Key Takeaways

Stablecoin reserves and miner outflows drop, signaling strong spot buying and long-term conviction. NVT/NVM ratios spike and spot volume cools, hinting at growing risk of short-term exhaustion.

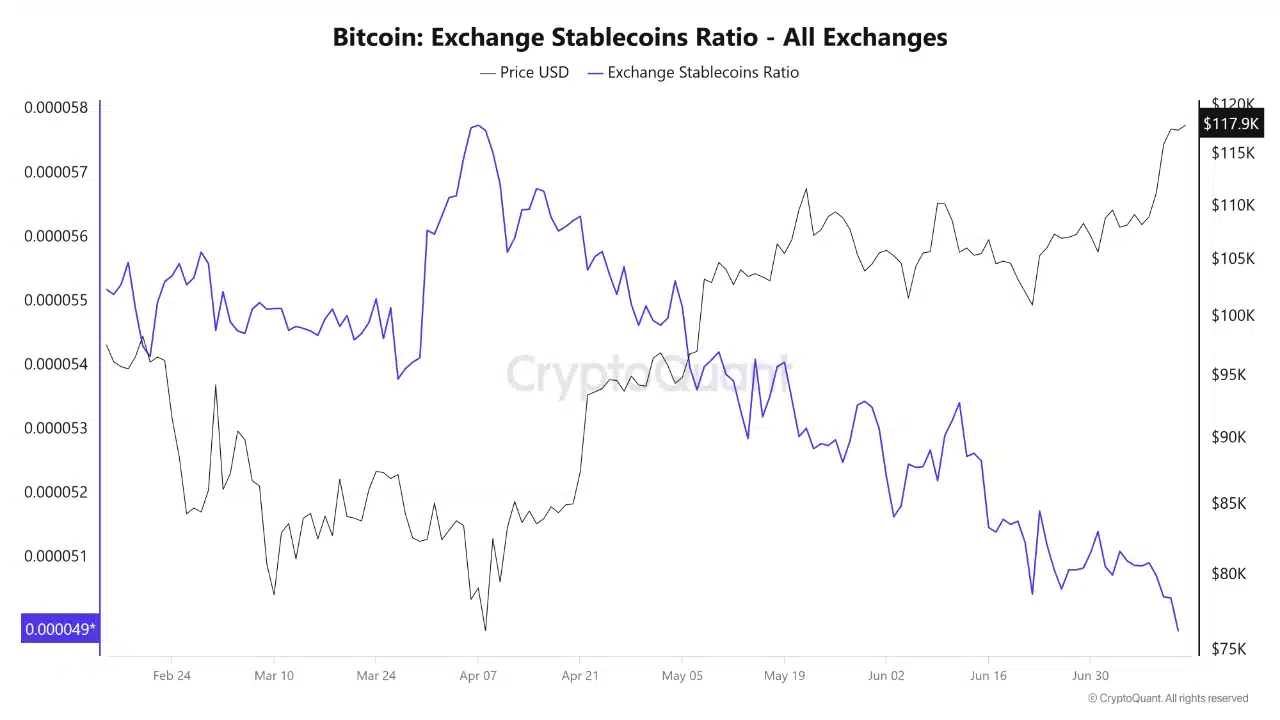

Bitcoin [BTC] continued to climb as stablecoin reserves on exchanges hit new lows, reflecting increased market conviction and spot-driven buying momentum.

BTC was priced at $117,913 at press time, with support trailing near $111,591 based on Parabolic SAR. Meanwhile, the Exchange Stablecoins Ratio fell to its lowest level in months.

This decline signals that available stablecoin liquidity is being deployed to acquire BTC, suggesting strong investor demand.

Such depletion also indicates reduced buying power on exchanges, which could limit further upside if new capital fails to enter the market.

Source: CryptoQuant

Is Bitcoin rallying too fast?

Despite the ongoing rally, the Spot Volume Bubble Map reflected a cooling trend, revealing weakening trading activity beneath the surface.

The diminishing bubble size and subdued activity suggested that momentum may be fading even as prices continued climbing.

This divergence raises concerns that fewer market participants are actively engaging in the rally, increasing the risk of exhaustion.

Unless volume recovers in the short term, Bitcoin’s bullish momentum could begin to lose traction, opening the door for sideways movement or minor pullbacks.

Source: CryptoQuant

Is a possible market top ahead?

Both the NVT and NVM ratios have spiked significantly, up 88.21% and 25.55% respectively, signaling a sharp divergence between market cap and transaction volume.

These metrics often indicate overvaluation when rising rapidly, as they show that price is outpacing network usage.

Historically, such imbalances have preceded short-term corrections or consolidation phases.

Thus, while sentiment remains bullish, these valuation indicators suggest that Bitcoin could be entering overheated territory, and traders should prepare for a potential rebalancing of price and utility metrics.

Source: CryptoQuant

Why are miners holding instead of selling at new highs?

The Miner Position Index (MPI) has plunged by over 142%, reaching -0.70, indicating that miners were reducing their outflows drastically. Thus, miners were likely expecting prices to continue rising.

Typically, miner selling increases during rallies; however, the current trend points toward long-term conviction.

This retreat from selling supports the bullish narrative, although it also adds pressure on late buyers if the market suddenly reverses and miners begin offloading again.

Source: CryptoQuant

Will the bulls maintain control if the trend remains weak?

Directional indicators reflected clear buyer dominance, with +DI at 33.12 and -DI lagging at 11.73 at press time. However, the ADX was at just 19.70, signaling weak trend strength overall.

While bulls clearly control the market, the lack of strong directional force suggests that the rally still lacks full conviction.

In addition, Parabolic SAR support at $111.6K provides a cushion, but unless ADX begins to rise, the uptrend could stall.

Therefore, traders should remain cautious as trend strength has yet to catch up with price momentum.

Extended run or cooldown?

Bitcoin’s rally was supported by strong investor demand, reduced miner selling, and bullish spot flows.

However, overvaluation signs from NVT/NVM ratios, cooling volume, and weak trend strength hint at growing risk.

Unless market participation and trend momentum improve soon, BTC could face consolidation.

While short-term conditions still favor buyers, the sustainability of this run depends on renewed inflows and broader confirmation from technicals.

The next few days will be crucial in determining whether Bitcoin can extend its breakout or pause for a breather.