CoinShares, a major European cryptocurrency investment firm, has secured a license under the local regulatory framework, Markets in Crypto-Assets (MiCA).

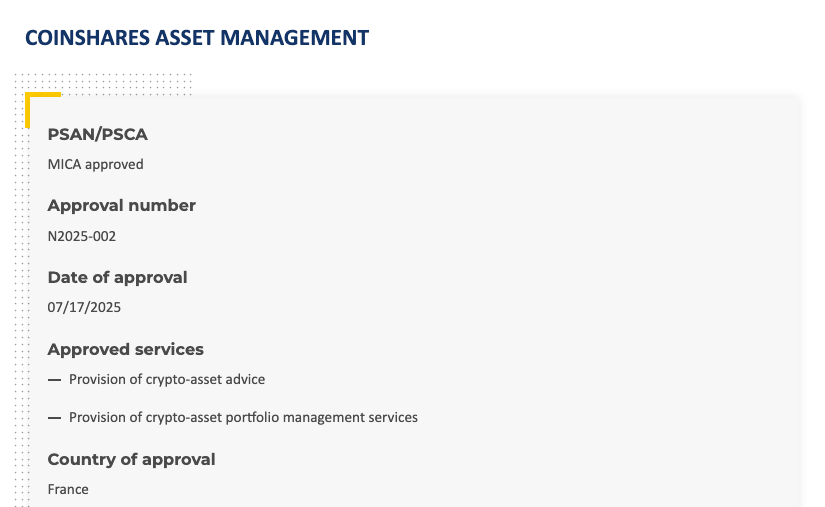

CoinShares received the MiCA license through its French subsidiary, CoinShares Asset Management, the company announced on Wednesday.

With the license, CoinShares became the “first continental European regulated asset management company” to be qualified under MiCA, the announcement noted.

CoinShares, a major provider of crypto exchange-traded products (ETPs) in Europe, has also been expanding its US presence since acquiring Valkyrie Funds last year.

Triple license mix

Following the new license acquisition, CoinShares now holds three regulatory licenses in Europe, including MiCA, the Markets in Financial Instruments Directive (MiFID) license and the Alternative Investment Fund Managers Directive (AIFM) license.

CoinShares said it’s the only continental European asset manager with this triple license, allowing it to offer services across all EU asset classes.

CoinShares’ MiCA license, issued by the French Autorité des Marchés Financiers (AMF) on Thursday, has enabled CoinShares to offer portfolio management and advice on crypto assets in the EU. The MiFID license allows it to do the same for traditional financial instruments.

The AIFM license authorizes CoinShares to provide services in alternative fund management and delegated management under the EU’s Undertakings for Collective Investment in Transferable Securities Directive (UCITS).

A milestone for entire EU industry

According to CoinShares co-founder and CEO Jean-Marie Mognetti, the MiCA license acquisition marks a major milestone not only for CoinShares, but for the entire crypto industry in Europe.

“For too long, asset managers operating in crypto have been confined to partial or improvised regulatory frameworks,” Mognetti noted, adding that MiCA has brought a “clear, harmonised structure across the EU.”

CoinShares stressed that its MiCA license enables it to provide services across several EU jurisdictions, with operations currently passported in France, Germany, Cyprus, Ireland, Lithuania, Luxembourg, Malta and the Netherlands.

Related: Crypto funds post record $4.4B inflows as Ether ETPs break 2024 gains

The announcement noted the possibility of extending the authorization across all EU member states.

CoinShares makes moves in the US

Apart from cementing its position as a key industry leader in the EU, CoinShares has also been actively working to compete with peers in the US market after officially entering the market in 2023.

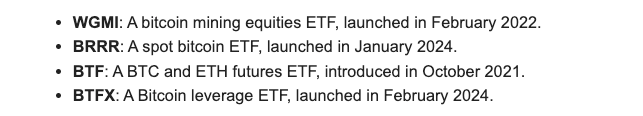

Since introducing the CoinShares Bitcoin and Ether ETF (BTF) — a futures ETF tracking the price of Bitcoin (BTC) and Ether (ETH) — in the US in October 2021, CoinShares has launched three more crypto funds in the market.

The other funds include the CoinShares Bitcoin Mining ETF (WGMI) launched in February 2022, the spot Bitcoin ETF, CoinShares Bitcoin ETF (BRRR), and the Bitcoin Futures Leveraged ETF (BTFX), launched in January 2024 and February 2024, respectively.

Following last year’s acquisition of Valkyrie Funds, CoinShares has also been actively applying for other ETF products in the US, including a potential spot XRP (XRP) ETF.

Magazine: Will Robinhood’s tokenized stocks REALLY take over the world? Pros and cons