Key Takeaways

MemeCore [M], Stellar [XLM], and Mog Coin [MOG] led the week with sharp price surges. In contrast, Jito [JTO], Tokenize Xchange [TKX], and Maple Finance [SYRUP] saw significant declines.

This week in crypto saw many firsts. As Bitcoin [BTC] broke past its $111k resistance for the first time, reaching a new all-time high, the broader market followed suit as capital flowed in.

Meanwhile, the first-ever Layer 1 blockchain dedicated solely to memecoins outpaced the entire market, posting staggering triple-digit gains over the week.

Weekly winners

MemeCore [M] — Meme-focused Layer 1 blockchain surged to a $1 valuation

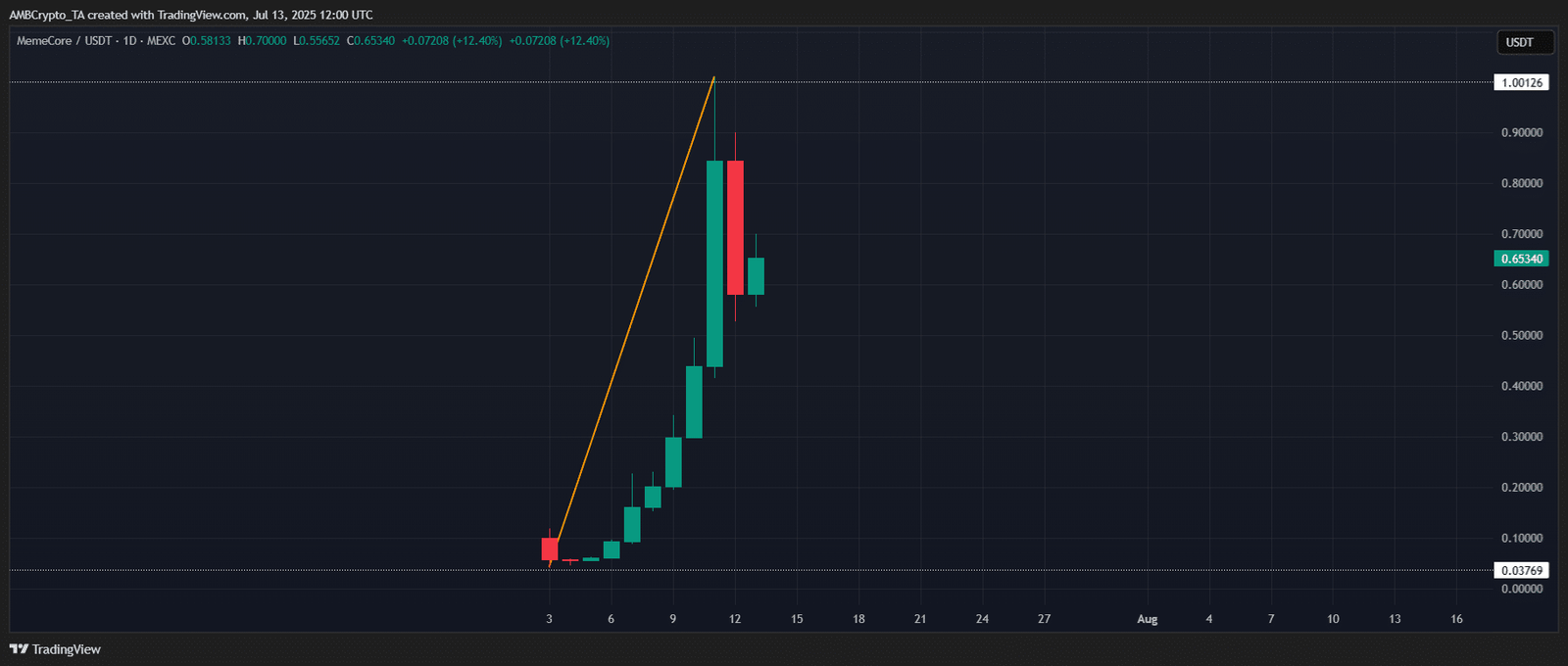

MemeCore [M] dominated this week’s top gainers with a staggering 830%+ surge from its $0.09 opening.

For context, MemeCore is the first Layer 1 blockchain built specifically for Meme 2.0 assets. Its goal is to redefine memecoins as more than speculative tokens.

The market seems to agree. M kicked off the week with a 71.59% daily pump, its biggest since launching on the 3rd of July.

And the momentum came right on cue. As BTC broke above $110k resistance, capital started rotating into meme plays. M followed through with four straight days of gains, adding another 215%+ to its rally.

That run peaked on the 11th of July, when M cracked the $1 mark. But the sharp pullback that followed, wiped out nearly 32% of its weekly gains.

According to AMBCrypto, it signals some clear risk-adjustment. The red candle was hard to miss.

An 11% intraday bounce has since helped M stabilize around $0.65, but with volume down 25%, momentum looks to be cooling off. Unless fresh bids step in, M could struggle to reclaim a new high in the near term.

Steller [XLM] — P2P blockchain posted a breakout rally

Stellar [XLM] wrapped up the week with a solid 80% gain, landing in the second spot among top gainers.

While the rally tracked with broader market flows, the reversal carried extra weight for XLM, which had spent most of Q2 printing lower lows and falling to as low as $0.20.

It opened the week with a modest 0.81% dip at the $0.25 resistance. But quickly flipped with a 4.45% move the next day.

That kickstarted five straight green candles, pushing price back to the $0.45 zone, levels last seen in late January.

This marks XLM’s strongest rebound since the early Q1 rally, likely bringing a wave of sidelined or underwater holders back into profit or breakeven.

RSI is deep in overbought territory, while MACD still points bullish. Continuation depends on macro risk sentiment, but if momentum holds, a breakout above $0.50 is definitely on the table.

Mog Coin [MOG] — Memecoin soared to a six-month high

Mog Coin [MOG] closed the week with a strong 78% rally, making it the third-best performer.

The broader memecoin sector was up 22%, pushing total market cap above $60+ billion. However, MOG clearly stood out.

It started the week with a 4.05% dip at $0.0000010, but that quickly flipped, likely due to a short squeeze, leading to a 10.10% bounce the next day.

From there, MOG ran for five straight sessions, tagging a six-month high at $0.0000017. A 50% drop in volume suggests a short-term cooldown may be underway.

But if the market stays risk-on, we could see more capital rotate into high-beta plays like MOG. In that case, a push toward the $0.0000020 resistance is definitely in play.

Other notable winners

Outside the majors, altcoin rockets stole the spotlight this week.

Manyu [MANYU] led the charge with a stunning 543% surge, followed by Kori [KORI], which jumped 326%, and Hyperlane [HYPER], rallying 318% to round out the leaderboard.

Weekly losers

Jito [JTO] — Solana’s liquidity protocol posted a lower low

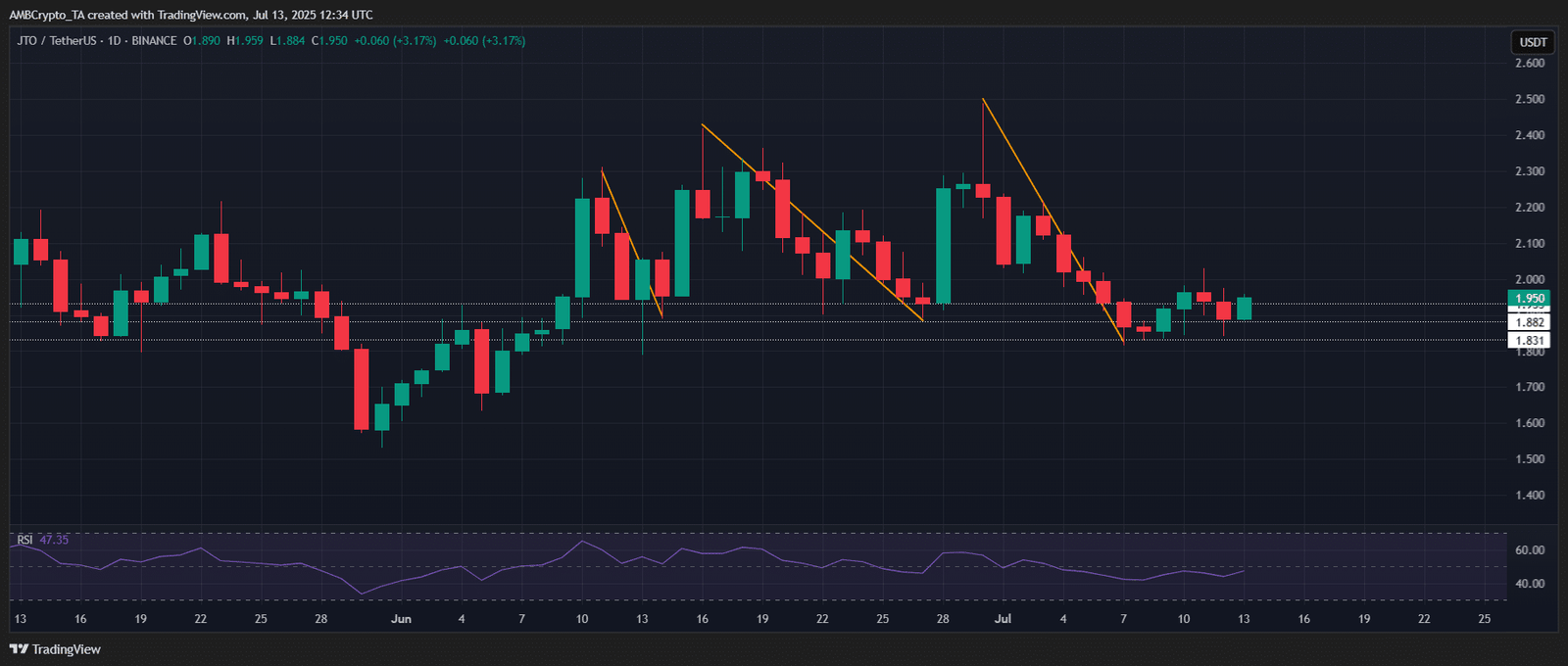

Jito [JTO] ended the week down around 3% from its $1.90 open, making it the only clear weekly loser among the top 100.

But despite the red close, this week might’ve marked a key turning point.

JTO spent the past few days consolidating between $1.70 and $1.95. It is a tight range that stands in contrast to its late Q2 downtrend, where it printed three straight weekly lower lows and confirmed a bearish structure.

This consolidation looks different. More controlled and less “hype-driven” than previous cycles. It could be the first real sign of accumulation.

If bulls can hold this range and flip $2.00, that would shift momentum and open up a path toward the $2.50 resistance.

In that case, JTO could be setting up for a cleaner Q3 reversal with strong upside potential.

Tokenize Xchange [TKX] — The trading platform token fell to a five-year low

Tokenize Xchange [TKX] topped the losers this week, dropping to a five-year low of $1, the lowest wick since its listing day.

The slide followed TKX’s late-May breakdown, where it lost the key $25 support. Bearish pressure has been relentless.

But there’s a glimmer of life. With RSI sitting deep in oversold territory, TKX posted a strong rebound late in the week, jumping 6.49% intraday to trade around $11.71 at press time.

It was also the asset’s longest green candle in over a month, suggesting buyers are stepping in around extreme undervaluation. If this bounce holds, a recovery could be in play.

Still, reclaiming the $20+ level won’t be easy. Bulls will need multiple attempts to flip long-term sentiment.

Maple Finance [SYRUP] — The DeFi platform extended it bearish Q3 trend

Maple Finance [SYRUP] came in third among weekly losers, extending its downtrend after peaking near $0.63 in late June.

Despite a brief late-week rebound attempt last week, the bulls couldn’t keep the momentum alive.

SYRUP kicked off this week with a sharp 7.59% drop, breaking below the $0.58 support zone. The price has since consolidated around $0.50, but so far, there’s not enough strength behind the bounce.

Unless this range starts showing real accumulation, the odds of a breakout remain slim.

Other notable losers

In the broader market, downside volatility hit hard.

SpaceN [SN] led the losers with a 47% drop, followed by Seraph [SERAPH], down 40%, and Bananas for Scale [BANANAS31], which slipped 39% as momentum sharply cooled.

Conclusion

Crypto was wild this week. Big gains, sharp drops, and nonstop swings kept traders on edge. As always, do your own research, stay alert, and trade wisely!