Spot Bitcoin exchange-traded funds (ETFs) saw $812.25 million in net outflows on Friday, marking the second-largest single-day loss in the history of these products.

The drawdown erased a week of steady gains and pushed cumulative net inflows down to $54.18 billion. Total assets under management slid to $146.48 billion, representing 6.46% of Bitcoin’s (BTC) market capitalization, according to SoSoValue.

Fidelity’s FBTC led the exodus with $331.42 million in redemptions, followed by ARK Invest’s ARKB, which saw a substantial pullback of $327.93 million. Grayscale’s GBTC also lost $66.79 million. BlackRock’s IBIT posted a relatively minor loss of $2.58 million.

Trading volumes remained active, with $6.13 billion in value exchanged across all spot Bitcoin ETFs. IBIT alone accounted for $4.54 billion in volume, suggesting continued interest despite the outflows.

Related: Spot Ether ETF staking could ‘dramatically reshape the market’

Ether ETFs end 20-day inflow streak

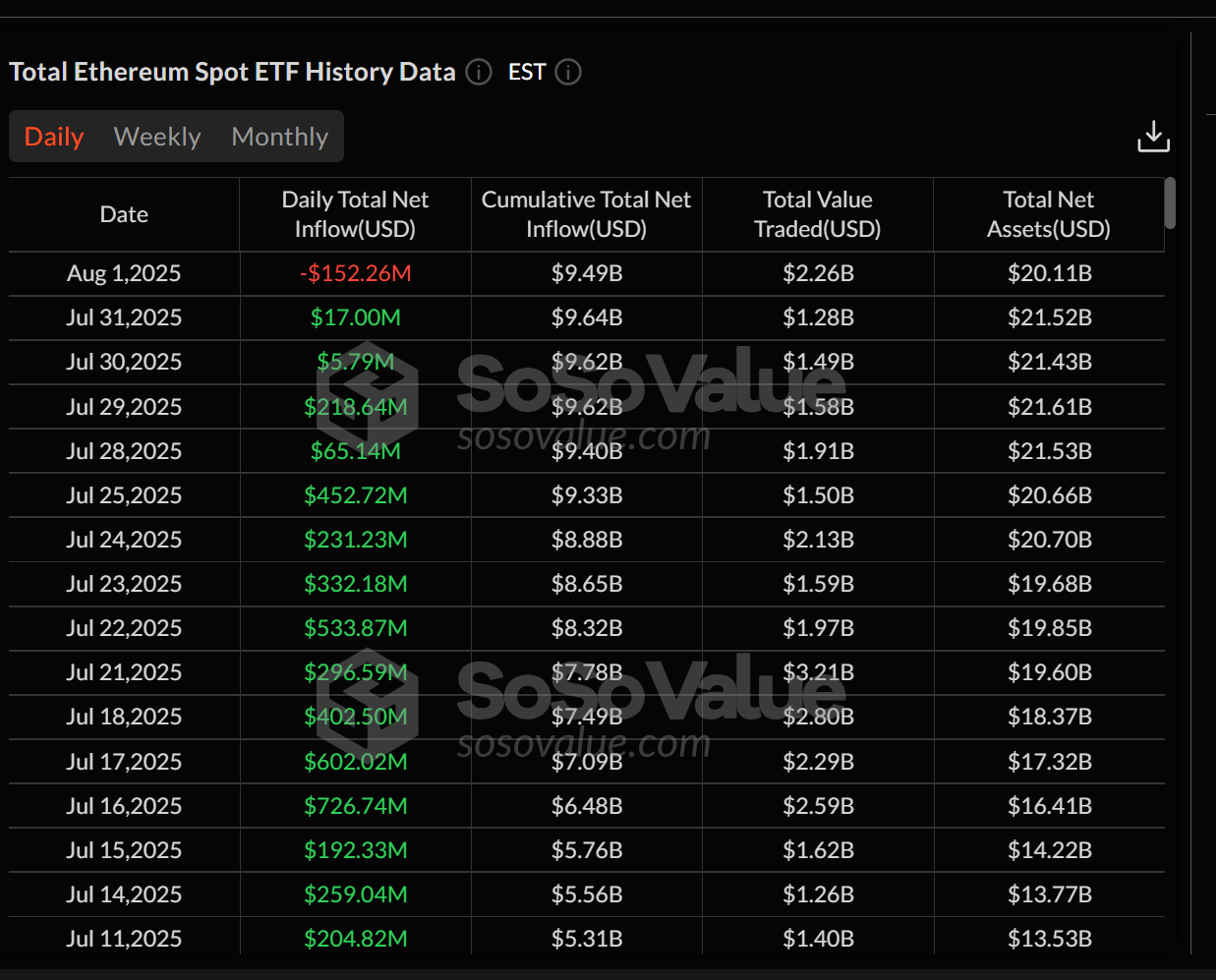

Meanwhile, Ether ETFs ended their longest inflow streak to date. After 20 consecutive trading days of net inflows, the sector recorded a $152.26 million outflow on Friday. Total assets under management now stand at $20.11 billion, or 4.70% of Ether’s (ETH) market cap.

Grayscale’s ETHE led the losses, shedding $47.68 million, while Bitwise’s ETHW followed with a $40.30 million drop. Fidelity’s FETH posted $6.17 million in outflows. Only BlackRock’s ETHA remained flat for the day, holding steady with $10.71 billion in assets and no inflows or outflows.

The combined value traded across all spot Ethereum ETFs was $2.26 billion. Grayscale’s ETH product contributed the most with $288.96 million in daily trades, reflecting ongoing volatility.

The recent run saw record-breaking activity on July 16, when Ethereum ETFs registered a $726.74 million daily inflow, the largest since their debut. July 17 followed with $602.02 million amid a growing appetite for Ether products.

Related: ‘Parabolic bull markets and devastating bear markets are over’ — BTC analyst

Corporations double down on Ether

Corporations are now acquiring Ether at twice the rate of Bitcoin, according to a recent report by Standard Chartered. Since the beginning of June, crypto treasury firms have snapped up around 1% of Ethereum’s total circulating supply.

The bank highlighted that this accumulation, combined with steady inflows into US spot Ether ETFs, has been a key driver behind Ether’s recent rally. It believes these trends could push ETH above its $4,000 price target by the end of the year.

Looking ahead, Standard Chartered predicts that Ethereum treasury holdings could grow to represent as much as 10% of the entire supply, citing the added benefits of staking and DeFi participation.

Magazine: Dummies’ guide: Ethereum’s roadmap to 10,000 TPS using ZK tech