In the rapidly evolving blockchain landscape, the crypto market is still introducing new technologies and investment opportunities for investors. Among the wide range of blockchain protocols vying for attention, Sui has emerged as a prominent name, promising high performance, scalability, and a unique approach to digital asset management.

About Sui Blockchain

Blockchain Layer 1 Sui was developed by Mysten Labs, a team of former Meta engineers with profound experience from the Diem and Move projects. Launched to address the scalability issues of the current blockchain trilemma, Sui stands out because of its special design that allows multiple transactions to happen at the same time and uses object-based programming. These innovations make it well-suited for high-speed applications such as real-time gaming, dynamic NFTs, and interactive financial platforms.

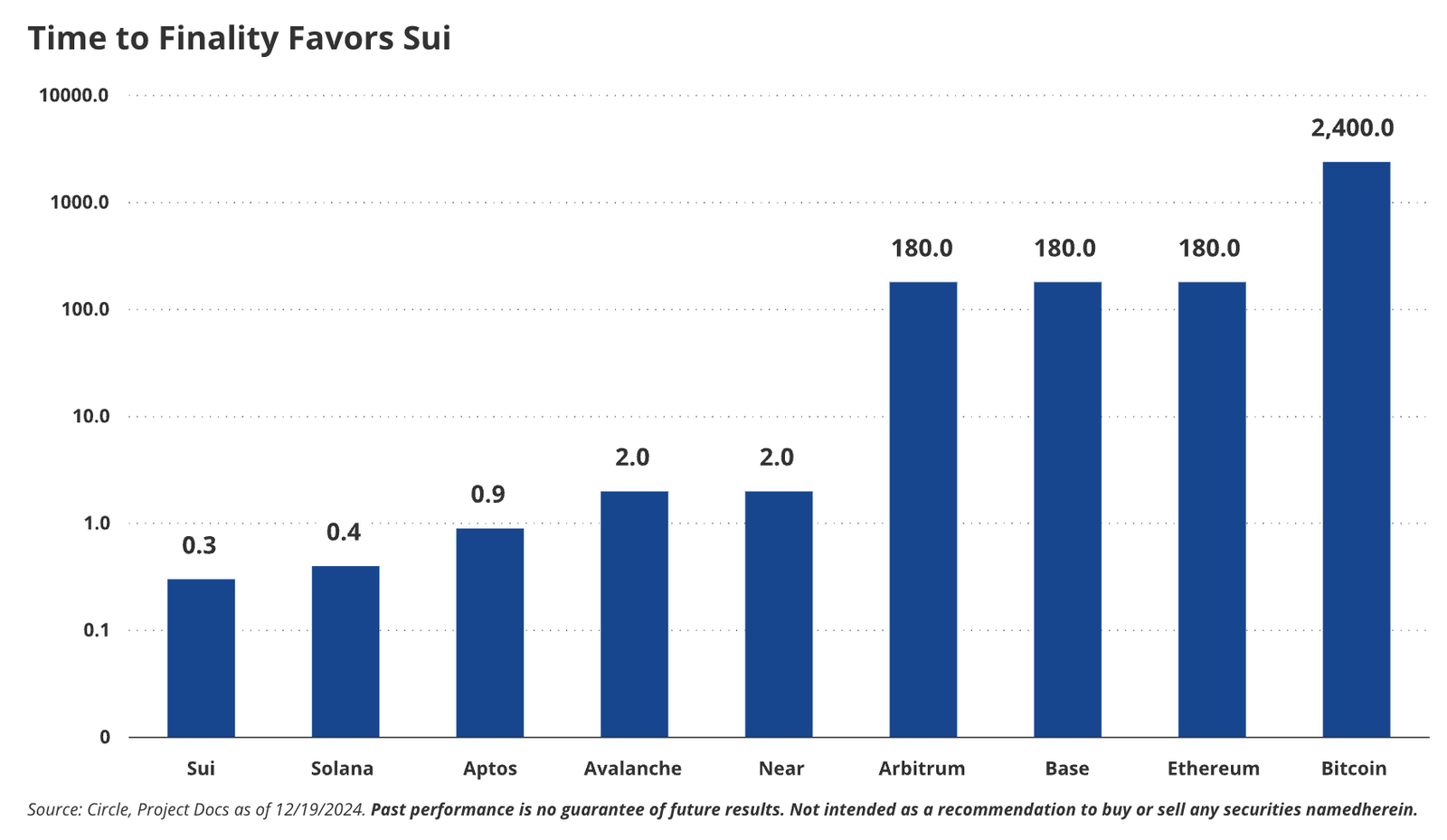

In the busy Layer 1 market of 2025, Sui aims to make its mark not just by being fast, but also by making it easier for developers to use and create tools, thanks to its ability to handle multiple transactions at the same time. From a traditional blockchain’s perspective, they often process transactions sequentially, leading to bottlenecks and slower transaction speeds, especially during periods of high network congestion. Sui solves this problem by identifying independent transactions that do not conflict with each other and processing them simultaneously.

For more: Sui Deep Dive: A Comprehensive Analysis

Source: Artemis

We consider another aspect: parallel execution. Sui made it possible with its object-centric model, where the system can determine dependencies between transactions based on the objects they interact with. For instance, peer-to-peer asset transfers can achieve near-instant finality. Sui significantly enhances user experiences and enables high-throughput applications.

As data from the Sui blockchain indicates, theoretical peak TPS can reach up to 297,000. In reality, as with other blockchains, it’s shown that the observed TPS can vary, with some reports indicating an average of around 55 TPS and a theoretical initial support of up to 120,000 TPS.

Source: Artemis

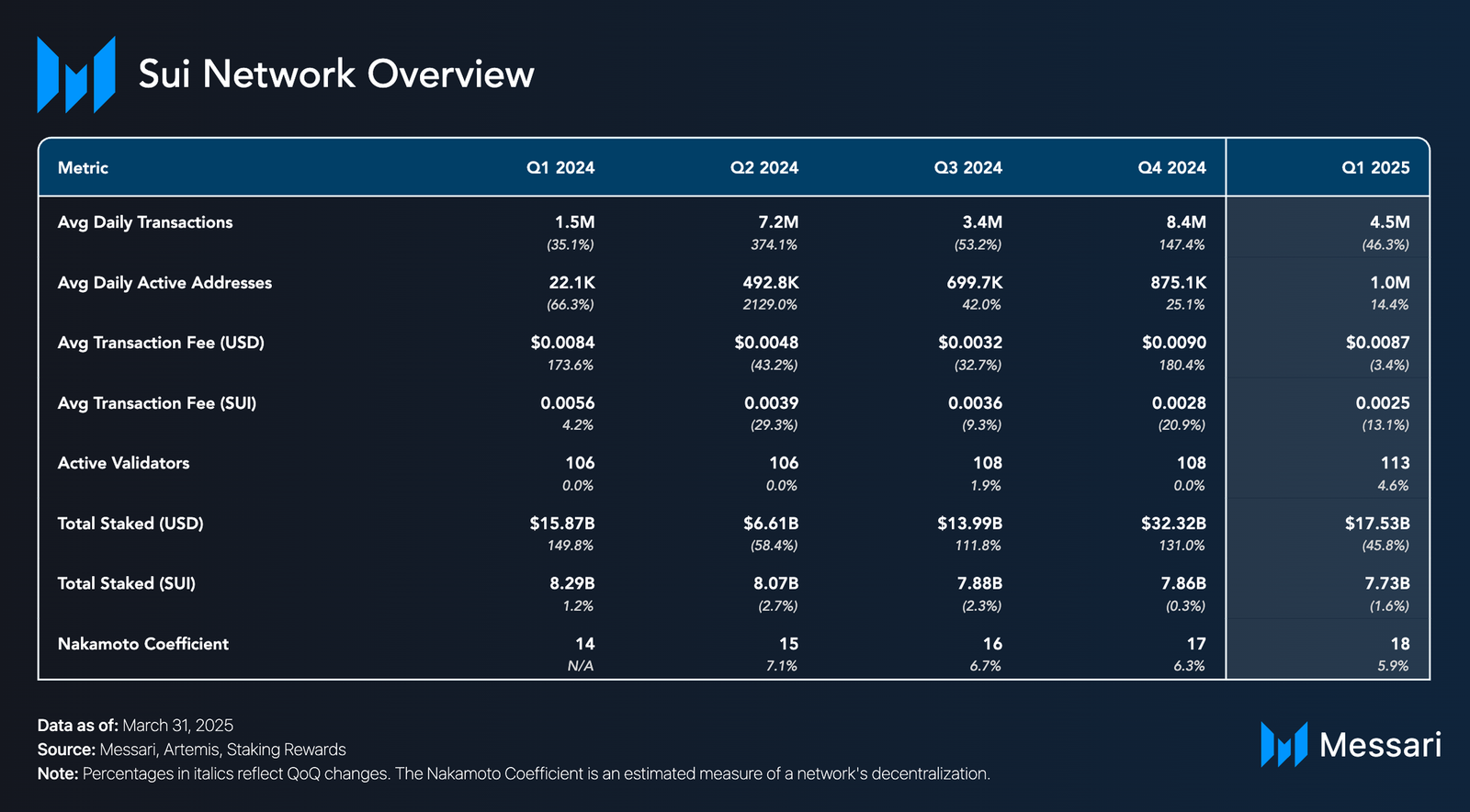

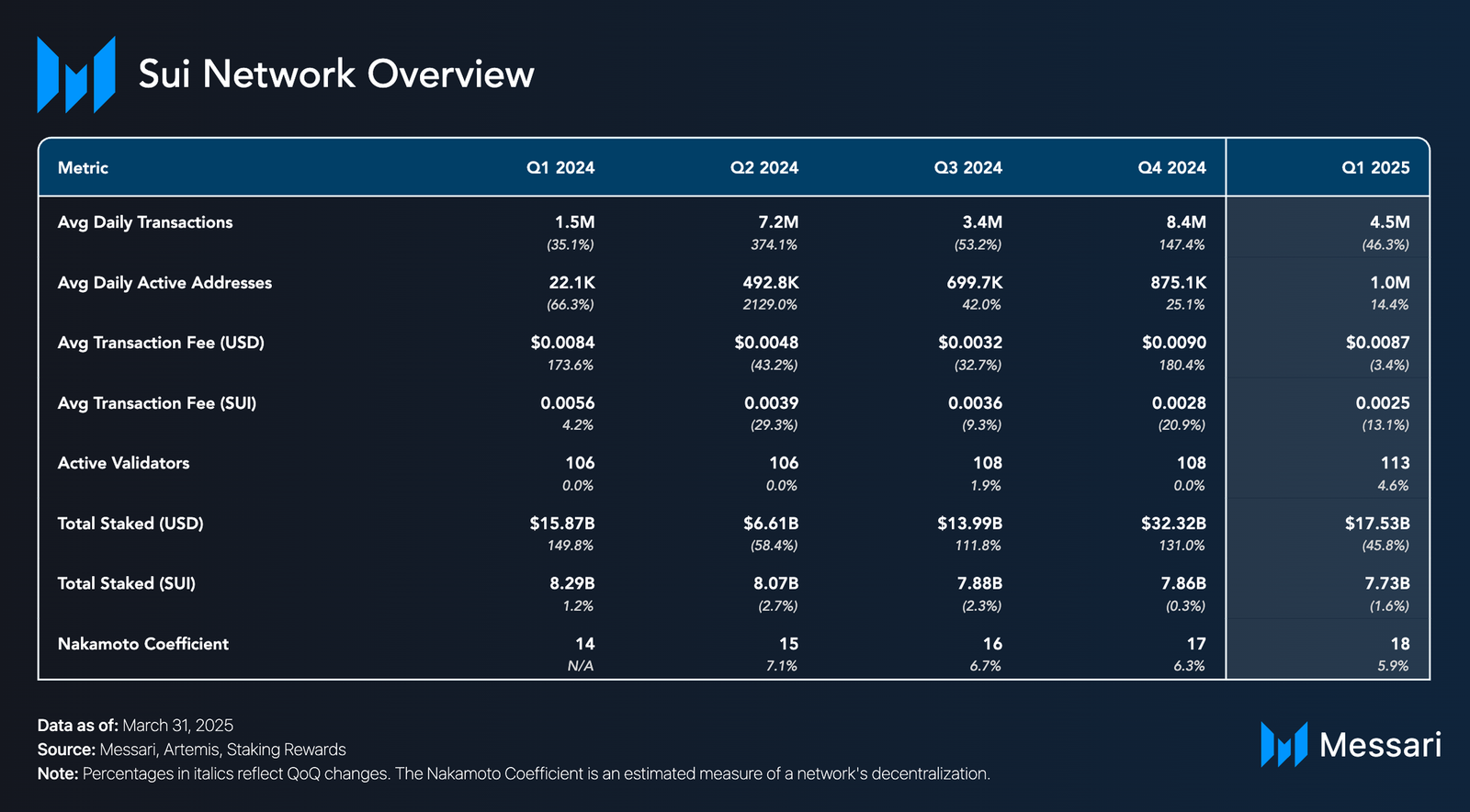

The Growth of Sui Network and Ecosystem Expansion Breakdown

Over the past year, Sui has shown a remarkable transformation from an “early child” Layer 1 blockchain to an increasingly active and robust blockchain development. Following the network’s mainnet debut in 2023, user adoption and application deployment have accelerated, mainly driven by Sui Labs Foundation activities to bootstrap user incentives and dApps integration.

Sui Blockchain Metrics

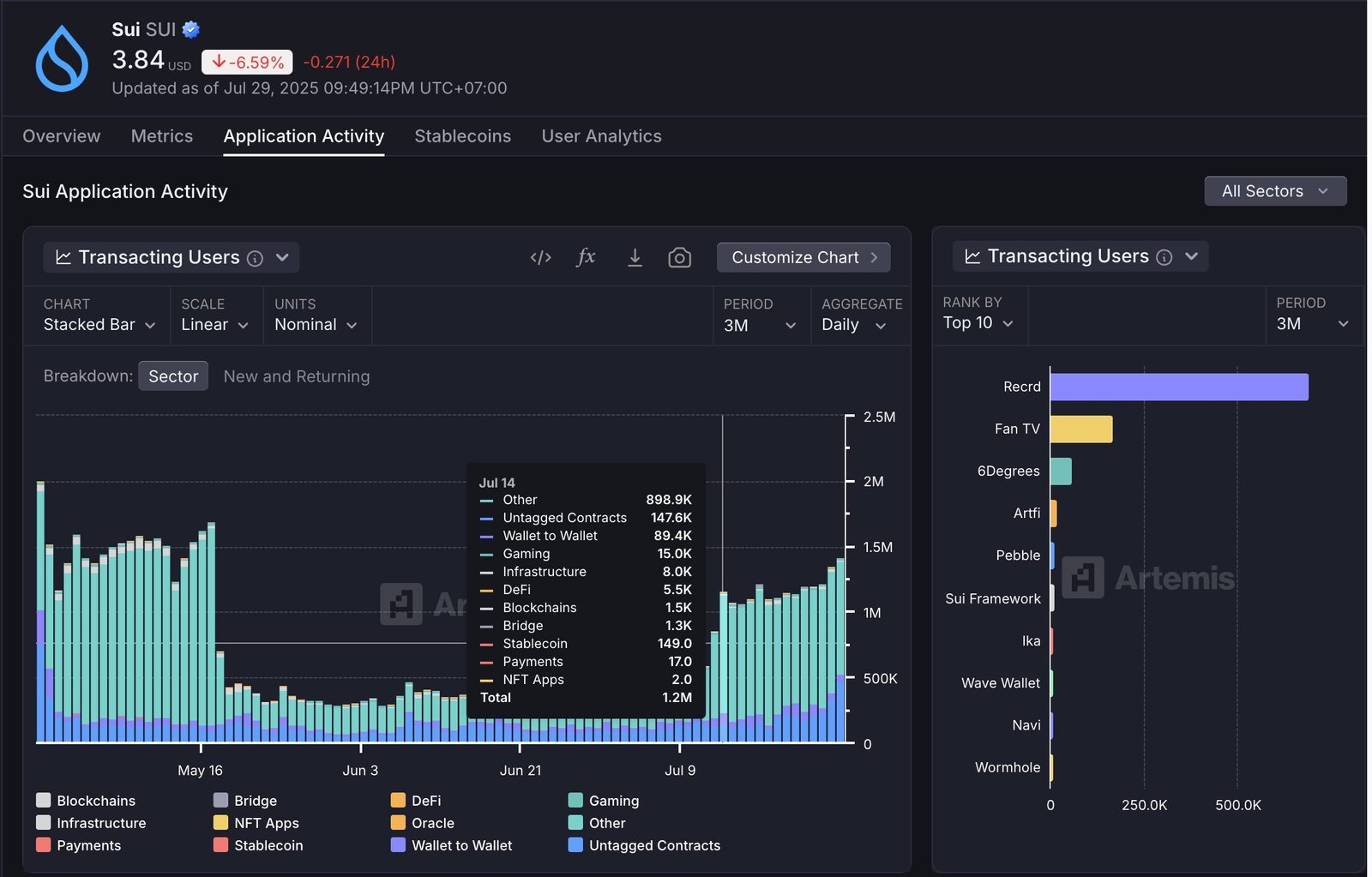

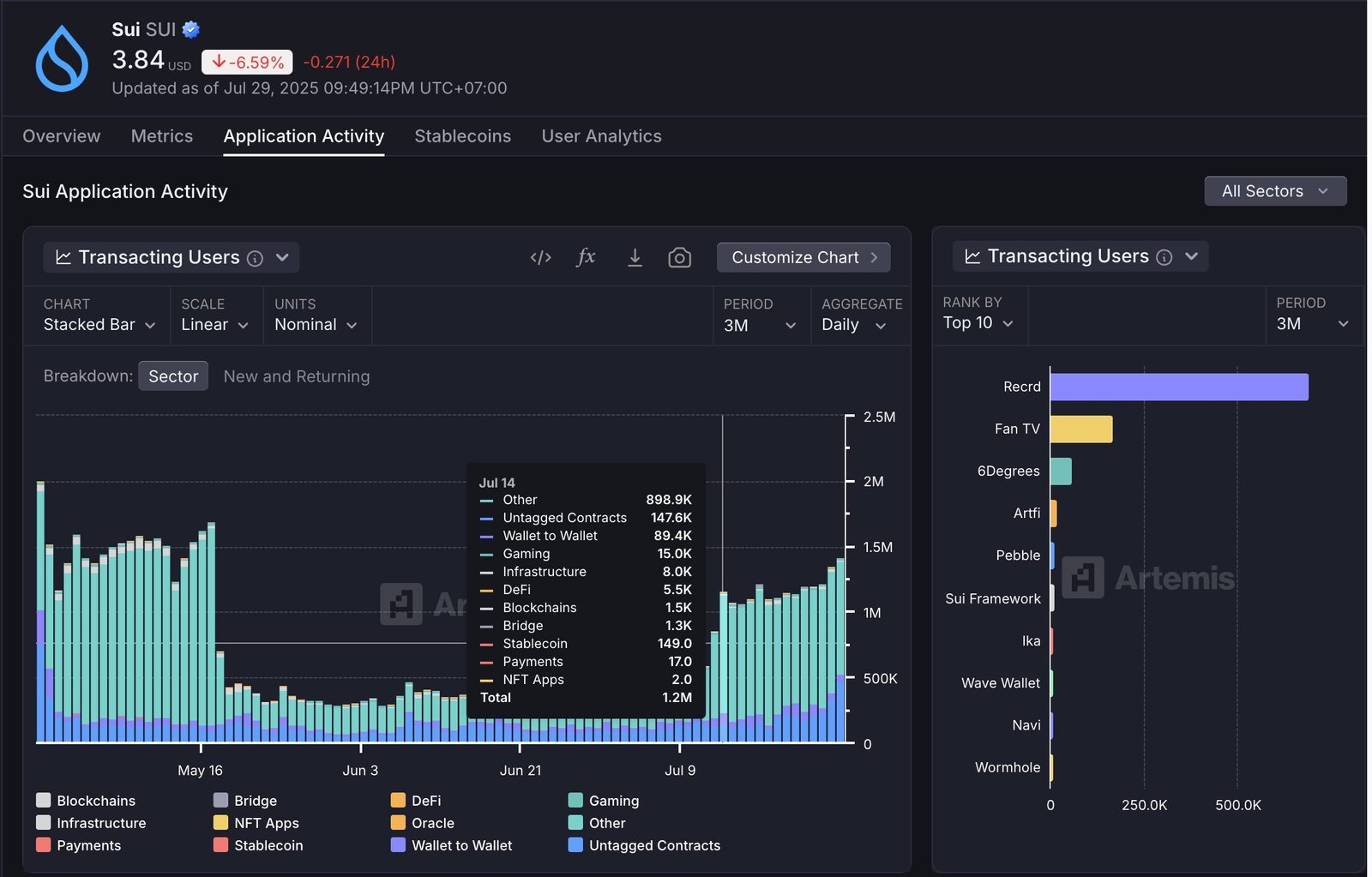

As of July 2025, the activities on the Sui Network have exhibited a significant “blooming.” As data from Artemis shows, daily active addresses reached over 1.2 million on July 14. Surprisingly, we could see an increase of nearly x2 at the end of the month, showcasing a steep upward trend over the previous two months.

Source: Artemis

Taking a closer breakdown into the number of active users, nearly 900,000 transactions originated from miscellaneous “Other” activities—likely from developers testing, including encompassing bots, testing protocols, or experimental dApps. However, more meaningfully, wallet-to-wallet transactions exceeded 89,000, while gaming dApps contributed over 15,000 daily users, reflecting the growing appeal of Sui-based interactive applications.

Source: Artemis

Sui DeFi Activities

The data from Sui’s infrastructure activities, including DeFi protocols and stablecoin usage, have maintained a modest but steady presence, indicating a well-distributed range of use cases across sectors. Notably, stablecoin-based transactions exceeded 149,000, highlighting rising demand for on-chain liquidity and value transfer mechanisms.

Source: Messari

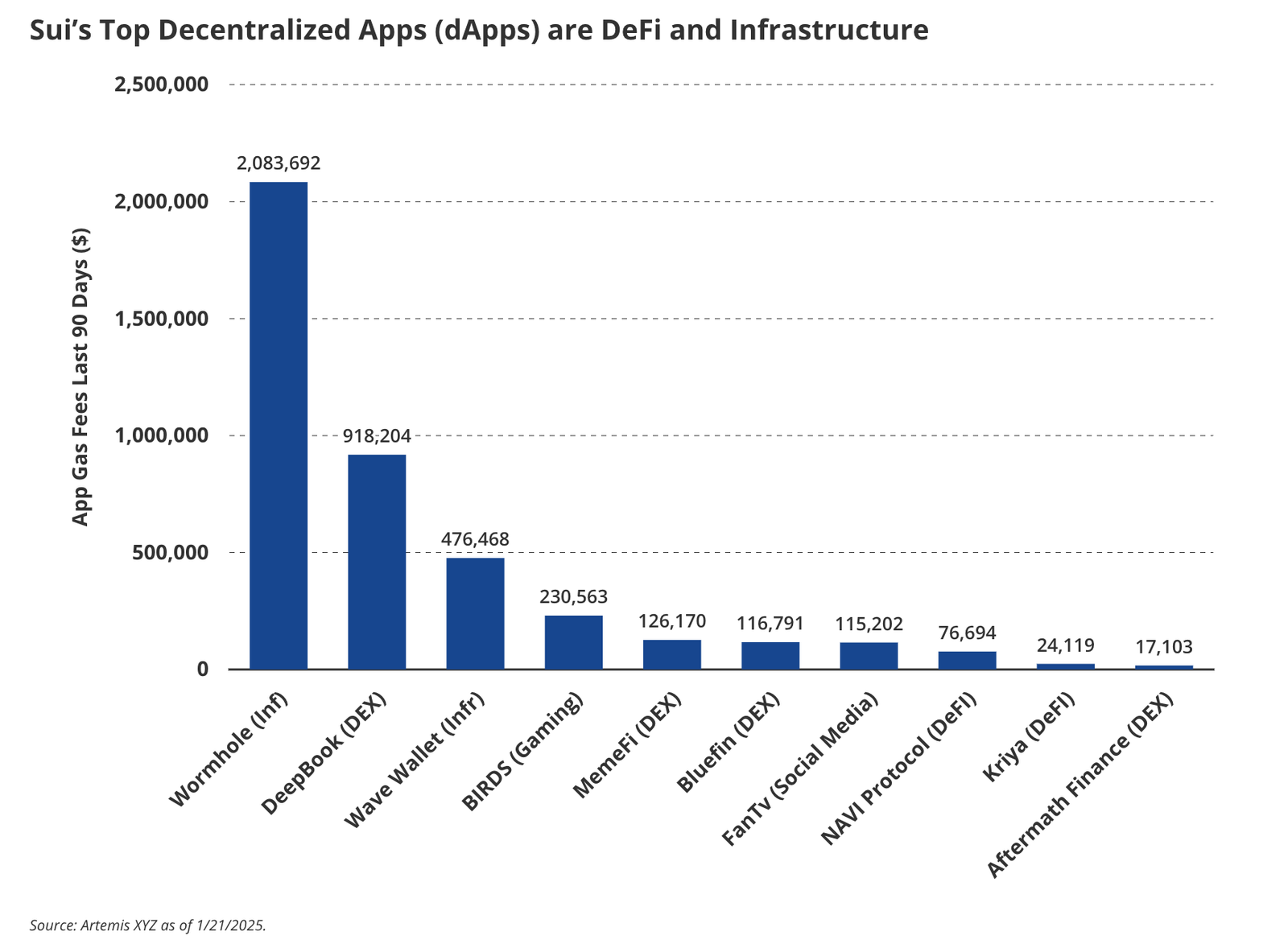

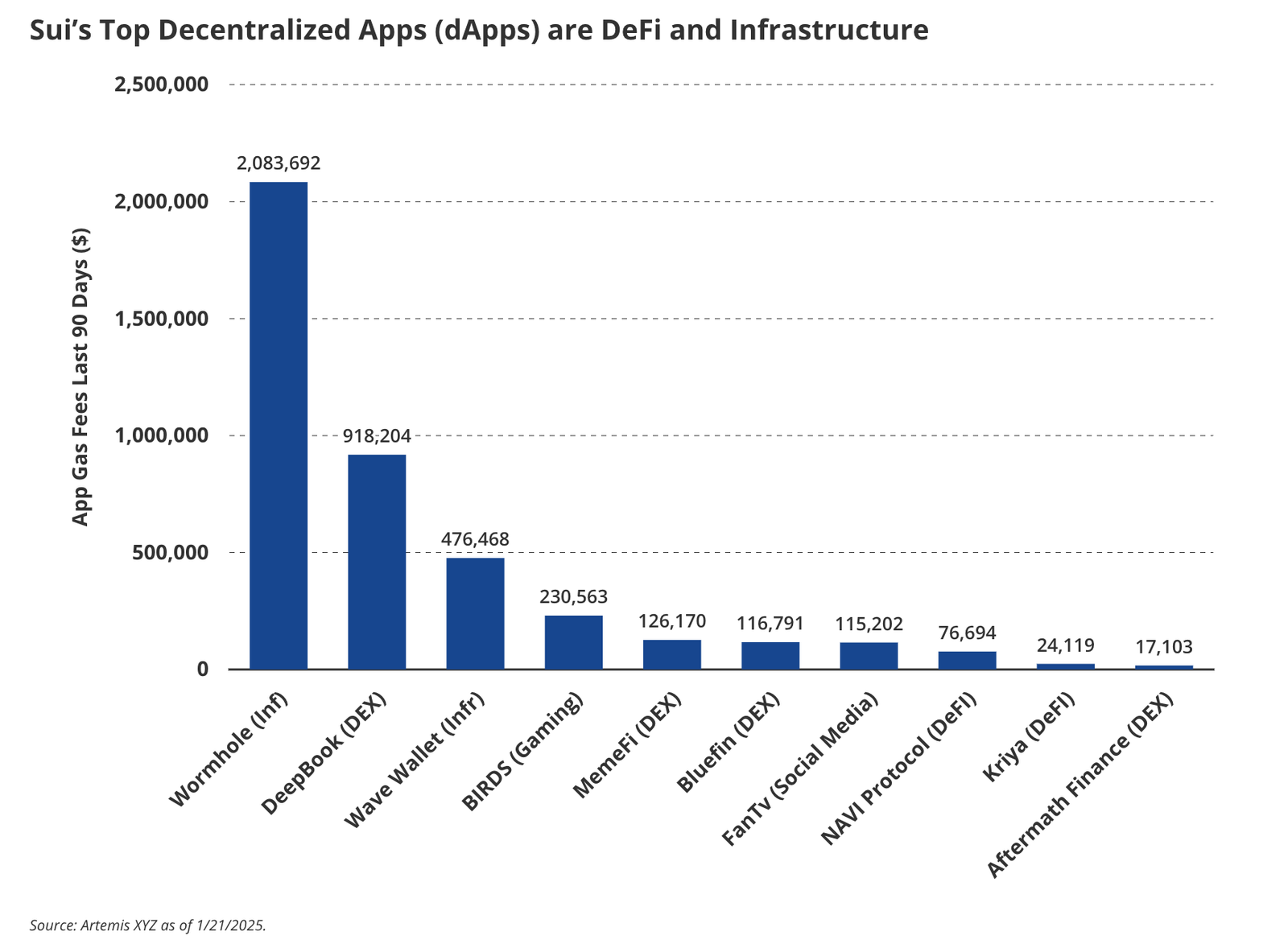

On the application leaderboard, social app Recrd emerged as the dominant contributor to user activity, with more than 500,000 transacting users in the last three months. Other top-performing platforms include Fan TV, 6Degrees, and Artfi, each reflecting a mix of entertainment, communication, and creator economy utilities.

For more: Sui’s DeFi Ecosystem: Rapid Growth and Strategic Positioning

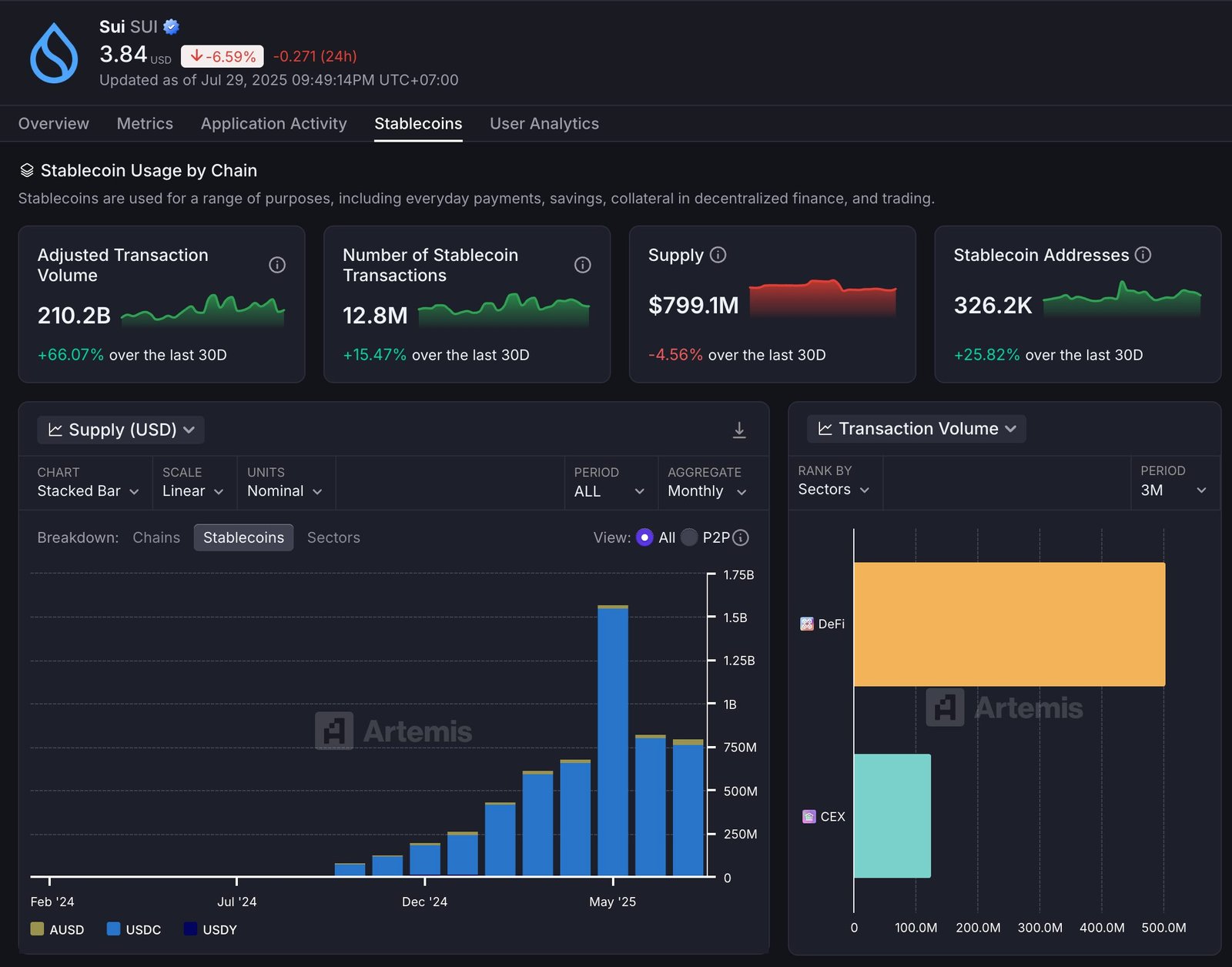

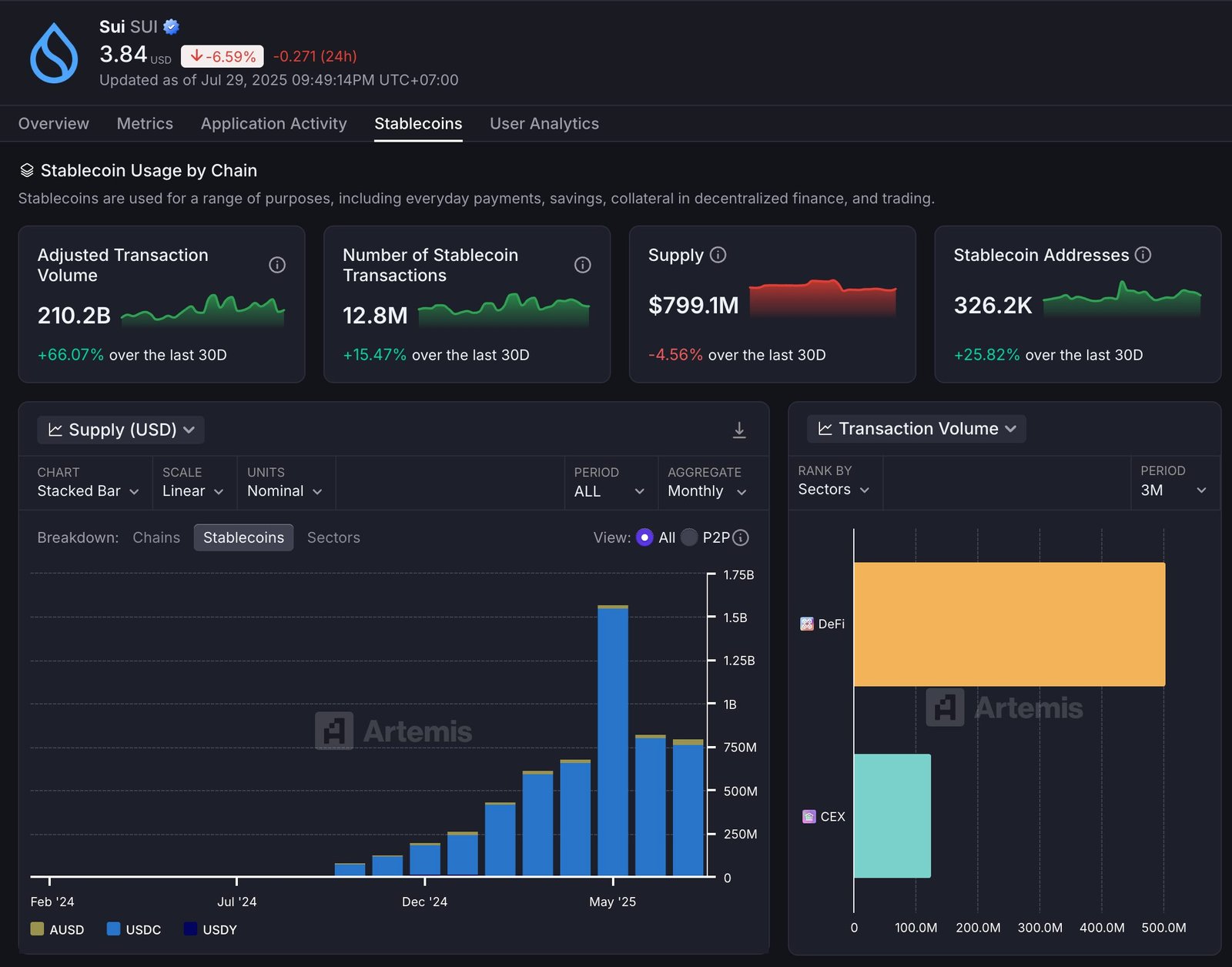

Sui Stablecoin Growth and On-Chain Payments

The growth of stablecoin usage within Sui underscores its rising traction in both DeFi and peer-to-peer payments. According to Artemis data as of July 29, 2025, adjusted stablecoin transaction volume surged to $210.2 billion—representing a remarkable 66.07% increase over the last 30 days. Concurrently, the number of stablecoin transactions hit 12.8 million (+15.47%), while the count of unique stablecoin addresses rose by 25.82% to reach 326,200.

Source: Artemis

While supply slightly declined to $799.1 million (−4.56%), monthly transaction volumes remain dominated by DeFi applications, with centralized exchanges trailing behind. USDC and USDY are the leading stablecoins by volume, with substantial growth seen particularly from May through July 2025. A robust stablecoin layer supports liquidity and enhances Sui’s appeal to developers who are building payment, lending, and synthetic asset protocols.

Sui NFT and Gaming Sector

The data, sourced from Messari and TradePort, illustrates the NFT sector shows signs of being “bullish.” The Sui blockchain’s trading activity for Q1 2025 reveals a total trading volume of 13.2 million SUI among the top 8 collections.

Source: Messari

At the top of the leaderboard is Fuddies, which dominates the market with 3.7 million SUI in trading volume, significantly outperforming all other collections. SuiFrens: Bullsharks follows with 1.9 million SUI, while SuiFrens: Capys ranks third at 1.4 million SUI. Three collections alone account for over half of the total NFT volume on the network.

For more: Best Sui Gaming and NFT Ecosystem

Sui Ecosystem Resurgence

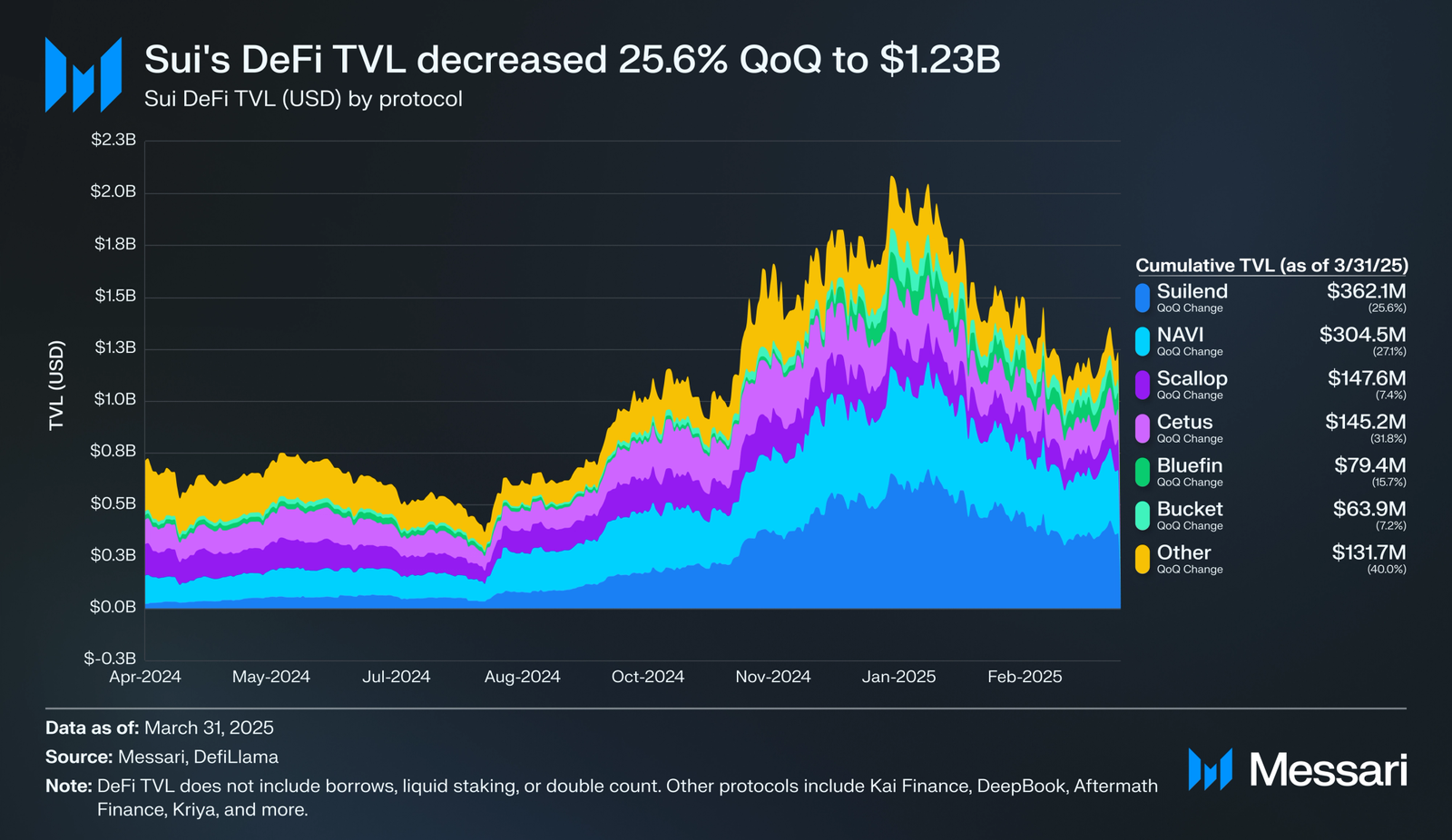

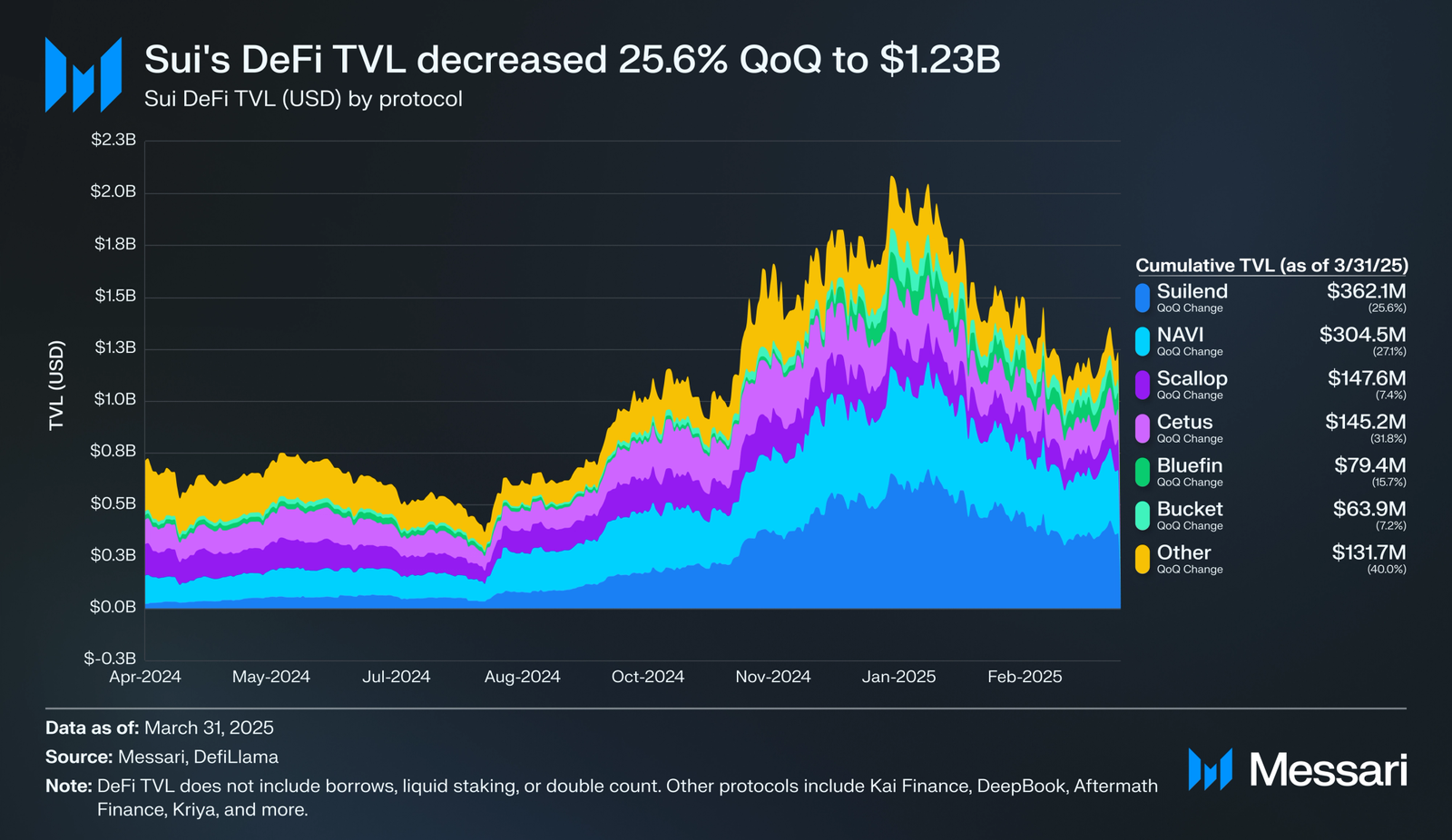

Crucially, we could see a resurgence in network usage following the recovery from the Cetus DEX exploit in late 2024. The Cetus event marks a significant move for the whole Sui ecosystem. Initially causing a dip in DeFi confidence in Sui security, the hack temporarily disrupted user growth and liquidity. Nevertheless, Sui’s ecosystem rebounded quickly, based on the hard work of the Sui Foundation during this recovery.

Source: Messari

Though recovered, the protocol’s revenue from transaction fees has also contracted, declining to $3.6 million—a 33.3% decrease quarter-over-quarter. Nonetheless, the network’s average transaction fee remains low at $0.0087, which is attractive for user onboarding and dApp deployment but doesn’t make any sense for protocol revenue.

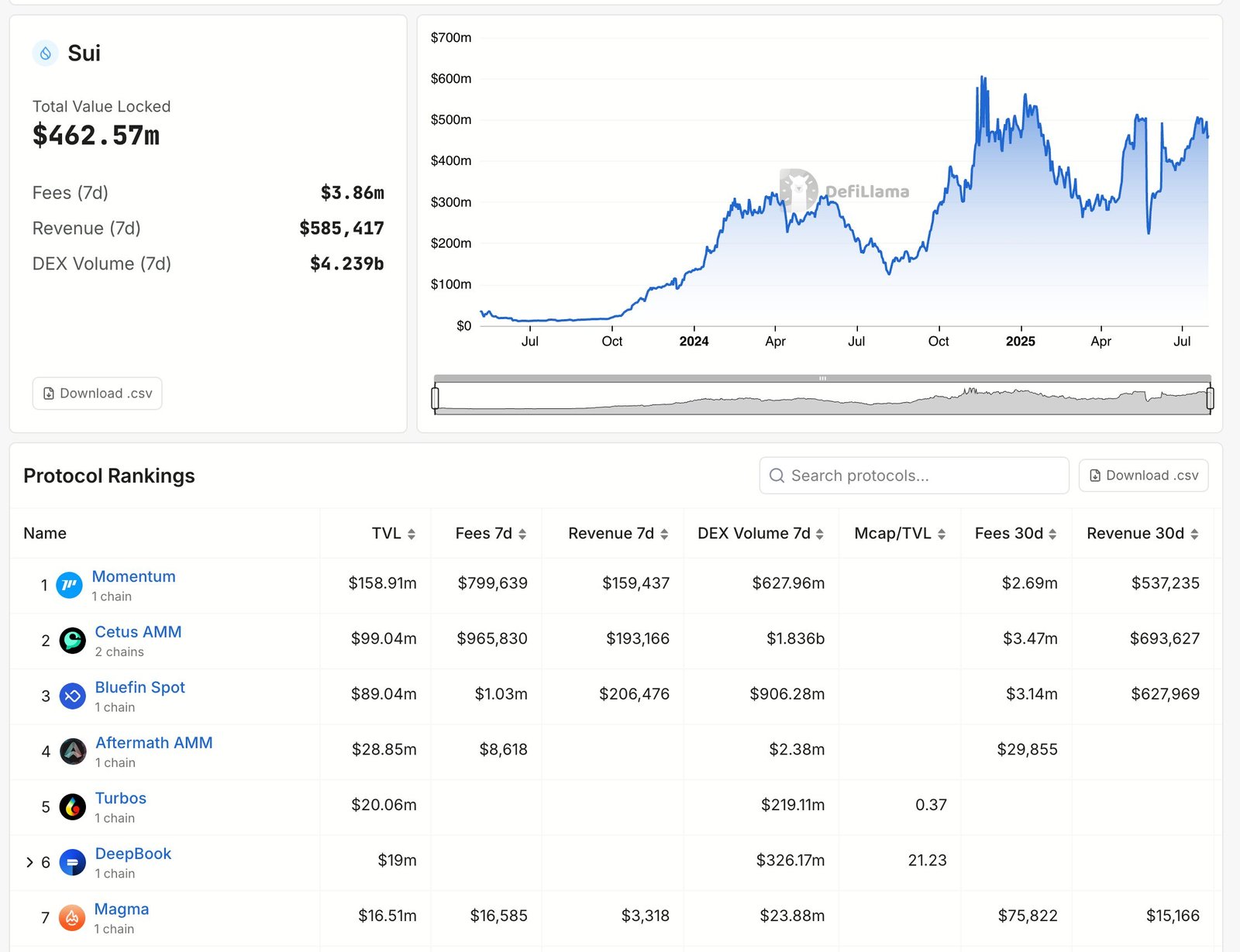

By Q1 2025, Sui TVL returned to over $460 million, and DEX trading volumes reached $4.3 billion in 7 days. Cetus alone reclaimed its dominant role with $193 million in 7 days of trading volume, followed by Bluefin and Kriya, demonstrating renewed trust in decentralized exchanges on the network.

Developer momentum remains another pillar of Sui’s ecosystem expansion. With over 1,400 monthly active developers as of mid-2025—up 219% compared to early 2024—Sui stands out as one of the fastest-growing chains in terms of builder engagement. Such developer interest is essential for sustaining long-term innovation and for nurturing a pipeline of high-quality decentralized applications.

Sui Projects Funding

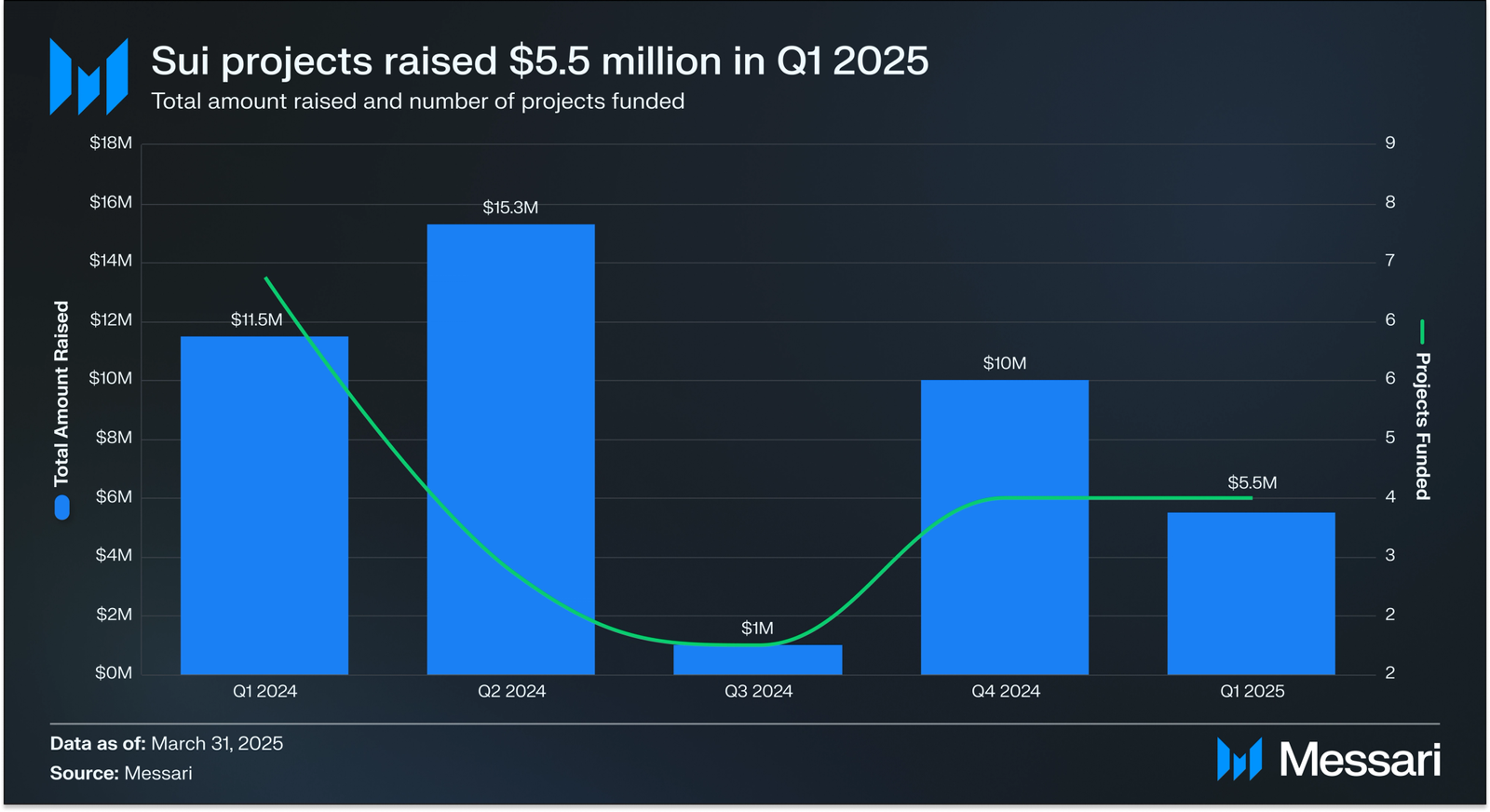

On the ecosystem funding front, capital inflows slowed in Q1 2025 compared to previous quarters. According to Messari, projects on Sui raised a total of $5.5 million in Q1, spread across four funded ventures. Compared to the $10 million raised in Q4 2024 and the sharp decline from the $15.3 million peak in Q2 2024, there was a temporary slowdown in VC sentiment.

Source: Messari

SUI Tokenomics and Market Performance

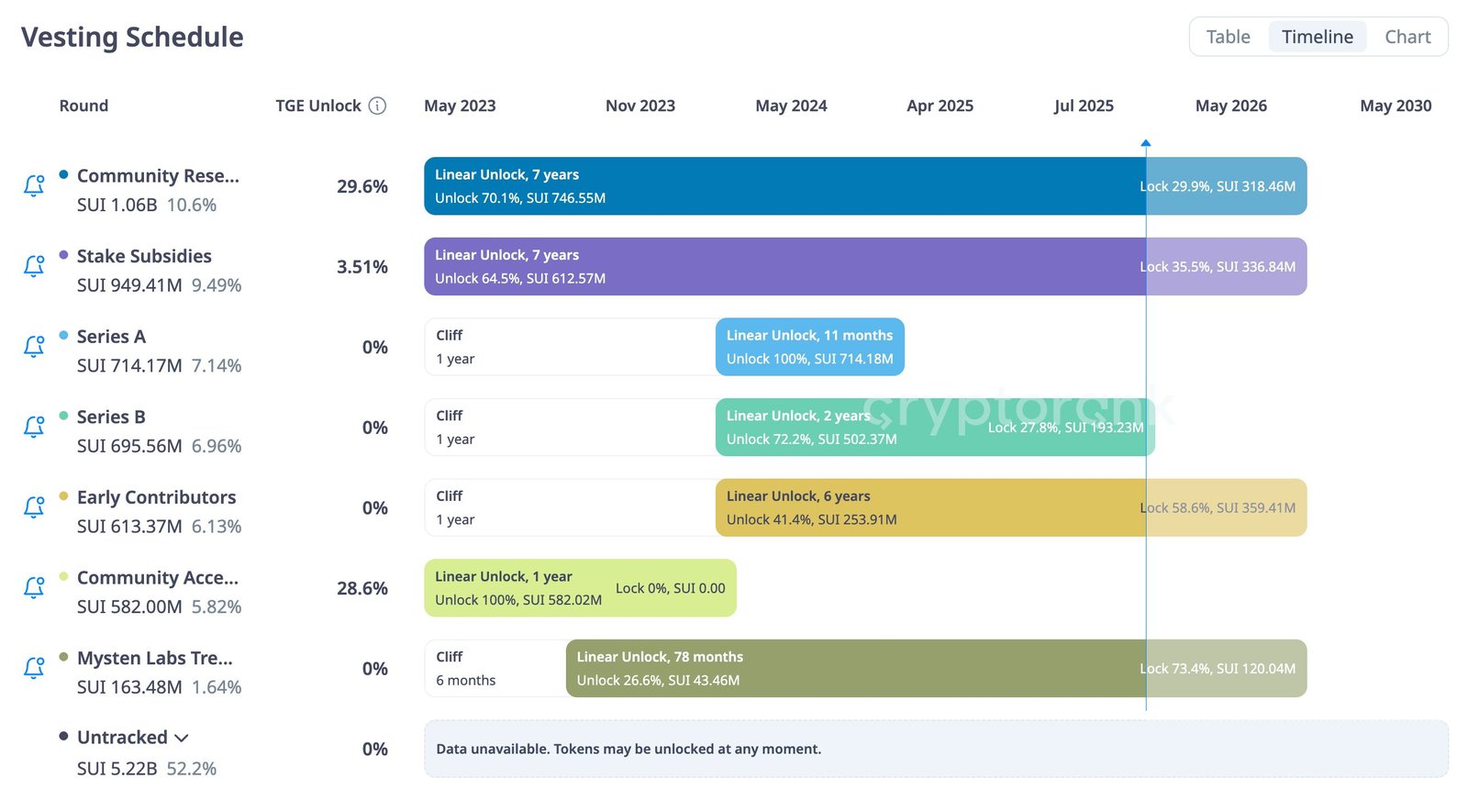

The tokenomics structure of SUI is both ambitious and contentious. Although the total supply is capped at 10 billion, only 3.17 billion tokens are in active circulation as of Q1 2025. During the same quarter, 242 million SUI tokens (2.42% of the total supply) were unlocked—primarily distributed to private investors, team members, and the community. Consequently, the market cap declined by 40.3% to $7.19 billion in Q1, ranking SUI 13th among crypto assets. The token’s price fell from $4.11 in Q4 2024 to $2.27.

Source: CryptoData

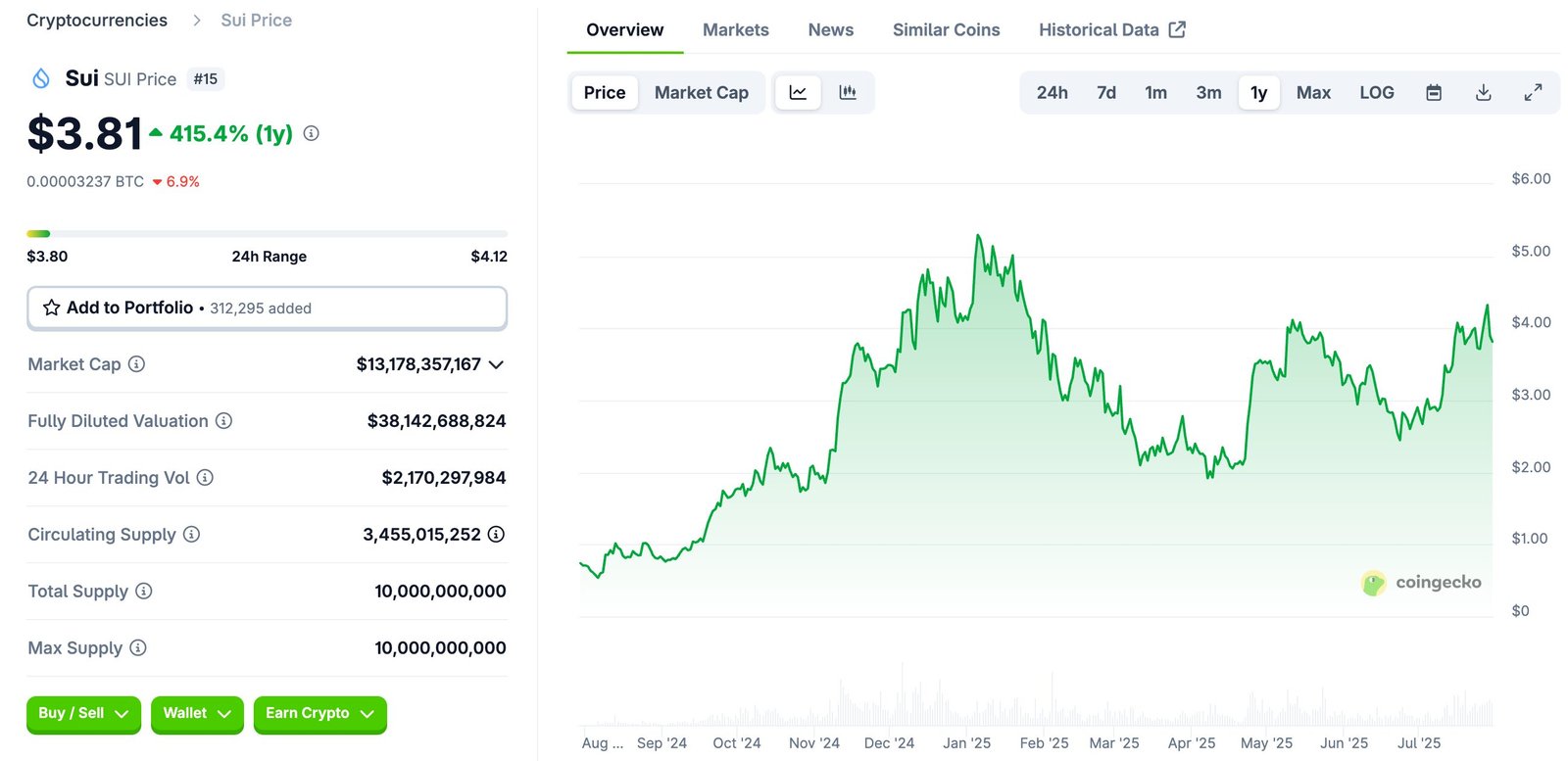

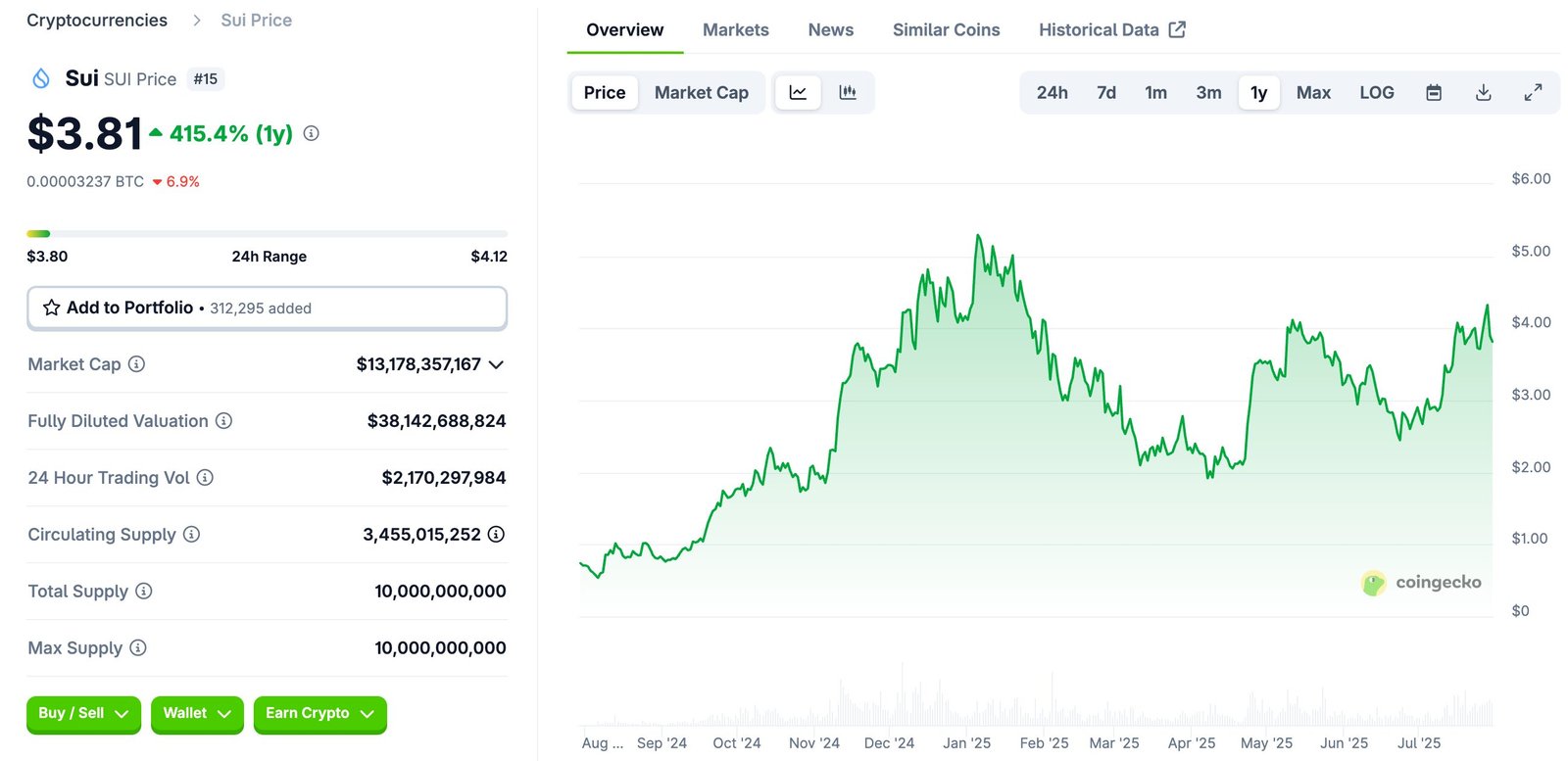

As of July 2025, SUI trades in the $3 to $4.5 range, with occasional spikes tied to network updates or incentive programs. Its performance over the year has been mixed—decently resilient in downturns but underwhelming in comparison to Layer 1 leaders like Solana or Avalanche.

Market analysts predict varied outcomes for SUI in the coming year. A bullish scenario—supported by broader altcoin interest and sustained adoption—could push prices toward $5–$6. A neutral path might see it stabilize around $3, while a bearish trend, driven by unlock oversupply or macro corrections, could bring it down to the $1–$2 range.

Source: Coingecko

Competing in a Saturated Layer 1 Market

In 2025, Sui competes in a congested Layer 1 landscape dominated by Ethereum, Solana, and upstarts like Aptos. While Ethereum continues to be the largest and most established Layer 1, its scalability challenges and high gas fees have created opportunities for competitors such as Solana. Solana has gained significant traction due to its high transaction throughput and low costs, but it has also faced criticisms regarding network stability and centralization concerns. Sui aims to offer a more robust and scalable alternative, particularly through its parallel execution capabilities and object-centric model, which theoretically allows for even greater throughput than Solana in certain scenarios.

Compared to Aptos, Sui’s object-centric model is a notable distinction. Aptos, while also using Move, employs an address-centric model. On the other hand, Sui’s approach is argued to be more intuitive for representing real-world assets and enabling more complex, composable applications. However, both chains are still relatively young and are actively building out their ecosystems, making a definitive long-term comparison challenging at this stage.

For more: Comparison of Monad vs Other L1s: Sui, Solana, Ethereum

To provide a clearer picture, let’s look at some comparative metrics:

| Metric | Sui | Solana | Aptos |

| Theoretical Peak TPS | Up to 297,000 | Up to 65,000 | Up to 160,000 |

| Observed Average TPS | ~55-120,000 | ~2,000-3,000 (non-vote) | Varies, often lower than theoretical |

| Total Value Locked (TVL) | ~$2.1 Billion | ~$4.5 Billion | ~$200 Million |

| Daily Active Addresses | ~1.1 Million | ~4 Million | Varies, generally lower than Sui/Solana |

| Monthly Active Developers | ~1,400 (219% increase in H1 2024) | Significant, but growth rate varies | Growing, but smaller than Sui/Solana |

Note: TPS figures can vary widely based on methodology (theoretical vs. observed, with or without vote transactions) and network conditions. TVL and DAA are dynamic and subject to change.

Sui’s focus on developer experience and its unique technical architecture position it as a strong contender in the Layer 1 race. With a strong capability of handling high transaction volumes and low latency, it is crucial for mass adoption, especially for applications like gaming and social media that require instant interactions. However, the success of any Layer 1 blockchain ultimately depends on its ability to attract and retain developers, users, and capital, which will be a continuous battle against well-entrenched competitors.

Is Sui a Good Investment?

Sui presents a compelling but speculative investment opportunity. We both know that from a technical architecture aspect, Sui shows its innovative strength, and its long-term scalability advantage could prove valuable if the chain gains traction with high-frequency applications. For long-term investors who are comfortable with risk and have conviction in emerging infrastructure plays, SUI could be a worthwhile position within a diversified portfolio. However, with long term investors, they should be prepared for near-term volatility driven by token unlocks and a still-nascent ecosystem. Especially when compared to more established Layer 1 or Ethereum-based protocols, the token’s current fundamentals do not justify a heavy allocation. Sui is currently the best high-beta option for investors looking to gain exposure to the upcoming generation of smart contract platforms.