Key points:

-

Bitcoin sees some weekend volatility as Hyperliquid’s notorious James Wynn flip-flops between short and long BTC.

-

Short timeframes show bulls staying “in control” of BTC price action.

-

The weekly and monthly candle closes have a chance to become Bitcoin’s highest ever.

Bitcoin (BTC) passed $108,500 into the June 29 weekly close as familiar “whale games” combined with bullish market structure.

Bitcoin hits two-week highs as James Wynn returns

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD gaining 1% on the day to near two-week highs.

“Out-of-hours” trading conditions meant that lower liquidity allowed for more volatile market moves on less volume.

News that now-infamous Hyperliquid trader James Wynn had opened a $13.9 million BTC short position thus sparked what appeared to be an attempt by other market participants to liquidate it.

Wynn’s liquidation price was $108,630 at the time of writing, with Bitcoin inches from reaching that level. Wynn closed his short prematurely, flipping long with around 60 BTC.

Bullish on $BTC?

James Wynn(@JamesWynnReal) has closed his short and flipped long on $BTC.

Aguila Trades(@AguilaTrades) is doubling down, increasing his long to 2,201 $BTC ($238M).https://t.co/FX6sISWuDPhttps://t.co/1Aq6gywbqf pic.twitter.com/HB61RN0Gnv

— Lookonchain (@lookonchain) June 29, 2025

Elsewhere, chart analysis saw encouraging signs that Bitcoin market strength would continue.

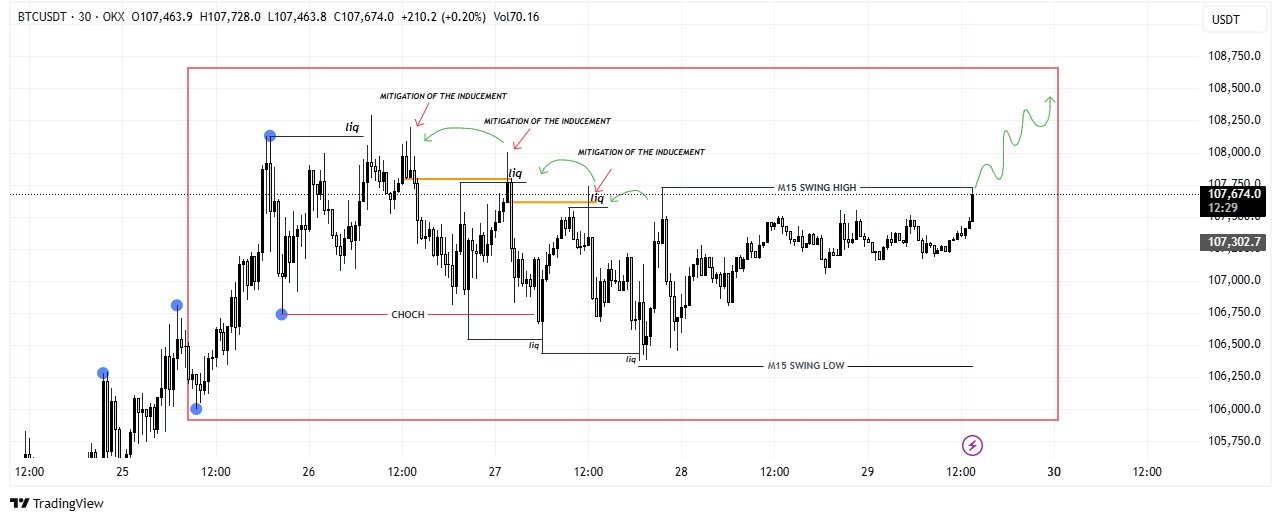

“If you look at the 15-minute chart, the structure is bullish,” popular trader Autumn Riley wrote in part of ongoing commentary on X.

“Every time price sweeps a high, it reacts down but keeps making higher lows. The pressure from sellers is fading slowly.”

Fellow trader BitBull, meanwhile, noted a golden cross playing out on Bitcoin’s Moving Average Convergence/Divergence (MACD) indicator — a sign that near-term price action was outperforming.

“Another signal which shows that bulls are in control,” part of an X post on the topic reported.

“Right now, we are in a low liquidity weekend so don’t expect big movements. Once the market opens tomorrow, I’m sure the volatility will kick in and it’ll most likely be to the upside.”

BTC price eyes record candle closes

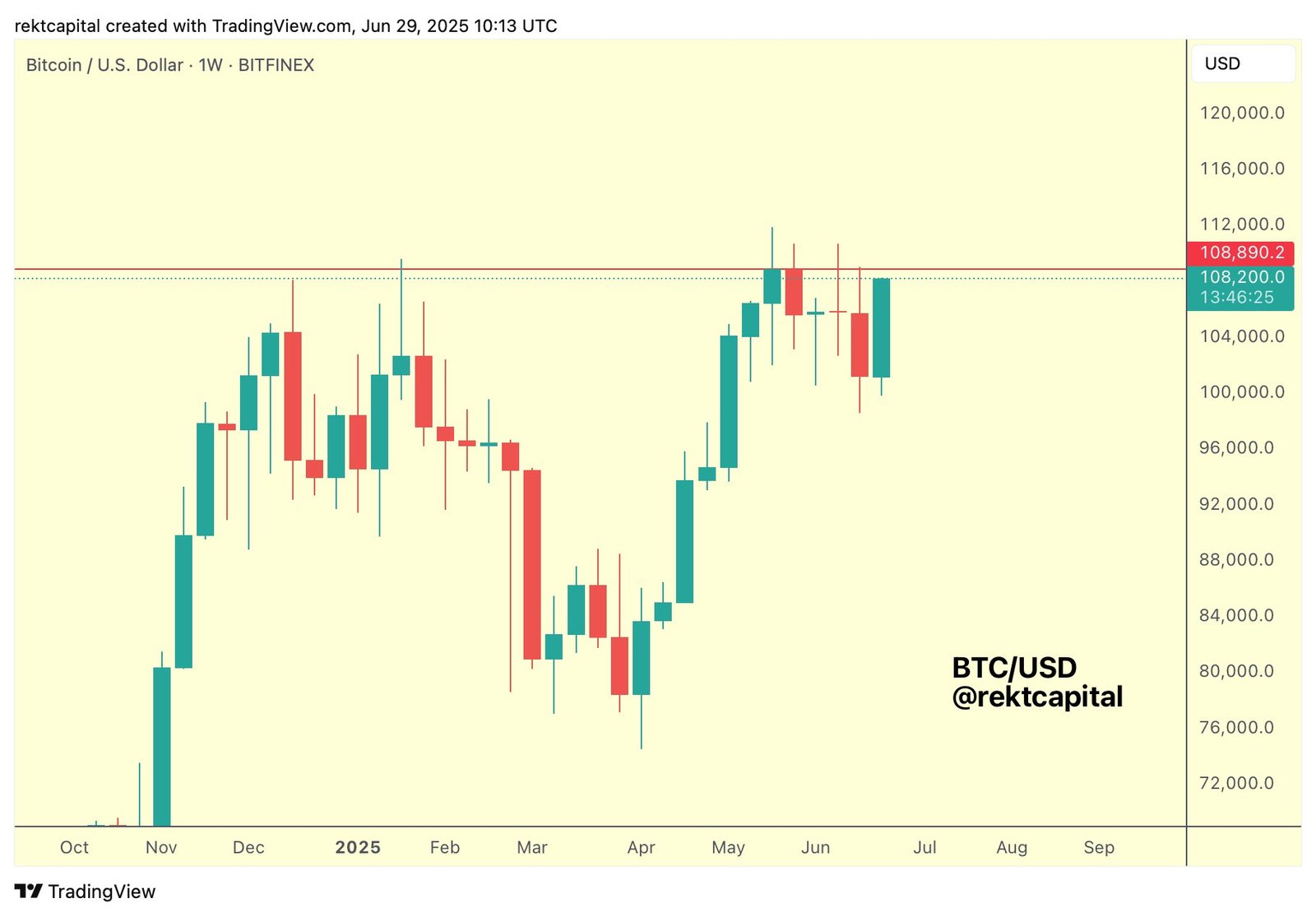

Ahead of the weekly and monthly candle close, popular trader and analyst Rekt Capital eyed a key price point of interest next.

Related: Bitcoin long-term holders stack 800K BTC per month in record hodl run

Bitcoin, he argued this weekend, was on the cusp of making history with the highest weekly close ever.

“Can Bitcoin Weekly Close above the final major Weekly resistance?” he queried.

“Bitcoin has never performed such a Weekly Close. Therefore in doing so, that would not only be historic, but it would enable Bitcoin to enjoy a new uptrend into new All Time Highs.”

The current highest-ever weekly close lies just above $109,000 on Bitstamp. The highest monthly close is lower at around $104,630.

Earlier this week, Rekt Capital said that a close above $102,400 would be enough to confirm a “monthly range breakout.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.