In the ever-changing world of cryptocurrencies, on thing remains constant-the security of your digital assets, which make it crucial for you to understand the difference between cold wallet vs. and hot wallet? These are the two basic types of digital wallets, and they serve unique purposes, each with its own advantages and disadvantages.

When asking yourself how cryptocurrency hot wallets are different from cold wallets, you need to consider several other factors besides usability. Moreover, knowing the difference should help you discover what type of wallet you will need for specific purposes.

The following detailed guide will give you an overview of how crypto wallets function, how they differ, a comparison of their value factors, and which one is best suited for your needs. We’ll help you understand when, why, and where you should use one over the other.

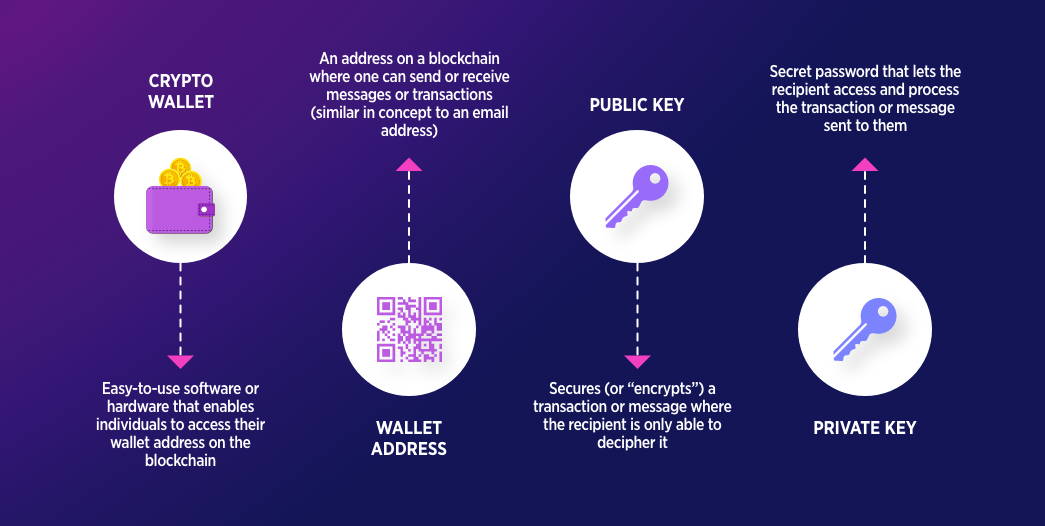

What Are Crypto Wallets?

The simplest definition of a crypto wallet is a virtual or digital alternative to a physical wallet. However, such a simple definition assumes that you would use your crypto wallet to store your digital assets or cryptocurrencies – nothing could be further from the truth. That’s because crypto wallets don’t work like the physical wallet, where you can store your fiat currency or debit and credit cards.

Crypto wallets can be software or a physical device storing the keys you need to access a blockchain network to manage your cryptocurrency. Your digital assets remain on the blockchain network and don’t move to your wallet; the keys in your crypto wallet become crucial in enabling you to safeguard or transfer the tokens as may be required. As the owner, you’re given public and private keys when registering a wallet.

- Public Keys: A cryptographic code that allows users to receive crypto transactions. It is used to encrypt data, and you can share it freely.

- Private Keys: A special code associated with public keys that help you decrypt the encrypted message must be kept secret at all times. It can be a 256-character binary code, a 64-digit hexadecimal code, a QR code, or a Mnemonic phrase.

The keys function as proof of ownership of the cryptocurrencies and will act as your identifier every time you want to access your digital assets. As a result, it is essential that you safeguard these keys jealously and employ the correct security measures to protect and manage your crypto wallets.

Therefore, crypto wallets’ primary function is to secure your public and private keys, which act as digital signatures for authorizing crypto transactions. Moreover, there are crypto wallets that have extra functionalities, including staking crypto and interacting with decentralized applications (DApps).

What Is a Hot Wallet?

So, what is a hot storage wallet in the world of crypto? These are types of crypto wallets that maintain contact with the internet and come in different forms, including web, mobile, and exchange wallets. Web-based wallets are accessible via web browsers, while mobile wallets are compatible with smartphones. Exchange wallets, on the other hand, integrate with particular cryptocurrency exchanges. Some of the key characteristics of hot wallets include:

- Online Accessibility: Connected to the internet, enabling fast access and on-the-go transactions.

- User-Friendly: Easy-to-use interfaces make them ideal for beginners.

- Integrate with Exchanges: Hot wallets can integrate with crypto exchanges, facilitating simple trading activities.

- Fast Transactions: Ideal for trading and using as they facilitate fast transactions.

- Multi-Platform Compatibility: Available in different formats such as web, mobile, and desktop, offering user flexibility.

How Do Hot Wallets Work?

A hot storage wallet operates via internet connectivity to store your private keys and manage digital assets. Every time you execute a transaction, the wallet will use the private keys to sign in to the blockchain and ensure your transaction is secure and verifiable. The constant connection to the internet enables hot wallets to perform functions like:

- Transactions Management: You can store, receive, send, and track your digital asset balance in real time.

- Integrate with Exchanges: You can easily perform trades within the blockchains that support your hot wallet.

- Access to DApps and DeFi: They allow you to enjoy expanded functionality by accessing DeFi platforms and DApps.

Types of Hot Wallets

While there are many hot wallet brands in the market, the following are the main classifications that you need to choose from:

1. Free vs. Paid Wallets

You may need to choose between free and paid hot wallets. The freely available versions are ideal for beginners because they only have a few basic features, making them easy to navigate and use. On the other hand, paid wallets bring premium features and numerous subscription-based services. Paid versions have robust security features, including multi-signature authorizations for added security and customer support.

Source: Trust Wallet

2. Specific Cryptocurrency Wallets

These are mostly non-custodial wallets, such as MetaMask, created by leading wallet manufacturers. Users of these wallets have complete control over their private keys, giving them peace of mind. Users interested in using DeFi products and other smart contract functionalities usually go for these types of hot wallets.

Source: Metamask

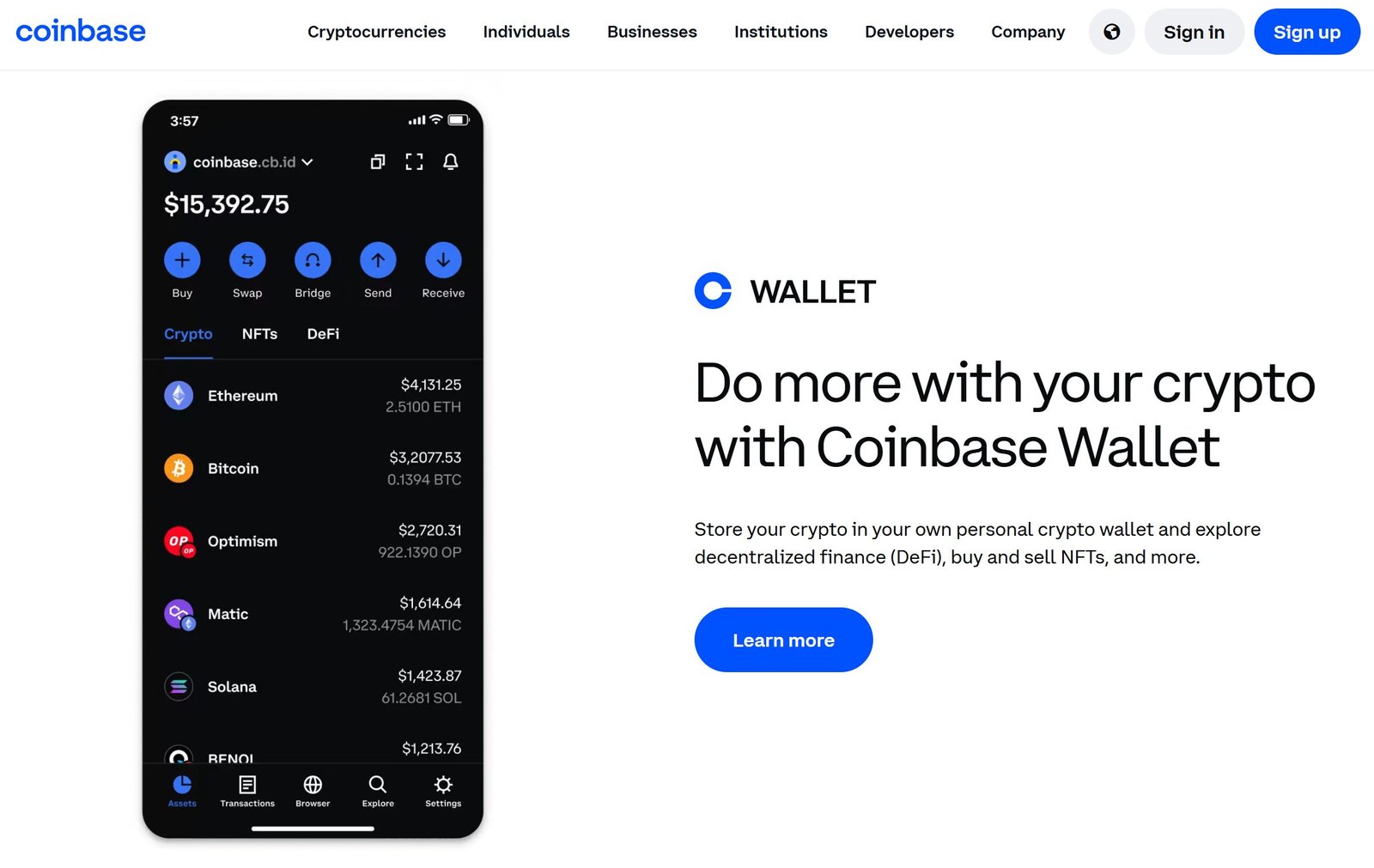

3. Exchange-Based Crypto Wallets

These custodial wallets are offered by cryptocurrency exchanges like Coinbase and Binance and are managed by the said platforms. They are designed to provide convenience and easy access to the exchange’s services, but users must be careful not to leave their assets idle in exchange wallets.

Source: Coinbase

Pros and Cons of Hot Wallets

Hot wallets offer several benefits that appeal to cryptocurrency enthusiasts, especially when accessibility and convenience are on the priority list. However, before you choose one, it is necessary to consider both sides of the coin. Here are some notable factors you need to think carefully:

Pros

- Ease of Use: Hot wallets are renowned for their user-friendliness, allowing users to navigate the crypto ecosystem seamlessly. Users can easily set them up, access funds, and execute transactions without needing technical knowledge.

- Convenience: Hot wallets facilitate a quick and easy way to access digital assets, making them suitable for trading and everyday use.

- User-Friendly: Most have easy-to-follow, intuitive interfaces ideal for beginners. Moreover, you can use them anywhere as long as you have an internet connection.

- Fast Transactions: Speed is essential in the crypto space, especially when you are an active trader. Using hot wallets ensures you have instant access to your funds, especially when you want to make quick trade decisions or seamless payments.

Cons

On the other hand, there are important factors you need to know about the potential downsides of hot wallets.

- Compatibility Limitations: In most cases, specific hot wallets may not be compatible with different blockchain networks or newer cryptocurrencies, limiting users’ access to desired actions.

- Security Risks: Because they are online-based, hot wallets are naturally more vulnerable to hacking incidents, cyberattacks, and other security threats.

- Lack of Control: Wallet service providers control the private keys, leaving users susceptible to abuse by unscrupulous players.

- Less than Ideal in Some Cases: Hot wallets aren’t ideal for users who want to keep large amounts of assets or those interested in long-term crypto holdings.

What Is a Cold Wallet?

A cold storage wallet, also known as a hardware wallet, is an alternative to hot wallets that is considered safer because it doesn’t store users’ private keys online. Users must connect the hardware wallet to the internet or a mobile application using Bluetooth or a USB stick when they want to execute transactions using cold wallets. Once connected to the internet, you can gain access to your cryptocurrency and conduct your transaction during the brief exposure to the internet, making it a relatively safe option.

The primary advantage of cold wallets is the offline authorization process with private keys. This means that your private keys will never be exposed online, making a cold wallet a better choice than a hot wallet. Moreover, you can also implement password protection protocols to your cold wallet as an extra security layer, especially when using popular hardware wallets like Ledger or Trezor.

These gadgets are called cold storage wallets for a specific reason: They are secure from the “hot” online environment, which makes them safe from cybersecurity threats and hacking attempts. Compared to hot wallets, which are mostly used for transactions and trading, cold wallets are ideal for users interested in long-term storage or investors who want to safeguard their holdings from online attacks or unauthorized access.

How Do Cold Wallets Work?

The cold storage wallet keeps private keys completely away from the internet, which means hackers cannot reach your digital assets remotely. The only time the wallet connects to the internet is when you wish to move crypto, and you connect briefly before disconnecting again. Some hardware wallets like Ledger Flex or Nano X store users’ keys on the physical device, meaning no online threat can compromise your assets. These cold wallets use air-gapped technology, which makes them the top choice among crypto investors.

There are two classifications of cold wallets, namely:

- Custodial Wallets: Custodial wallets are cold wallets with private keys managed by third parties. While they provide extra convenience, users lack total control over their assets.

- Non-Custodial Wallets: The user has total control of this wallet’s ownership and private keys. These are mostly hardware wallets such as Trezor and Ledger, among others, which are preferred for offering self-custody solutions.

Types of Cold Wallet

There are at least five different types of cold wallets in the world of cryptocurrencies:

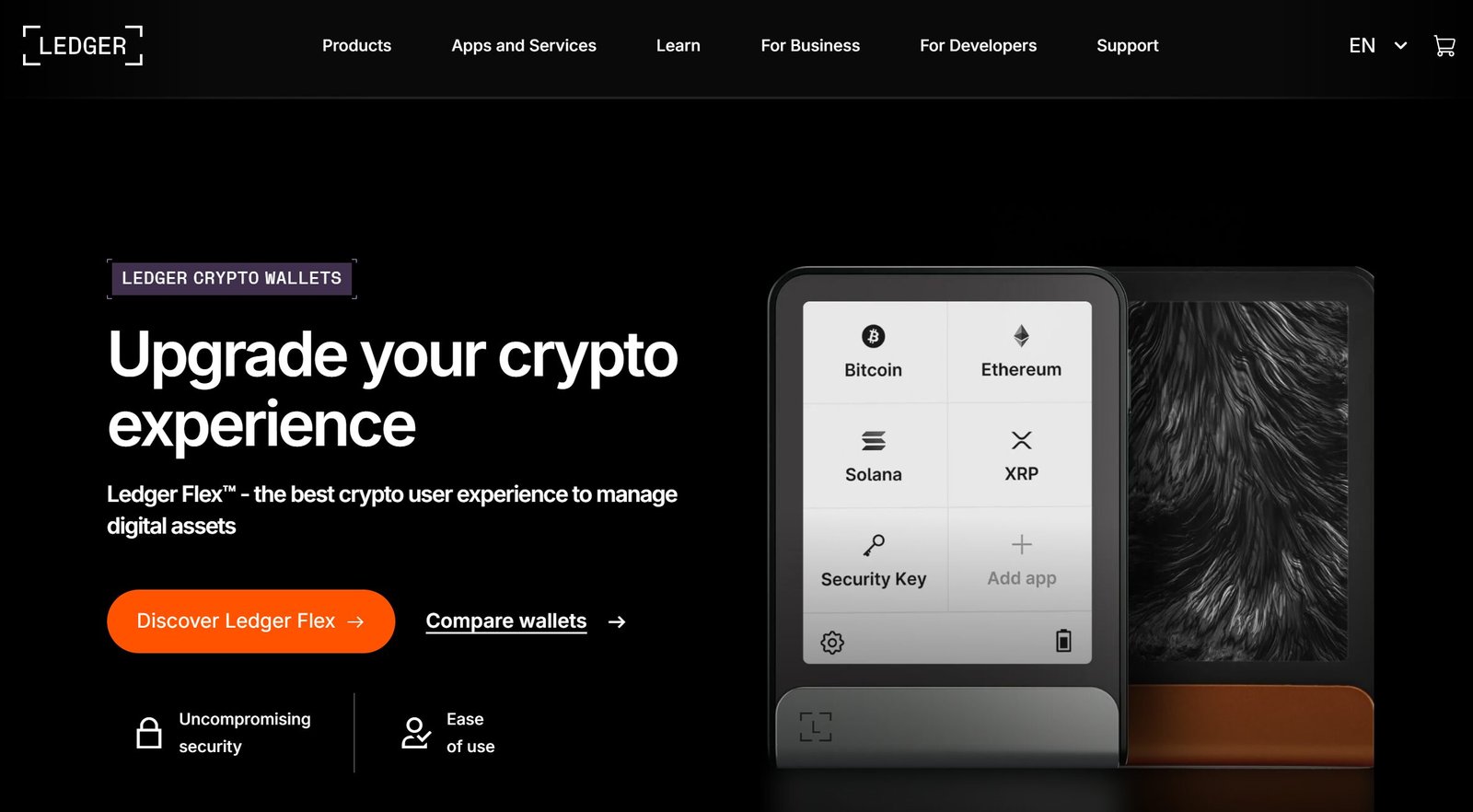

1. Hardware Wallets

Hardware wallets are physical devices that resemble USB drives and can be used to keep private keys securely offline. Users must briefly connect the hardware wallet to the internet using a device to execute any transaction. After that, they disconnect it once again and keep it securely until the next time to ensure the private keys are protected.

Some hardware wallets are designed with state-of-the-art features like passphrase protection and secure elements and are compatible with the leading blockchain networks. Moreover, others have touchscreen interfaces that enhance the user experience so that navigating and confirming transactions can happen seamlessly.

Source: Ledger

2. Paper Wallets

A paper wallet is one of the cold wallet types that stays completely offline. Creating one involves printing your public and private keys on a physical piece of paper. However, you must be very careful to avoid damaging or losing the paper, which could lead to the loss of your funds.

Source: Zonebitcoin

3. Crypto Vaults

Some specific cryptocurrency exchanges and wallet service providers offer crypto vaults that guarantee enhanced security features, including delayed withdrawals and multi-signature authentication. This provides an alternative secure form of cold wallet popular with institutional players.

Source: Thechainsaw

4. Steel Wallets

This type of cold wallet entails engraving your private keys onto a metallic sheet. Unlike paper wallets, steel wallets are more physically durable and can endure environmental hazards like water and fire damage.

Source: Amazon

5. Offline Software Wallets

A few select software wallets are designed with features that allow users to create their offline version and install them on computers that aren’t connected to the internet. Also known as air-gapped devices, these mobile devices or computers remain offline to guarantee that the user’s private keys remain securely offline. Such wallets are popular with tech-savvy individuals seeking ultra-secure crypto storage.

Source: H17N Bitcoin

Pros and Cons of Cold Wallets

Now that we have understood how this type of hardware wallet crypto operates, we must learn about the advantages and disadvantages of this type of storage solution to help you make an informed decision.

Pros

Superior Security: Security is the greatest feature associated with cold storage wallets. Since they store the user’s private keys offline, they are immune to everyday security breaches caused by malware, phishing, or hacking attempts. This has made cold wallets the number one choice for users interested in safely storing large amounts of digital assets.

- Safe from Internet Threats: Cold wallets stay almost entirely offline from any online attack. The gadgets’ isolation from the internet ensures that criminals cannot access your digital assets.

- Long-term Storage: Unless you’re a regular crypto user or trader interested in day trading, cold wallets are the ideal choice for HODLers who intend to keep their cryptocurrency intact for an extended period and enjoy peace of mind with guaranteed security.

- Physical Control of Assets: With cold wallets, you have physical control over your assets. Whether it’s a hardware or paper wallet, you can store it securely, like a safe, further enhancing your security.

Cons

- Hard to Access: Compared to hot wallets, which you can use on the go because they are only a tap away, a cold wallet requires deliberate effort to use. To make a transaction, you must look for a device to connect your wallet, start the process, and wait until the blockchain sends a confirmation. The process can be long and windy, especially when you don’t have the time to wait or are a frequent user.

- Risk of Physical Loss: Taking care of your cold wallet could become a full-time job, considering that you risk losing everything, especially when you haven’t written your private keys somewhere. Moreover, physical devices are susceptible to environmental damage, including floods or fire. This differs greatly from hot wallets, which have a practical recovery option when things go wrong.

- Technical Issues: Unless you have some technical knowledge or are quick to learn, setting up and using a cold wallet can prove challenging for people who aren’t tech-savvy, especially beginners. Some cold wallets aren’t ideal for users who are not used to complex devices.

How Are Cryptocurrency Hot Wallets Different from Cold Wallets?

| Features | Hot Wallet | Cold Wallet |

| Ideal usage | Best for making payments and day trading | Best for keeping large amounts of crypto and long-term holding |

| Cost | Mostly free | Between $50 and $250 |

| Ease of Use | Easy to use even by beginners | Complex and requires some technical knowledge |

| Cybersecurity | Less secure and susceptible to hacks and cyberattacks | Highly secure as they remain mostly offline |

| Recovery | Owners can use seed phrase to recover lost wallet and regain access | Users can use recover phrase to regain access |

| Ease of Exchange transfer | Efficient and seamlessly connects to crypto exchanges | Moderate as users must use an additional step like a USB or QR code to connect to an exchange |

How To Choose Between Hot And Cold Wallets

The choice between a hot vs. cold wallet will determine whether you will execute effortless transactions or have logistical nightmares in your crypto journey. Worse still, it could also mean the difference between securing your crypto assets and facing potential losses.

To safely undertake the security of your digital assets, you need to know when, why and where to choose a cold wallet vs. hot wallet. It is, therefore, essential to consider the following factors when navigating this critical issue:

1. The Purpose of Holding Crypto

An essential factor you must consider when choosing between a hardware wallet and a software wallet is the reason behind your crypto investment. Whether you’re a day trader, someone who uses crypto for your daily and weekly transactions, or you plan to hold your assets as a long-term investor as you watch them grow in value makes a whole lot of a difference.

Despite its vulnerabilities, day traders and individuals who use crypto regularly need the immediacy and connectivity that require a hot storage wallet. On the other hand, if you’re a HODLer who considers crypto a long-term investment, you need the security offered by a cold wallet to safeguard your funds from scammers.

2. Ease of Use

While most people invested in digital assets seem to be predominantly tech-savvy individuals who understand all the complex technical procedures in cryptography, the truth is that we also have many ordinary Joes. As a result, you must remember that crypto wallets vary in the complexity or otherwise of their user interfaces and functionality.

Some wallets come with chic, intuitive designs that novices have in mind, while others are chock full of advanced features that can easily scare beginners. Consequently, when deciding between a hot wallet vs. cold wallet you must choose one that aligns with your technical knowledge. You must remember that an error in the crypto space caused by a misunderstanding could easily cost you a fortune.

3. Security Concerns

Nothing is more critical than security regarding valuable things like your funds held in digital wallets. You must carefully evaluate your preferred wallet’s security protocol against your risk tolerance. Ask yourself if you’re comfortable with your private keys being only and potentially exposed to the entire world or prefer an offline solution where your crypto is isolated. In most cases, you may need to go for the best of both worlds. You could go for both a cold and hot wallet and use them as needed.

Considering the significance and value of cryptocurrencies, you need to approach the subject of choosing between a hot vs. cold wallet with the same care you take to make any investment. In addition to considering important features like encryption standards, two-factor authentication, and backup options, you must also create a balance between purpose, usability, and security so you can have peace of mind knowing your choice will complement your digital investment strategy.

Conclusion: Which Wallet is Better?

Ultimately, the choice between a cold wallet and a hot wallet goes beyond convenience and security. You need to clearly appreciate your personal needs, investment goals, and the value of your crypto holdings. Moreover, storage methods keep evolving like the crypto world, meaning you must remain on the lookout for new trends and updates.

Remember to choose a hot storage wallet when your main concerns are convenience and accessibility or a cold storage wallet if you want enhanced security for long-term holding. Carefully balance the pros and cons of both hot and cold wallets, and where possible, go for a combination of both storage methods so you can address your different needs at different times. Since there are no one-size-fits-all solutions in crypto, carefully learn the intricacies of both and make an informed decision regarding your investment.

FAQs

Which is better, a hot wallet or a cold wallet?

Hot wallets connect to the internet and make transactions fast and convenient. However, they are susceptible to hacking incidents and other cyber threats. On the other hand, cold wallets operate offline and provide better security, but accessing your funds is much longer and more complicated. Generally, cold wallets are considered safer since they work offline and are less vulnerable to cyberattacks.

Are cold wallets 100% safe?

There’s no doubt that cold wallets are a safe way to secure your crypto assets. However, it’s hard to say they are 100% safe, especially considering the potential for human error. You only need to accidentally expose your cold wallet to a smart contract or corrupt Dapp, and you could compromise your private keys. Therefore, you must always remain vigilant when using cold wallets.

Can you lose crypto in a cold wallet?

Even though cold wallets offer strong protection by staying offline for long periods, you can still lose your crypto if you misplace your hardware wallet, damage it, or accidentally reveal your private keys.

Should I put my crypto in a cold wallet?

Consider using a cold wallet when you intend to store your digital assets for the long term or when you are holding large amounts for enhanced security. Cold wallets are less vulnerable to hacks and cybersecurity incidents.

Can I Use Both a Cold and a Hot Wallet?

It’s advisable to use a combination of cold and hot wallets for different purposes. Use the hot wallet for your regular day-to-day transactions or trading or when you are dealing with small amounts of crypto. Use the cold wallet to store your large amount of crypto or for HODLing for the long term.

Is Coinbase a hot or cold wallet?

Coinbase Wallet is generally a hot wallet since it stores your private keys using internet-based software. Nonetheless, the Coinbase exchange offers cold storage wallet solutions that enable users to store their funds online when they need enhanced security.