Key Takeaways

Solana tumbled 12% in a week as whales dumped tokens and loaded up on shorts. Despite growing retail buying, bearish momentum persists – $154 support could be next.

Solana [SOL] has dropped 12.38% in just one week, tumbling from $206 to a local low of $159. At press time, the price hovered near $162, reflecting a 3.95% daily dip.

This sharp correction pushed the asset into a descending channel, with momentum indicators flashing bearish cues. But while retail traders bought the dip, whales chose to exit.

Whale panic hits the spot market

Notably, after taking a step back from the spot market over the past month, Solana whales have returned.

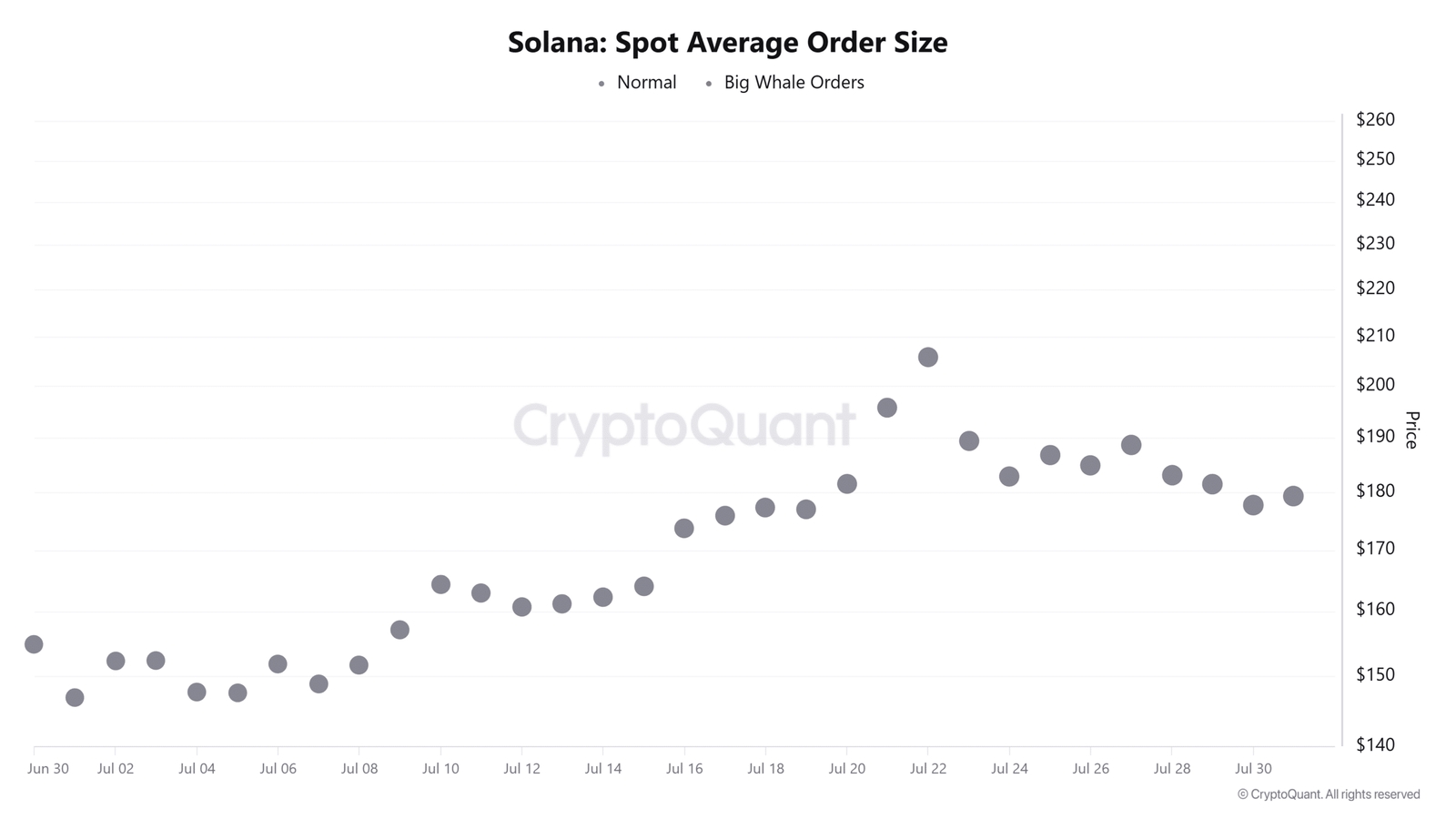

According to CryptoQuant’s Spot Average Order Size, Solana whales stopped accumulating or selling as the market rebounded.

As such, the spot market has recorded no big whale orders over this period, signaling the absence of whales in the market.

Surprisingly, now that the market has declined, whales have returned to close existing positions. According to Lookonchain, a whale deposited 108,016 SOL worth $17.74 million into OKX and Binance.

Typically, when a whale deposits assets into CEXs, it indicates preparation to sell or outright selling. Historically, when whales turn to aggressive selling, it signals a lack of conviction in the market and could precede lower prices.

Shift in strategy

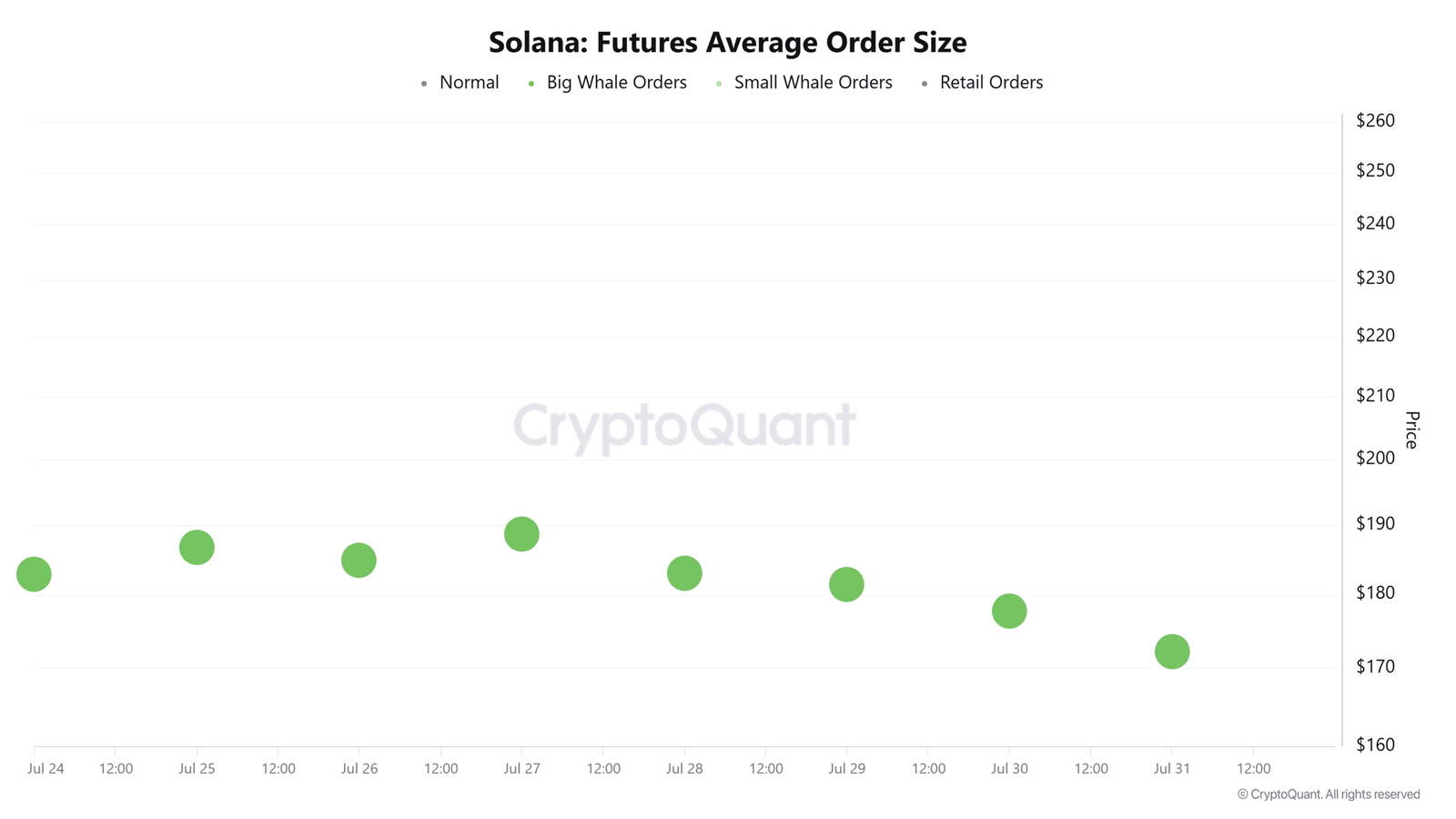

Interestingly, while spot orders slowed, CryptoQuant’s Futures Average Order Size chart showed the opposite trend. Large whale positions returned and this time in the derivatives market.

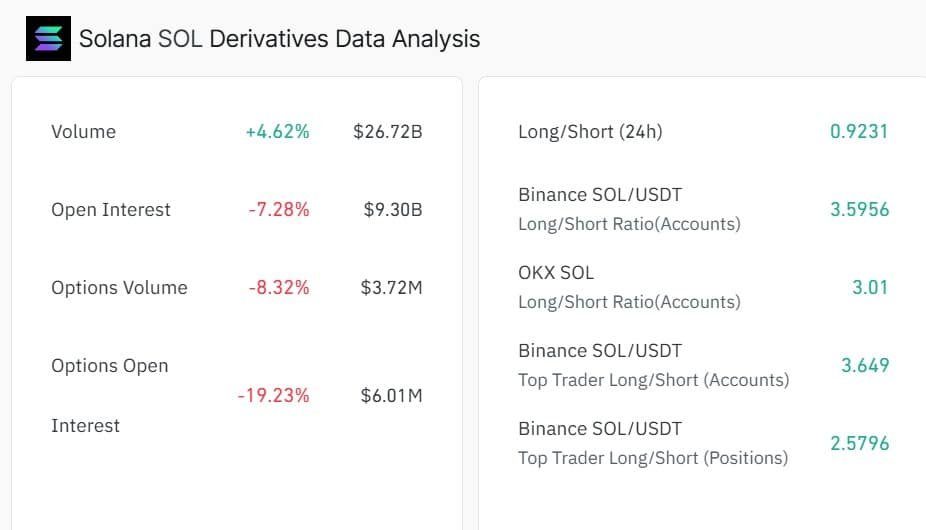

This shift coincided with Solana’s Open Interest falling 7.28% to $9.30 billion, at press time.

At the same time, Derivatives Volume jumped 4.62% to $26.72 billion, suggesting renewed trading interest, but not for bullish bets.

In fact, the Long/Short Ratio stood at just 0.9231, indicating that most traders were positioning for further downside. Binance’s top trader data confirmed this skew toward shorts, with a position ratio of 2.57.

Retail steps in as whales pull out

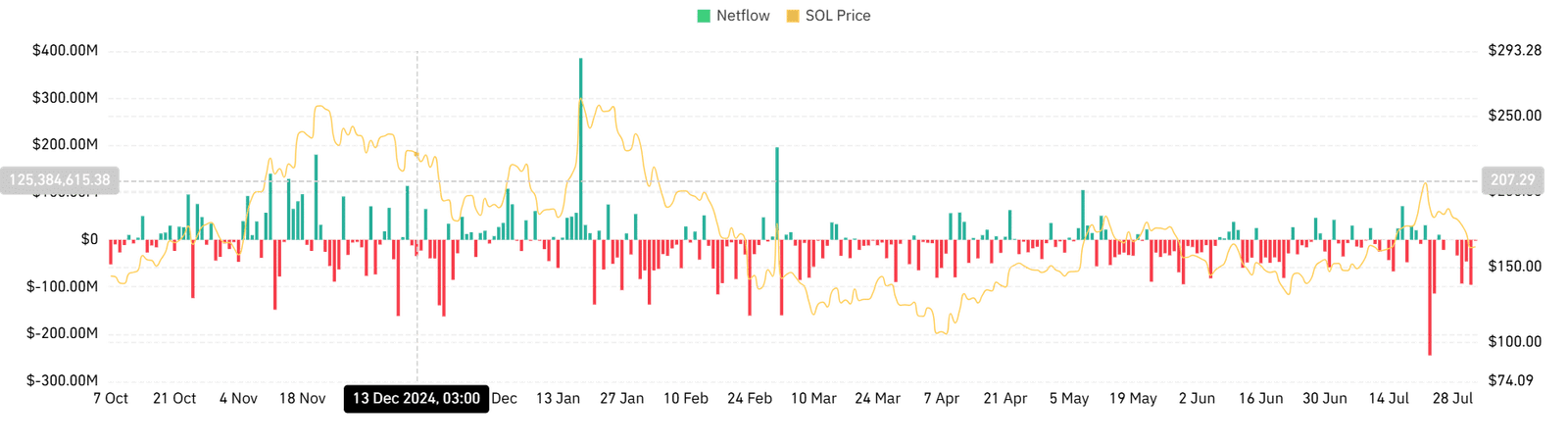

While whales are bearish, small-scale investors continue to accumulate. According to CoinGlass, Solana has recorded a negative Spot Netflow for seven consecutive days.

At press time, the altcoin’s Netflow was -$1.86 million, a significant drop from -$95.49 million on the 1st of August.

In simple terms, whales sold off, but retail traders kept buying the dip. Whether they’ll hold or get shaken out remains the question.

What’s next for SOL?

According to AMBCrypto’s analysis, Solana experienced strong downward momentum amid strengthening bearish sentiments.

For that reason, the altcoin’s Relative Strength Index declined to 41, closing into oversold territory. Likewise, its Stochastic RSI fell to a recent low of 0.07, further confirming the seller’s presence.

When momentum indicators are set like this, they signal strengthening downward momentum as bears dominate the market.

That said, if the current trend persists, SOL may make more losses and decline to $154 support. However, if retailers can hold on, sustained buying could absorb the pressure and boost SOL to reclaim $183.