A proposal for the decentralized finance (DeFi) lending protocol Aave to launch a centralized version of its service on the crypto exchange Kraken’s Ink blockchain has received widespread approval among the community.

An Aave request for comment (ARFC) for the deployment of a whitelabel version of Aave v3 for the Ink Foundation, the organization behind the Ink blockchain, was approved with 99.8% of the votes cast in favor.

An ARFC acts as a preliminary offchain vote before proceeding with a full decentralized autonomous organization (DAO) vote. The next phase involves drafting an Aave improvement proposal (AIP) that will be voted onchain.

The ARFC states that “by granting a license to deploy a centralized version of the Aave (AAVE) codebase, Aave can expand its technology adoption while creating new revenue streams.”

Aave had not responded to a request for comment by publication time.

Kraken unveiled its Ink blockchain in late 2024, following an October announcement. The chain aims to serve as a compliant layer-2 platform for tokenized assets and institutional DeFi.

Related: TradFi could move onchain due to ‘horrible banking experiences’

Aave eyes institutional lending market

The proposal states that the partnership could be “an opportunity for Aave to expand its influence in the institutional lending space,” creating additional revenue streams for the protocol.

The Aave DAO would receive a share “greater than or equal to the equivalent of a Reserve Factor of 5% based on borrow volume in all pools.” The Ink Foundation also committed funds to the development of the new protocol:

“The Ink Foundation has committed significant incentives to bootstrapping this instance. This includes multiple liquidity mining programs that are expected to bring over $250m in early supply to the instance.”

Related: No more ETH dumps? Ethereum Foundation turns to DeFi for cash

Aave’s positive growth trajectory

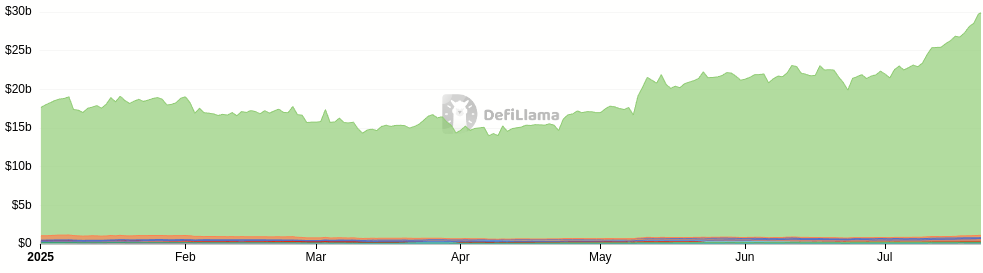

The announcement follows Aave reaching a total value locked (TVL) of $40.3 billion in mid-May.

However, data from DefiLlama shows Aave’s current TVL has dipped to about $33.5 billion, placing it second behind liquid staking platform Lido, which holds $34.3 billion in assets.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story