The approval of spot Bitcoin ETFs in January 2024 paved the way for wider institutional access to cryptocurrency. Shortly after, attention turned to Ethereum. As the second-largest crypto asset by market capitalization, Ethereum’s eventual ETF approval was inevitable — and it came in May 2024, when the U.S. Securities and Exchange Commission (SEC) approved multiple spot Ethereum ETF applications. As of July 2025, nine spot ETH ETFs are trading on U.S. exchanges.

A Major Milestone of Ethereum ETF Approval

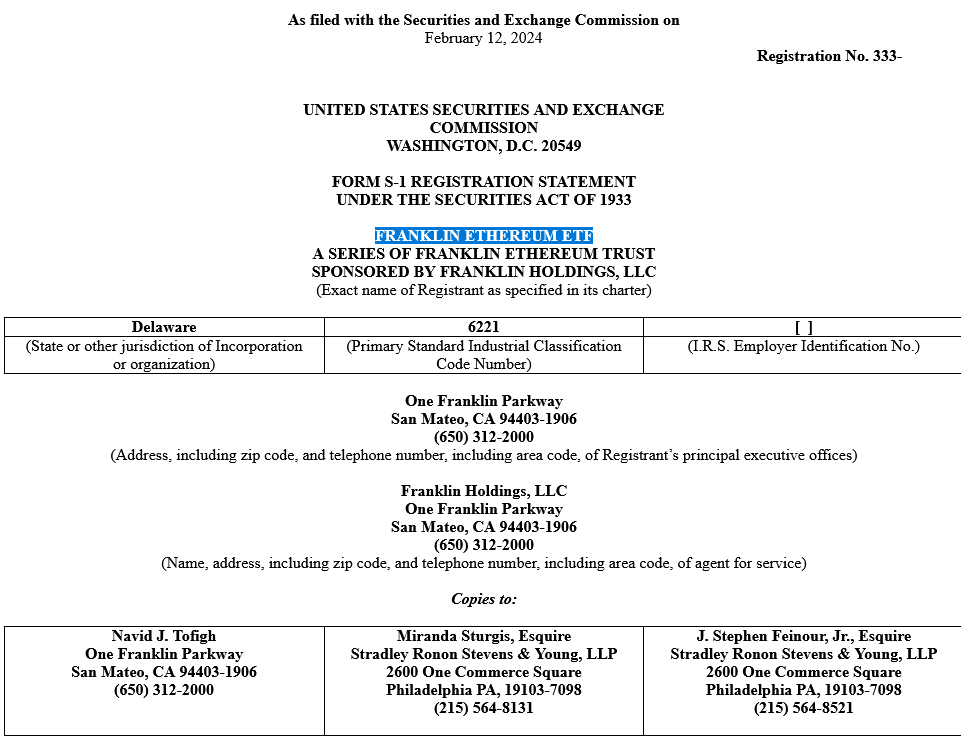

In May 2024, the SEC approved spot Ethereum ETFs from several major asset managers, including BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark Invest, Franklin Templeton, and Invesco Galaxy. The ETFs officially launched in early July 2024, marking a watershed moment in Ethereum’s institutional adoption. While these ETFs do not currently support staking—a core component of Ethereum’s design—their mere ability to gain exposure to spot ETH in regulated markets significantly reduces barriers for institutional and retail capital alike.

Staking is not “done”. There are plenty of ETH staking ETF filings already on the books. Final deadline for earlier filings is in late October. The Blackrock filing today won’t have a final deadline until ~April 2026 (but we think staking will likely be approved by at least 4Q25) https://t.co/QWn9L2DVPA

— James Seyffart (@JSeyff) July 17, 2025

The lack of staking was initially considered a limitation since Ethereum’s proof-of-stake mechanism yields an average of 3–4% annually. However, analysts anticipate the SEC could allow staking within ETFs by late 2025, which could make these products even more attractive.

For more: Tokenized Stocks vs ETFs: Which One Wins in the Long Run?

A Strong ETH ETF Launch Day Performance

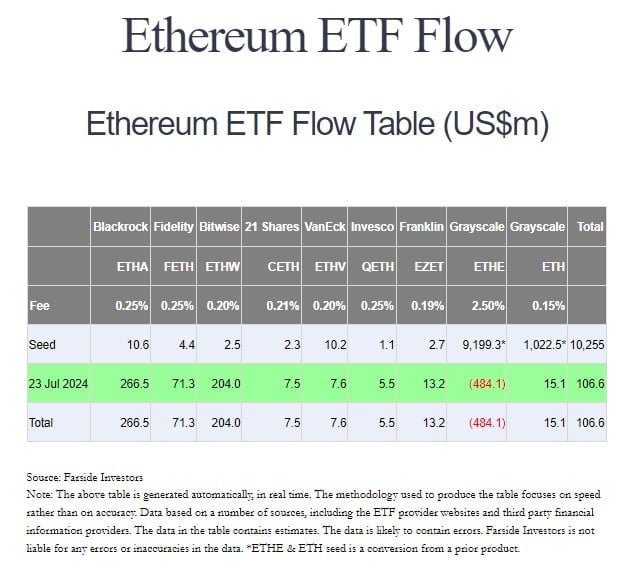

When trading began on July 8, 2024, the Ethereum ETFs drew $106.8 million in cumulative inflows on day one, with over $1.12 billion in volume across the group, according to CoinShares. For comparison, Bitcoin ETFs attracted $655 million in inflows on their launch day back in January.

Source: Farside Investors

BlackRock’s ETF — iShares Ethereum Trust (ticker: ETHA) — was the most successful, accumulating $266 million on its first day. Meanwhile, Grayscale’s conversion of its ETH trust into an ETF led to outflows, consistent with what was observed when the GBTC trust converted earlier in the year.

While these figures may seem modest compared to Bitcoin ETFs, they were nevertheless substantial. According to Coindesk, the ETH ETFs have outperformed expectations during volatile markets, attracting sticky capital despite short-term dips in ETH’s spot price.

For more: The Impact of Bitcoin ETFs on BTC Price – Real Data Analysis

Institutional Capital Floods Ethereum ETFs

Ethereum ETFs began gaining serious traction in Q3 2024 and have sustained momentum into 2025. As of July 2025, total assets under management across all spot ETH ETFs exceed $12.1 billion. BlackRock’s ETHA alone holds approximately $5.6 billion in AUM, making it the largest Ethereum ETF in the market.

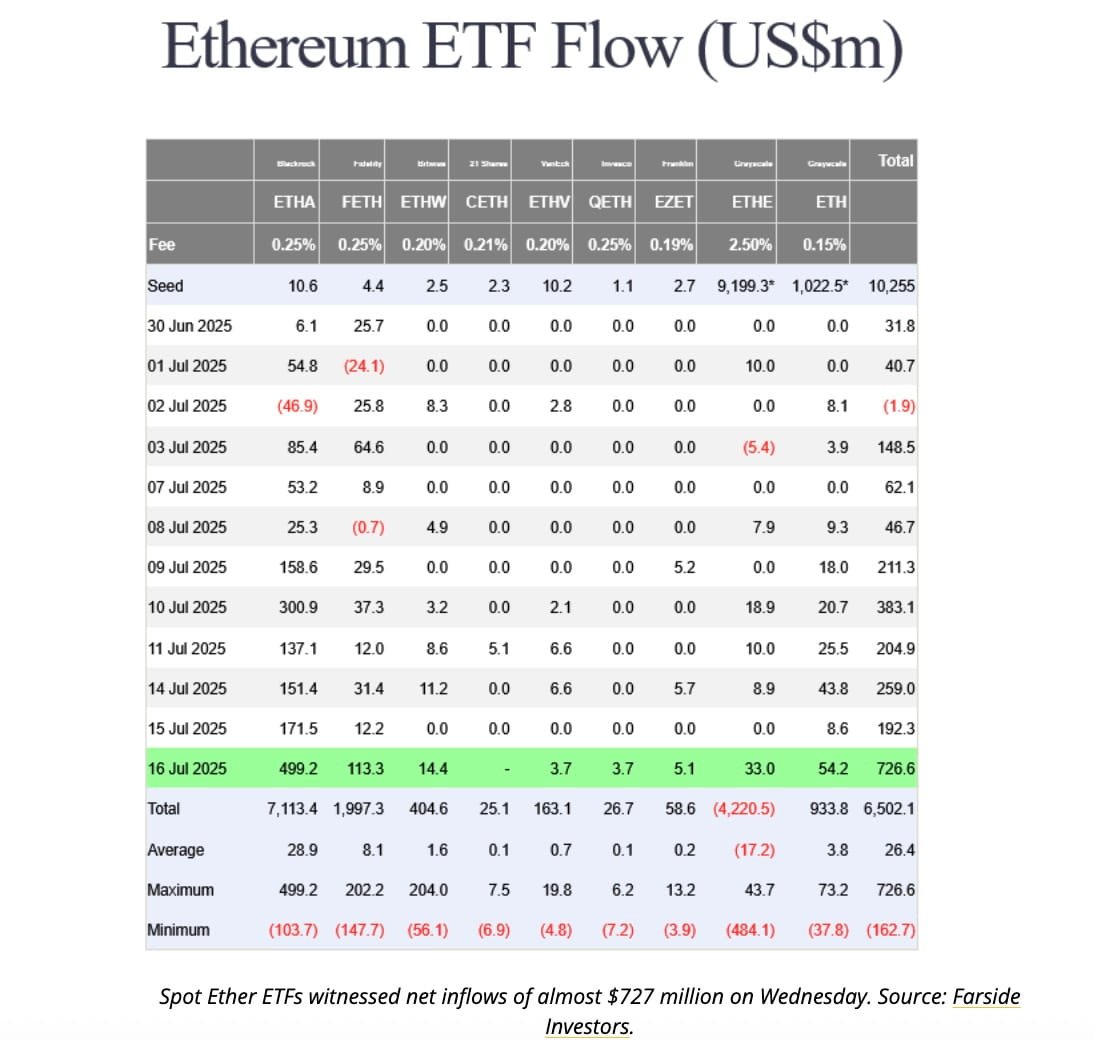

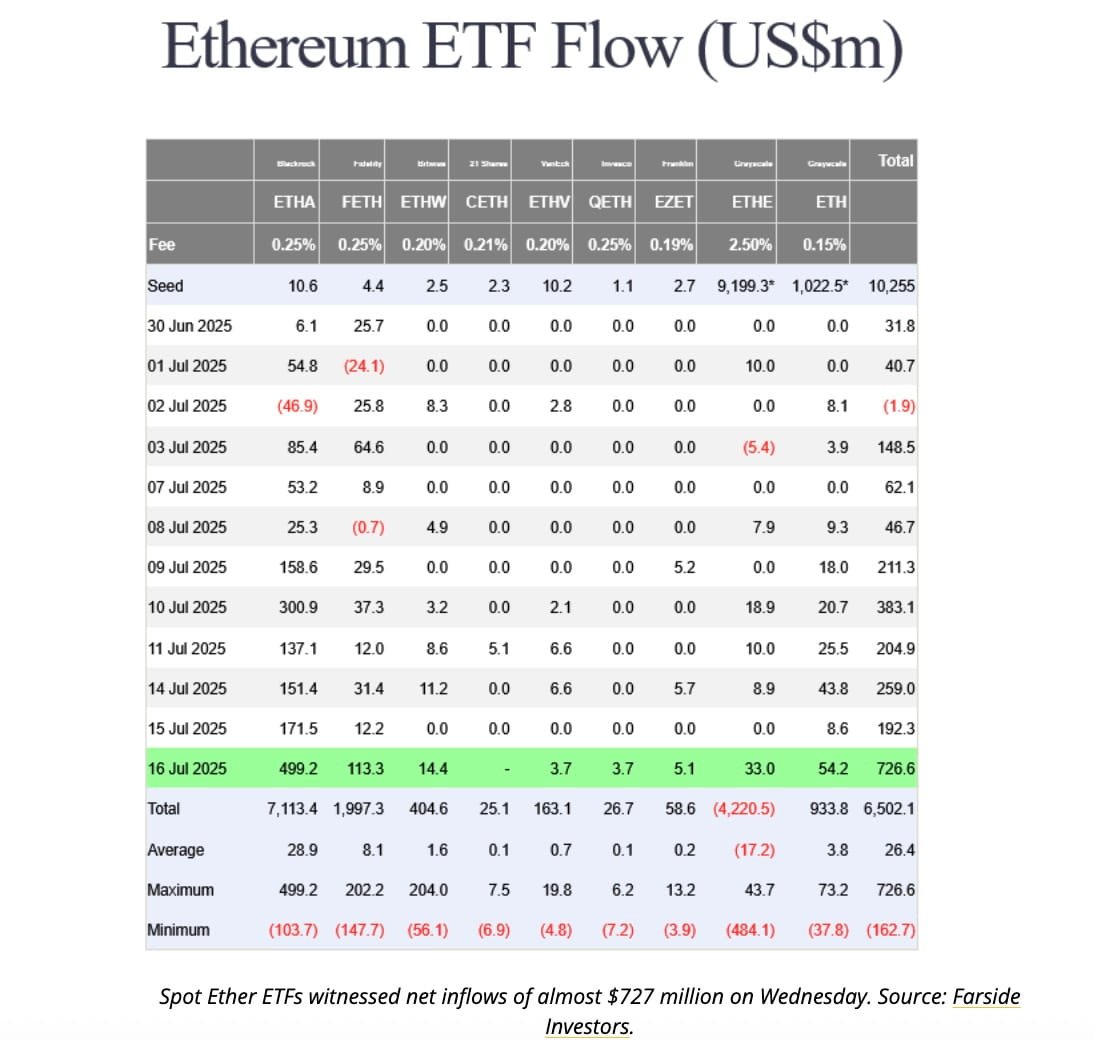

Source: Farside Investors

Net inflows into ETH ETFs surged dramatically in July 2025. According to The Block, ETH ETFs drew over $727 million in one day on July 18, the third-largest single-day inflow across all crypto ETFs. That week, total net flows reached $2 billion, showing how institutional sentiment toward Ethereum has pivoted decisively.

In July 2025, Ethereum ETFs experienced their strongest week of inflows since launch, with $703 million in net institutional additions, signaling renewed confidence in ETH’s long-term potential amid ETF-driven demand.

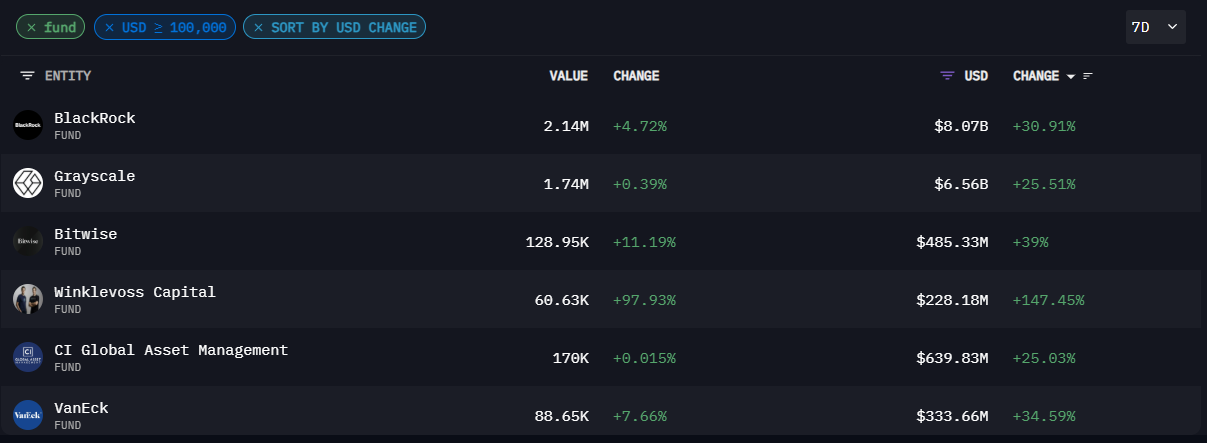

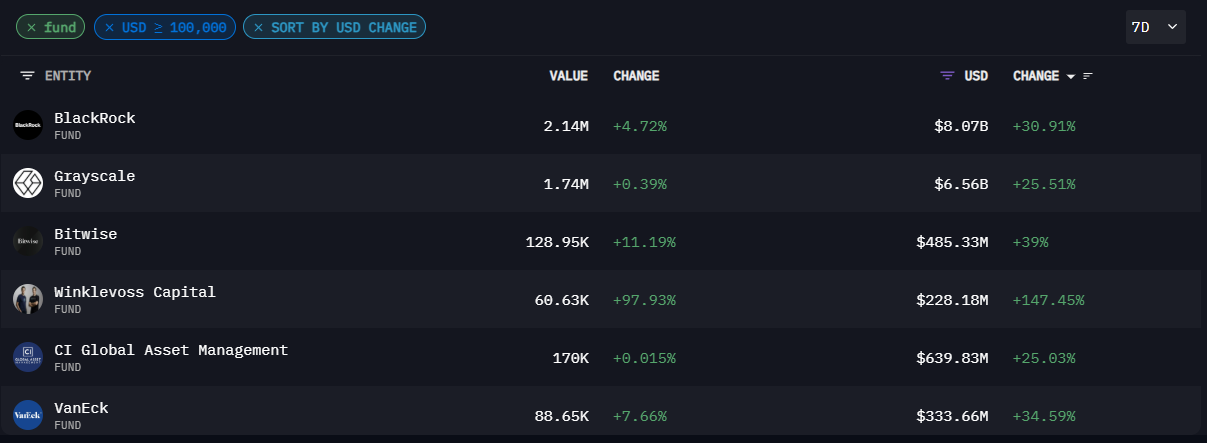

Data from leading fund tracking platforms shows that BlackRock leads the inflow race with $8.07 billion in assets under management (AUM), gaining +30.91% in just 7 days. The surge in AUM represents a 3x increase from just $6 billion in late June, reflecting rapid institutional onboarding. The price of ETH has risen in parallel, reinforcing the correlation between ETF inflows and upward market momentum.

Grayscale follows closely with $6.56 billion in AUM (+25.51%), while Bitwise maintains solid growth with $485.33 million (+39%). Notably, Winklevoss Capital saw an exceptional weekly surge of +147.45%, bringing its total holdings to $228.18 million. Meanwhile, CI Global Asset Management and VanEck recorded inflows of $639.83 million and $333.66 million, respectively, reflecting consistent institutional appetite.

These figures, based on a 7-day tracking window, underscore the market’s accelerating rotation into ETH-based financial products—likely catalyzed by expectations of Ethereum’s deflationary supply dynamics and the upcoming protocol upgrades.

For more: Altcoin ETFs After Solana – XRP, ADA, AVAX Next in Line

Correlation With ETH Price Movements

Ethereum’s price performance has closely mirrored ETF flow dynamics. From early April to July 2025, ETH rallied from $1,750 to over $3,400 — a near 95% increase. In July alone, ETH gained over 40%, outperforming Bitcoin and most Layer-1 assets.

Source: CryptoQuant

Data from Glassnode and CryptoQuant show that ETF-driven demand has reduced liquid ETH on exchanges. As of late July 2025, only 16.2% of Ethereum’s total supply — approximately 19.6 million ETH out of 120.71 million ETH — remains on centralized exchanges (CEXs). This is a significant decline from over 25% just 18 months ago. This data implies a severe reduction in immediate sell-side liquidity.

Meanwhile, the ETH/BTC ratio — a key indicator of relative strength — has shown that the price of Ethereum has climbed steadily since June, indicating a rising investor preference for Ethereum amid altcoin rotations.

According to Investopedia, roughly half the total ETF inflows (~$3.3 billion) occurred in the five weeks prior to July 21, highlighting a surge in confidence that ETH would continue to gain institutional favour.

| Date | Daily Inflow (USD) | Cumulative Inflow (USD) | Net AUM (USD) | ETH Price (approx) |

| July 22 | $533.87M | $8.32B | $19.85B | $3,670 |

| July 21 | $296.59M | $7.79B | $19.06B | $3,582 |

| July 18 | $402.50M | $7.49B | $18.36B | $3,467 |

| July 17 | $602.02M | $7.09B | $17.32B | $3,370 |

| July 16 | $726.74M | $6.49B | $16.27B | $3,210 |

Ethereum ETFs require spot ETH to back each share issued. Every new inflow necessitates the on-chain acquisition of ETH, thereby eliminating liquidity from exchanges and decreasing the circulating supply.

In July 2025, Ethereum recorded a burn of approximately 8,470 ETH, equivalent to ~$25 million at current market prices. A resurgence in NFT minting, DEX usage, and on-chain stablecoin transfers largely drive this activity. These use cases result in high gas consumption, which in turn burns ETH via the EIP-1559 mechanism.

The result? A supply-side squeeze in a deflationary environment, driven not by speculation but by regulated institutional demand. This structural buying power makes ETF inflows one of the most important price catalysts for Ethereum in 2025 and beyond.

Comparative Analysis: ETH ETFs vs. BTC ETFs

Bitcoin ETFs have led the crypto ETF space with over $70 billion in AUM by July 2025, but Ethereum ETFs have shown stronger relative performance during periods of volatility. For example, during a June 2025 correction in BTC, Ethereum ETFs experienced net inflows. This indicates a growing perception that ETH is viewed as a “tech growth” asset rather than merely as pure monetary collateral.

Ethereum’s exposure to DeFi, NFTs, Layer-2 scaling, and its environmental narrative (due to proof-of-stake) enhances its appeal to ESG-focused funds. Several advisors, including those from Galaxy Digital, estimate that ETH ETF inflows could reach $1–1.5 billion per month if market conditions remain favourable.

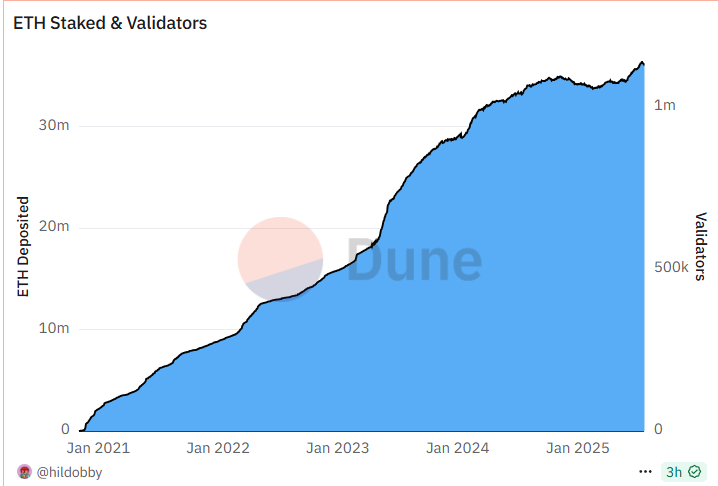

Although ETH ETFs currently lack staking functionality, their price responsiveness is greater than Bitcoin’s. Ethereum’s supply dynamics — including locked ETH in staking contracts (over 26% of supply, per BeaconScan) — reduce available float, amplifying the price impact of ETF-related buying.

Forward Drivers: Staking, Regulation, and Altcoin Expansion

Looking ahead, several factors could accelerate ETF-driven ETH demand.

First, a significant development on the horizon is the potential approval of staking mechanisms within Ethereum ETFs, which could materialize as early as Q4 2025. Several major asset managers — including BlackRock, Fidelity, Grayscale, Franklin Templeton, and 21Shares — have filed proposals with the U.S. Securities and Exchange Commission (SEC) to incorporate staking into their ETH ETF structures. This would mark a critical evolution in ETF functionality, allowing issuers to generate native on-chain yield by participating in Ethereum’s proof-of-stake consensus.

According to a report by Barron’s (July 2025), the SEC is actively engaged in internal discussions regarding the expansion of ETF capabilities to include staking, though no final decision has been disclosed. Staking within ETFs, if approved, could provide an additional layer of return beyond mere price appreciation, turning ETH ETFs into yield-bearing instruments. This would further differentiate Ethereum from Bitcoin in the ETF landscape and attract a broader class of yield-seeking institutional investors.

Second, pending legislation like the GENIUS Act and the Clarity for Digital Tokens Act is expected to provide clearer tax and custodial frameworks for crypto ETFs. This regulatory clarity could draw in pension funds and sovereign wealth funds, currently underweight in crypto due to compliance restrictions.

Finally, BlackRock has hinted at potential expansion into additional crypto ETFs, including Solana and Cardano products (FN London). If Ethereum ETFs continue a low upward trajectory, they may pave the way for a broader asset class reclassification.

Risks and Limitations

Despite their success, Ethereum ETFs carry specific risks. The lack of staking capabilities reduces yield-generating potential, resulting in opportunity costs of roughly 3–4% per annum. Additionally, Ethereum’s price remains volatile, and any regulatory crackdown or denial of staking could pressure ETF demand.

For instance, in February 2025, Ethereum ETFs experienced a mid-month sell‑off. On February 20 alone, they recorded $13.1 million in net outflows, reflecting broader macroeconomic uncertainty and geopolitical tensions. This correction underscores that even regulated crypto instruments remain sensitive to global risk environments.

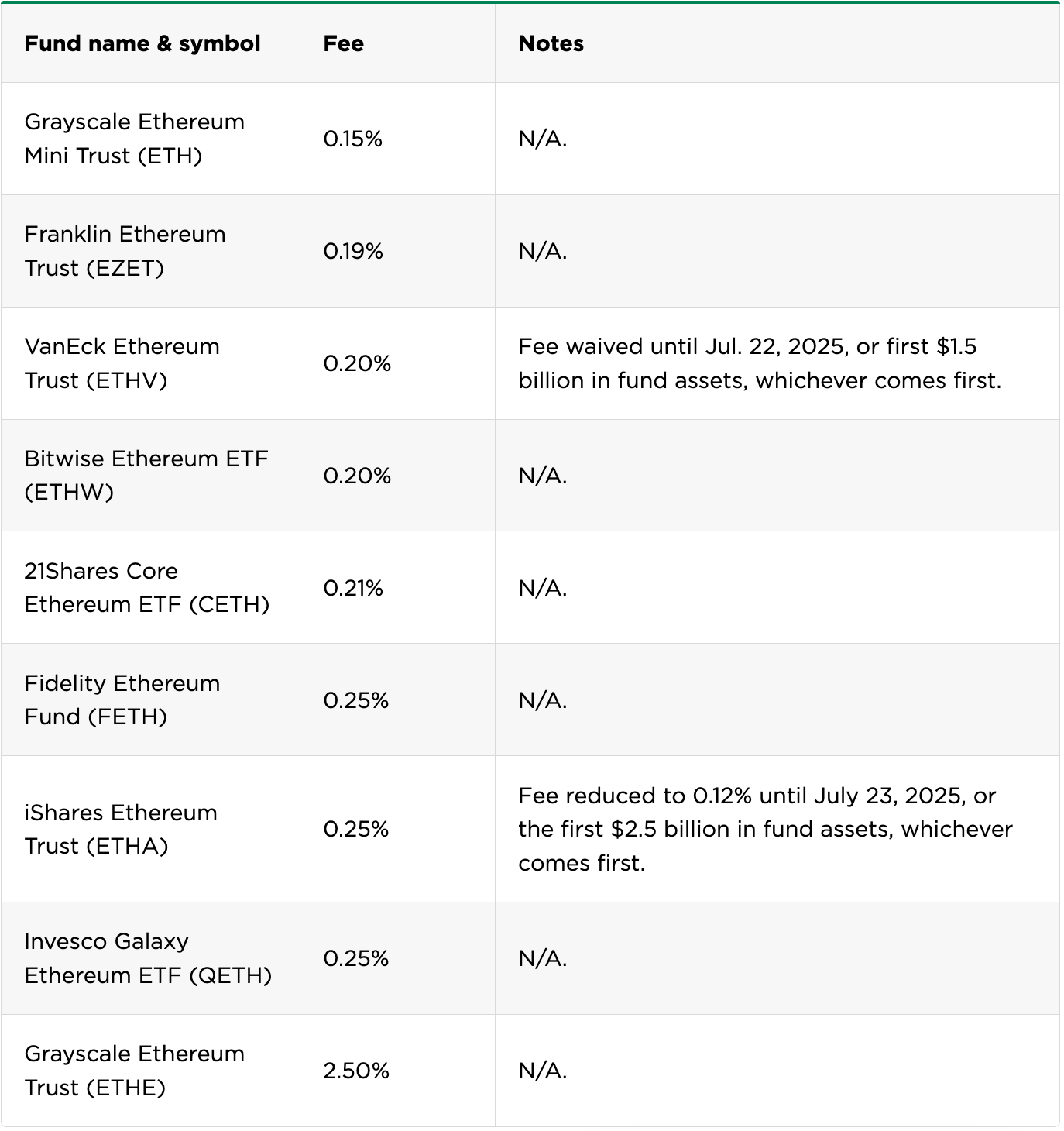

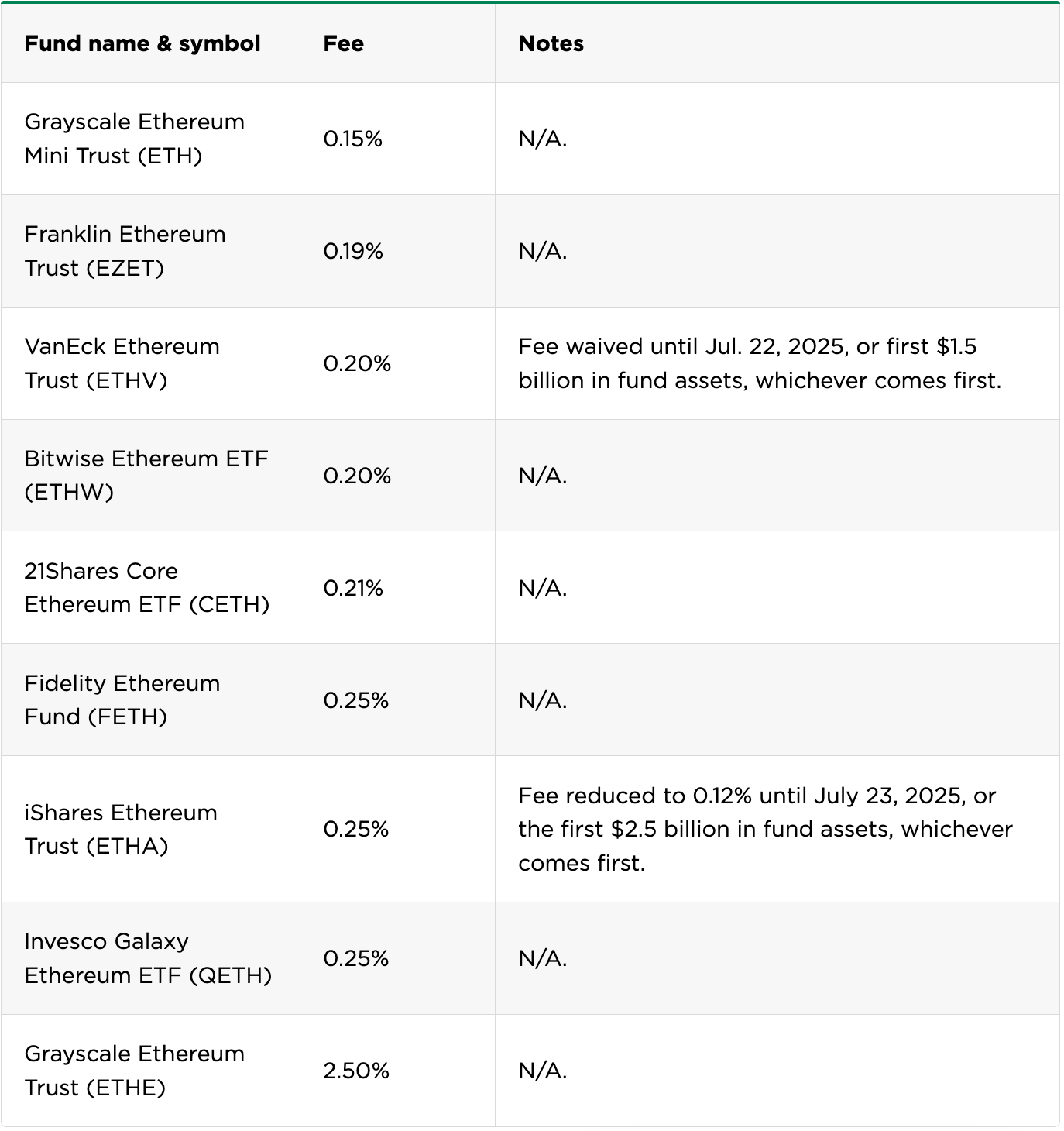

Moreover, expense ratios for ETH ETFs are currently higher than traditional equity ETFs, typically ranging from 0.25% to 0.95%. These figures could become a point of contention for fee-sensitive institutional allocators.

Conclusion

The launch of spot Ethereum ETFs has already demonstrated profound market impact, driving billions in inflows and propelling ETH’s price to new post-merge highs. While the ETFs are still evolving, and with staking and broader regulatory clarity on the horizon, they’ve undeniably legitimized Ethereum as an institutional-grade asset.

From Q3 2024 to mid-2025, Ethereum has transitioned from being a “tech token” to a fully investible financial product. If current trends continue — especially with potential ETF staking and further fund adoption — Ethereum could see its valuation and market share rise significantly.

Regulation, technological development, and macro conditions will shape the road ahead. However, it is undeniable that Ethereum ETFs have arrived and will remain in the market.