- JUP could soar by 35% and reach $0.55 level if it closes a daily candle above the $0.43 level.

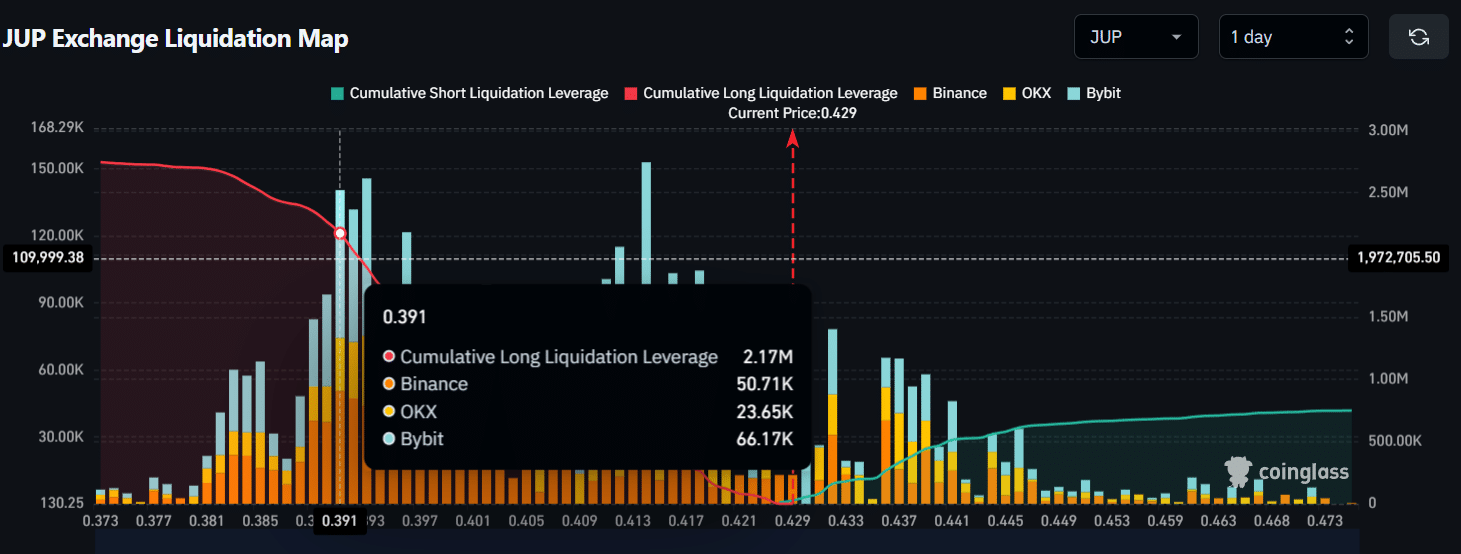

- Traders have built $2.17 million worth of long positions.

Over the past week, Solana-based Jupiter [JUP] has been garnering significant attention from crypto enthusiasts due to its impressive 30% rally.

This momentum has not only paved the way for continued upside potential but has also attracted traders who are increasingly betting on the bullish side.

At press time, JUP was trading near $0.426, recording a price surge of over 6.25% in the past 24 hours. Traders have shown strong interest and confidence in the token, leading to a 10% increase in trading volume.

Why is Jupiter’s price rising?

Experts and analysts believe that the primary reason behind this continued upside momentum is JUP’s DEX trading volume.

On the 22nd of June, the Jupiter DEX shared a report revealing that its trading volume had surpassed $1 trillion, with 1.7 billion transactions.

This highlights Jupiter’s strong market presence within the DeFi ecosystem, which not only helped the platform reach the $1 trillion milestone but also led to a significant surge in revenue.

At press time, data from DeFiLlama showed that Jupiter DEX generated $254,176 in protocol revenue over the past 24 hours, bringing its cumulative revenue to an impressive $200.65 million.

Price action and key technical levels

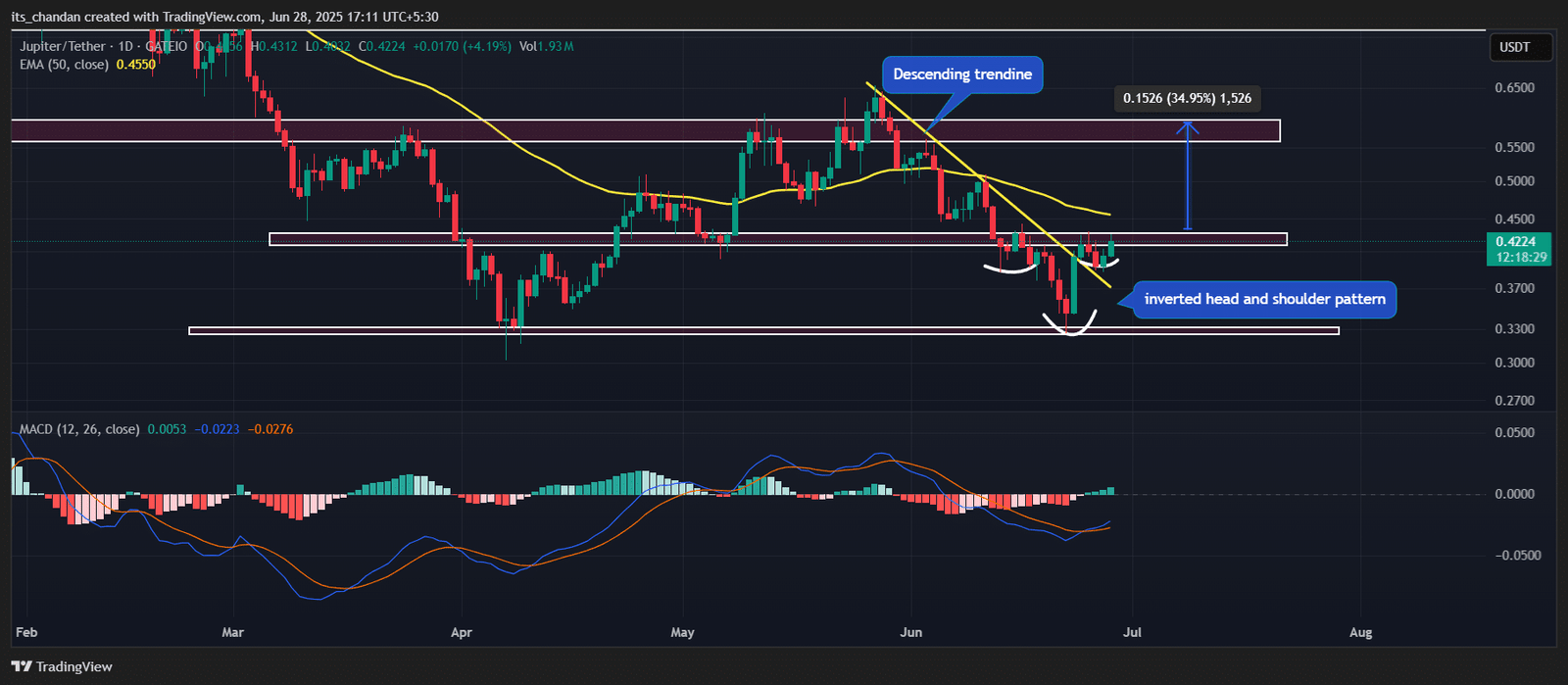

According to expert technical analysis, JUP appeared bullish and is on the verge of a significant upside move.

The daily chart revealed that the asset had recently broken out of a descending trendline, forming a bullish inverted head and shoulders pattern, which appeared on the verge of a breakout.

Based on recent price action and historical patterns, if the ongoing upside momentum continues and JUP breaks out above the neckline at the $0.43 level, there is a strong possibility that the price could soar by 35%.

Thus, price could reach the $0.55–$0.59 range in the near future.

This bullish outlook was further strengthened by the MACD, which crossed above the signal line following the recent rally.

Additionally, the MACD histogram bars have turned green and appeared to be growing in size, signaling a surge in bullish momentum and suggesting the potential for further upside in the coming days.

Traders’ eyes on the long positions

Given the current market sentiment, traders appeared to have a bullish outlook, as they were strongly betting on the upside, according to on-chain analytics firm CoinGlass.

Data shows that traders are over-leveraged at $0.391 on the lower side and $0.446 on the upper side.

At these levels, they have built $2.17 million worth of long positions and $612K worth of short positions, suggesting that the bulls are back and currently dominating the asset.