Key Takeaways

Curve Dao rallied 15.5% to hit a 2-month high before slightly retracing to $0.79. CRV’s scarcity soared to a new time high, with the stock-to-flow ratio hitting 71.68.

Curve Dao [CRV] rallied 15.5% to hit a 2-month high of $0.80 before slightly retracing to $0.79 at press time. On the daily charts, the altcoin’s momentum shifted after coiling within a long-term compression wedge.

As a result, its market cap spiked 14% to $1.08 billion, while trading volume surged 43% to $454 million. The volume rising alongside market cap reflected growing on chain activity and massive capital flow.

But what’s driving this price upswing?

Buyers make a strong comeback

After sitting on the sidelines, buyers returned to the market with strength, prompting the altcoin to recorded two consecutive days of a negative netflow.

According to CoinGlass, Curve DAO’s Exchange Netflow dropped significantly, hitting a 3-week low of -$2.67 million.

A similar pattern was observed on the 15th of July, with Netflow dropping to -$2.29 million, a clear sign of aggressive accumulation.

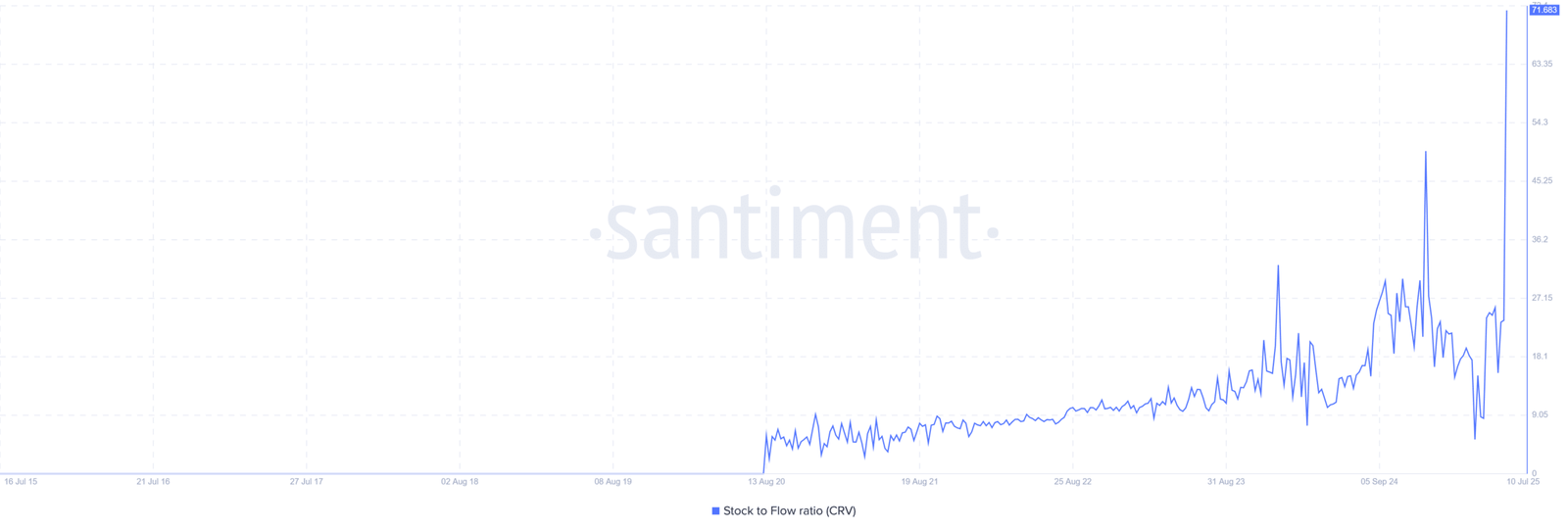

As a result of this aggressive buying, CRV’s scarcity soared to an all-time high of 71.68 according to Santiment data. When scarcity surges, it suggests that there are fewer tokens available for immediate selling.

Historically, such market behavior has preceded higher prices as upward pressure on prices mounted amid low selling activity.

Futures are eyeing more gains

Amidst a strong price upswing, buyers rushed into the market to strategically position themselves, awaiting the next move.

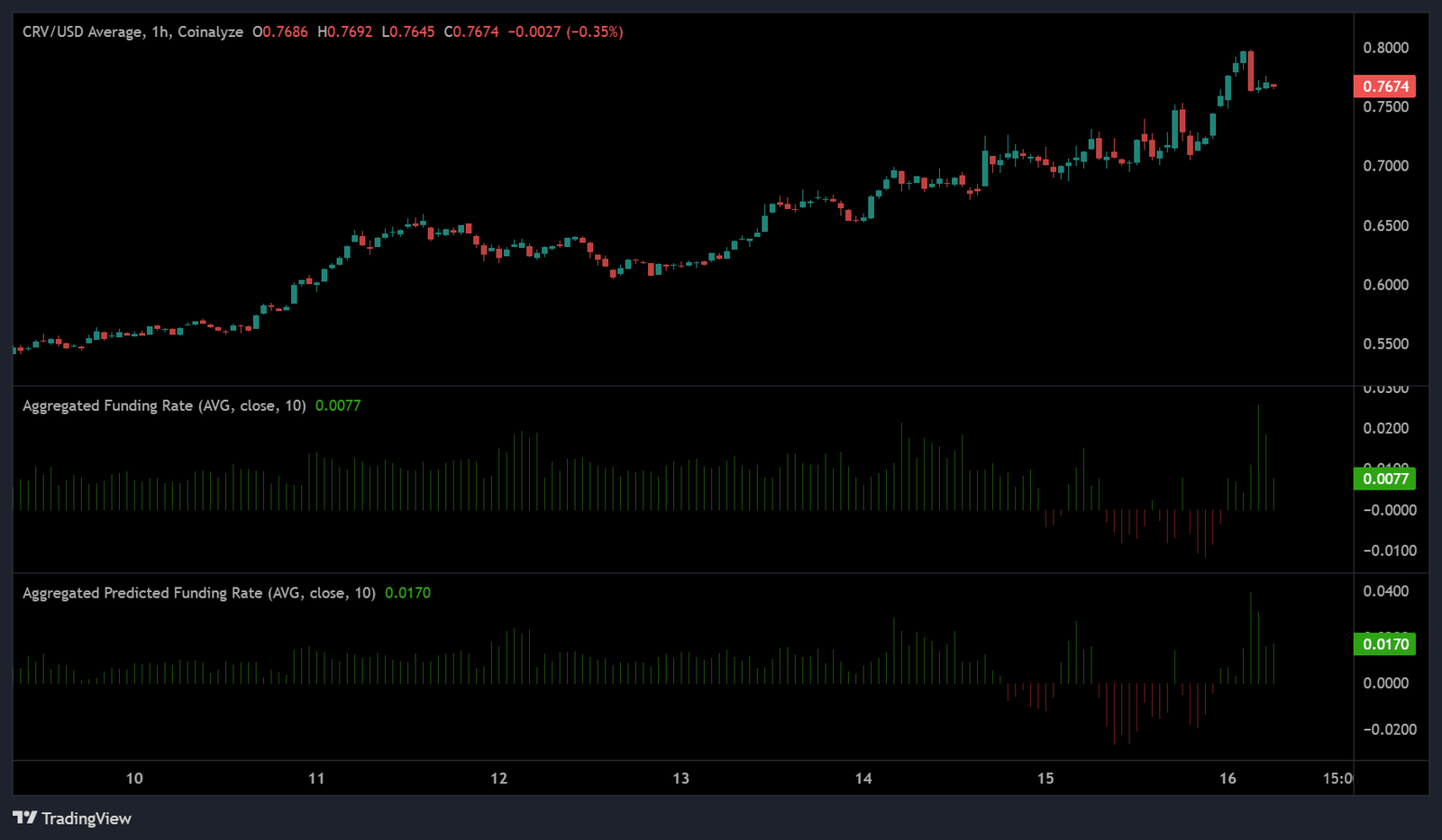

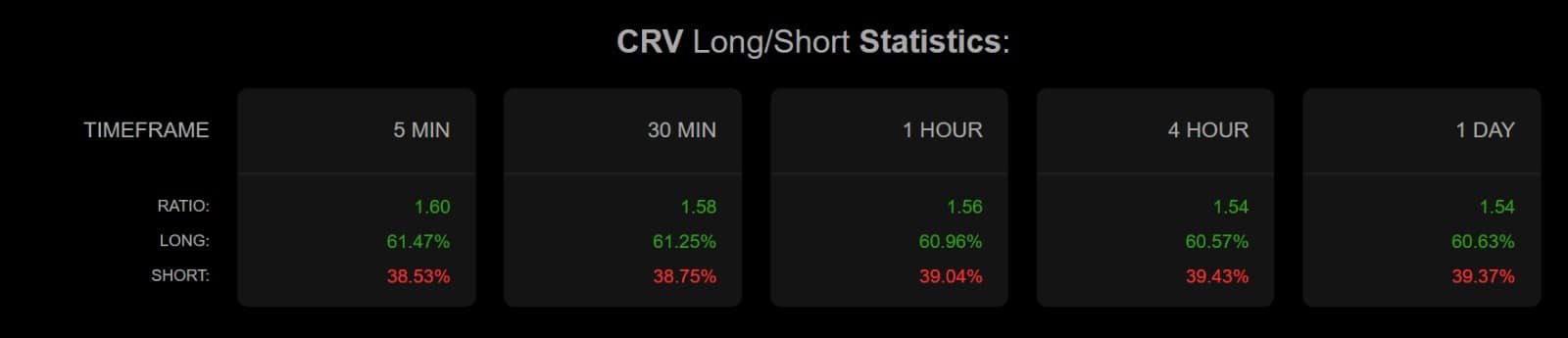

According to Coinalyze, Curve DAO’s Funding Rate turned positive again on the 16th of July. As of this writing, Funding Rate was o.0077 while Predicted Funding Rate was 0.01,7 reflecting strong demand for long positions.

As a result, Long Short Ratio surged to 1.56 with Longs accounting for 60%, while shorts made up 39.37%. A high demand for long positions often implies that investors are aggressively betting on rising prices.

Can CRV hold these gains to target $0.86?

According to AMBCrypto’s analysis, Curve DAO surged as buyers flowed into the market to chase the rally.

As a result, the altcoin’s Relative Strength Index (RSI) soared to 76, touching overbought territory. Likewise, +DI of DMI hiked to 40.5, reflecting strong upward momentum and its continuation potential.

When these momentum indicators are set, they suggest that markets are bullish and the trend is likely to continue.

That said, if buyers continue at the current speed, Curve DAO could make more gains. The final supply level remains $0.86 as it aligns with multi-month resistance.

However, CRV must record a daily close above 0.77 after the flip; anything below would invalidate this uptrend and retrace to $0.70.