Key takeaways:

-

Bitcoin’s options market signals extreme fear, but historical patterns show potential for significant rebounds.

-

Global economic pressures from US trade tariffs negatively affected traders’ sentiment.

Bitcoin (BTC) fell below $113,000 for the first time in over two weeks, surprising traders and triggering the liquidation of $113 million in leveraged long positions. The sharp decline followed the $124,176 all-time high on Thursday, raising questions about whether the bull market is over as the macroeconomic environment grows more uncertain.

SEC investigation and corporate AI disappointments

Bitcoin’s price correction accelerated after reports that the United States Securities and Exchange Commission (SEC) is allegedly investigating fraud and stock manipulation at Alt5 Sigma, a company that recently partnered with US President Donald Trump’s World Liberty Financial in a $1.5 billion deal.

World Liberty, whose website lists President Donald Trump as “co-founder emeritus,” raised roughly $550 million through two public token sales, marketing itself as a DeFi and stablecoin platform. In June, Trump disclosed earning $57.4 million from his stake in World Liberty Financial, while Eric Trump is slated to join Alt5 Sigma’s board.

Cryptocurrency investors also reacted to a 1.5% drop in the Nasdaq 100 after MIT NANDA research, based on 150 corporate interviews and 300 public artificial intelligence deployments, found that 95% of companies failed to achieve rapid revenue growth from AI pilot programs.

US import tariffs and weakening confidence in the Fed

Another factor driving risk aversion was the US’s new 50% import duties on 407 additional aluminum- and steel-containing products. The affected items include everyday goods such as car parts, plastics, and specialty chemicals, prompting economists to raise concerns about supply chain disruptions and higher consumer prices.

UBS investment bank lifted their gold price forecast to $3,700 by September 2026, according to CNBC. UBS strategists expect gold price to rally from below-trend economic growth, Federal Reserve policy easing and a weaker dollar. Investor concerns over the US fiscal deficit and questions about Fed independence also underpin the outlook.

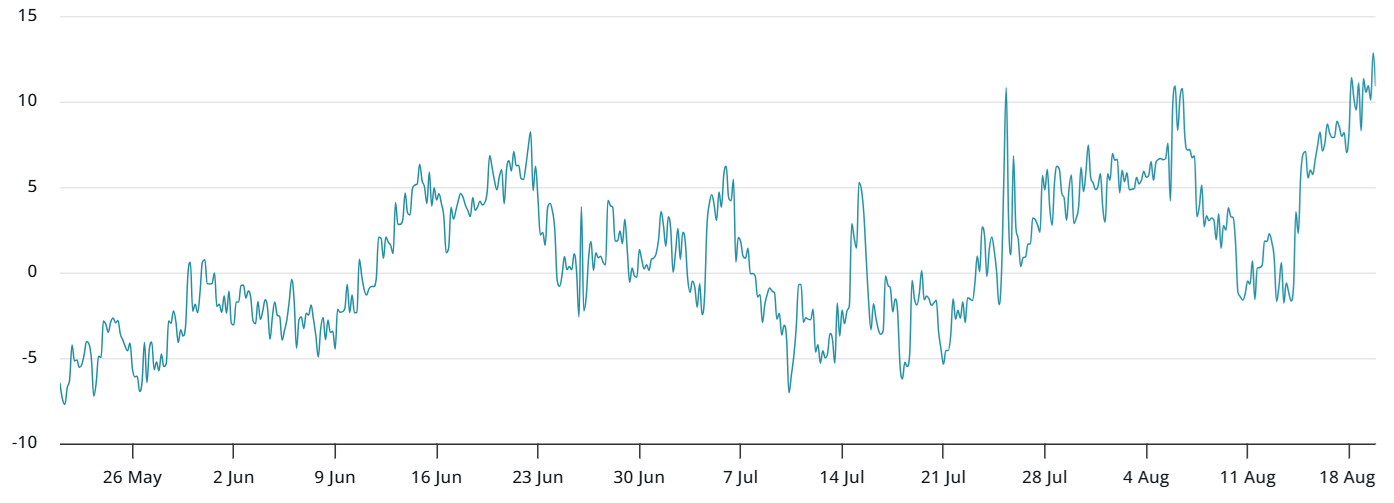

Amid growing fears of economic contraction and the potential impact on companies linked to Trump’s World Liberty Financial, demand for downside protection surged in Bitcoin derivatives markets. The BTC options skew metric turned bearish on Friday and has continued to deteriorate, reflecting heightened investor caution.

The Bitcoin 30-day options delta skew (put-call) surged to 12%, its highest level in over four months. Under neutral conditions, this indicator typically oscillates between -6% and +6%, reflecting balanced pricing for call (buy) and put (sell) options. Levels above 10% signal extreme fear but are rarely sustained.

Related: Bitcoin ‘liquidity zones swept’ but uptick in open interest hints at BTC recovery

A prior spike to 13% delta skew occurred on April 7, when Bitcoin dropped below $74,500 for the first time in five months. Investors who embraced the risk then saw gains of 40% over the following month as Bitcoin rallied to $104,150 by May 8.

There is no evidence that Bitcoin’s bull run has ended. Traders’ fear often overshoots rational expectations. In fact, the cryptocurrency might even benefit from potential outflows in the stock market, suggesting that current turbulence does not invalidate the market’s longer-term bullish trend.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.