Key Takeaways

- Bitcoin’s price hasn’t reached its cycle top yet, according to the Repetition Fractal Cycle and MVRV Ratio, both signaling room for a final rally before a possible correction near the $110K resistance zone.

Bitcoin [BTC] may not have hit its cycle peak just yet.

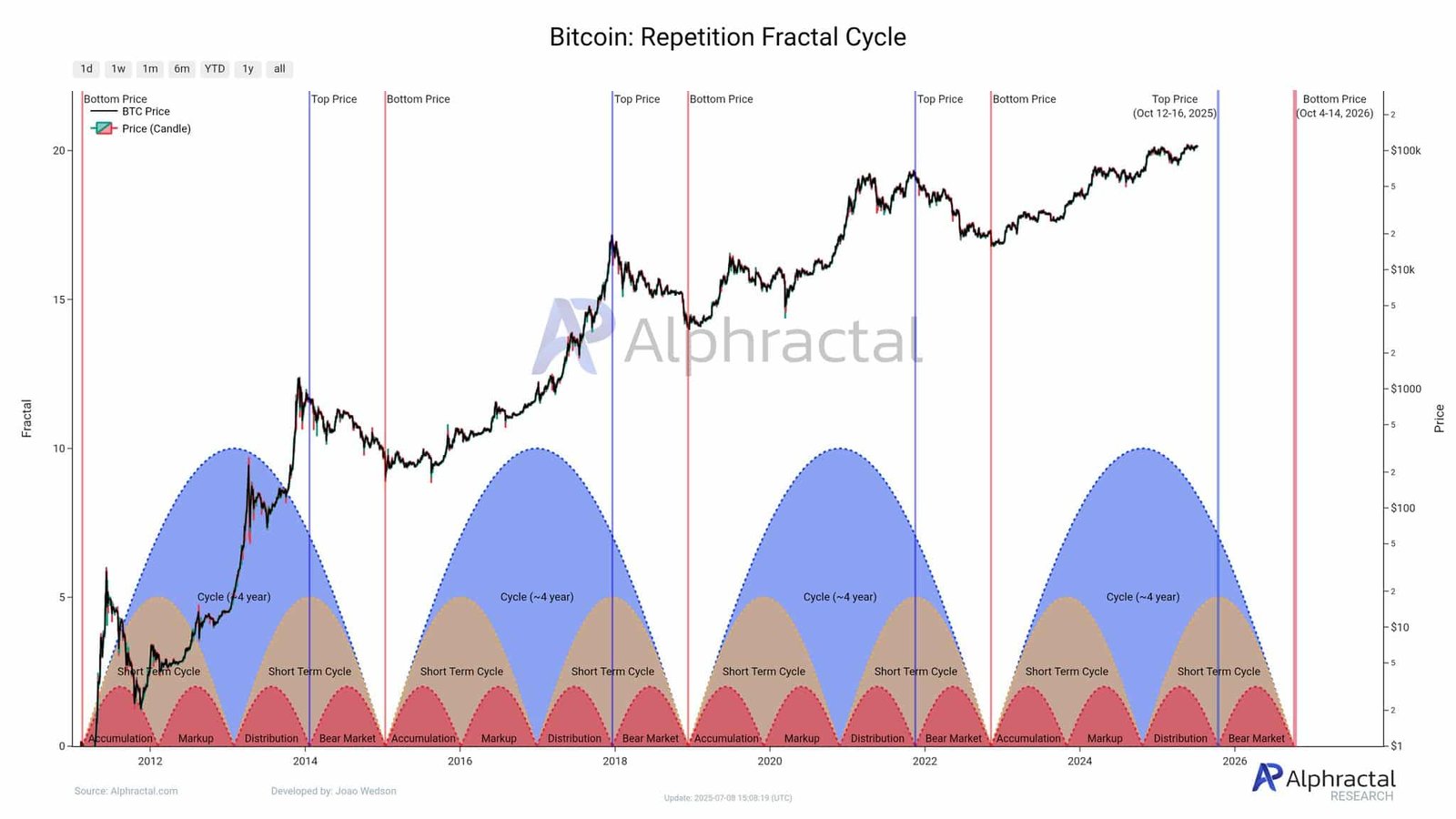

According to the Repetition Fractal Cycle metric, the price action is still playing out a pattern that has accurately predicted tops and bottoms since 2012, nearly to the day.

This same fractal flagged the 2017 euphoria peak and even the 2020 COVID-19 crash bottom. Naturally, if this symmetry continues, there’s room for another push before a broader reversal.

One last climb before the chill?

Current price action is following the path laid out by the fractal pattern. As of writing, BTC prices were surging as they climbed past the $111K key price level.

And with the pattern still giving green lights for a rally, Bitcoin could surge higher for a while before going into a deep correction phase.

But the fractal does not guarantee an exact top; the data only plots out likely behavior based on previous symmetry. However, its accuracy through three cycles lends validity to its forecasts.

BTC MVRV Ratio approaches an overvalued region

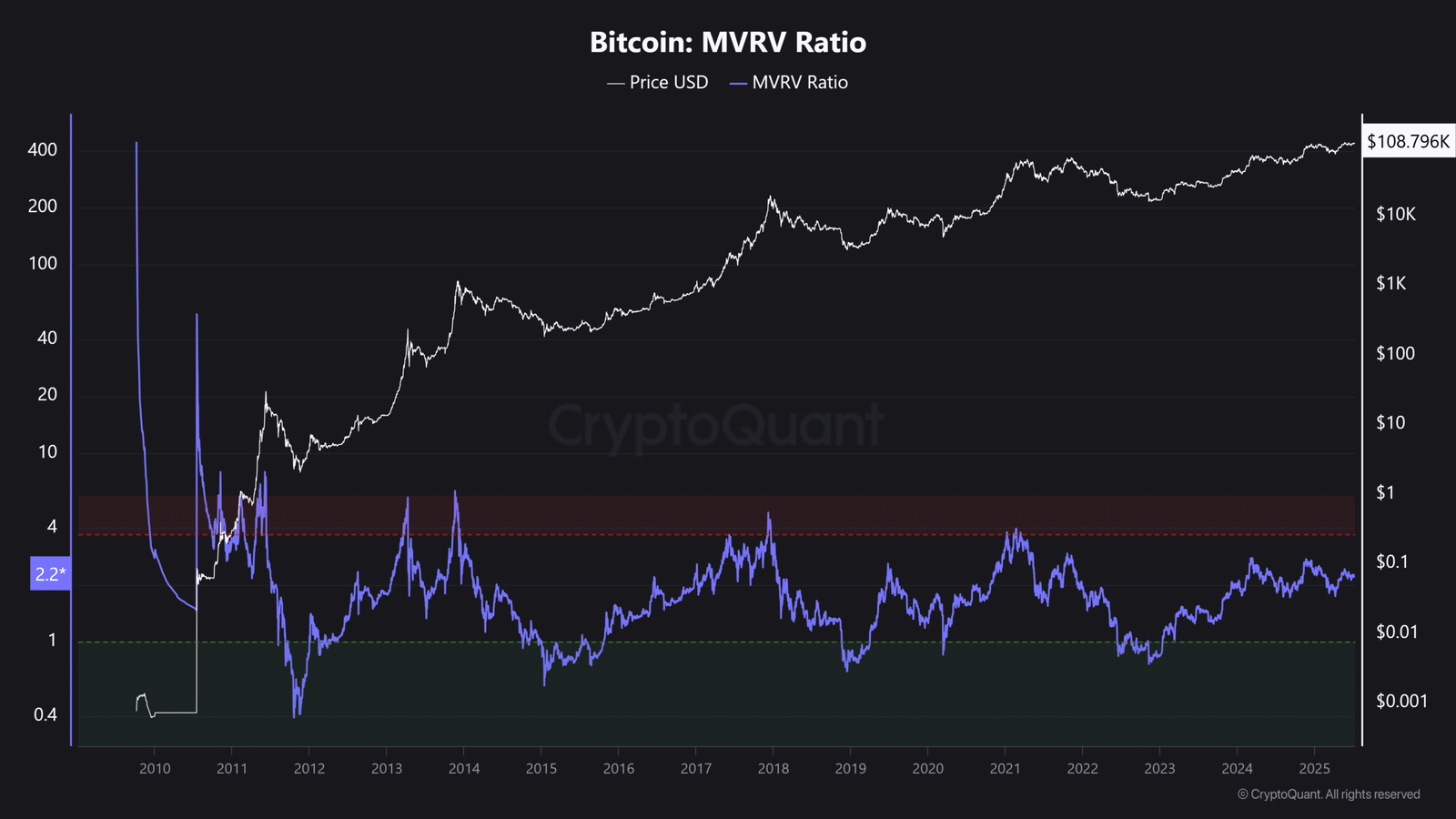

Adding to the caution, the Bitcoin MVRV (Market Value to Realized Value) ratio is increasing to levels previously associated with cycle highs.

Historically, the metric measures how profitable investors are and if prices are overheating or not.

When MVRV hits an overvalued level, corrections usually follow. It last touched those kinds of levels at the 2021 cycle top, before a spectacular bear run.

The fractal cycle positioning currently relative to MVRV suggests the market is nearing the end of its bull run, with euphoria soon to set in.

The convergence of a consistent fractal pattern with supportive on-chain valuation indicators such as MVRV suggests a balanced outlook for Bitcoin’s price movement.

Although the short-term technical structure remains bullish, broader market dynamics hint at a potential correction.