Key Takeaways

ALGO spiked over 33% to a 4-month high as Volume soared, but Netflow trends and derivatives data hint at rising sell pressure. Has profit-taking already capped this rally’s upside?

Algorand [ALGO] jumped 33.68% in 24 hours, breaking out of a multi-month range to touch a 4-month high of $0.31 before easing to $0.2808.

As a result of a strong uptick, the altcoin’s Market Cap surged to $2.5 billion, while 24-hour Volume rose 357.45% to $762.75 million.

Such a massive upswing in volume alongside market cap signals massive capital flow and growing on-chain activity. But is this a speculative bubble or the start of something bigger?

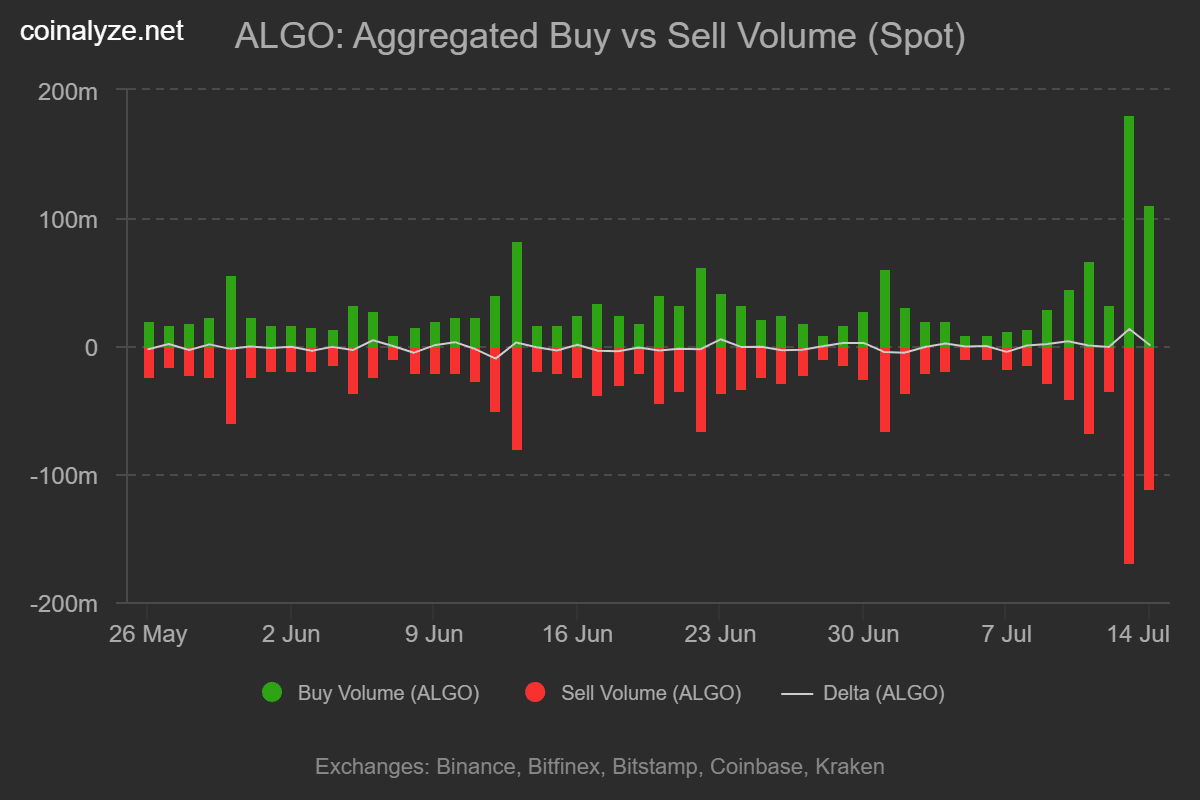

Buyers charge back into spot markets

After taking a step back in the market, buyers returned with strength. According to Coinalyze, Algorand has recorded two consecutive days of a positive Buy Sell Delta.

At press time, Algorand saw 111.39 million in Buy Volume compared to 110.6 million in Sell Volume. The previous day, the altcoin saw 181.84 million in Buy Volume relative to 168.61 million.

As a result, the altcoin ALGO saw a positive delta of 791.88K and 13.24 million respectively; a clear sign of aggressive spot demand.

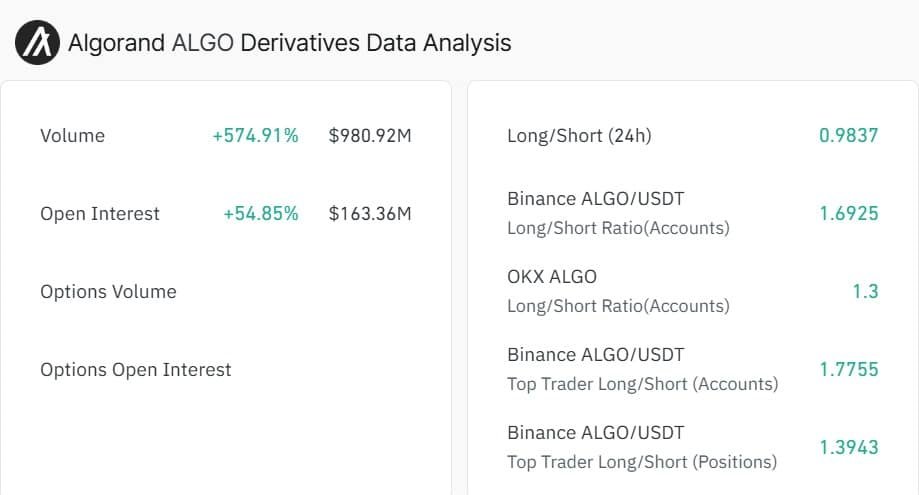

Derivatives heat up, but…

Interestingly, as Algorand price spiked, so did investors’ need for strategic positions.

According to CoinGlass, Open Interest jumped 54.85% to $163.36 million, while Derivatives Volume surged by 574.91% to $980.9 million.

Notably, when Volume surges alongside OI, it signals growing participation in the Futures market as traders take strategic positions.

However, sentiment wasn’t clearly bullish. The 24-hour Long/Short ratio stood at 0.9837, suggesting a tilt toward short bets despite price gains. Traders, it seems, remain cautious — even opportunistic.

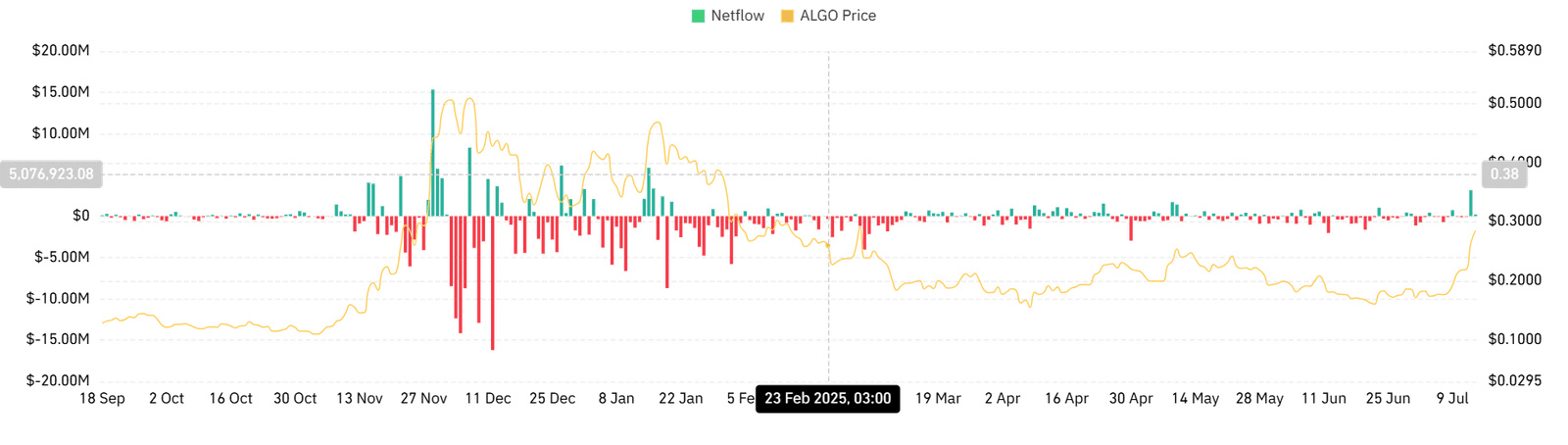

Profit takers are even more aggressive

Exchange Netflow data revealed rising selling pressure.

On the 13th of July, Netflow hit +$3.14 million, a clear sign of profit-taking. By press time, it dropped to +$480k, indicating slower, but persistent outflows.

When Netflow holds within a positive region, it implies higher exchange deposits than withdrawals, meaning holders are cashing out.

Historically, a higher selling pressure has preceded lower prices as downward pressure on price builds.

Momentum is red-hot! But so are the warning signs

According to AMBCrypto’s analysis, Algorand saw a strong upswing as buyers returned to the market with strength.

As a result, the altcoin’s Relative Strength Index (RSI) surged to 83.18, reaching overbought territory. Likewise, Algorand’s Stochastic RSI spiked to 100, also hitting overbought conditions.

When these indicators enter into overbought zone, it signals buyers’ dominance but also warns of brewing volatility.

If bulls defend this momentum, ALGO could push toward $0.34 next. But if sell pressure persists, the price may retrace to $0.25, where support previously held.