Key Takeaways

Sonic offered conflicting signals of its next price move as it approached the $0.36 resistance level. Traders need to exercise patience and wait for the market to show its hand.

Sonic [S] has rallied 19.4% in 24 hours at press time, and it could go higher still for the day. On Tuesday and Wednesday, the 29th and the 30th of July, S tested the local support level at $0.297.

The $0.3 zone has been a key support level for a month.

Sonic’s price action has been range-bound over the past month. The bulls teased a breakout on the 18th of July, but this attempt was met with rejection.

This group have had the upper hand in July, according to the OBV.

Trading the Sonic range

S has traded within a range (white) from $0.3 to $0.418. At press time, the mid-range resistance at $0.356 was about to be tested as resistance.

While the OBV has climbed higher over the past week to show buying pressure, the CMF has remained below +0.05.

The CMF can be relied upon more in this instance, as the MFI also showed weakness from the bulls. Hence, it appeared likely that S might lack the strength to push beyond the $0.356 resistance.

The 4-hour chart showed a bullish structure and strong demand in recent trading sessions. The trading volume has been high in the lower timeframes, compared to the past few days.

The volume indicators agreed that demand has been consistent and supported the idea of a move past the $0.36 resistance.

The MFI’s reading of 76 also showed bullish strength. Overall, the H4 chart differed from the 1-day timeframe and indicated a move higher was likely.

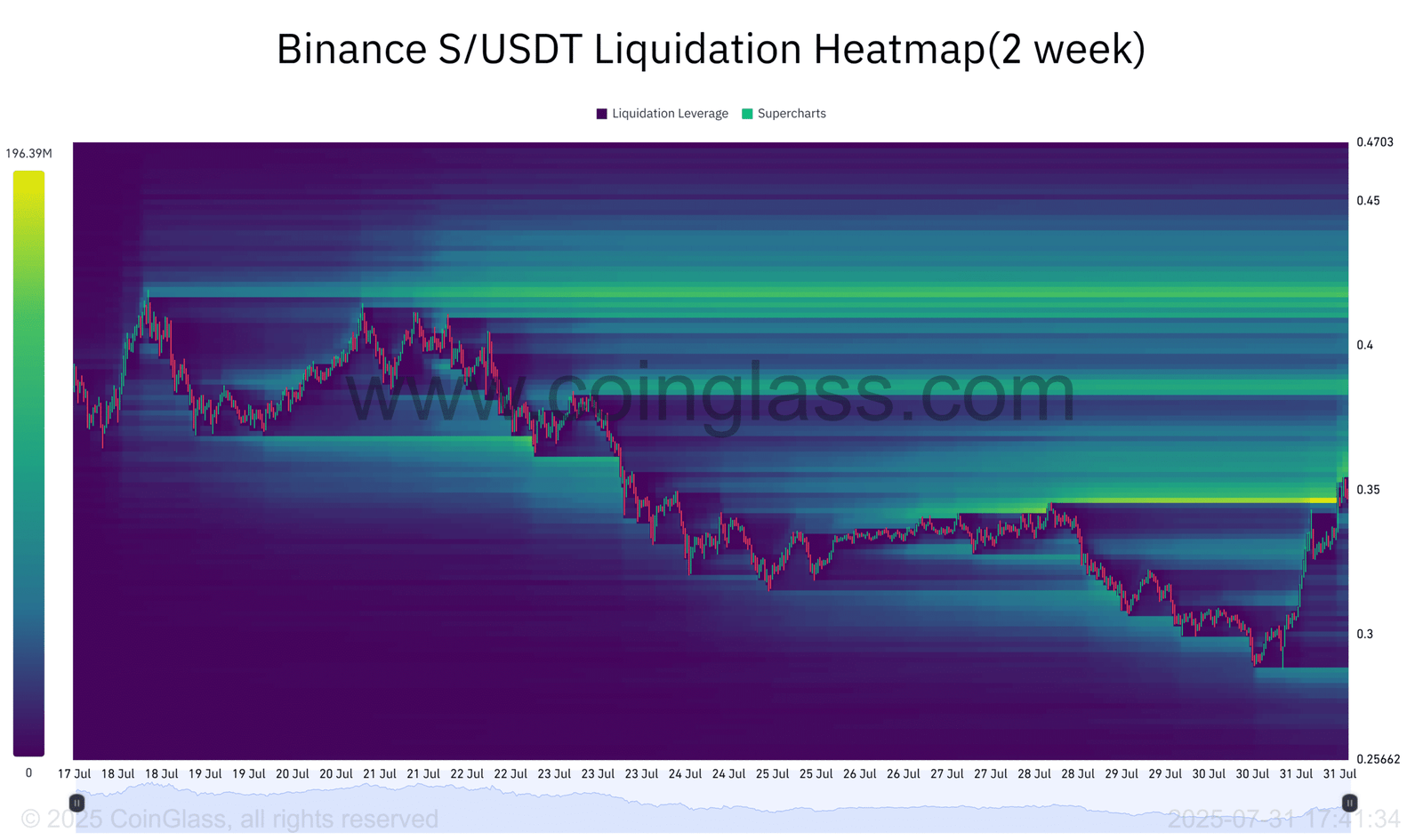

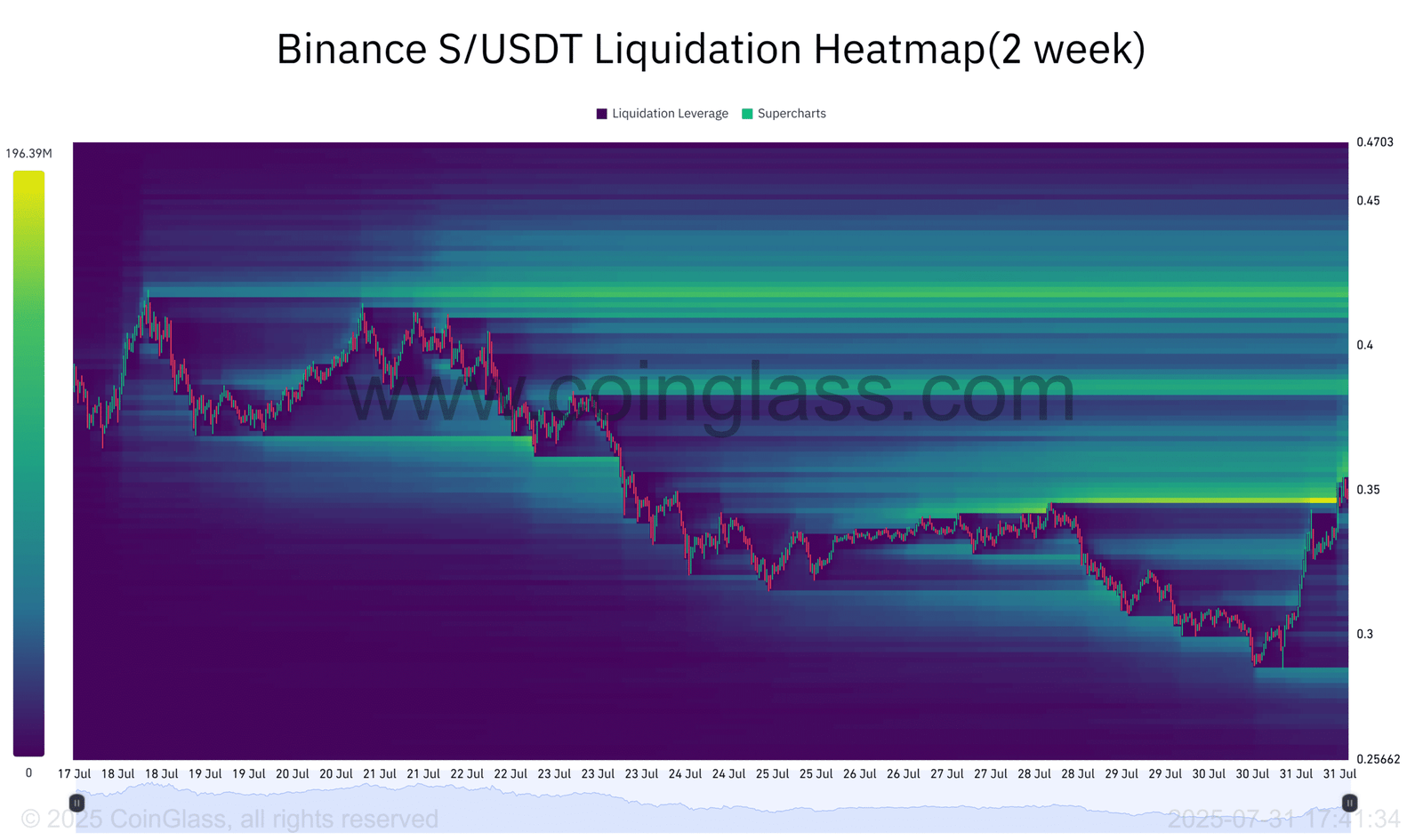

Source: CoinGlass

To resolve the differing findings, the liquidation heatmap was examined. It showed that a collection of liquidation levels at the $0.35 area has been swept in recent hours.

Overhead, the $0.36-$0.362 area was a magnetic zone.

It could pull Sonic prices higher, before acting as a barrier and causing a rejection. For that to occur, long liquidations have to build up underneath the market price. There was a hint of that happening at the $0.34 zone.

The evidence put together showed that traders must be careful. A move past $0.36 and a retest of the mid-range level as support could offer a buying opportunity with a tight stop-loss.

Going long in anticipation of a breakout might end in a failed trade, and waiting for a breakout could be the wiser option.

Similarly, an early short position could hurt a trader, especially if Bitcoin [BTC] turns bullish with a move past $118.6k.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion