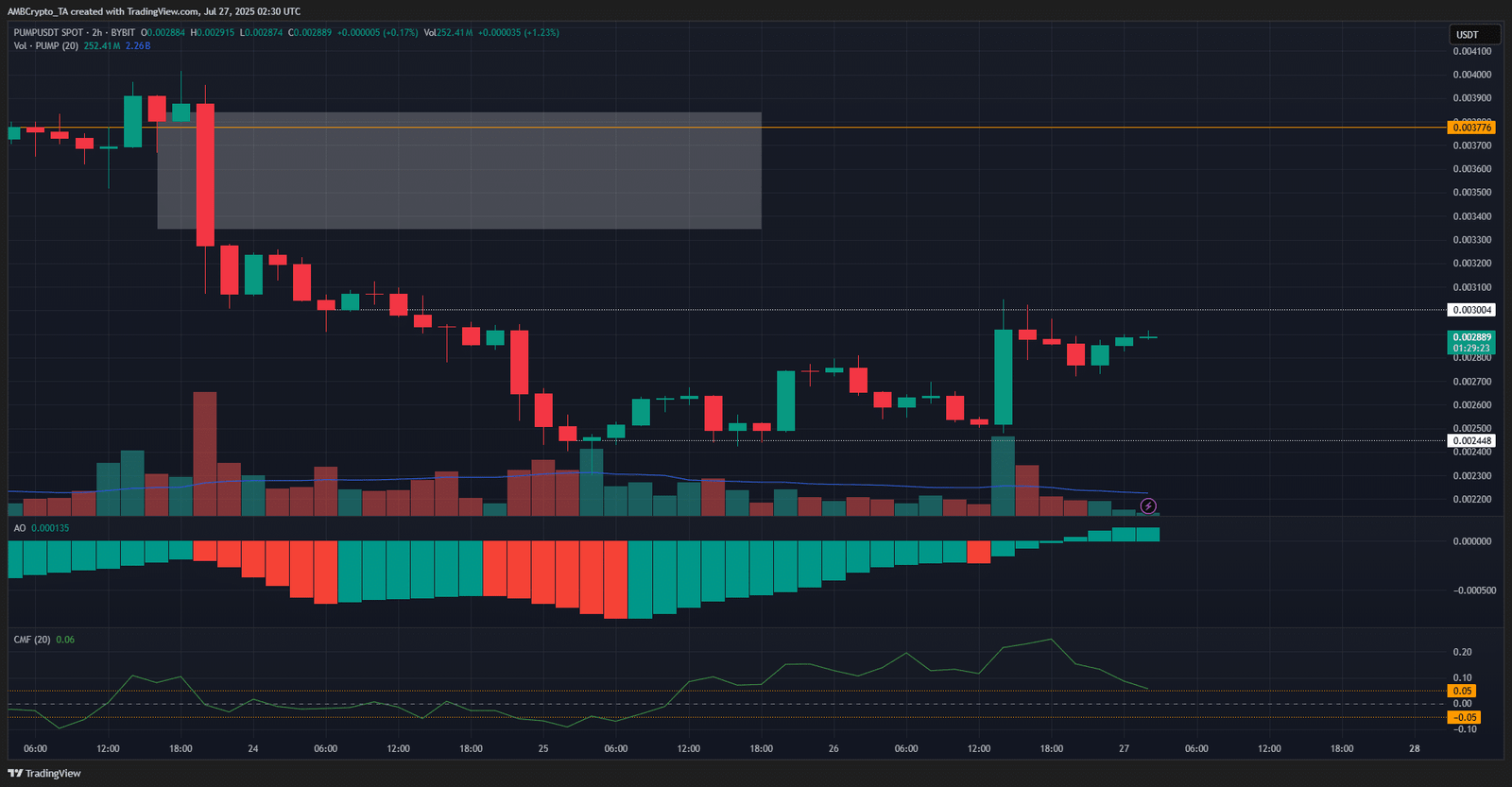

The price action of the 2-hour chart showed PUMP was shifting in favor of the bulls. The price bounce on the 25th of July to reach $0.0029 came alongside high trading volume.

Although the bounce appeared encouraging, it was still the local resistance zone from the 24th of July.

The $0.00245 level has been a support level over the past 48 hours. The Awesome Oscillator highlighted that bearish momentum was weakening.

The CMF was above +0.05, signaling increased buying pressure in recent trading hours.

At press time, PUMP remained bearish in the short term, but there was some hope for recovery. A push beyond the $0.0029-$0.003 resistance could pave the way for further short-term gains.

However, the past ten days of trading have been predominantly bearish. Traders and investors must exercise caution if looking to bid.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion