- Cardano and the rest of the altcoin market faced sizeable losses earlier in June

- Traders can look for short-term long setups on ADA if it can climb past $0.594

Cardano [ADA] has been trying to establish an uptrend on the price chart, but the market sentiment is not sufficiently bullish yet. Bitcoin’s [BTC] volatility over the weekend helped a little, but the altcoin did not see sustained demand in June. Quite the opposite.

In fact, sellers had the upper hand throughout the month.

This is not a problem that only Cardano faces though. The TOTAL2 captured the combined crypto market cap, excluding Bitcoin. Since February, the altcoin mcap has been unable to climb above the $1.25 trillion mark.

The most recent attempt on 11 June was followed by a sharp rejection, as altcoin holders panic-sold due to the rising tensions in the Middle East. This retracement also saw Bitcoin sink below the $100k-mark momentarily, helping explain the bearish market outlook.

The lack of sustained demand for altcoins and ADA is a concern for bulls and long-term investors. Can this change anytime soon?

Cardano beginning to trend higher in the short-term

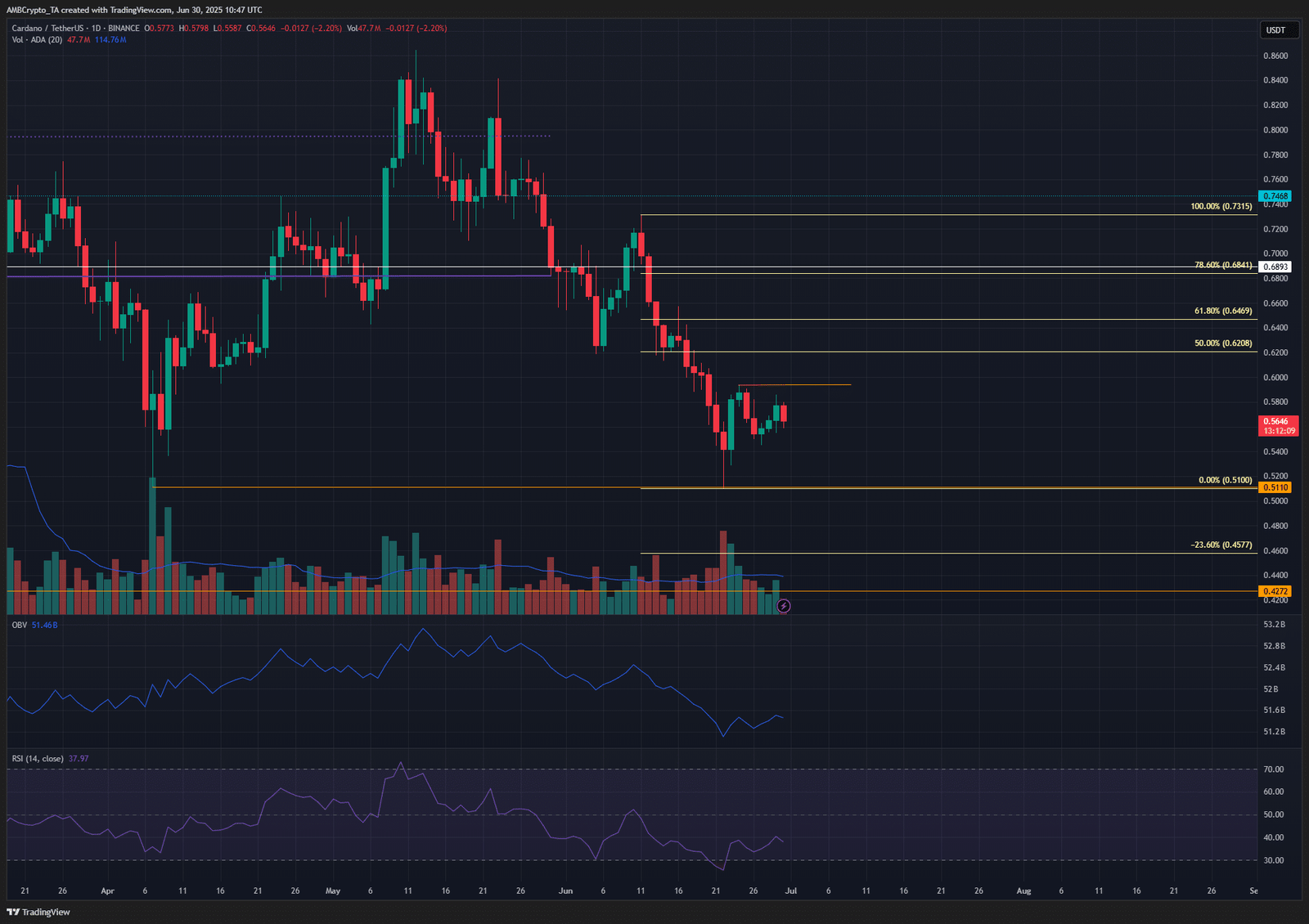

Over the past week, ADA has bounced from the $0.51 support level, while establishing a higher low at $0.545. If it can break the $0.594 local high from last Tuesday, it would shift the market structure bullishly.

The RSI, like the price, made higher lows over the past few days, indicating that the bearish momentum was beginning to weaken. The OBV also saw a small bounce, and its sustained upward movement would be a positive short-term sign. It would showcase greater demand, which could see ADA bounce to $0.62 or $0.65.

Traders looking to go long must remember that the major structure has remained bearish, following the deep drop from $0.73 seen earlier in June. Hence, any long trades should be quick to capture profits and cut losses. Especially as the trade would be against the prevalent trend.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion