Key Takeaways

Dogecoin defends $0.19 support amid growing bullish bets, but rising long liquidations signal fragility. A breakdown could unwind leveraged optimism and delay a move toward $0.25.

Dogecoin [DOGE] surged earlier in July and reclaimed the $0.19 support level, sparking optimism of a possible run toward $0.25.

The upward momentum formed on rising volume and bullish market participation, signaling strong intent from buyers.

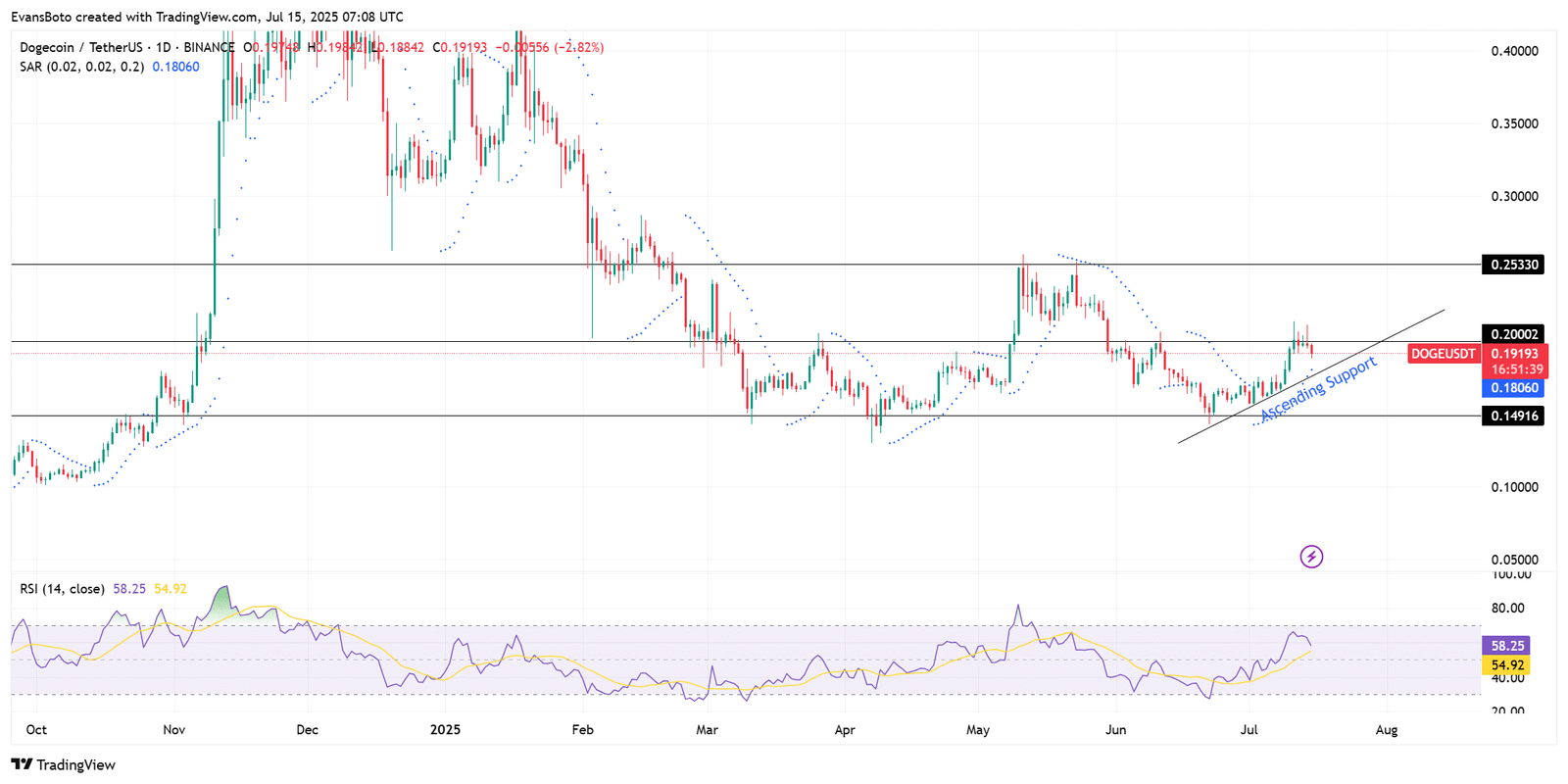

Trading at $0.1916 after a 7.85% daily drop at press time, DOGE remained above the ascending support line. This structure continued to hold despite the pullback, making the $0.19 zone critical.

A sustained close below this area could trigger further selling, while another bounce could revalidate the bullish setup and bring $0.25 back into focus.

Source: X/Ali

The bullish case for DOGE

Speculative appetite around DOGE has spiked.

Options volume was up 1546% and Open Interest surged 229%, hitting $2.2 million. These increases typically point to traders bracing for volatility — and likely upside.

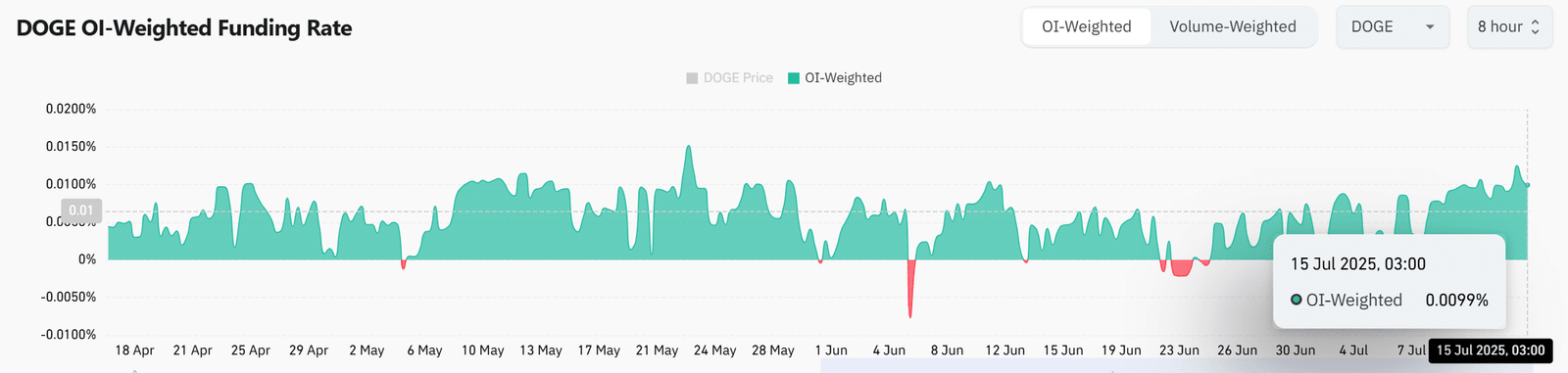

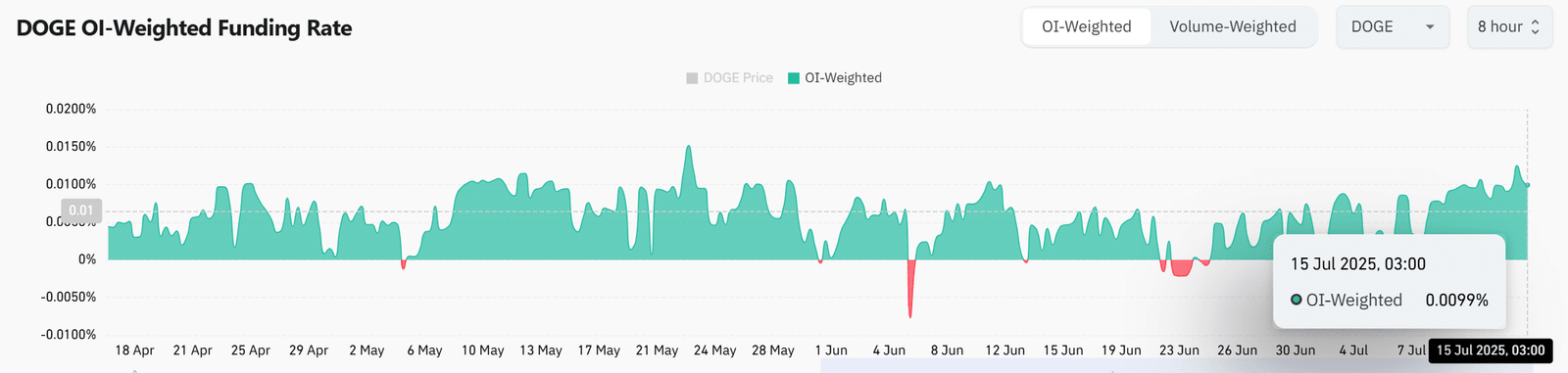

Funding Rates back this up.

As of the 15th of July, the OI-Weighted Funding Rate stood at +0.00999%, confirming longs are still paying to hold positions.

The derivatives market remains tilted bullish, but this conviction may weaken fast if DOGE slips under $0.19.

Source: CoinGlass

Ascending support and RSI strength

DOGE continues to respect the ascending support trendline formed since mid-June.

Price action bounced cleanly off this structure multiple times, suggesting it is being closely monitored by traders.

Meanwhile, the RSI stood at 58, just below the overbought threshold, indicating bullish momentum is building without signaling exhaustion.

If this trendline holds and RSI continues rising, bulls may push toward the $0.25 resistance. However, any bearish divergence or break below the trendline could invalidate the short-term bullish thesis.

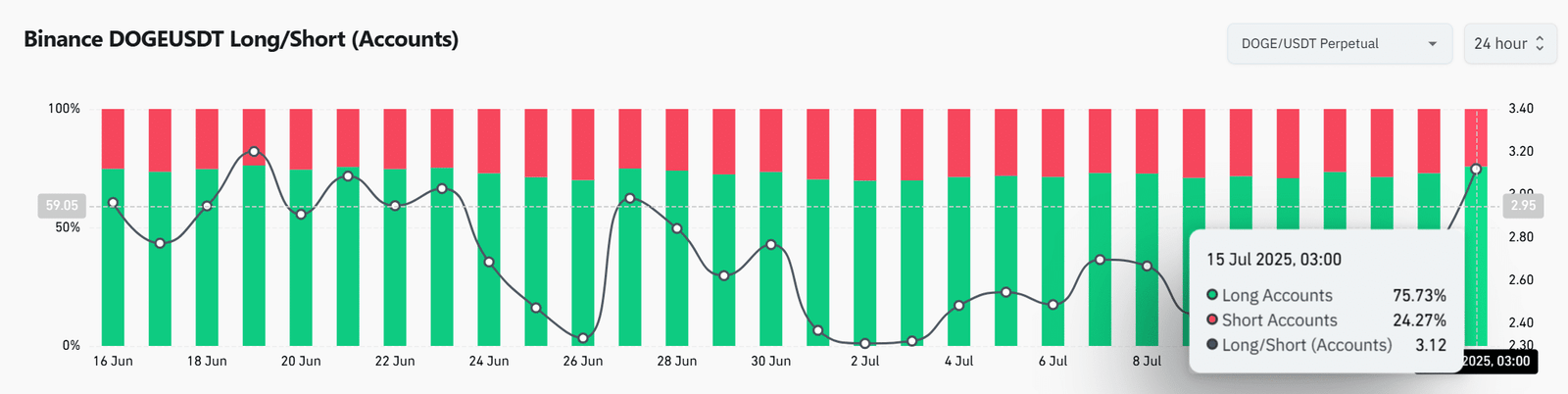

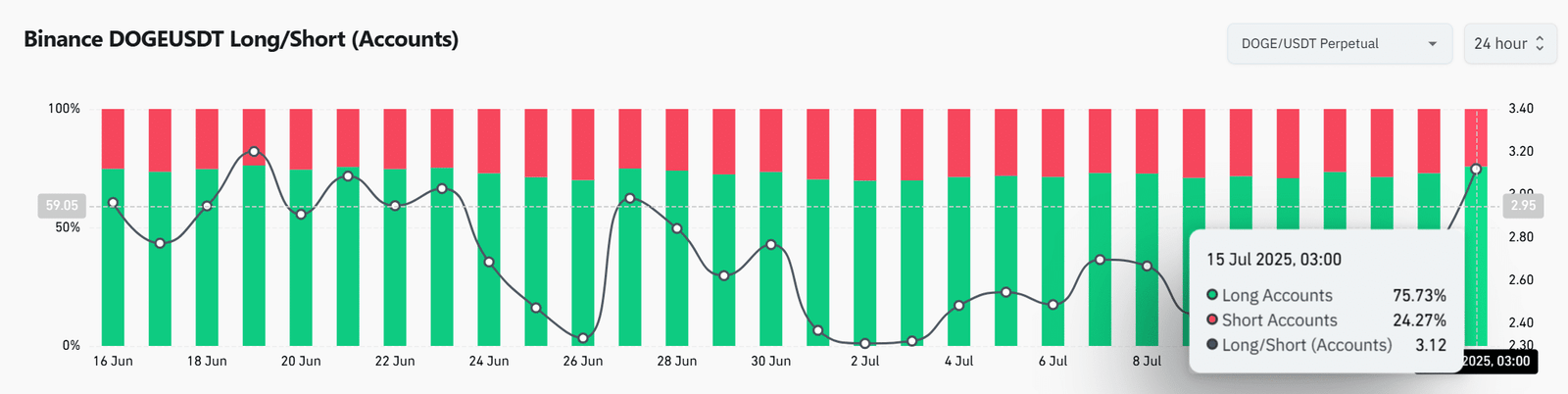

Are too many longs on Binance a sign of confidence or risk?

On Binance, long accounts accounted for 75.73% of all DOGE positions. The Long/Short Ratio was 3.12 at the time of writing, showing extreme bias toward upside.

This can be a double-edged sword. While it shows strong confidence, an overcrowded long trade often increases the risk of liquidation cascades if the price dips.

Traders chasing the trend late may face a harsh reset if $0.19 gives out.

Source: CoinGlass

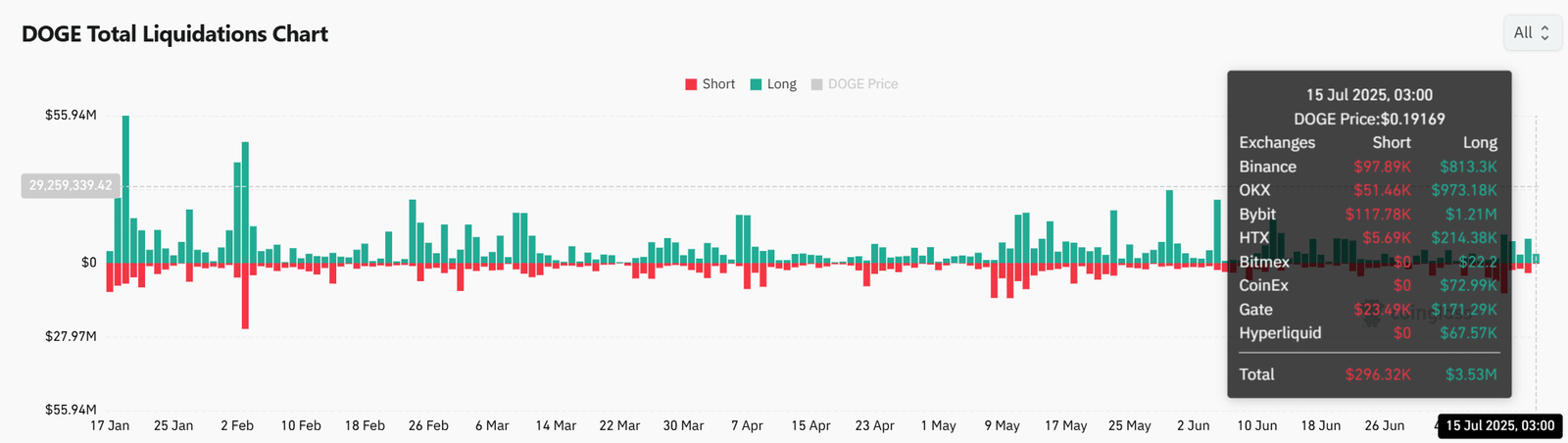

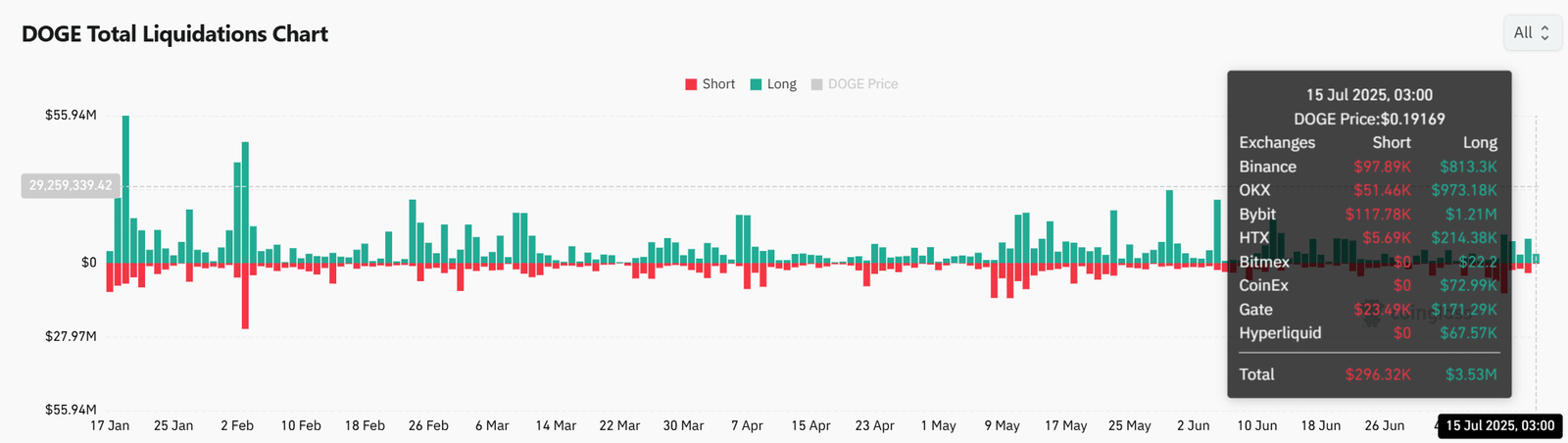

Have bulls become too aggressive?

Despite bullish sentiment, long traders are taking heavier losses. On the 15th of July, total long liquidations surged to $3.53 million, while shorts lost only $296K.

This imbalance suggests that leveraged long positions are being flushed out as DOGE struggles to gain ground above $0.20.

This pattern reflects a growing vulnerability in the market, as traders enter with high leverage but fail to sustain upward momentum.

If the $0.19 support gives way, more liquidations could follow and intensify selling pressure.

Source: CoinGlass

Conclusively, DOGE remains at a critical juncture.

While derivatives activity and ascending technical structure still favor bulls, the surge in long liquidations highlights market fragility. Holding $0.19 could reignite momentum toward $0.25.

However, a breakdown below this level would likely trigger more pain for overexposed longs and delay the breakout.