Key Takeways

Bitcoin’s bull run is still intact, led by institutions with retail yet to jump in, signaling more upside ahead.

Bitcoin’s [BTC] bull run might feel like it’s topping out. After opening at $119,720, BTC dipped 2.25% intraday, printing its longest red daily candle of the month.

But it wasn’t panic selling. Glassnode data shows investors locked in $3.5 billion in realized profits. Notably, this marked one of the biggest spikes this year, with over half of that coming from long-term holders.

According to AMBCrypto, this divergence matters. In fact, it could be the very factor that shapes how the next leg of Bitcoin’s bull run unfolds as we head deeper into Q3.

Strategic selling reflects market maturity

Bitcoin’s OG supply is on the move. According to CryptoQuant, a 14-year-old dormant whale just offloaded 20,000 BTC from an 80,000 BTC treasury, signaling that LTHs are beginning to strategically exit.

The sell-off sliced through two long liquidity clusters in under 24 hours, each worth over $60 million in open interest.

The result? A sharp retracement that wiped out two days of gains, pulling BTC back into the $116k–$117k range.

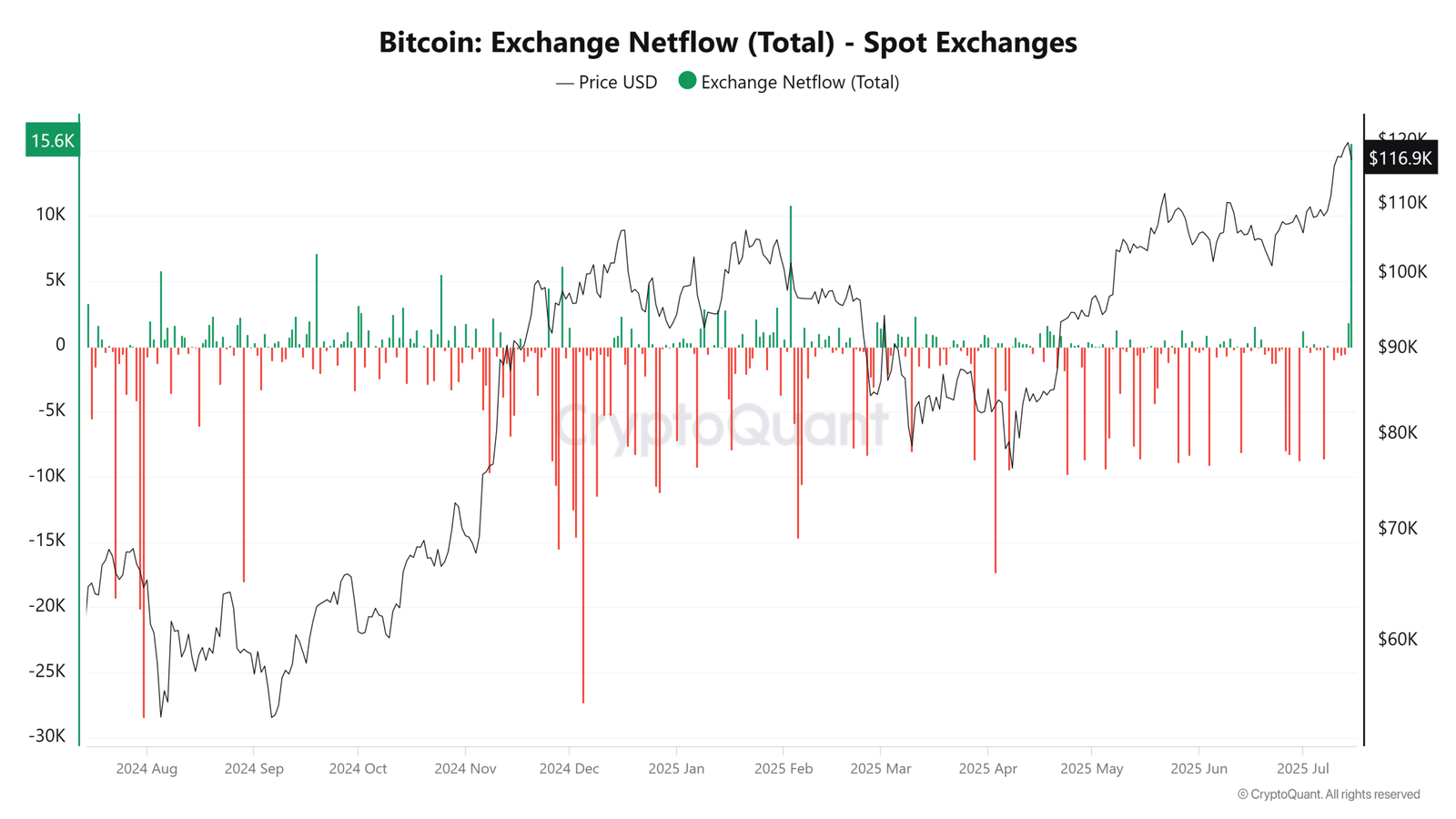

Still, the market isn’t flinching. The Fear & Greed Index remains elevated at 70, underscoring ongoing bullish appetite. Reinforcing this, net spot inflows have surged to a yearly high, with 15.6k BTC moving onto exchanges.

Taken together, the data suggests the market isn’t de-risking or capitulating. Instead, it’s simply realizing gains. And that’s a healthy dynamic for a structurally intact bull market.

In this context, smart money is eyeing a high-conviction reentry. Should Bitcoin revisit the $110k zone and confirm it as support, it could serve as a springboard for the next vertical leg of Bitcoin’s bull run.

Bitcoin bull run still has room to run

As noted by AMBCrypto, this has been Bitcoin’s most aggressive bull run yet. Weekly gains clocked in at 12%, and OI soared to an ATH of $87 billion, making profit-taking almost an inevitable.

In fact, Nic Puckrin, crypto analyst and founder of “The Coin Bureau,” told AMBCrypto that the recent shakeout is a greed-driven reset. With leverage stretched, the market needed to cool before the next leg higher.

He noted,

“Unlike previous all-time highs, future funding rates are still at normal levels, meaning the risk of cascading liquidations is low. On top of this, interest rates are still high, and the money printers haven’t even been turned on yet.”

Puckrin continued,

“This rally is still driven by institutional capital, while the typical signs of retail involvement – soaring search traffic and crypto app rankings – are absent. And I don’t see them getting involved in a meaningful way until we get to around $150,000 and the FOMO kicks in.”

From a macro lens, BTC has rallied this far without a single rate cut, meaning true liquidity hasn’t even kicked in yet. Add to that the absence of retail FOMO, and Bitcoin’s bull run may still be ahead.

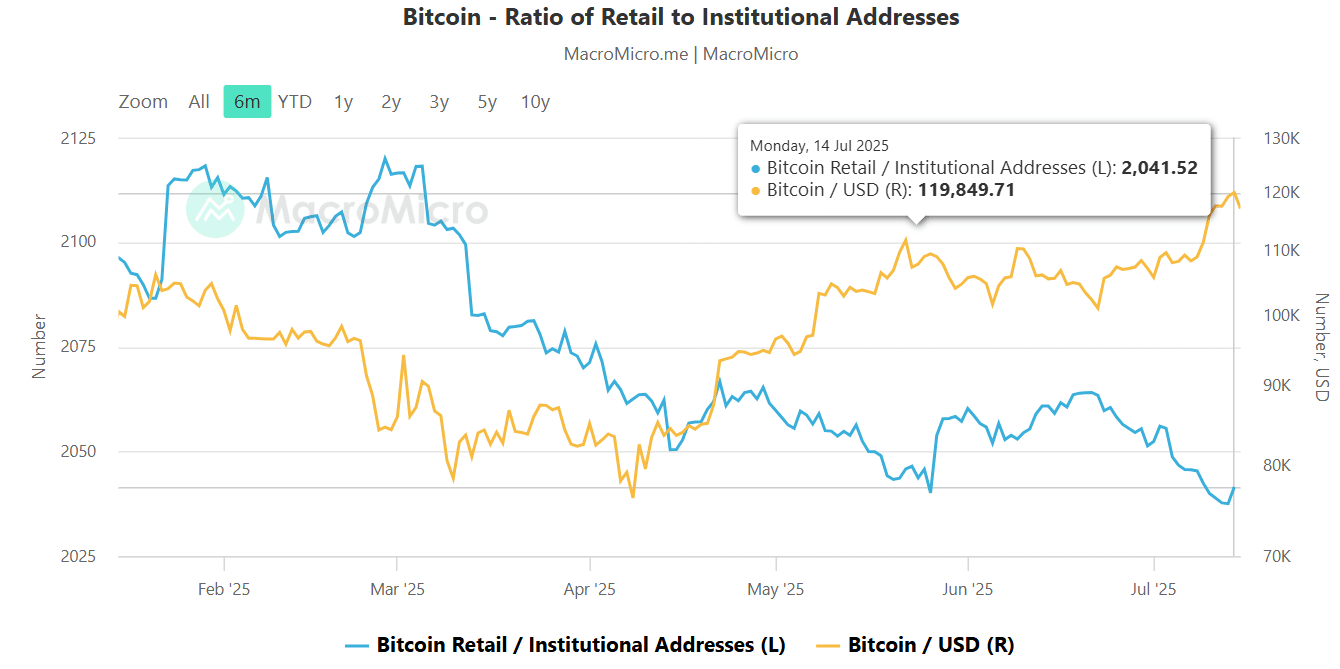

The Retail-to-Institutional Address Ratio supports this view.

The ratio has now dropped to a yearly low, coinciding with Bitcoin’s climb to $120,000. This signals that institutions are driving the rally, while retail investors are largely still sidelined.

In short, Bitcoin’s bull run is far from over.

With risk appetite intact, retail euphoria absent, and a macro backdrop that could welcome rate cuts before year-end, BTC appears poised to ignite its next leg toward new all-time highs.