Cryptocurrency investment products posted another strong week, bringing total inflows for the first half of 2025 close to last year’s figure, according to a new report from digital asset manager CoinShares.

Global crypto exchange-traded products (ETPs) posted $2.7 billion in inflows in the trading week ending Friday, marking 11 consecutive weeks of inflows, CoinShares reported on Monday.

Given all half-year inflows minus outflows, crypto ETP gains totaled $17.8 billion in inflows, 2.7% down from last year’s $18.3 billion, said CoinShares’ head of research, James Butterfill.

The ongoing 11-week inflow haul netted $16.9 billion, accounting for almost 95% of the year-to-date inflows by the end of June 2025.

Bitcoin ETPs made up 84% of H1 inflows

With $14.9 billion inflows YTD, Bitcoin (BTC) investment products accounted for nearly 84% of the 2025 half-year inflows, bolstering Bitcoin’s leading position in the ETP industry.

In line with this trend, Bitcoin ETPs led with $2.2 billion, or 83% of total inflows last week, with Ether (ETH) ETPs following with $429 million of inflows. Ether also ranked second in terms of half-year inflows of $2.9 billion, or 16.3% of total inflows in the period.

XRP (XRP) ranked third in both last week and half-year inflows, seeing $10.6 million inflows last week and $219 million inflows YTD.

Related: ‘All systems go’ for Solana staking ETF to launch any moment: Analysts

XRP ranks among the top three ETP gainers, even as spot XRP exchange-traded funds remain pending in the United States, with Canada having launched them on June 18.

BlackRock’s crypto ETFs lead H1 inflows with 96%

Similarly to Bitcoin’s dominance in crypto ETPs, BlackRock, the largest global crypto investment firm, is dominating the industry among the issuers.

According to the latest data by CoinShares, BlackRock’s crypto funds saw more than $17 billion of inflows in the first half of 2025, or 96% of total half-year inflows in crypto ETPs.

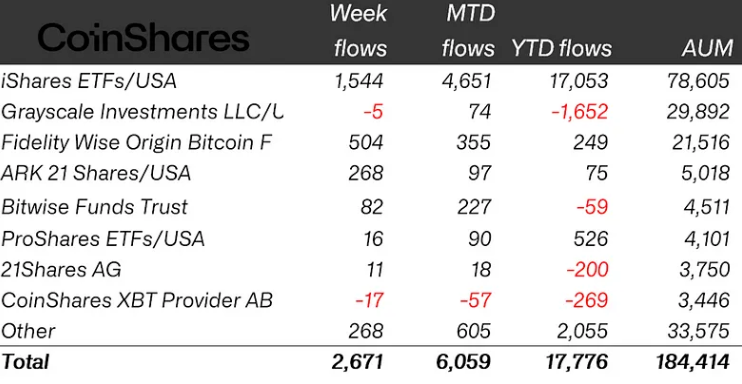

ProShares and Fidelity followed BlackRock with $526 million and $246 million in half-year inflows, while major competitors like Grayscale Investments netted outflows of nearly $1.7 billion.

CoinShares’ latest inflow update came amid Bitcoin seeing a slight correction below $108,000 on Monday. The cryptocurrency posted a significant surge last week, jumping from around $101,000 on June 23 to as high as $107,800 by the end of the week, according to CoinGecko.

Magazine: Bitcoin ‘bull pennant’ eyes $165K, Pomp scoops up $386M BTC: Hodler’s Digest, June 22 – 28