Key takeaways:

-

President Donald Trump’s push for aggressive interest rate cuts could trigger a surge in inflation, weaken the dollar, and destabilize long-term bond markets.

-

Even without rate cuts, trade policy and fiscal expansion are likely to push prices higher.

-

Bitcoin stands to benefit either way—whether as an inflation hedge in a rapid-cut environment, or as a slow-burn store of value as US macro credibility quietly erodes.

The US economy may be growing on paper, but the underlying stress is increasingly difficult to ignore — a tension now in sharp focus at the Federal Reserve’s Jackson Hole symposium. The US dollar is down over 10% since January, core PCE inflation is stuck at 2.8% and the July PPI surged 0.9%, tripling expectations.

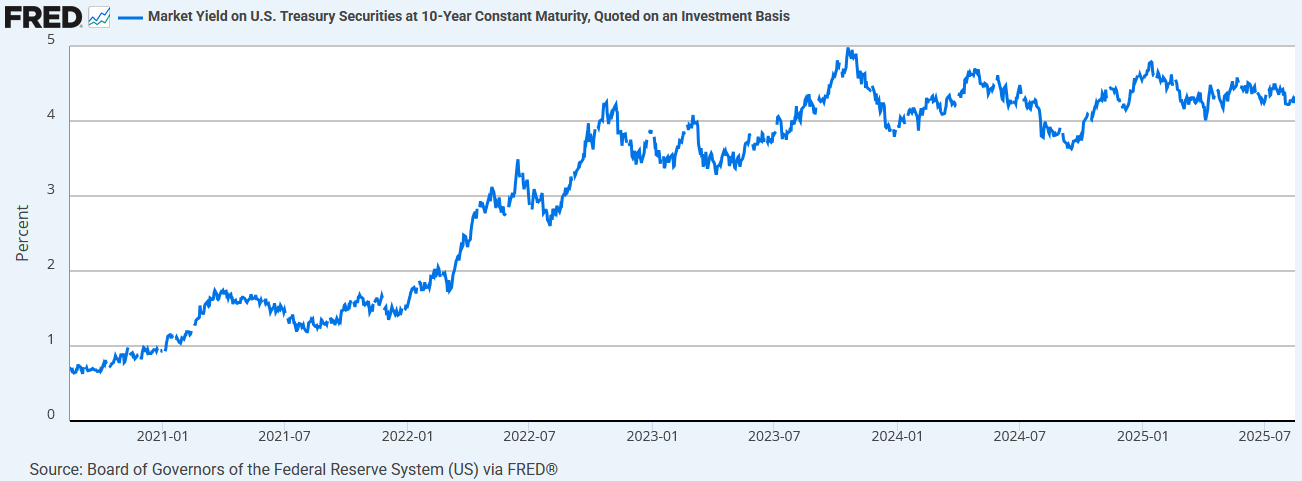

Against this backdrop, 10-year Treasury yields holding at 4.33% look increasingly uneasy against a $37 trillion debt load. The question of interest rates has moved to the center of national economic debate.

President Donald Trump is now openly pressuring Federal Reserve Chair Jerome Powell to cut interest rates by as much as 300 basis points, pushing them down to 1.25-1.5%. If the Fed complies, the economy will be flooded with cheap money, risk assets will surge, and inflation will accelerate. If the Fed resists, the effects of rising tariffs and the fiscal shock from Trump’s newly passed Big Beautiful Bill could still push inflation higher.

In either case, the US appears locked into an inflationary path. The only difference is the speed and violence of the adjustment, and what it would mean for Bitcoin price.

What if Trump forces the Fed to cut?

Should the Fed bow to political pressure starting as early as September or October, the consequences would likely unfold rapidly.

Core PCE inflation could climb from the current 2.8% to above 4% in 2026 (for context, post-COVID rate cuts and stimulus pushed core PCE to a peak of 5.3% in February 2022). A renewed inflation surge would likely drag the dollar down even further, possibly sending the DXY below 90.

Monetary easing would briefly lower Treasury yields to around 4%, but as inflation expectations rise and foreign buyers retreat, yields could surge beyond 5.5%. According to the Financial Times, many strategists warn that such a spike could break the bull market altogether.

Higher yields would have immediate fiscal consequences. Interest payments on US debt could rise from around $1.4 trillion to as much as $2 trillion—roughly 6% of GDP—by 2026, triggering a debt servicing crisis and putting further pressure on the dollar.

More dangerous still is the potential politicization of the Fed. If Trump finds a way to force Powell out and appoint a more compliant chair, markets could lose faith in the independence of US monetary policy. As FT columnist Rana Foroohar wrote:

“There’s a huge body of research to show that when you undermine the rule of law the way the president is doing with these unwarranted threats to Powell, you ultimately raise, not lower, the cost of borrowing and curb investment into your economy.”

She cited Turkey as a cautionary tale, where a central bank purge led to market collapse and 35% inflation.

If the Fed holds steady

Maintaining policy rates may seem like the responsible option, and it would help preserve the Fed’s institutional credibility. But it won’t spare the economy from inflation.

Indeed, two forces are already pushing prices higher: the tariffs and the Big Beautiful Bill.

Tariff effects are already visible in key economic indicators. The S&P Global flash US Composite PMI rose to 54.6 in July, the highest since December, while input prices for services jumped from 59.7 to 61.4. Nearly two-thirds of manufacturers in the S&P Global survey attributed higher costs to tariffs. As Chris Williamson, chief business economist at S&P Global, said:

“The rise in selling prices for goods and services in July, which was one of the largest seen over the past three years, suggests that consumer price inflation will rise further above the Fed’s 2% target.”

The effects of the Big Beautiful Bill are yet to be felt, but warnings are already mounting over its combination of increased spending and sweeping tax cuts. At the beginning of July, the IMF stated that the bill “runs counter to reducing federal debt over the medium term” and its deficit‑increasing measures risk destabilizing public finances.

In this scenario, even without immediate rate cuts, core PCE inflation may drift up to 3.0–3.2%. Yields on 10-year Treasurys would likely rise more gradually, reaching 4.7% by next summer. Debt servicing costs would still climb to an estimated $1.6 trillion, or 4.5% of GDP, elevated but not yet catastrophic. DXY could continue plummeting, with Morgan Stanley predicting that it could go as low as 91 by mid‑2026.

Even in this more measured outcome, the Fed doesn’t emerge unscathed. The debate over tariffs is dividing policymakers. For instance, Governor Chris Waller, seen as a possible new Fed Chair, supports rate cuts. Macquarie strategist Thierry Wizman recently warned that such splits within the FOMC could devolve into politically motivated blocs, weakening the Fed’s inflation-fighting resolve and eventually steepening the yield curve.

Related: Bitcoin won’t go below $100K ‘this cycle’ as $145K target remains: Analyst

The impact of macro on Bitcoin

In the first scenario—sharp cuts, high inflation, and a collapsing dollar—Bitcoin would likely surge immediately alongside stocks and gold. With real interest rates negative and Fed independence in question, crypto could become a preferred store of value.

In the second scenario, the rally would be slower. Bitcoin might trade sideways until the end of 2025, until inflation expectations catch up with reality next year. However, as the dollar continues to weaken and deficits accumulate, non-sovereign assets will gradually gain appeal. Bitcoin’s value proposition would solidify not as a tech bet, but as a hedge against systemic risk.

Expectations for a rate cut continue to rise, but whether or not the Fed complies in the fall or stands firm, the US is on a collision course with inflation. Trump’s aggressive fiscal stimulus and trade policy ensure that upward price pressure is already baked into the system. Whether the Fed cuts rates soon or not, the path ahead may be rough for the dollar and long-term debt, and Bitcoin isn’t just along for the ride—it may be the only vehicle built for this road.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.