- Retail demand falls 10% as whales send 45K BTC to Binance.

- Bitcoin forms cup-and-handle pattern; liquidations rise while derivatives activity cools.

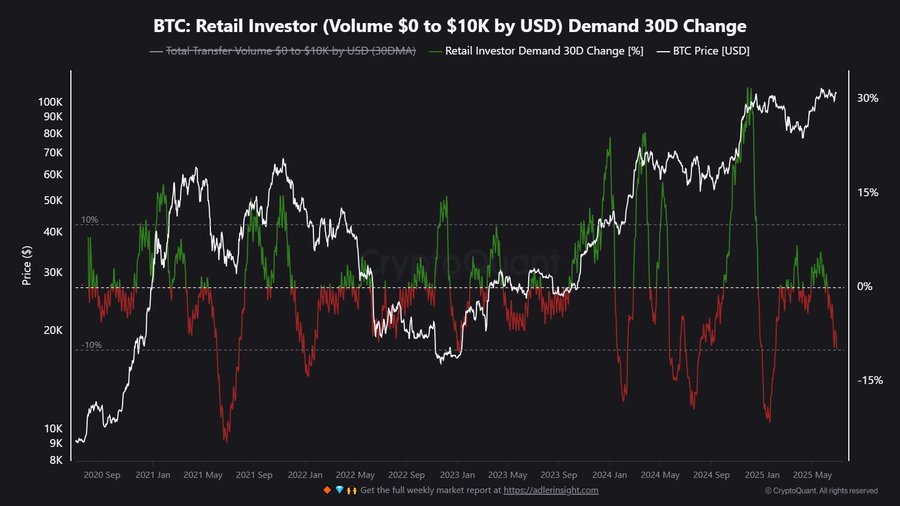

Retail investor participation in Bitcoin [BTC] has continued to fade.

According to the 30-day demand change chart, BTC transfers between $0–$10K dropped over 10%, the lowest in six months.

This drawdown, marked in red on the chart, reflects dwindling conviction from smaller market participants despite BTC hovering at $107,349.

Historically, such declines have preceded either consolidation or more volatile moves, depending on whether whales step in.

Therefore, the shrinking presence of small investors may signal a growing reliance on institutional activity to sustain market direction.

BTC whales resurface, what are they planning?

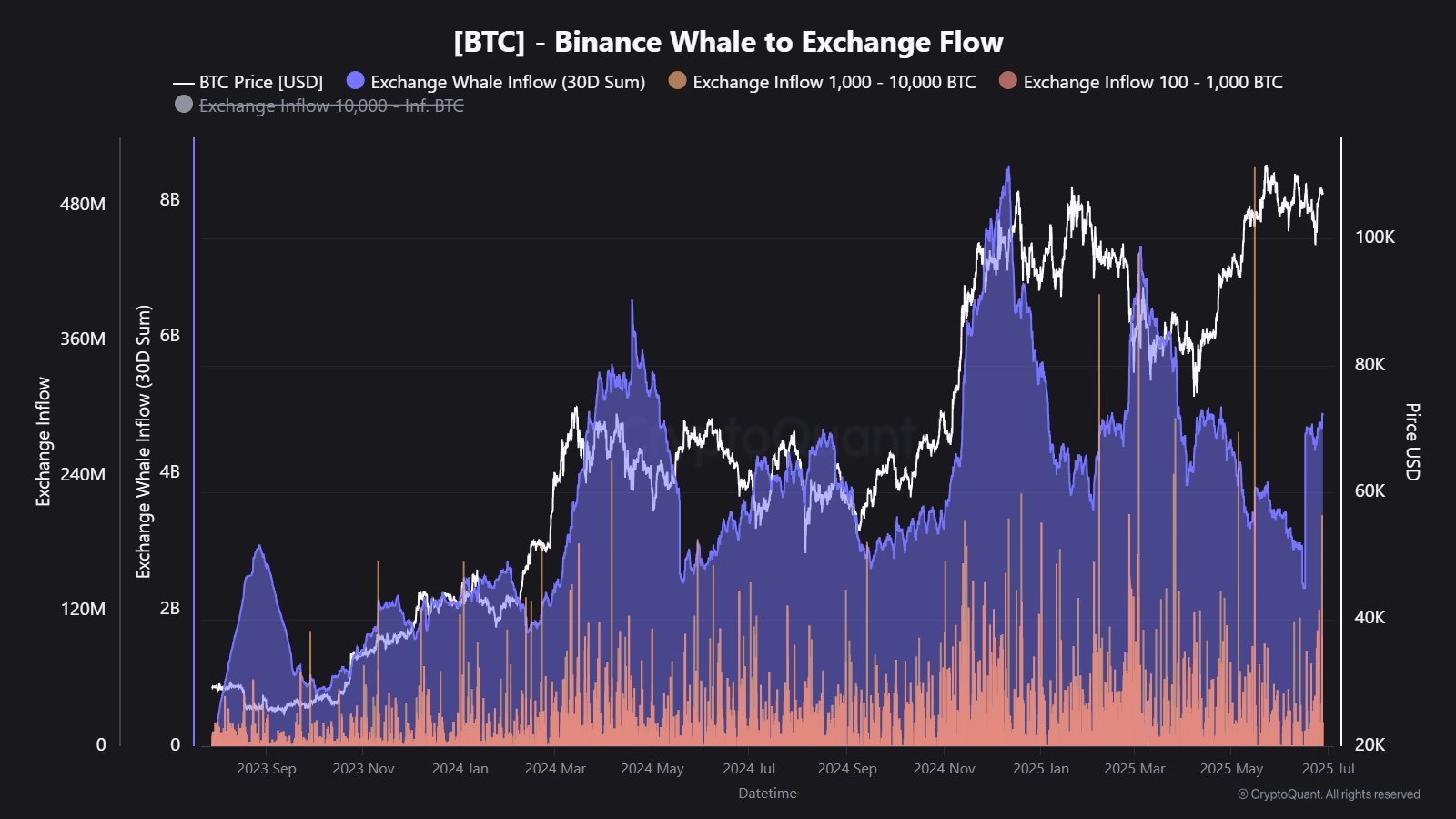

Having said that, whales are doing the opposite.

Over the last thirty days, more than 45,420 BTC—worth roughly $4.88 billion—flowed into Binance.

This influx in Exchange Whale Inflow represents a sharp pivot toward active positioning, often seen before large price swings.

Unlike previous accumulation phases, this flow coincides with weakening retail demand, suggesting whales are either preparing to distribute or react to market catalysts.

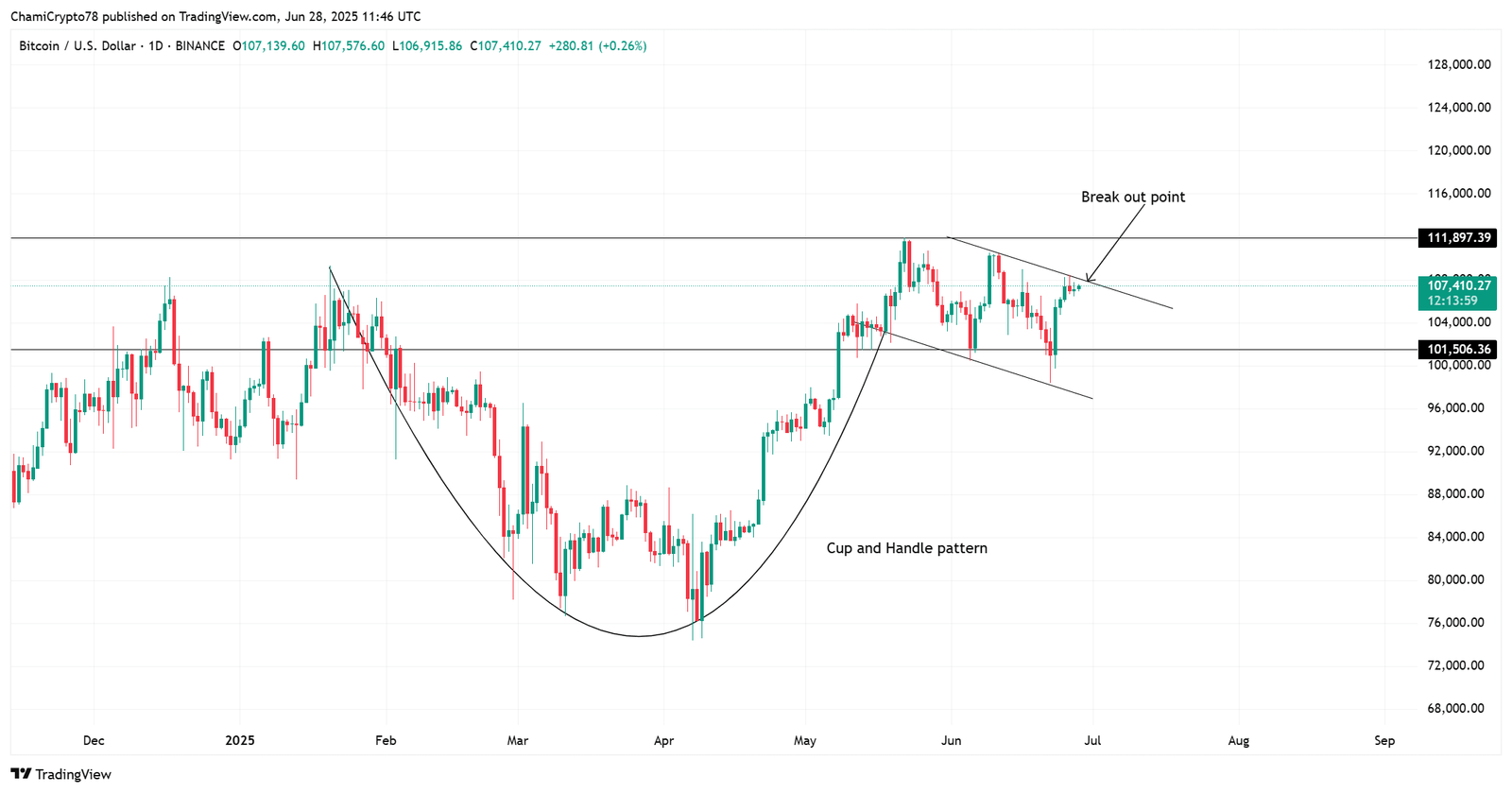

Bitcoin’s next breakout!

Bitcoin’s price structure now reveals a classic cup and handle formation, with a potential breakout zone near $111,897. After bouncing from the $101,506 level, BTC has reclaimed higher ground, hovering near $107,389.

This bullish pattern often signals potential upward movements but requires confirmation through a clear breakout and strong volume.

The next trading sessions are vital, especially if BTC can break resistance convincingly. Conversely, a failed breakout may trigger profit-taking and lead to a retest of lower support levels.

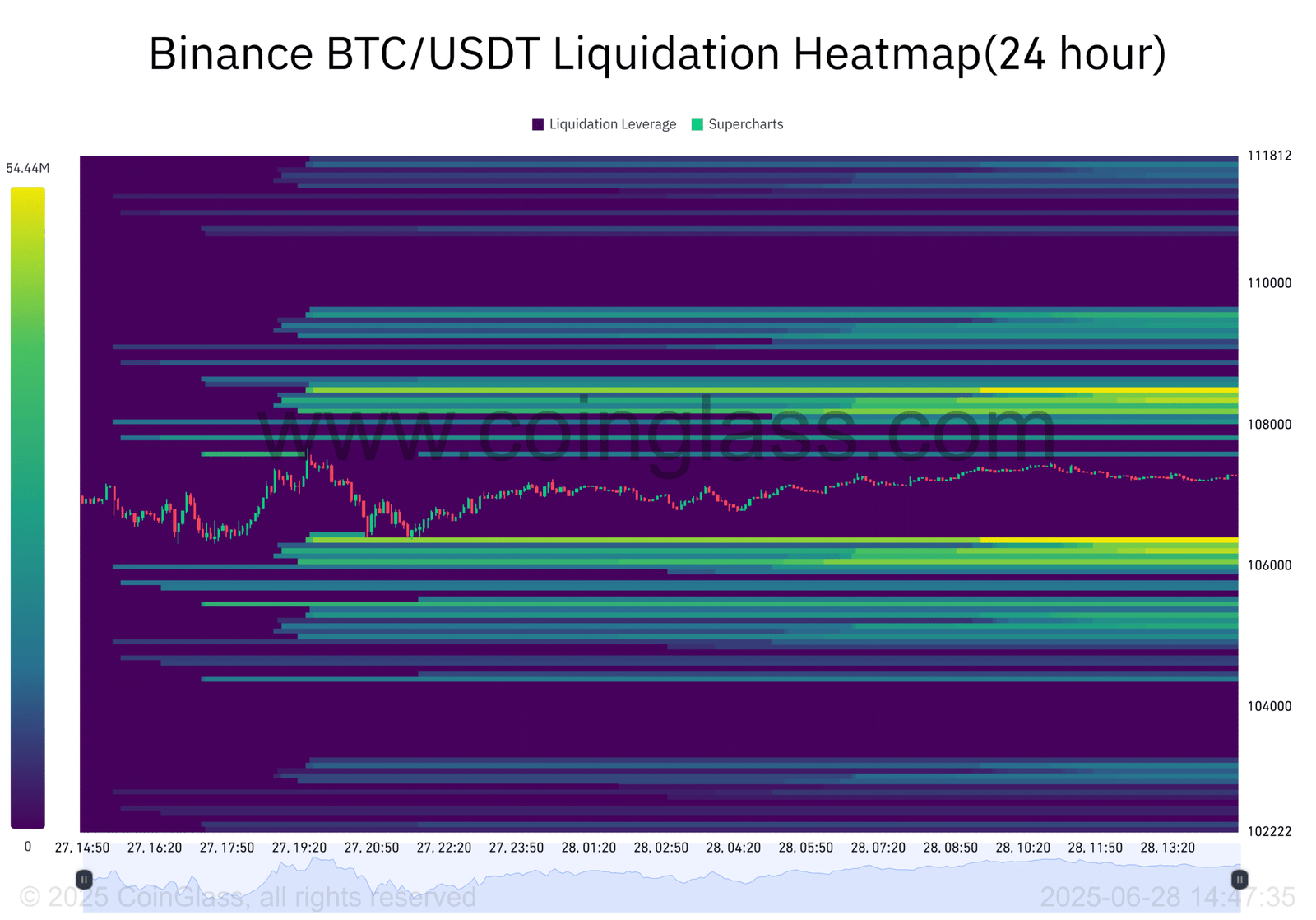

Will liquidation pressure above $108K trigger a short squeeze?

The Binance Liquidation Heatmap showed thick liquidity bands between $108K and $111K. This is where most over-leveraged short positions are likely to be wiped out if BTC pushes higher.

Moreover, these liquidation zones often act as magnets, drawing price action into volatile territory.

A breakout through $108K may trigger a cascade of short liquidations, rapidly pushing the price toward the $115K–$118K range.

However, failure to breach this zone could result in another round of sideways consolidation and indecisive sentiment.

Derivatives pullback: Are traders hedging or hesitating?

Meanwhile, derivatives markets are tapering off.

Futures Volume dropped 25.88% to $49.19 billion, and Open Interest hovered flat at $71.37 billion. Options weren’t spared as Volume sank 28.01%, and Open Interest slipped 3.88%.

Traders are clearly hedging or pulling back—reflecting caution and fear of being misaligned ahead of potential volatility.

Yet, such contractions have often set the stage for explosive breakouts once market conviction returns.

Can BTC maintain momentum amid diverging signals?

Bitcoin’s outlook remains mixed. While technicals suggest a bullish setup, falling retail demand and cautious derivatives’ activity imply hesitation.

Whale inflows may inject liquidity, but unless they convert into active buying, the price risks stagnation. Therefore, a confirmed breakout above $111K—fueled by short liquidations—remains the key trigger to watch.