Grove, an institutional-grade credit protocol backed by Steakhouse Financial, is targeting $250 million in real-world assets (RWAs) on the Avalanche blockchain — a move that will significantly expand the network’s tokenization footprint.

As part of this effort, Grove is partnering with Janus Henderson Anemoy — a $373 billion asset manager known for its mutual funds, exchange-traded funds (ETFs) and alternative investments — to launch two products on Avalanche.

Initially, Grove will deploy the Janus Henderson Anemoy AAA CLO Fund (JAAA) and the Janus Henderson Anemoy Treasury Fund (JTRSY) on Avalanche.

JAAA offers exposure to the collateralized loan obligation (CLO) market, a key segment of the broader credit and fixed-income landscape. The fund was issued onchain through Centrifuge, a tokenization platform behind the tokenized S&P 500 Index fund and others.

JTRSY is an actively managed onchain fund providing access to short-term US Treasury bills, also issued through Centrifuge. It holds over $408 million in assets, largely on Ethereum.

Grove was developed by Grove Labs and incubated under Sky, formerly known as MakerDAO. Grove Labs is a subsidiary of Steakhouse Financial, a digital asset advisory company specializing in DeFi and stablecoins, with a strong presence in the Morpho ecosystem.

Related: Goldman Sachs, BNY to offer tokenized money market funds for clients

Tokenized RWAs expand beyond Ethereum

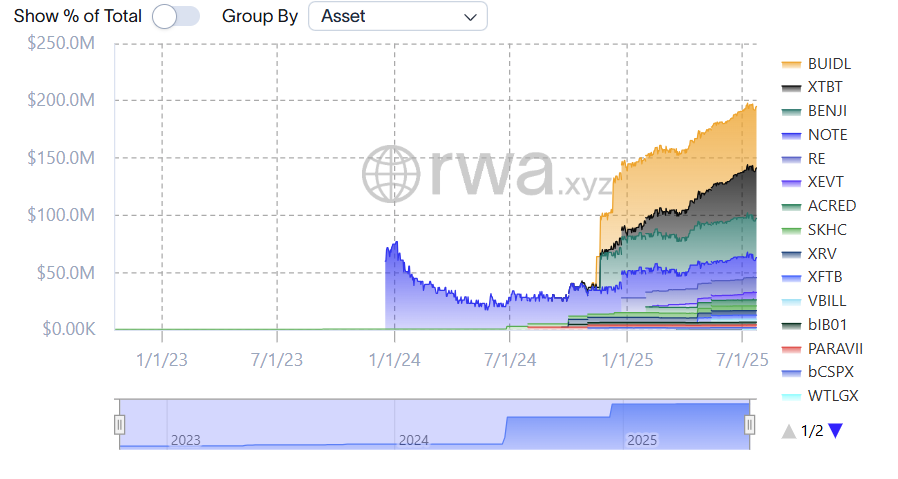

The Grove deployments will more than double Avalanche’s RWA footprint in total onchain value. According to industry data, Avalanche currently hosts 29 RWAs with a combined value of $195 million.

While Ethereum remains the dominant network for RWAs, capturing roughly 59% of the market, other platforms like Aptos are quickly gaining traction.

As Cointelegraph reported, Aptos has experienced a surge in tokenization, driven by issuers such as BlackRock, Franklin Templeton and Berkeley Square. Solana, Stellar and Algorand have also seen growing adoption in the RWA space.

Aptos’ chief business officer, Solomon Tesfaye, recently told Cointelegraph that the passage of the US GENIUS Act will accelerate RWA adoption, as stablecoins are increasingly viewed as reliable on-ramps to tokenized assets.

To date, the RWA market has been dominated by private credit and US Treasury bonds, with tokenization technology offering capabilities that private credit markets have historically lacked, according to a recent report by RedStone.

However, RedStone pointed to other emerging tokenization growth areas, including equities and commodities.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story