In the decentralized finance (DeFi) landscape, few protocols have made as significant an impact in such a short time as Hyperliquid. Launched in late 2023, Hyperliquid has rapidly gained traction by offering a fully on-chain orderbook-based perpetual exchange with lightning-fast finality, minimal fees, and a user-aligned economic model.

But beyond its trading engine, Hyperliquid is successfully evolving into a broader ecosystem — one that integrates staking, spot trading, vaults, governance, and permissionless token listings.

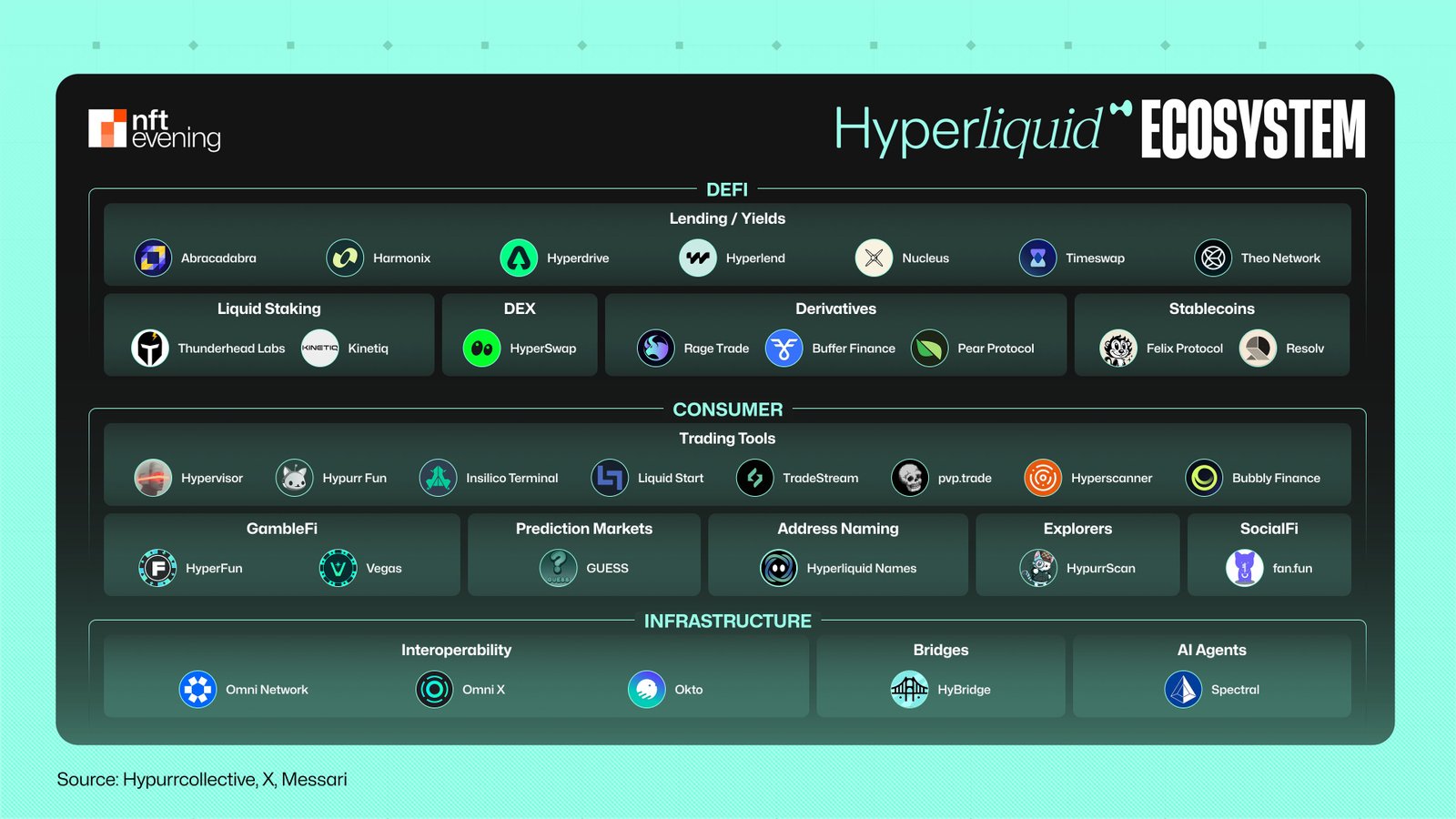

Hyperliquid Ecosystem Overview

The Hyperliquid ecosystem has evolved beyond a trading platform into a full-stack DeFi hub, attracting builders across primitives, infra, and consumer apps. As of July 2025, over 35 protocols are actively building on Hyperliquid’s L1 and its smart contract layer, HyperEVM — a rapid ecosystem expansion that rivals what dYdX or Sei achieved over longer timelines. What sets Hyperliquid apart is the convergence of deep liquidity, programmable perps, and real economic alignment, making it fertile ground for developers.

Projects like Rage Trade and Buffer Finance are replicating their success from Arbitrum on Hyperliquid, drawn by HyperCore’s execution engine and composable trading APIs. LSDfi entrants like Kinetiq and stablecoin projects such as Felix Protocol are also leveraging native primitives like Vaults and HIP-standard token auctions to bootstrap liquidity without VC gatekeeping. Even in consumer verticals — from prediction markets (GUESS) to GambleFi (Vegas) — developers are shipping faster due to Hyperliquid’s on-chain tooling and builder incentives.

Compared to ecosystems like Aevo or Blast, where builder activity often lags token hype, Hyperliquid is showing traction that’s real, verifiable, and revenue-generating — making it one of the most capital-efficient playgrounds in DeFi right now.

For more: Hyperliquid vs. dYdX, Aevo, GMX: Into the Future of Derivatives

Hyperliquid Ecosystem

Network Growth, Metrics and Performance

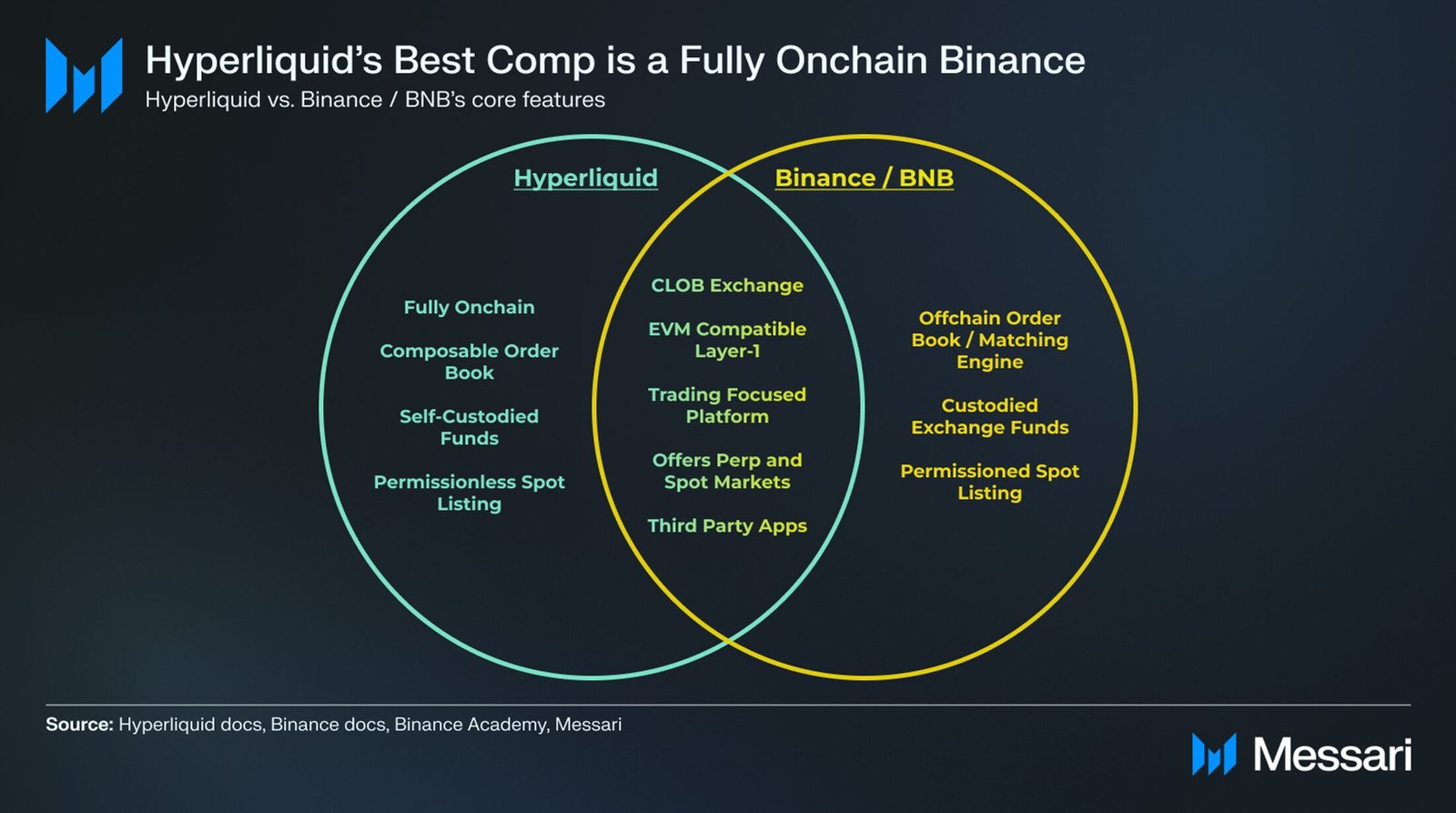

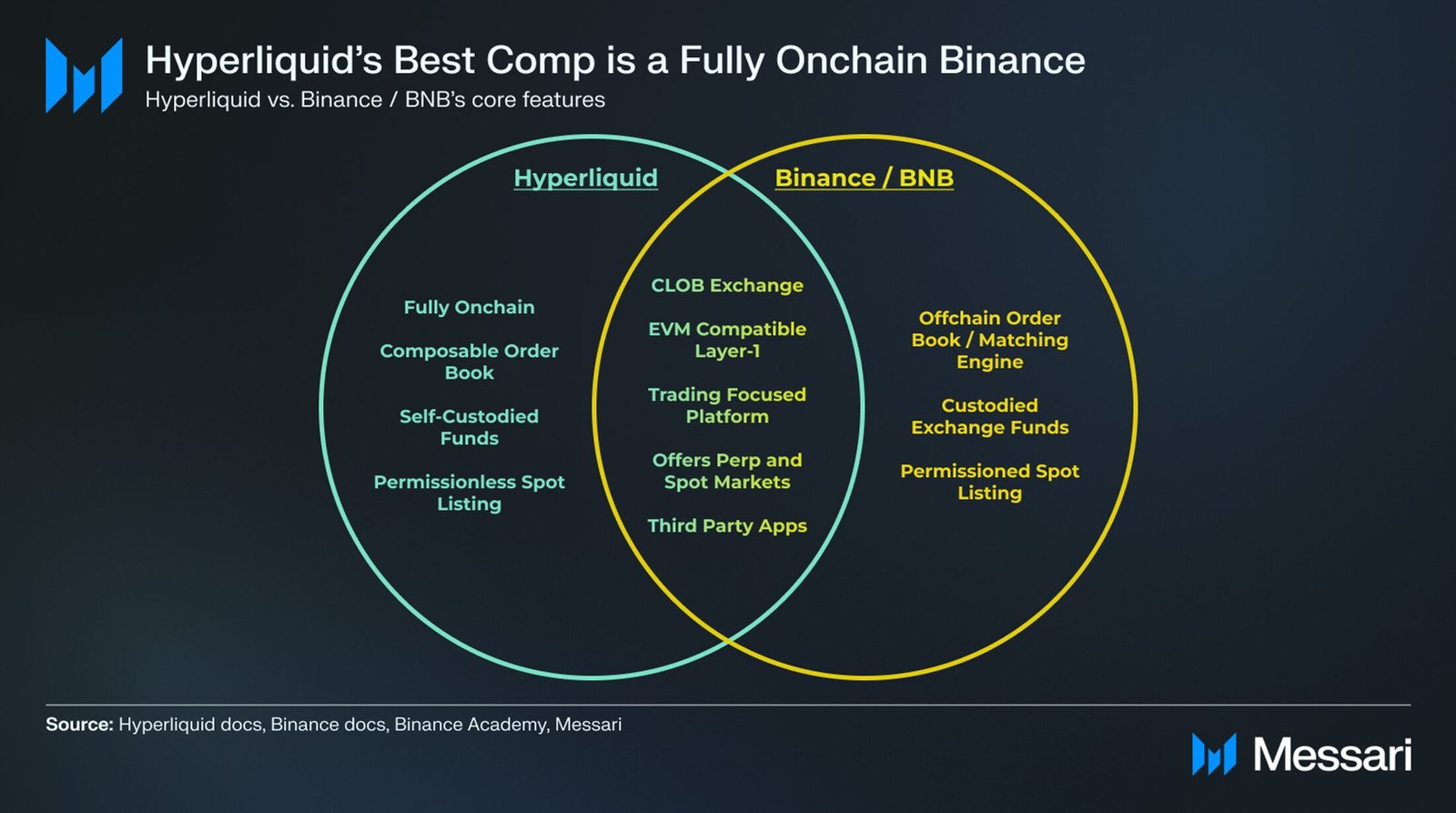

Hyperliquid’s growth since its late-2023 launch has been explosive, earning comparisons to an “on-chain Binance.” By June 2025, the network ranks #8 in DeFi TVL with ~$1.75B locked across vaults and protocols. Including bridged assets, stablecoin float exceeds $3.7B, showcasing deep liquidity. This rebound is especially notable considering the protocol held just ~$150M post-incident in March 2025.

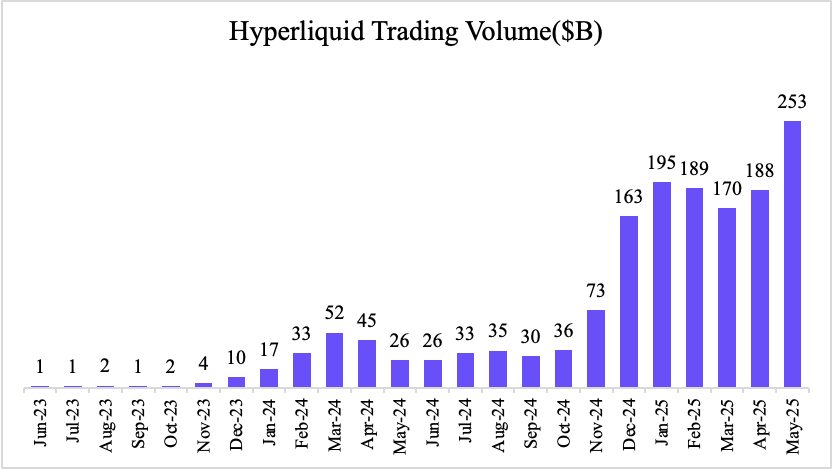

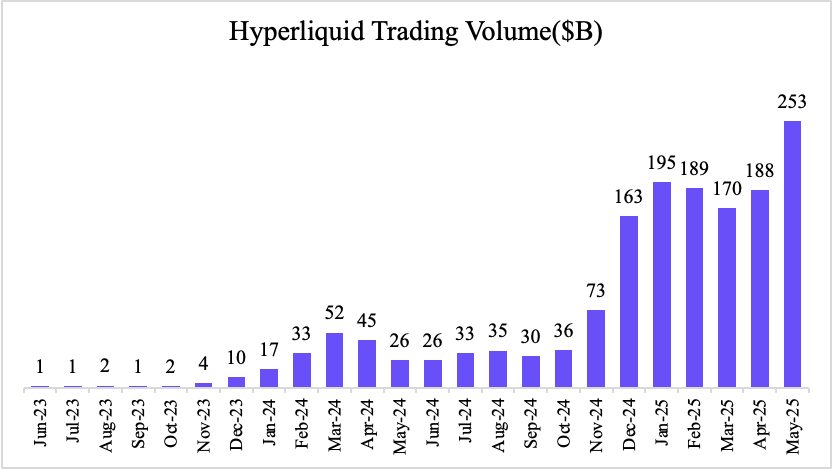

Source: Artemis

Trading volumes are equally staggering. In May 2025 alone, Hyperliquid processed $248B in perpetuals, contributing to a $1.57T annualized total. Combined spot/perp daily volumes regularly exceed $2B, with its flagship CLOB exchange alone handling ~$420M per day. Its monthly trading volume now rivals or exceeds Uniswap and PancakeSwap combined — even reaching 10% of Binance’s derivatives volume at peak.

Source: Messari

User adoption has scaled rapidly. The protocol now boasts over 500,000 unique wallets, with strong retention post-airdrop. Community-led trading tools and consistent incentives keep engagement high. Ecosystem apps launching on HyperEVM benefit from immediate exposure to a large, active user base.

Source: Artemis

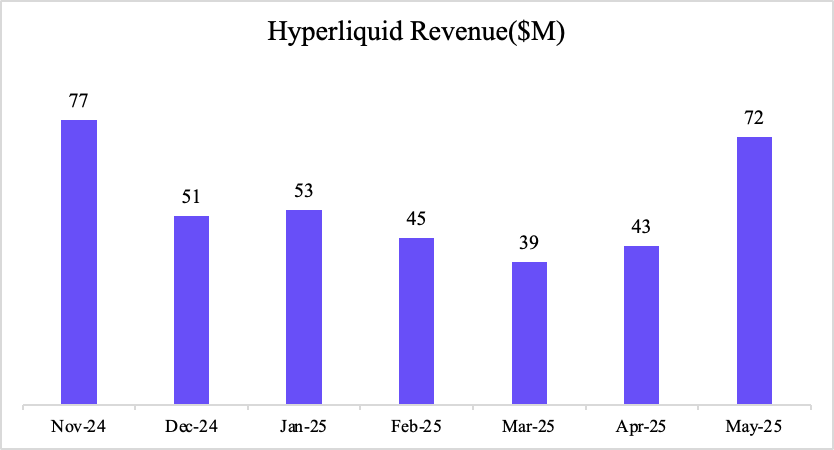

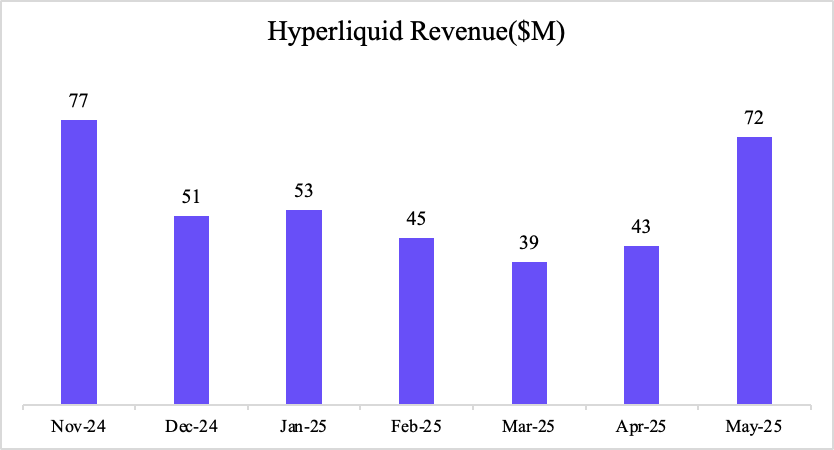

Revenue generation is robust. Hyperliquid earned $66M in fees in May 2025, outpacing Tron and Ethereum. Nearly all fees (97%) are funneled into automated buybacks and burns of the HYPE token. Over $900M of HYPE has been removed from circulation, helping drive a 300% rally in Q2 2025. The remaining fees are distributed to LPs via the HLP vault, which consistently delivers double-digit APYs.

With dominant on-chain perp market share (>70%), growing integrations, and rising institutional attention (e.g. Lion Group holding $600M in HYPE), Hyperliquid is entering a flywheel of volume, revenue, and token value — a rare combination in today’s DeFi landscape.

For more: Hyperliquid Deep Dive: Understand HYPE and HLP Model

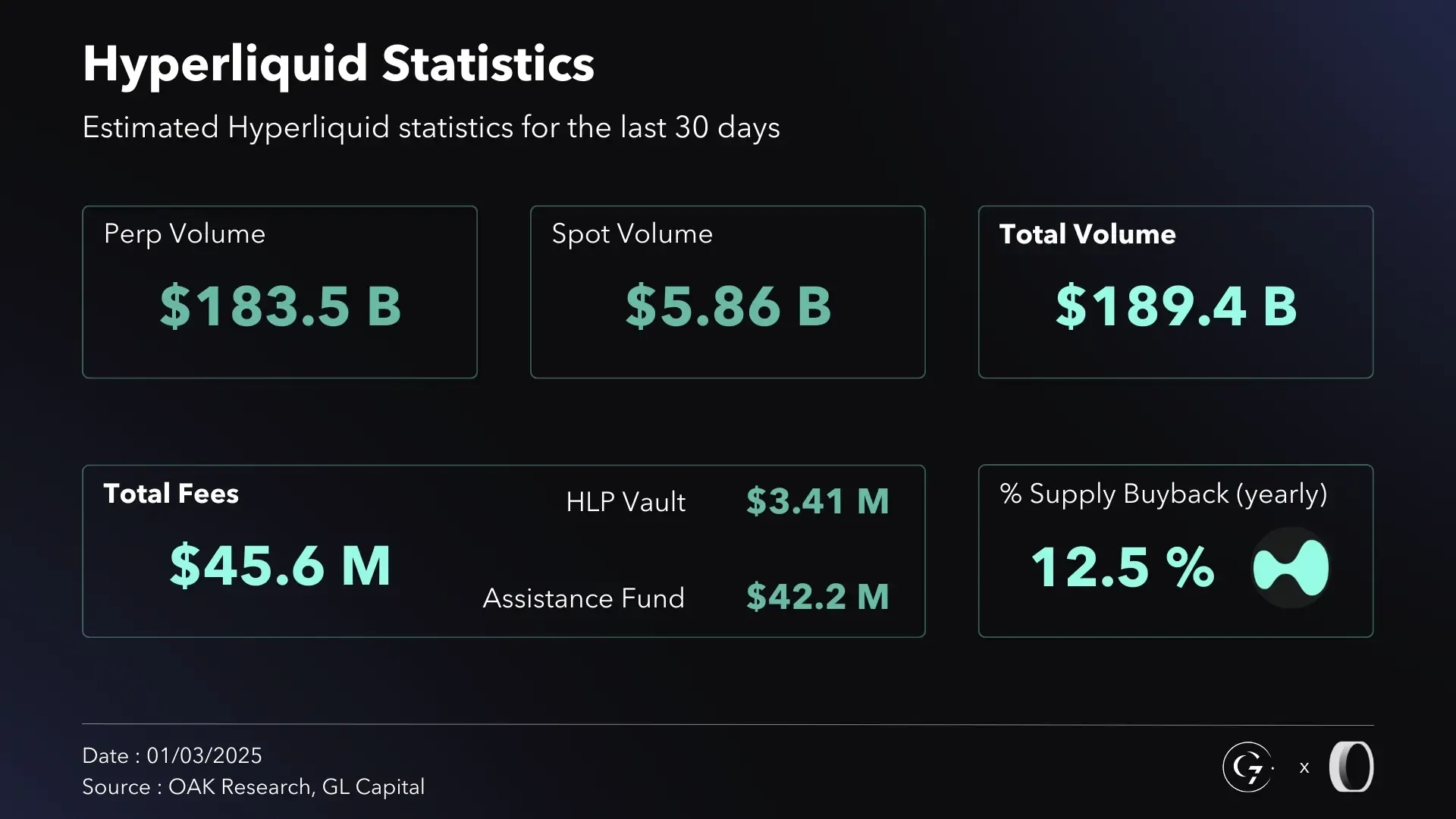

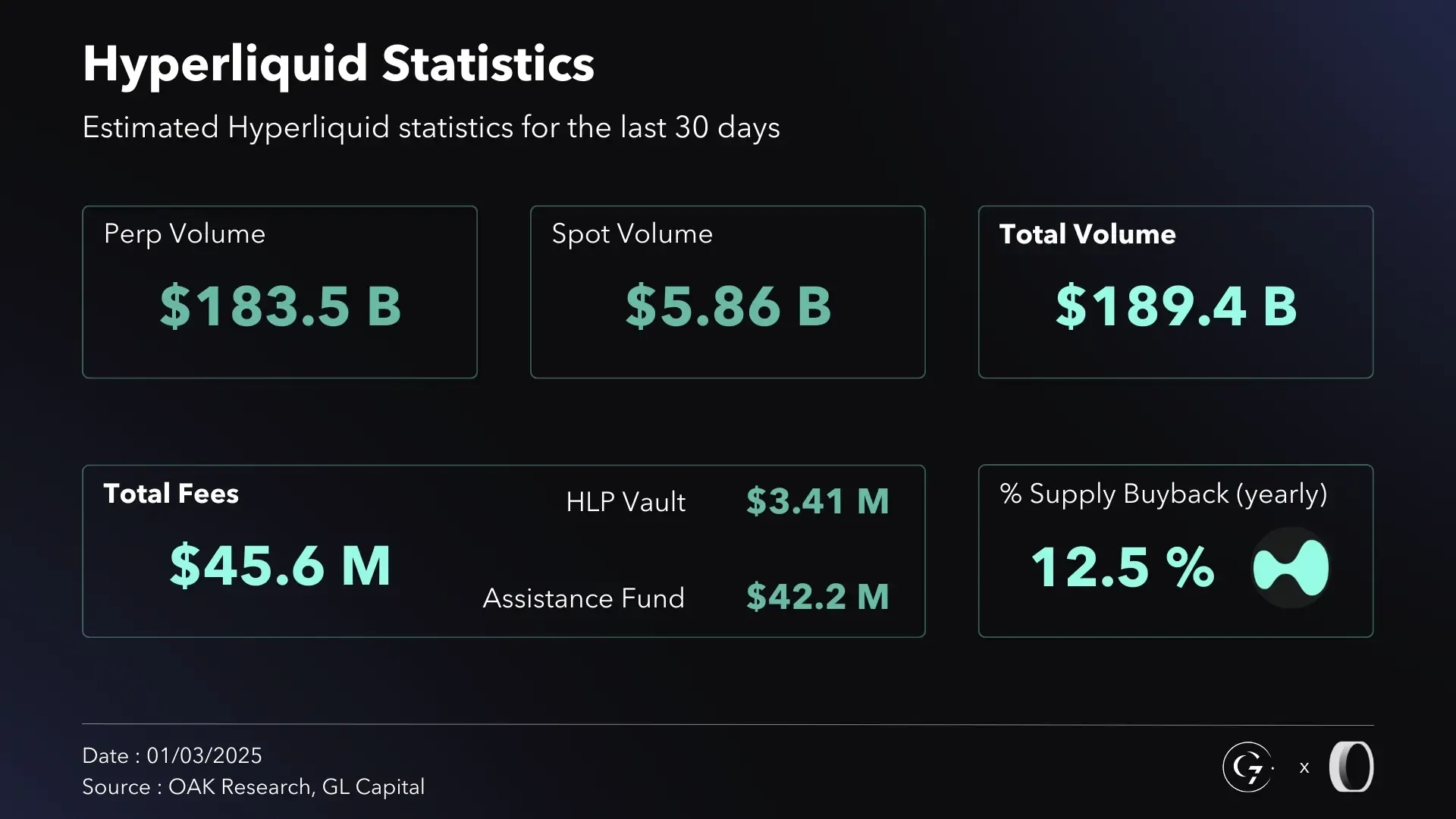

Source: OAK Research & GL Capital

Builder Tooling and Incentive Programs

Hyperliquid has built a uniquely builder-centric ecosystem by aligning incentives through smart tooling and monetization primitives. Developers on HyperEVM benefit from full EVM compatibility, using familiar tools like Solidity and Hardhat, while also accessing custom functions to interact directly with HyperCore’s orderbook. Resources like open APIs, precompiles, and community-maintained SDKs (e.g. from HypurrCollective) simplify building advanced DeFi strategies.

A standout feature is the “builder code” system, which lets developers append fee-splitting IDs to trades they generate. If users opt in, these builders receive a share of protocol fees — up to 0.1% on perps and 1% on spot — creating a built-in revenue stream for dApps, bots, or social trading platforms. By mid-2025, many third-party tools, including PvP.trade and front-end vault managers, were actively monetizing via this model.

Vaults are another key pillar of Hyperliquid’s builder economy. Anyone can deploy a vault that executes trading strategies on behalf of depositors, earning 10% performance fees if profitable. The vault system offers both transparency (via public leaderboards) and risk management, since vaults share the same liquidation engine as normal accounts. These features have drawn attention to standout traders like “Wynn,” who ran a vault that managed over $1.2B in open positions, showcasing Hyperliquid’s deep liquidity and composability.

A newcomer gambler, 0x916E, deposited 4.28M $USDC into #Hyperliquid and opened a 25x leveraged long on $ETH an hour ago.

The position reached 44,523 $ETH($100.4M), with a liquidation price of $2,196.https://t.co/8u5DW0D4Vj pic.twitter.com/NjrSPoWRM3

— Lookonchain (@lookonchain) June 23, 2025

On the protocol side, staking and delegation systems ensure long-term engagement: one-third of the HYPE supply is staked, validators are capped at 1–2% commission, and delegation is open to all users. Finally, HIP-1 token listing auctions provide a clear path for launching ecosystem tokens. These Dutch auctions in HYPE — with prices reaching $300K+ per token — act as both a spam filter and a HYPE burn mechanism. Combined, these tools have fostered a “build-to-earn” culture, where talented developers are directly rewarded for bringing volume, users, and liquidity to Hyperliquid.

For more: Hyperliquid Ecosystem: From Perp DEX to Emerging Crypto Ecosystem

Integrations, Partnerships, and Ecosystem Expansion

Hyperliquid’s ecosystem is rapidly expanding through strategic integrations and community-driven development. Capital onboarding is streamlined via HyBridge and aggregators like RocketX, supporting deposits from 30+ chains. Users can easily connect through MetaMask, TrustWallet, and RPC nodes like QuickNode, ensuring broad accessibility. This seamless cross-chain access gives Hyperliquid a significant advantage over other app-chains that often struggle with fragmented bridging experiences.

Institutional interest has grown despite the project raising no VC capital. Lion Group, a Nasdaq-listed firm, reportedly holds $600 million in HYPE as treasury — a rare show of confidence in an exchange-native token. Major analytics platforms like Nansen have partnered with validator groups such as HypurrCollective to provide tooling and data infrastructure, while operators like Imperator.co support key services including HypurrScan and HypeRPC.

Developer incentives are a core growth engine. Around 39% of HYPE supply is reserved for community rewards, grants, and ecosystem growth. Programs like builder codes (protocol-level fee rebates) and Dutch auction token listings (HIP-1/HIP-2) allow projects to monetize and gain exposure without centralized gatekeeping. With the upcoming HIP-3 framework for custom derivatives and expanding DeFi integrations, Hyperliquid is well positioned to grow further. Its blend of deep liquidity, user-first design, and builder incentives marks it as a leading crypto-native ecosystem.

Investment Thesis for HYPE Token

The investment case for HYPE centers on a powerful alignment between protocol growth and token value. As the native asset of Hyperliquid, HYPE accrues value through multiple channels: staking for validator rewards, gas usage on HyperEVM, fee discounts for traders, and most critically, aggressive buybacks funded by real revenue.

With over $300 million in cumulative fees generated and more than $900 million worth of HYPE already bought back and burned as of mid-2025, the token exhibits strong deflationary pressure tied to platform activity.

24hr daily fees key points$hype back on top ahead of $trx$eth continues to outperform $sol (and imo solana performing better than sentiment on the tl) pic.twitter.com/lK2aJqGbyw

— nooman (@n01man) June 5, 2025

Unlike many DeFi tokens diluted by VC unlocks or passive governance roles, HYPE benefits from genuine utility and organic demand from both traders and developers. Its integration into every layer of the ecosystem — from trading to launching new assets — creates consistent token sinks.

Moreover, Hyperliquid’s refusal to extract protocol rent means nearly all value flows back to users and stakers, creating a virtuous cycle of usage, revenue, and value accrual. For investors seeking exposure to one of the few on-chain protocols with sustainable economics, growing market share, and a user-first ethos, HYPE presents a uniquely compelling long-term opportunity.