Key Takeaways

ENA pumped 27% following the Anchorage Ethena partnership and a bullish rating by analysts. Will buybacks and corporate treasury drive it higher?

Ethena [ENA] rallied 27% during the intra-day trading session on the 25th July as analysts turned bullish on its renewed growth catalysts.

In particular, the project could benefit from the stablecoin narrative and rising corporate treasury interest that will reduce VC supply overhang, noted Ryan Watkins, co-founder of Syncracy Capital.

“$ENA offers one of the only pure-play exposures to stablecoins and tokenisation… Bonus is VC supply overhang now practically neutralized.”

Can ENA add an extra 38% gain?

Ethena is behind the popular USDe stablecoin that’s collateralized by crypto, and another USDtb backed by short-term U.S treasury bills via BlackRock’s BUIDL.

Crypto influencer Ansem also echoed a similar bullish outlook, citing the token’s breakout from its multi-month price range and aggressive buyback program.

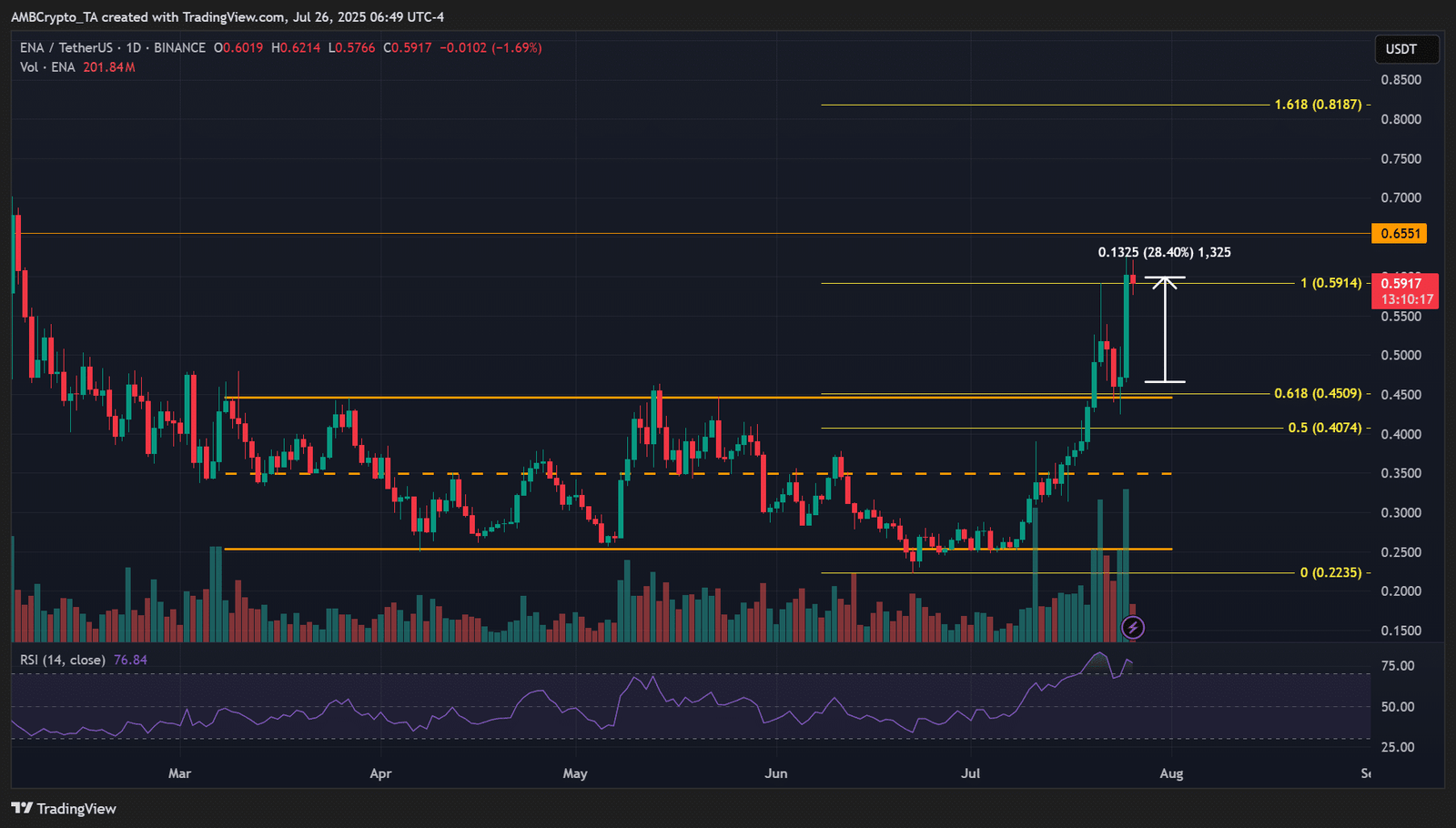

Per the daily chart, the breakout was defended at $0.45 as support and triggering a 27% rally to $0.60. Assuming the analysts’ catalysts hold, the next upside target would be $0.81, a 38% potential gain if hit.

But Messari analyst Sam noted that the extra rally will only be possible if TradFi bids for the token.

As of press time, only StablecoinX had shown interest in ENA as its corporate treasury. It remains to be seen whether others will follow suit.

The recent bullish drive was also induced by Anchorage Digital’s support for Ethena’s USDtb.

The team billed it as the ‘first GENIUS-compliant’ stablecoin, underscoring a vote of confidence in the project.

ENA’s valuation

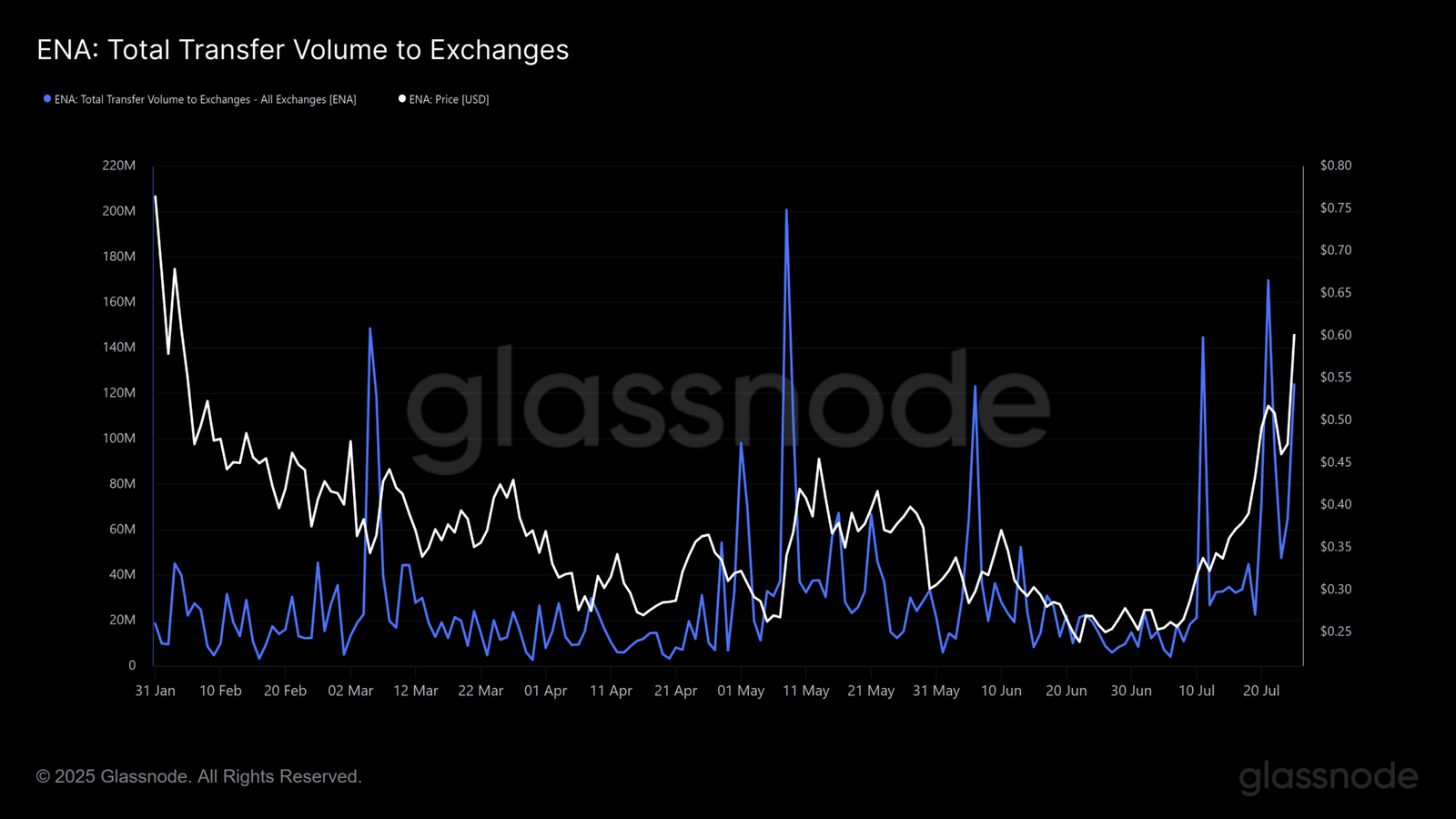

Meanwhile, the recent rally triggered sellers to lock in profit. At press time, about 124 million ENA tokens were sent to exchanges to be sold, a move that could cap the rally or trigger a cool-off.

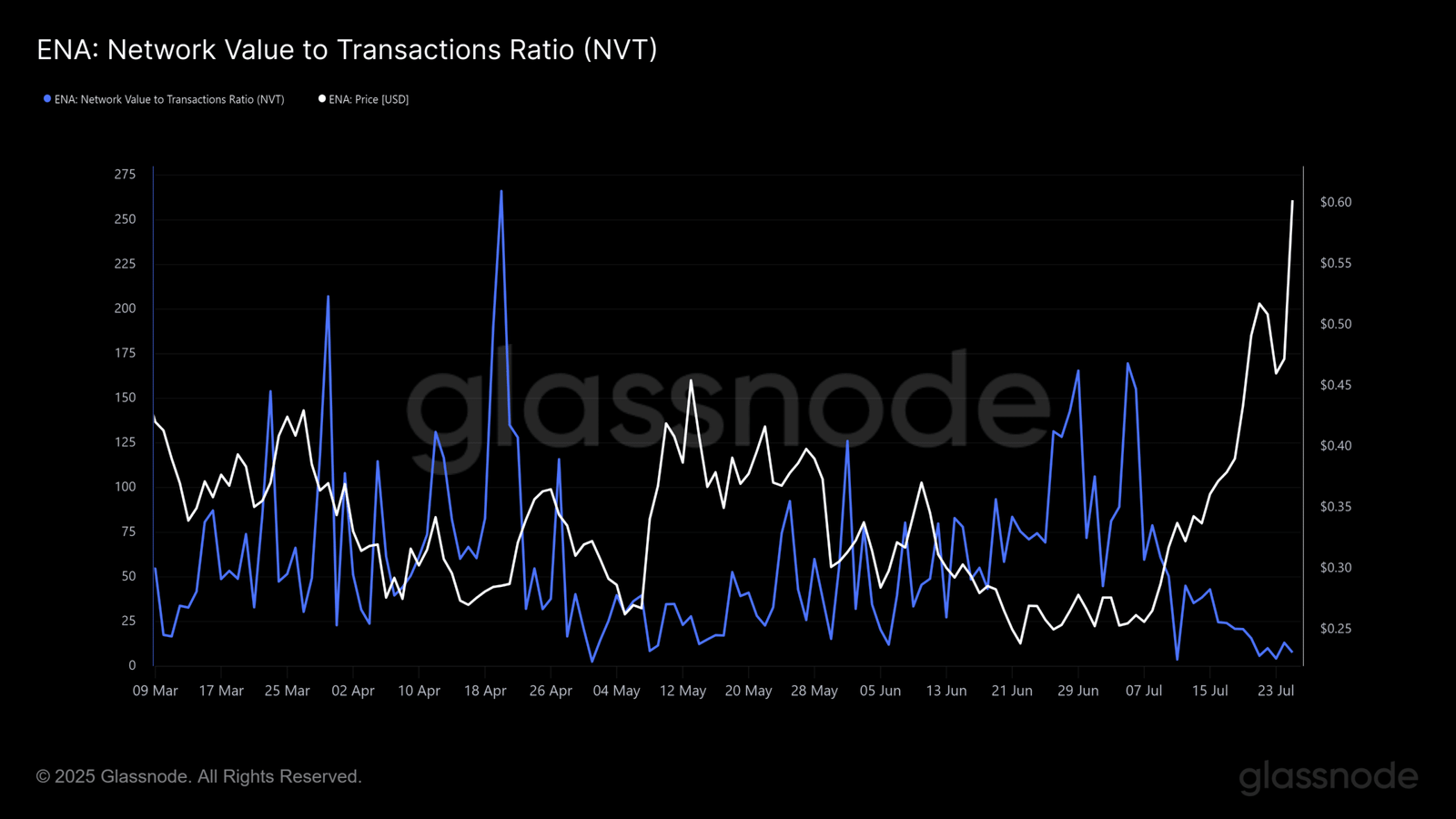

At the same time, the Network Value to Transactions Ratio (NVT) showed that ENA was undervalued relative to price, meaning there was network usage compared to the current price.

A higher NVT value would suggest overvaluation, but that was yet to be the case as of press time.

Overall, ENA’s breakout and underlying bullish catalysts like buybacks and treasury bids could fuel the next leg of the rally.

But broader market sentiment and demand from crypto treasuries could be crucial for its expected uptrend.