80,000 BTC moved: What does this mean?

On July 4, 2025, eight Satoshi-era Bitcoin wallets moved a total of 80,000 BTC. Each wallet contained 10,000 BTC, sparking inevitable turmoil in the cryptocurrency space.

The Satoshi era is generally considered to span the years 2009 to 2011. During that time, Bitcoin (BTC) could either be transacted or mined with regular computer processors. Eight dormant Bitcoin wallets each sent a transaction of about 10,000 BTC recently. This has led to speculation that threats from quantum computing caused the transfers.

The coins weren’t sent straight to cryptocurrency exchanges. They went to new SegWit addresses, which suggests a security upgrade. SegWit addresses are thought to be securer against quantum threats than older ones. The old addresses use pay-to-public-key (P2PK) or reused P2PK hash (P2PKH), which are more vulnerable.

Some posts on X suggested that the transfer might show a security breach or quantum worries. However, these claims lack evidence and seem speculative.

Between July 14 and July 15, 2025, only 10 days after the large movement, the wallet owner sent a total of 28,600 BTC, now valued at over $3 billion, to Galaxy Digital. So far, 9,000 BTC has been sold, probably triggering a downtrend on July 15, when BTC dropped roughly 5% from its most recent all-time high of $123,000.

Did you know? Bitcoin’s price in 2011 fluctuated between $0.78 and $3.37 when the whale purchased Bitcoin. At an average of $2.45 per Bitcoin, the 80,000 BTC would have cost the whale an initial investment of $197,200. At today’s price of roughly $118,000, the whale’s BTC is worth $9.44 billion, an increase of approximately 4,800,000%.

What is the quantum threat to Bitcoin?

Quantum technology is a threat to Bitcoin as it may compromise your wallet’s private keys. This could potentially risk all the Bitcoin you have in that wallet.

Many believe quantum computers may break the Bitcoin network and pose a serious risk to its survival. Bitcoin developers are upgrading the system to tackle future risks, though the real threat is still years away. They focus on dormant Bitcoin wallets, as they are more at risk from quantum attacks.

Quantum could take advantage of weaknesses in the asymmetric cryptography protecting Bitcoin wallets. This includes the Elliptic Curve Digital Signature Algorithm (ECDSA) that Bitcoin uses for security.

Bitcoin wallets are secured by ECDSA to generate a pair of private-public keys. If the ECDSA algorithm is compromised, then your Bitcoins are at risk. Experts think practical quantum attacks might happen in five to 20 years and see 2030-2048 as possible dates.

Old wallets are the most vulnerable to a quantum attack, as they use P2PK or reused P2PKH addresses, where public keys are exposed. It is estimated that 5.9 million BTC (approximately 25% of the supply) are in P2PK or reused P2PKH addresses; therefore, those coins are vulnerable to future quantum attacks.

The 80,000 BTC moved came from P2PK addresses. Their public keys weren’t exposed yet since these were old Bitcoin transactions that had first-spend. This meant they were quantum-safe at that time. Moving them to SegWit addresses further enhances security.

Bitcoin developers, led by Casa founder and chief technology officer Jameson Lopp, have proposed a Bitcoin Improvement Proposal (BIP) to address the potential threat of quantum computing to Bitcoin’s security. The proposal aims to protect the network by freezing and phasing out wallets vulnerable to quantum attacks, which could potentially compromise around 25% of Bitcoin’s supply, including the estimated 1 million BTC held by Satoshi Nakamoto.

Bitcoin whale inactive for 14 years

Arkham Bitcoin whale analysis has analyzed the eight wallets and found that they belong to the same entity. This sparked speculation as to who this most recent Bitcoin whale is.

A crypto whale is an individual or entity that holds a substantial amount of a particular cryptocurrency, often enough to potentially influence market prices. A Bitcoin whale who all of a sudden moves 80,000 BTC after 14 years of inactivity was not going to go unnoticed. Bitcoin whale trackers analyze blockchain data and transactions, but being an open ledger, the blockchain is visible to everyone.

Suspicious activity had been recorded the day before the main BTC transfer. A transaction of 10,000 Bitcoin Cash (BCH) was made from a related wallet cluster, possibly to test private key access. This raised speculation of a potential hack, as noted by Coinbase director Conor Grogan, though no evidence has been found yet.

Yet one of the most supported theories is that this was Roger Ver’s Bitcoin movement due to his early involvement with Bitcoin since 2011. Ver, also known as “Bitcoin Jesus,” was arrested in Spain on US tax evasion charges in April 2024. He is accused of failing to pay $48 million in taxes on the sale of $240 million worth of Bitcoin.

He was released on bail in June 2025, just before the movement occurred, sparking further speculation that the wallets are his.

Did you know? These 10,000-BTC movements come from eight wallets. Each one marks the largest Bitcoin transaction ever. The previous record for the biggest single transaction in Bitcoin history was a mere 3,700 BTC.

What are OP_RETURN messages?

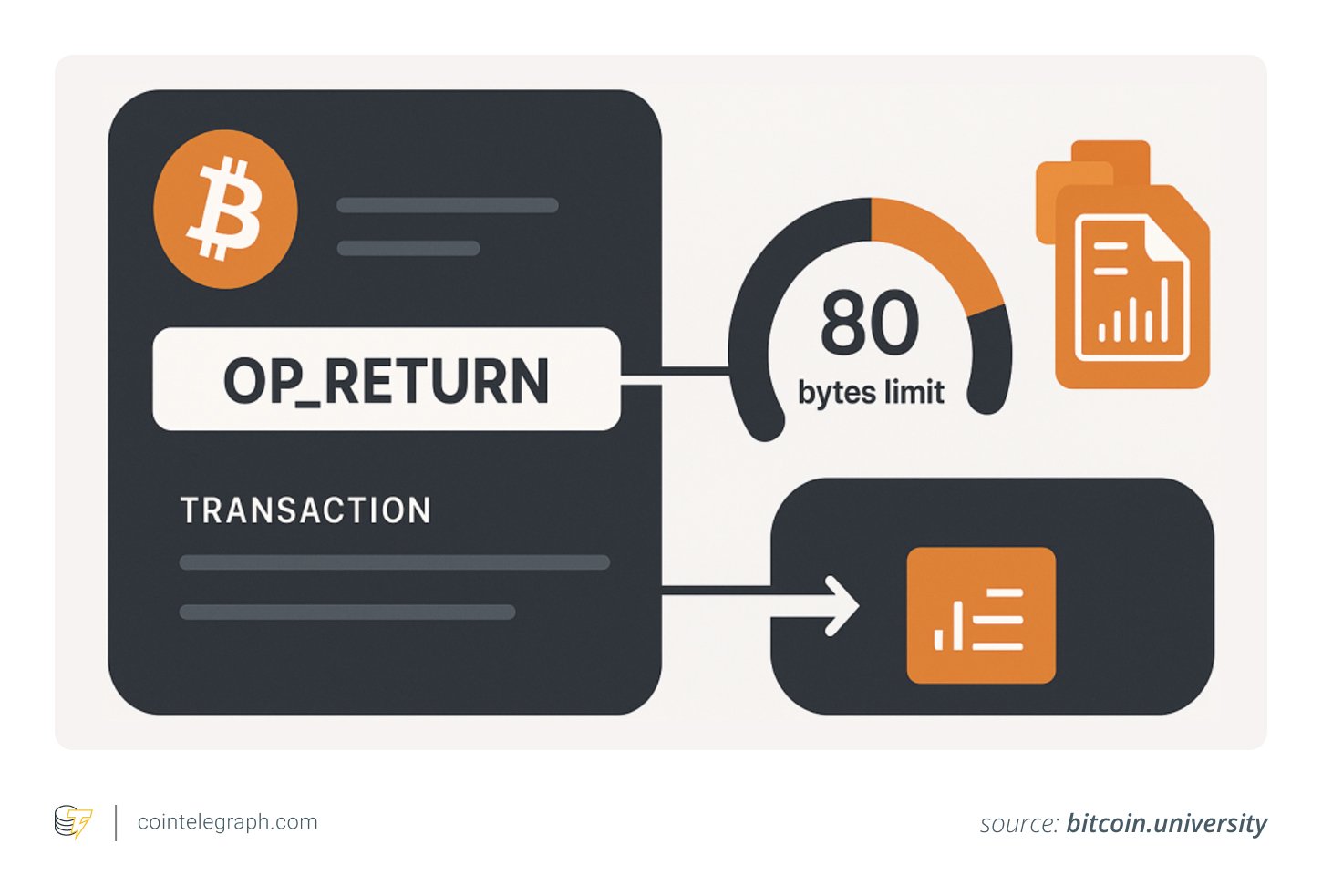

OP_RETURN messages are a feature of the Bitcoin blockchain that allows users to embed small amounts of data, with a maximum size of 80 bytes, directly into a transaction, which marks the output as unspendable.

From July 1 to July 4, 2025, four OP-RETURN messages were added to the Bitcoin blockchain. These messages were sent to several wallets at the same time.

The first, on July 1, 2025, at 00:30, reads:

“LEGAL NOTICE: We have taken possession of this wallet and its contents.” (Transaction ID: 4f7c80c05fd77a9c9b180f7f6400560d1ab6cf3a4ba1b6bf7429eeeefa500a05).

Three additional messages were sent over the next few days, culminating on July 4, 2025. One message gave the wallet owner an ultimatum. They need to prove ownership by making an onchain transaction with their private keys by Sept. 30, 2025.

There’s no proof of a hack. It’s more likely a planned spam campaign. This could be to trick the wallet owner into moving funds to show control. Scammers often target dormant wallets, claiming they are abandoned.

The spam campaign triggered speculation across various online platforms. Some speculated that the OP_RETURN messages were a “legal stunt” or scam to pressure the whale owner into revealing themselves.

Others called the messages “blockchain graffiti.” This is often a way to fill the chain with bold data. However, their specific focus and timing show clear intent.