- Ethereum nears breakout with $5,000 target in sight.

- Dogecoin holds key support as whale activity rises.

- Remittix gains investor traction with $17.9M raised.

With the Ethereum price holding strong and showing signs of a breakout, the spotlight is shifting toward what comes next.

If history repeats itself, after Ethereum pumps, the market usually sees capital rotate into Remittix (RTX), Dogecoin and Cardano. That pattern could happen again.

Ethereum price poised for breakout as bulls aim for $5,000

The Ethereum price is currently around $3,787. Ethereum bounced back quickly after the recent FOMC meeting, when the Federal Reserve decided not to cut interest rates.

Even as Bitcoin dropped to $115,000, ETH only dipped to $3,680 before pushing higher again. That quick recovery is giving traders hope that Ethereum could finally break the $4,000 wall.

Market expert Benjamin Cowen pointed out that ETH has hit the $3,941 level more than once but never closed above it. If it can do that soon, many believe ETH could jump toward $5,000.

Some traders have even shared triangle patterns showing a breakout target as high as $7,700.

source: @intocryptoverse on X

Dogecoin updates: Whale activity and support zones hold price steady

While Ethereum is leading the market, Dogecoin updates show it is holding firm at $0.2247. The coin fell 23% from this month’s peak but is still up 38% over the past month.

Analysts say DOGE is now in the second phase of the Elliott Wave pattern. The next wave, if it happens, could be a big one.

source: TradingView

One big whale pulled 200 million DOGE, worth about $43 million, out of Robinhood. Moves like this often signal long-term interest.

The coin is also testing support around $0.218 and $0.202, based on Fibonacci levels. If that support holds, DOGE could rally again soon.

Many traders believe that after Ethereum price pumps, meme coins like DOGE often follow.

With strong support levels and fresh whale activity, Dogecoin might be ready to move once ETH finishes its breakout.

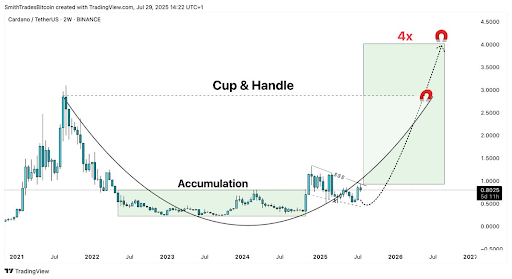

Cardano news: Cup and handle pattern sets stage for surge

Recent Cardano news shows the coin is slowly climbing back toward the $0.80 mark, with bullish setups forming on the charts. ADA gained 3% this week and is now testing the breakout level at $0.92.

If it clears this area, many think ADA could soar toward new highs.

One well-known trader, Crypto Smith, noted that whales have finished accumulating ADA. That often signals a coming rally. Technical charts also show a cup and handle pattern.

This setup typically predicts higher prices when the breakout is confirmed.

source: @CryptoSmith0x on X

Michael Pizzino also highlighted a breakout from a long-term resistance line going back to October 2024.

The overall outlook for Cardano is improving, and the Ethereum price strength could send new capital flowing into ADA next.

Remittix: Quietly becoming a top altcoin to watch

While Dogecoin updates and Cardano news get attention, Remittix (RTX) is quietly winning over serious investors. It has raised more than $17.9 million by selling over 577 million tokens at just $0.0895 each.

Many now believe Remittix is one of the top crypto to buy now before it gains wider exposure.

Key reasons Remittix is gaining momentum:

- Over $17.9M raised from global investors

- More than 577 million tokens sold at a stable entry price

- Offers fast and low-cost cross-border transactions

- Strong support from the crypto community on X

- Seen as a utility-backed alternative to meme coins

Final thoughts: Eyes on Ethereum but rotation may follow

The Ethereum price could be first to break out, but if it does, expect capital to rotate quickly into Dogecoin and Cardano.

And for those seeking early momentum plays, Remittix continues to show why it might be the most underrated token heading into the rest of 2025.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article is authored by a third party, and CoinJournal does not endorse or take responsibility for its content, accuracy, quality, advertisements, products, or materials. Readers should independently research and exercise due diligence before making decisions related to the mentioned company.