- Dragonfly’s Qureshi slammed the staking mania and called for better blockchain security models.

- Solana staker revenue hit a record high of $1.5B, while validator income surged to $300M.

Solana [SOL] staking is back in the headlines, following a strong criticism from a crypto VC.

According to Dragonfly’s founder, Haseeb Qureshi, the staking mania is a ‘meme’ and an illusion that doesn’t help with security as initially perceived.

“Staking mania is definitely a little bit of an illusion. This idea that you’re paying for security is kind of a meme.”

Staking involves locking or delegating tokens like SOL to validators to help them run the network.

In return, the validators or node operators earn ‘rewards’ or staking yield that they can share with their delegators.

The problem with staking: Inflation

But here’s the problem — staking is dominated by 12 validator firms across all the proof-of-stake (PoS) chains like Solana, Aptos [APT], Ethereum [ETH], and more.

According to Qureshi, only Ethereum is better off in terms of security because it has home stakers.

As a result, the current security model is heavily concentrated within select validator firms. This centralization risk doesn’t align with the ‘network security’ ethos of staking.

He went on and added,

“The security model is not what we pretended it was 6 years ago. As a result, it’s rational if we fix this problem.”

Additionally, he viewed staking rewards as inflation and taxation that dilute other holders who don’t stake.

He added that now U.S. spot ETF issuers are pushing for yield to avoid being diluted, and not necessarily to secure the network.

“The things that make L1s secure are not inflation rates. It’s the robustness of the software, and who the validators are.”

Solana co-founder Anatoly Yakovenko agreed with Qureshi’s stance.

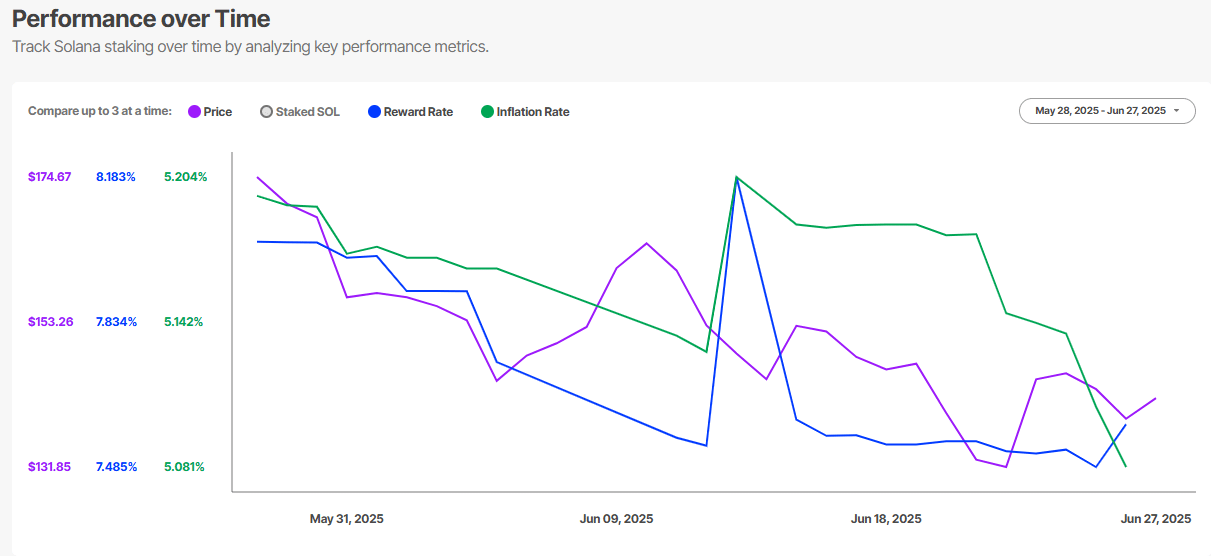

Notably, Solana’s inflation rate is currently fixed at 5% per year, and is closely tied to the rewards issued to validators. However, it adds more supply and exposes SOL to devaluation or dilution.

In fact, the community’s attempt to cut the inflation rate by 80% earlier in the year was voted down by key validators.

Now, some community members have voiced concerns about imbalance and hefty profit maximization by validators, leaving applications offering the staking services fighting for breadcrumbs.

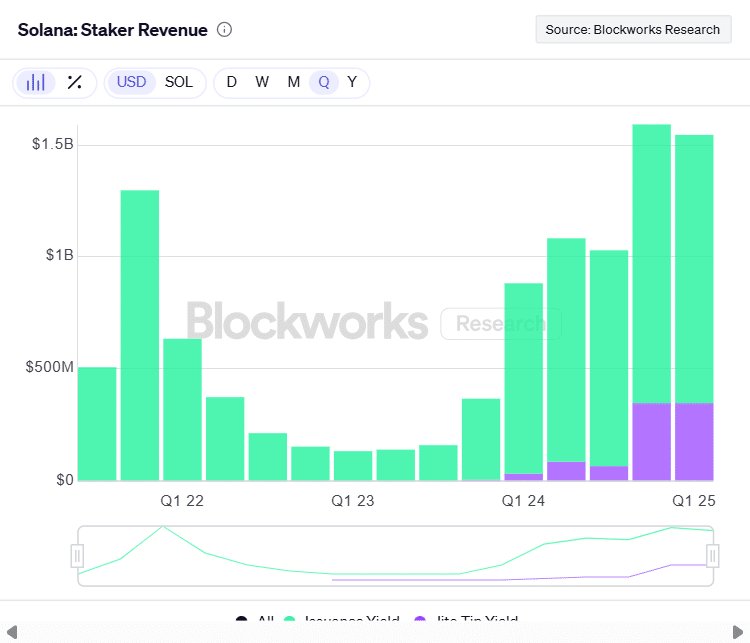

In Q4 2024, validator operator revenue hit a record high of $300 million while overall staker revenue across the Solana ecosystem hit a high of $1.59B.

In Q1 2025, staker revenue reached $1.54B, underscoring strong staking demand during the bull run.

It remains to be seen how Solana will resolve its inflation and whether the PoS system will heed to Qureshi’s call.