- Whale accumulation and short liquidations have driven HYPE’s price rebound amid market weakness.

- Development activity and heatmap clusters reinforce support as HYPE tests the $36 resistance range.

A newly created wallet has deposited $17.5 million USDC into Hyperliquid [HYPE] and acquired 517,602 HYPE tokens at an average price of $33.8, now valued at over $18.3 million.

This aggressive accumulation unfolded during a period of broad market weakness, where most altcoins suffered heavy losses and the altcoin season index plunged to a 2-year low.

Despite this backdrop, HYPE has demonstrated unusual strength, diverging from macro sentiment and outperforming peers.

The whale’s early positioning amid widespread sell pressure highlights growing confidence in HYPE’s upside potential.

Are short liquidations setting the stage for a breakout?

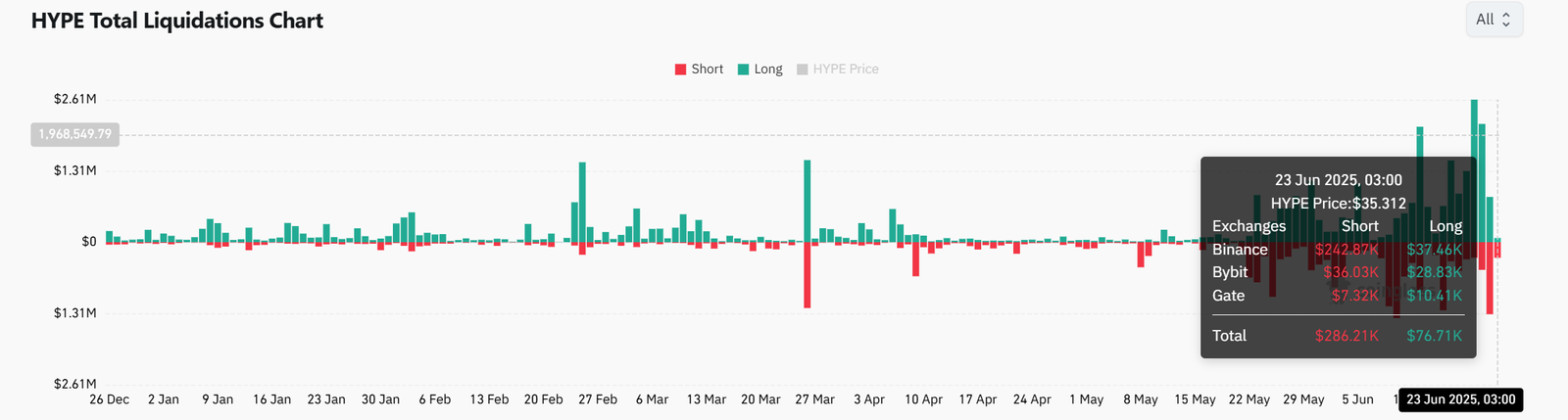

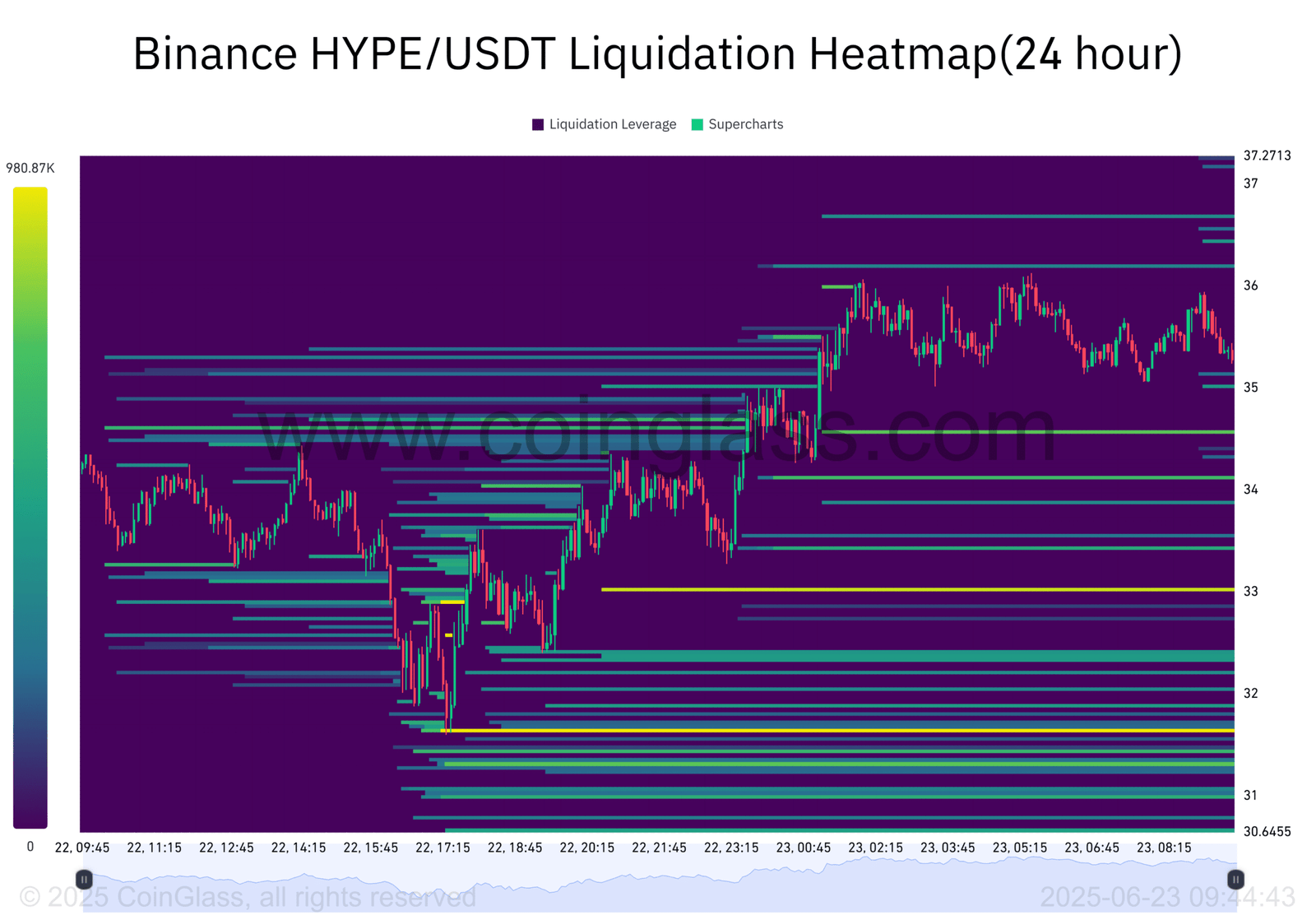

Over the last 24 hours, HYPE saw a spike in short liquidations totaling $286K, far exceeding the $76K in long liquidations. Most of this activity occurred on Binance and Bybit, where traders misjudged the strength of HYPE’s rebound.

The price surged to $35.61, up 6.1% on the day at the time of writing. This shift signals that bearish bets are being punished as upward momentum builds.

With liquidation clusters dense between $33 and $36, continued pressure could trigger more stop-outs and accelerate bullish price action in the short term.

Is fading sentiment masking hidden bullish conviction?

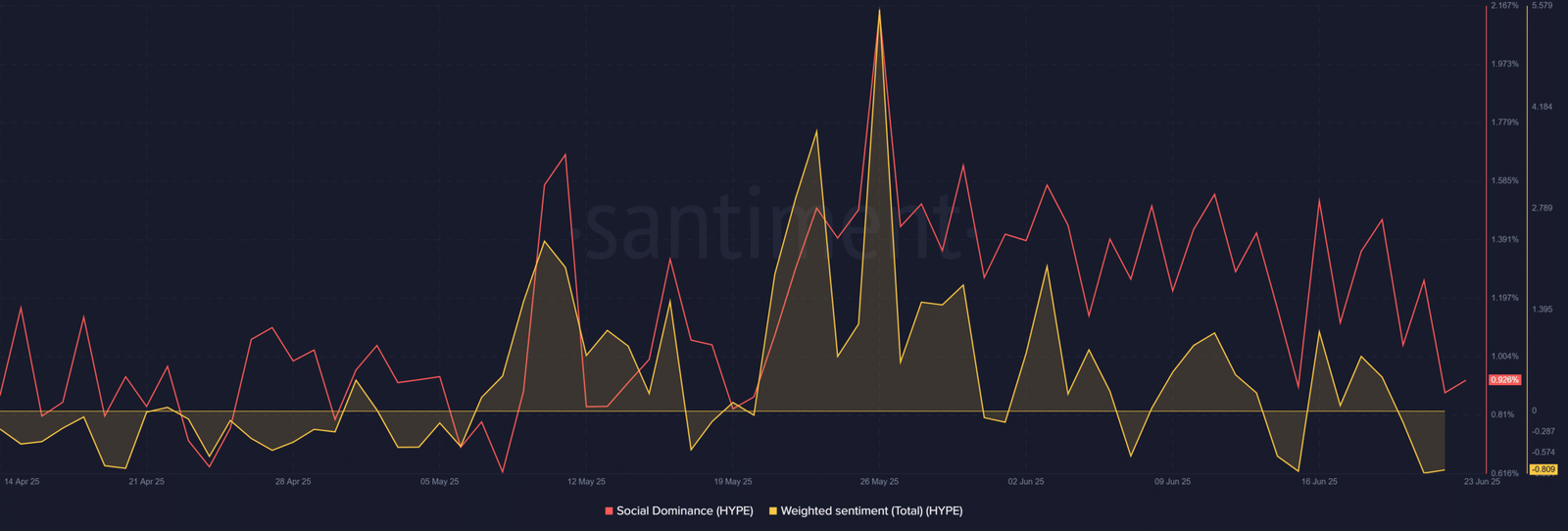

Although HYPE’s price has climbed, social metrics paint a mixed picture. Social Dominance has hovered just below 1%, while Weighted Sentiment has slipped to -0.809. This disconnect suggests traders remain cautious despite price gains.

However, this fading sentiment may act as contrarian fuel, especially as crowd disbelief often precedes strong upside continuation.

Therefore, the lack of euphoria could be a sign that HYPE still has room to rally as sidelined participants are gradually pulled back in.

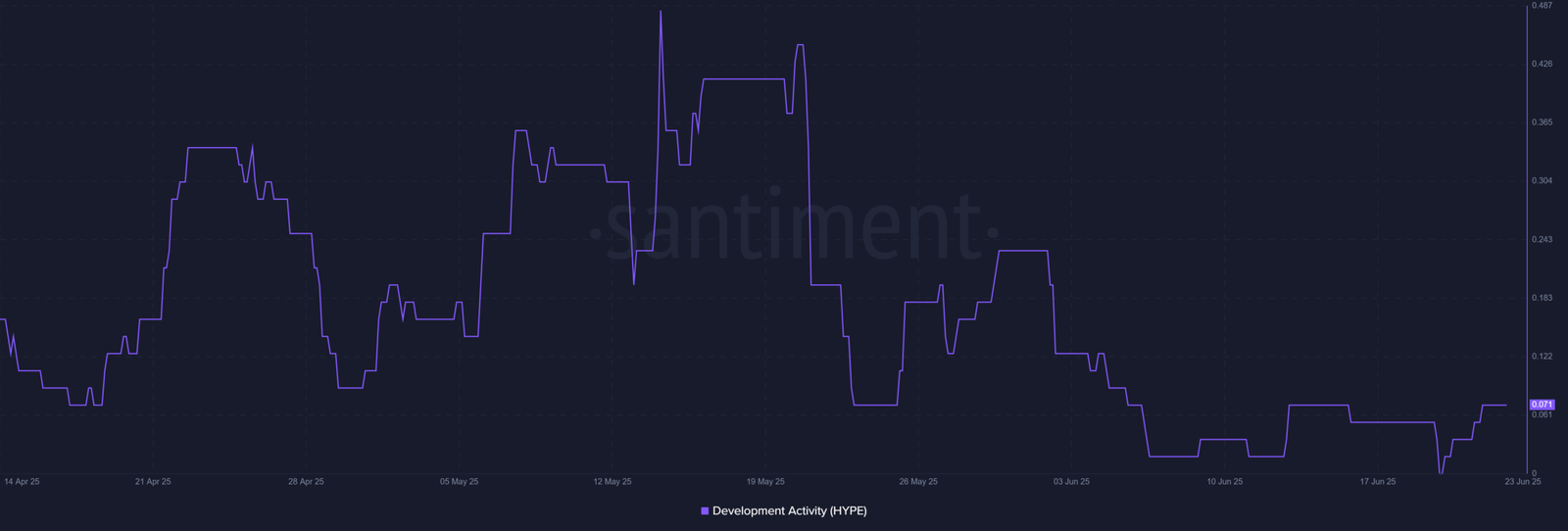

HYPE development activity begins recovering after June lull

After falling to near-zero levels in mid-June, HYPE’s development activity has shown a slight rebound, rising back to 0.071. While still far from early May highs, this uptick indicates that builder interest may be returning.

This recovery matters because consistent development signals longer-term project commitment, which can support valuation sustainability.

Therefore, even a minor increase in activity during volatile price swings could reinforce investor confidence over time.

Whale entries and liquidation levels define the $33–$36 battleground

The Binance liquidation heatmap shows dense clusters between $33 and $36, aligning with whale accumulation zones.

This overlap creates a key battleground for price action, where both bulls and bears could experience increased volatility.

If bulls maintain momentum and push through $36 with volume, additional liquidations could cascade, strengthening the upside move.

On the flip side, failure to hold above $33 may trigger downside pressure. For now, support from whale bids continues to anchor the range.

Can HYPE sustain its momentum in a weak altcoin cycle?

HYPE’s ability to rally against macro headwinds, absorb whale interest, and trigger short squeezes sets it apart from struggling altcoins. While social sentiment and development remain fragile, the underlying metrics point to a resilient structure.

If liquidation pressure persists and support holds above $33, HYPE may continue outperforming the market and extend its lead in this cycle.