Let’s be honest.

Last month, I released a white paper explaining that conservative investors should allocate 10% to crypto, moderate clients should invest 25% and aggressive investors should place 40% of their portfolios into crypto.

Bitcoin has outperformed every other asset class for 12 of the past 15 years, and it’s highly likely that it will continue to do so for years to come. Institutions are investing like never before. Congress and the administration now fully support crypto, and we’re beginning to get the regulatory clarity we’ve wanted.

The SEC and FINRA’s prohibitions that blocked brokerage firms from trading or custodying crypto have been rescinded. The OCC and the Fed have revoked similar prohibitions against banks, and the Department of Labor has rescinded its objection that prevented 401(k) plans from offering bitcoin as an investment option.

Despite the growth and performance of bitcoin, I keep seeing suggestions that people ought to allocate only 1 or 2 percent to crypto. In my opinion, that is no longer enough. Crypto is no longer speculative. It is no longer niche. It now deserves to be treated as a core allocation.

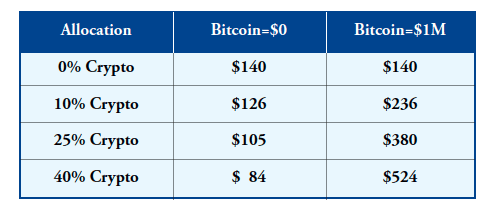

Consider this hypothetical illustration, comparing a traditional 60/40 portfolio of stocks/bonds to portfolios that hold 10 percent, 25 percent or 40 percent in bitcoin. Let’s assume we invest $100 for five years, earning 7 percent annually in the 60/40 allocation. Let’s also look at two extreme outcomes: bitcoin either becomes worthless, or it rises in five years to $1 million (roughly a 10x increase from today).

As you see in the chart below, the $100 invested in the 60/40 portfolio rises to $140 after five years. Not bad. But the portfolio with a 25 percent bitcoin allocation could be worth more than 250 percent more. Even if bitcoin were to become worthless (and you held it all the way to zero), your portfolio would still be profitable – with a value above your original investment. Seems to me that the risk/reward ratio strongly favors a significant crypto allocation – and certainly one that’s far higher than a measly 1 or 2 percent.

Potential Range of Portfolio Returns Based on Bitcoin Allocation

Bitcoin’s price appreciation isn’t speculation – it’s just supply and demand. In Q1 2025, public companies purchased 95,000 bitcoins – more than double the new supply. And that’s from just one category of buyers – it ignores additional demand from retail investors, financial advisors, family offices, hedge funds, institutional investors and sovereign wealth funds. This massive imbalance between supply and demand is driving bitcoin’s price to all-time highs. I predict that bitcoin will reach $500,000 by 2030 – a 5x increase as of this writing.

The adoption curve has tremendous room to run – supporting the thesis that there is substantial upside yet to come in bitcoin’s price. Read the white paper for more.