Key takeaways:

-

The Bitcoin Coinbase Premium Index hit its second-highest level in 2025, highlighting sustained US investor interest.

-

Binance’s retail inflow percentage reached a 2-year high, with a sharp increase in 0–1 BTC exchange deposits, hinting at active retail trading or profit-taking behavior.

-

Bitcoin’s jump to $105,000 was driven by short liquidations, not new long positions.

The Coinbase Bitcoin (BTC) Premium Index reached its second-highest value on Monday, reflecting a price premium on BTC available at Coinbase versus Binance. The index has remained green for most of June, indicating sustained buying pressure from US investors. This aligns with positive spot ETF flows for most of the month, as a study noted a 0.27 coefficient linking prior-day ETF inflows to price increases, suggesting market optimism.

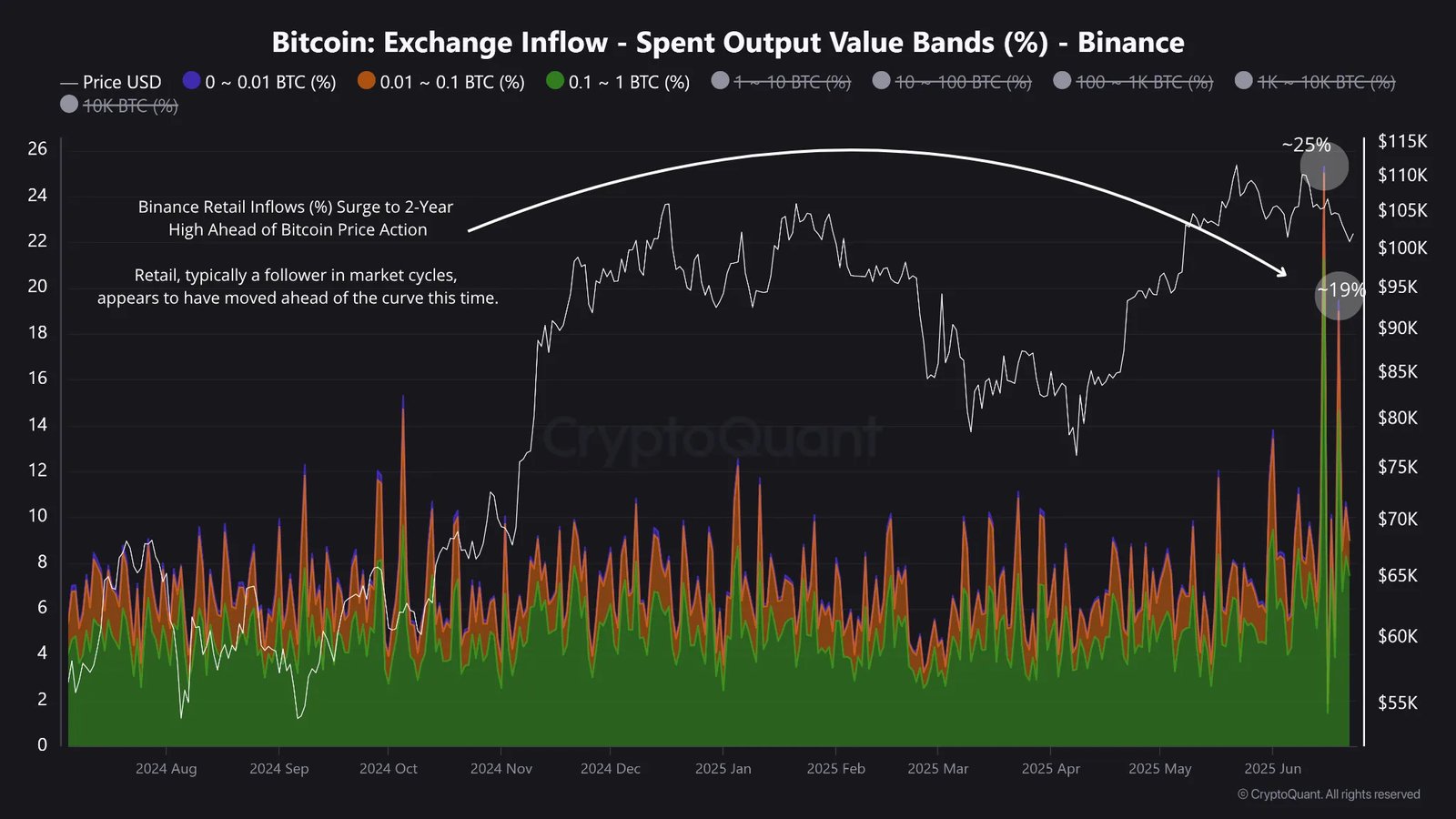

CryptoQuant data shows that Binance’s retail inflow percentage has surged to its highest level in two years, coinciding with a Bitcoin price decline. Onchain metrics also indicate a sharp rise in exchange inflows, particularly in the 0 to 1 BTC range, as reflected by the Spent Output Value Bands (SOVB) on the exchange.

With Binance dominating global retail trading volume compared to Coinbase, its user base’s behavior—potentially driven by lower entry barriers—could influence market trends. Onchain analyst Maartunn explained that,

“These inflows suggest proactive behavior rather than passive accumulation. The move to deposit BTC on Binance typically signals an intention to trade, not to hold. While retail participants are often seen as lagging market movers, this time they may have been ahead of the curve.”

Both metrics offer contrasting insights amid Bitcoin’s current price. The Coinbase premium suggests strong buyer interest, potentially from institutional investors via ETFs, cushioning the decline.

Conversely, high Binance inflows may reflect profit-taking or panic selling by retail investors, contributing to downward pressure. This mixed scenario implies caution for buyers: the premium indicates potential undervaluation opportunities, but corrections could deepen if retail selling persists.

Related: Bitcoin $105K ‘trend switch’ comes as Fed hints at July rate cut

Bitcoin short-covering could spark a sharp move

Bitcoin surged to $105,000 on Monday, after forming a range low around $98,300 on Sunday, a notable 6.7% rise. However, this uptick came with a 10% drop in open interest (OI), signaling that the surge was primarily driven by shorts covering rather than new bullish positions. Traders betting against Bitcoin likely faced liquidations, with $130 million in short positions wiped out on June 23, forcing them to buy back BTC, aligning with the sharp price bounce.

The aggregated funding rate is now rising on minimal OI growth, indicating over-leveraged longs paying shorts, a potential sign of market exhaustion.

For a bullish continuation, Bitcoin needs sustained buying volume and a rebound in OI, confirming new long positions. A retest of the $108,500 resistance could occur, with strong momentum signaling a sustained rally.

Conversely, a bearish outlook could emerge if funding rates spike further without OI support, suggesting a possible reversal. A drop to $102,000 and declining volume could trigger a deeper correction, especially if sentiment shifts bearish again. The current short-covering rally may evolve into a bull run or a pullback, as volatility remains evident this month.

Related: Panther Metals up 21% after $5.4M Bitcoin play to buy minerals and gold

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.