- BTC’s mid-term outlook appeared cautious and aligned with the historical summer lull.

- However, Polymarket bettors highly expected a new ATH in Q3.

Bitcoin [BTC] reclaimed $108.2K and extended its mid-week rally to nearly 10%, thanks to relatively calm markets after the Israel-Iran ceasefire deal.

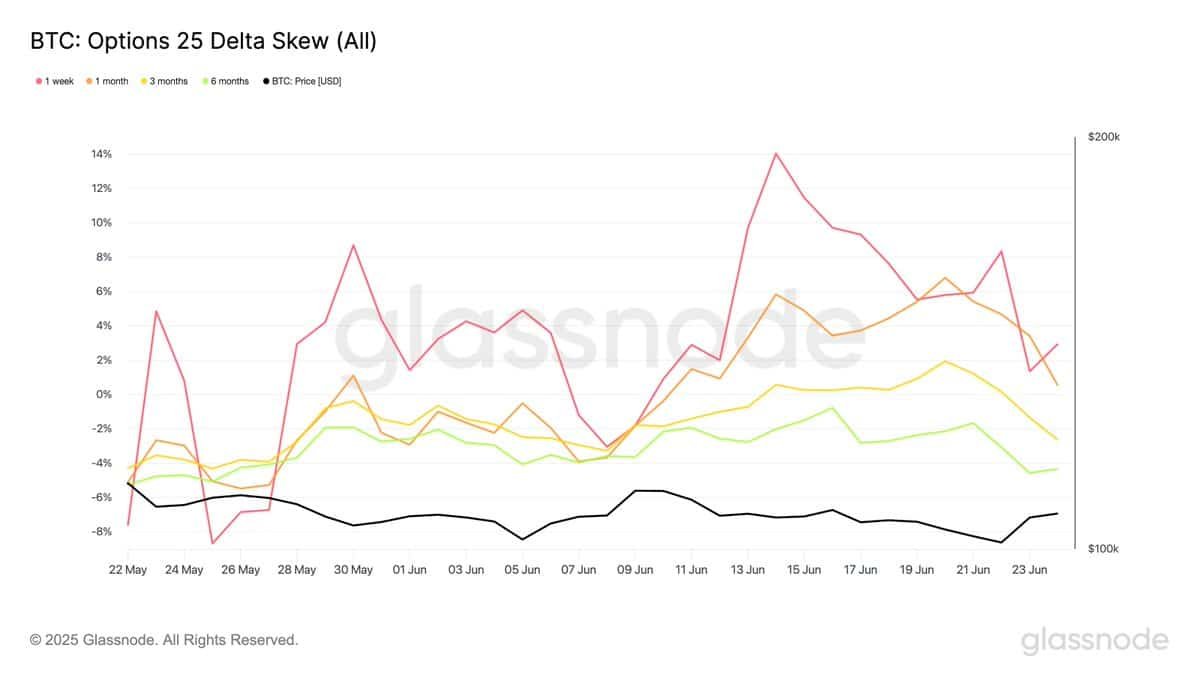

Despite the short-term optimistic outlook, however, the market was pricing in a mid-term caution, according to Glassnode.

Citing the Options market sentiment indicator, 25 Delta Skew, the analytics firm flagged bearish sentiment as shown by the negative skew for 3-month and 6-month tenors.

“3m and 6m (skew) remain negative (-2.6%, -4.3%). Combined with a put-heavy volume profile, this points to reduced short-term panic, but lingering medium-term caution.”

This meant a premium for puts (bearish bets) over calls (bullish bets) at the end of Q3 and December 2025.

Summer seasonal at play?

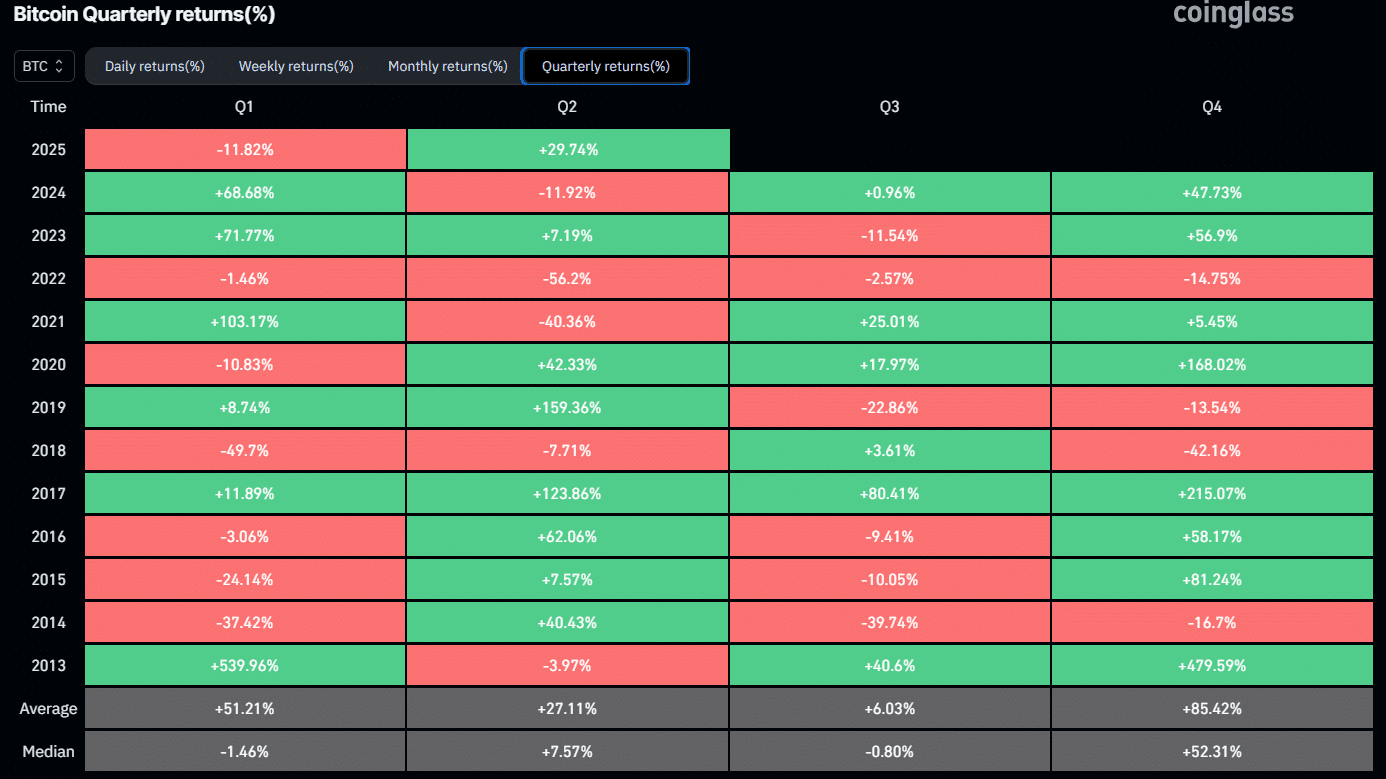

Unsurprisingly, the above sentiment and market positioning, especially for Q3, mirrored the summer seasonals.

According to CoinGlass’ historical performance, summer has always been the worst period for BTC. On average, BTC posted 6% returns in Q3, with the best period being Q4 (85%), followed by Q1 (54%).

However, not all months within Q3 performed poorly in the past. In particular, July has been an outlier, with 7.5% returns on average, suggesting historical weakening in August and September.

If history repeats, July could offer modest gains followed by selling pressure afterwards. Most analysts link this trend to low trading activity due to summer holidays.

However, past performance doesn’t guarantee future results.

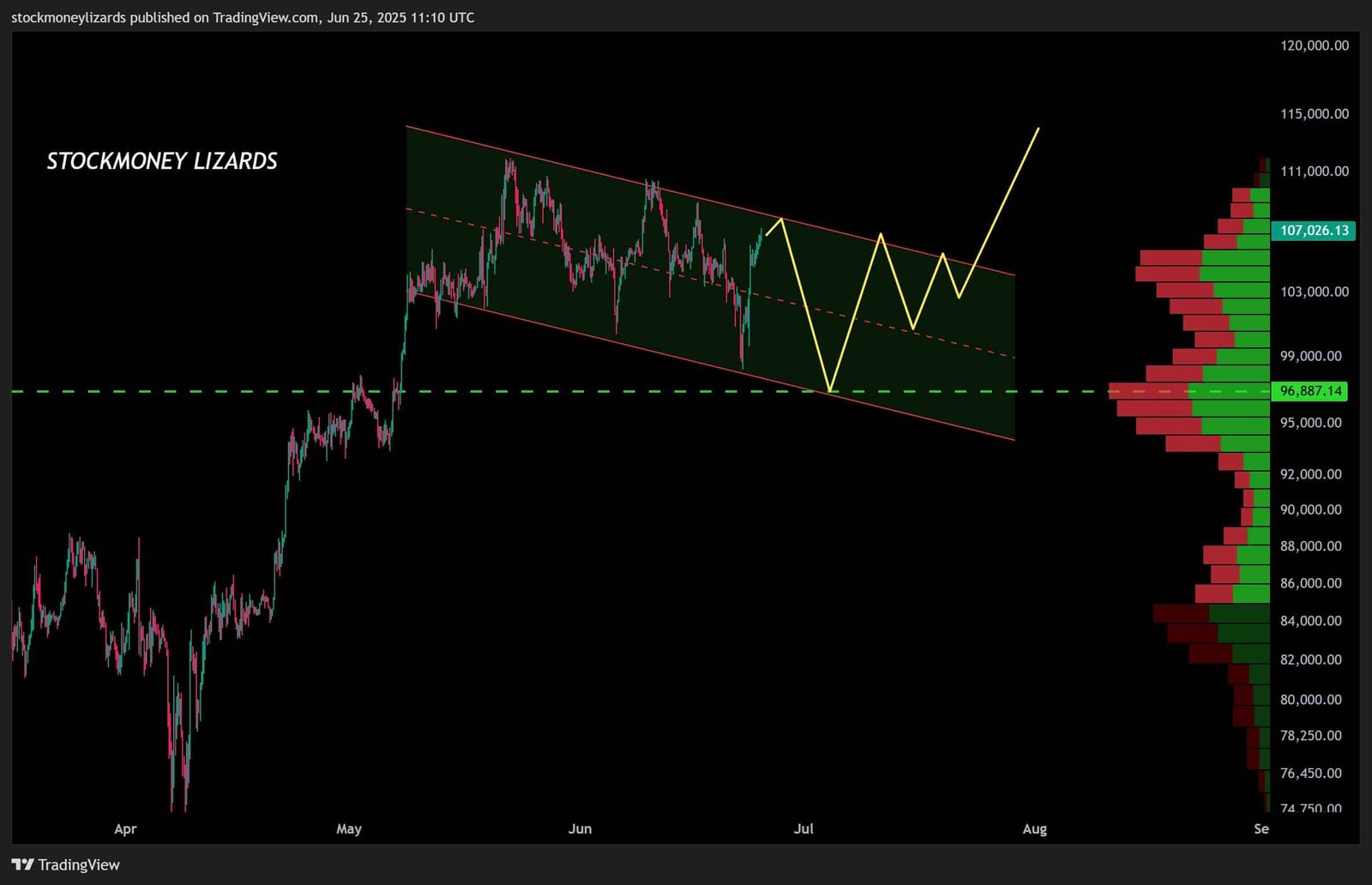

In fact, Polymarket bettors were betting against the above seasonality. The prediction site highly expects a new all-time high (ATH) before October, with over an 85% chance for such an outcome.

In other words, the market expects a push above $112K in Q3. Analyst Stockmoney Lizards echoed this consensus and eyed a potential jump to $115K by August.