- PENGU jumped 22% after Cboe filed for the first ETF combining a memecoin and NFTs.

- RSI and DMI indicators showed bullish momentum, but $0.012 remained the key breakout level.

Pudgy Penguins [PENGU] soared 22% after defending the $0.009 support, climbing to a local high of $0.01160.

Volume followed suit, ballooning 287% to $339.58 million, indicating the move wasn’t a fluke. But what triggered the rush?

PENGU ETF news triggers a surge

In a significant development, the Chicago Board Options Exchange (CBOE) has filed Form 19b-4 with the SEC. According to the filing, the exchange plans to list the Canary PENGU ETF.

In this case, Canary’s proposed ETF aims to allocate 80-95% of its portfolio to PENGU and 5-15% to Pudgy Penguin NFTs. According to the proposal, the ETF will also comprise SOL and ETH to cover operational costs.

If approved, it would mark the first time a regulated fund pairs a memecoin with NFTs.

ETF or exit?

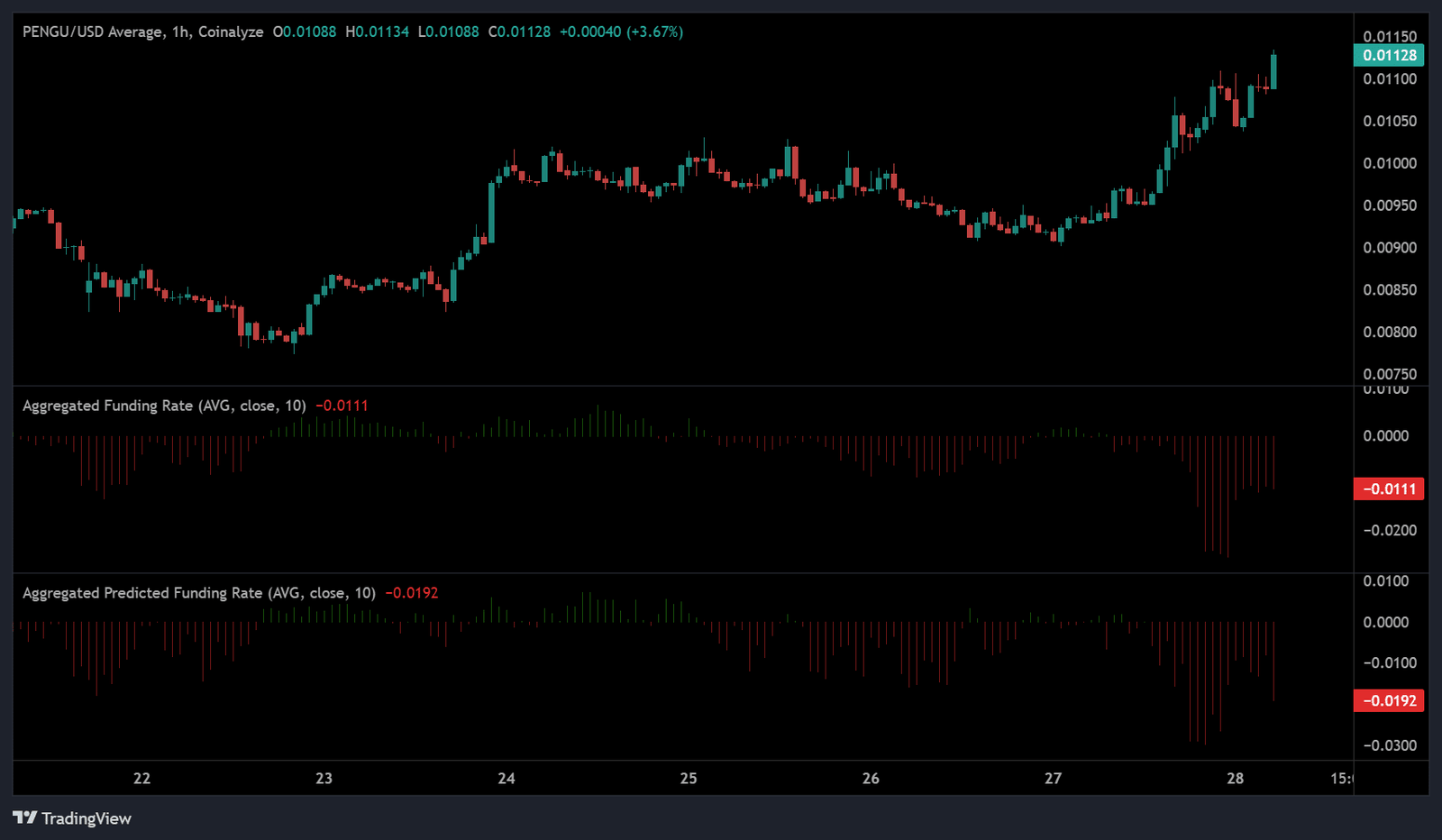

Of course, ETF headlines often cause short-term rallies. But what happens when derivatives traders refuse to follow? Take PENGU’s Funding Rate for example; that remained negative across all major exchanges.

As per Coinalyze, the predicted rate stood at -0.0192, hinting that most positions leaned short, despite the spot rally.

More telling was the 62% rise in Open Interest. This was driven by short positions, showing a clear bearish sentiment among investors.

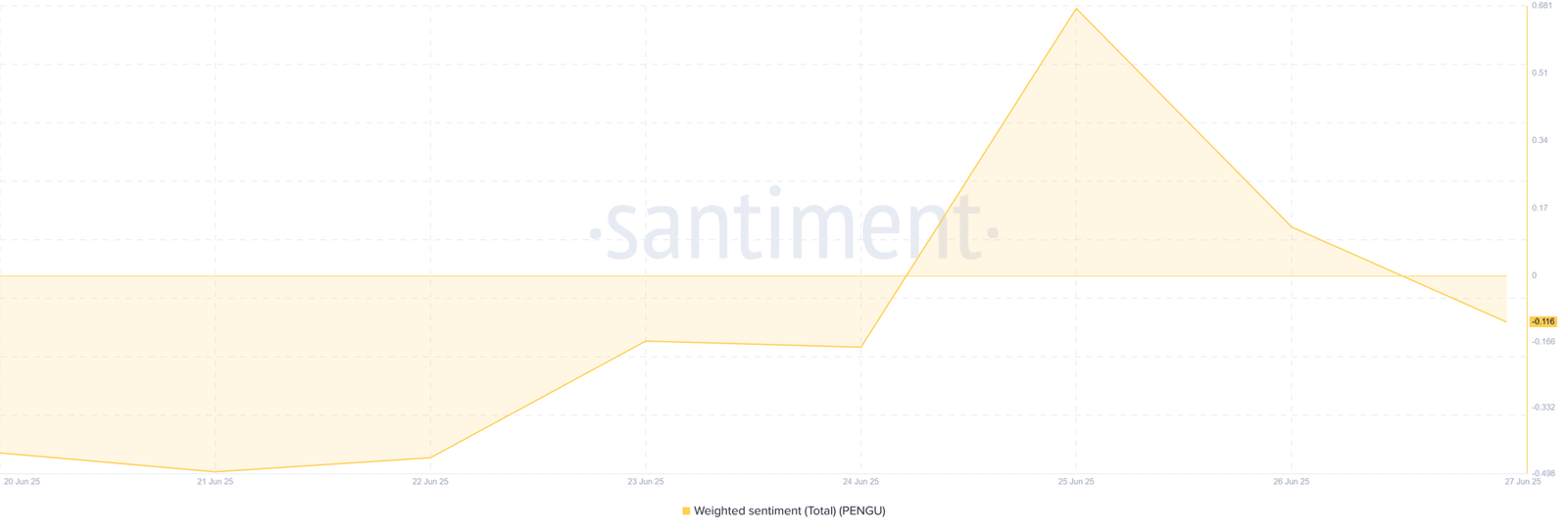

On-chain data backed the caution. Santiment showed Weighted Sentiment dipped to -0.116 as of the 27th of June, down from a local peak just days earlier.

Whales entering… but not to buy?

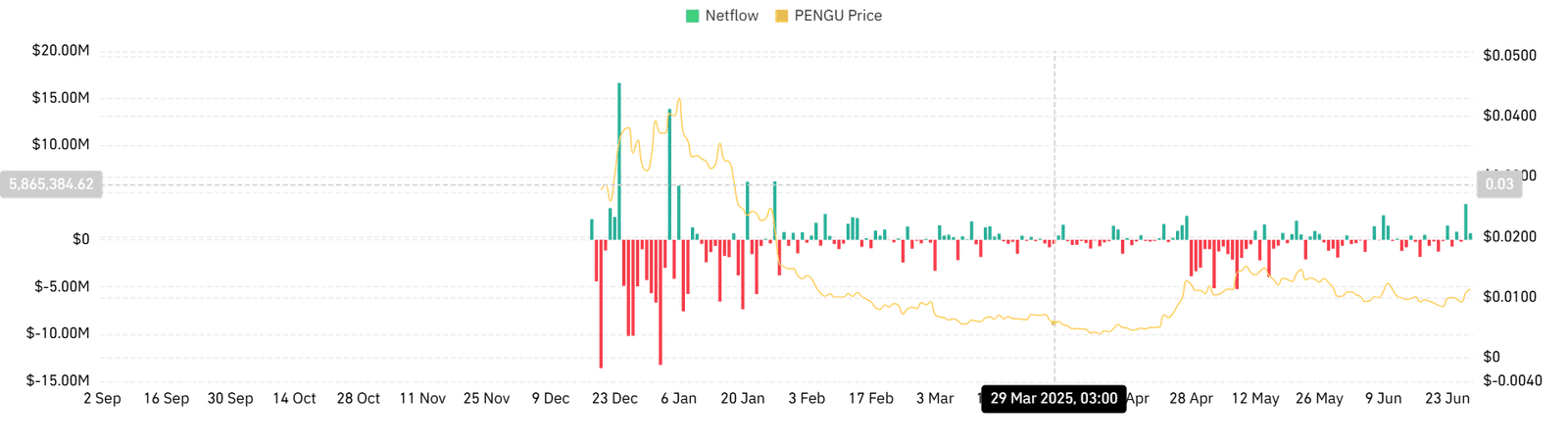

Besides activities in the Futures market, investors are also aggressively taking profit. According to CoinGlass, the memecoin’s Netflow remained in positive territory, reaching a high of $3.78 million.

A positive Netflow indicates a higher inflow of exchange relative to outflow. Historically, such a setup precedes higher selling pressure, resulting in downward pressure on prices.

Is Pudgy Penguins’ rally running out of room?

According to AMBCrypto’s analysis, the memecoin saw a strong upswing as speculators made a comeback. RSI hit 57.17, pushing into bullish territory and rejecting its previous downtrend.

Meanwhile, the Directional Movement Index (DMI) showed the +DI at 25.2, well above the -DI at 12.46—a setup that historically favors buyers.

Still, $0.012 remains a key resistance level.

If PENGU fails to break through it cleanly, a retrace toward $0.010 could follow—especially if the ETF speculation fades before regulatory approval lands.