Spot Bitcoin ETFs recorded a net inflow of $363 million on Friday, marking the twelfth consecutive day of net inflows amid strong investor interest.

BlackRock’s iShares Bitcoin Trust (IBIT) led the inflows with a net addition of $496.75 million, strengthening its position as the largest spot Bitcoin (BTC) ETF with $86.50 billion in assets, according to data from SoSoValue.

Fidelity’s Bitcoin ETF (FBTC) experienced a slight outflow, losing $17.94 million, while Grayscale’s Bitcoin Trust (GBTC) saw a larger outflow of $81.29 million despite managing $21.45 billion in assets. Ark’s Bitcoin Strategy ETF (ARKB) recorded a net outflow of $33.61 million.

Grayscale’s Bitcoin ETF remained steady with no net inflow or outflow, managing $5.37 billion. During the day, the total value traded was approximately $4.62 billion.

Related: The rise of ETFs challenges Bitcoin’s self-custody roots

Bitcoin ETFs attract $6.6 billion in 12-day streak

Spot Bitcoin ETFs attracted about $6.62 billion in net inflows over the 12-day positive period.

During this period, July 10 recorded the largest single-day inflow with $1.18 billion, closely followed by July 11 with $1.03 billion. This was the first time these products saw over $1 billion in inflows on two straight days.

Other notable inflows occurred on July 16 and July 3, with $799.40 million and $601.94 million, respectively. On the other hand, July 8 showed the smallest net inflow at $80.08 million.

The cumulative total net inflow into spot Bitcoin ETFs has now reached $54.75 billion. Meanwhile, total net assets under management stand at $152.40 billion, accounting for 6.51% of Bitcoin’s market capitalization.

Related: Bitcoin ETF inflows show institutions ‘doubled down’ on BTC at $116K

Spot Ether ETFs gain momentum

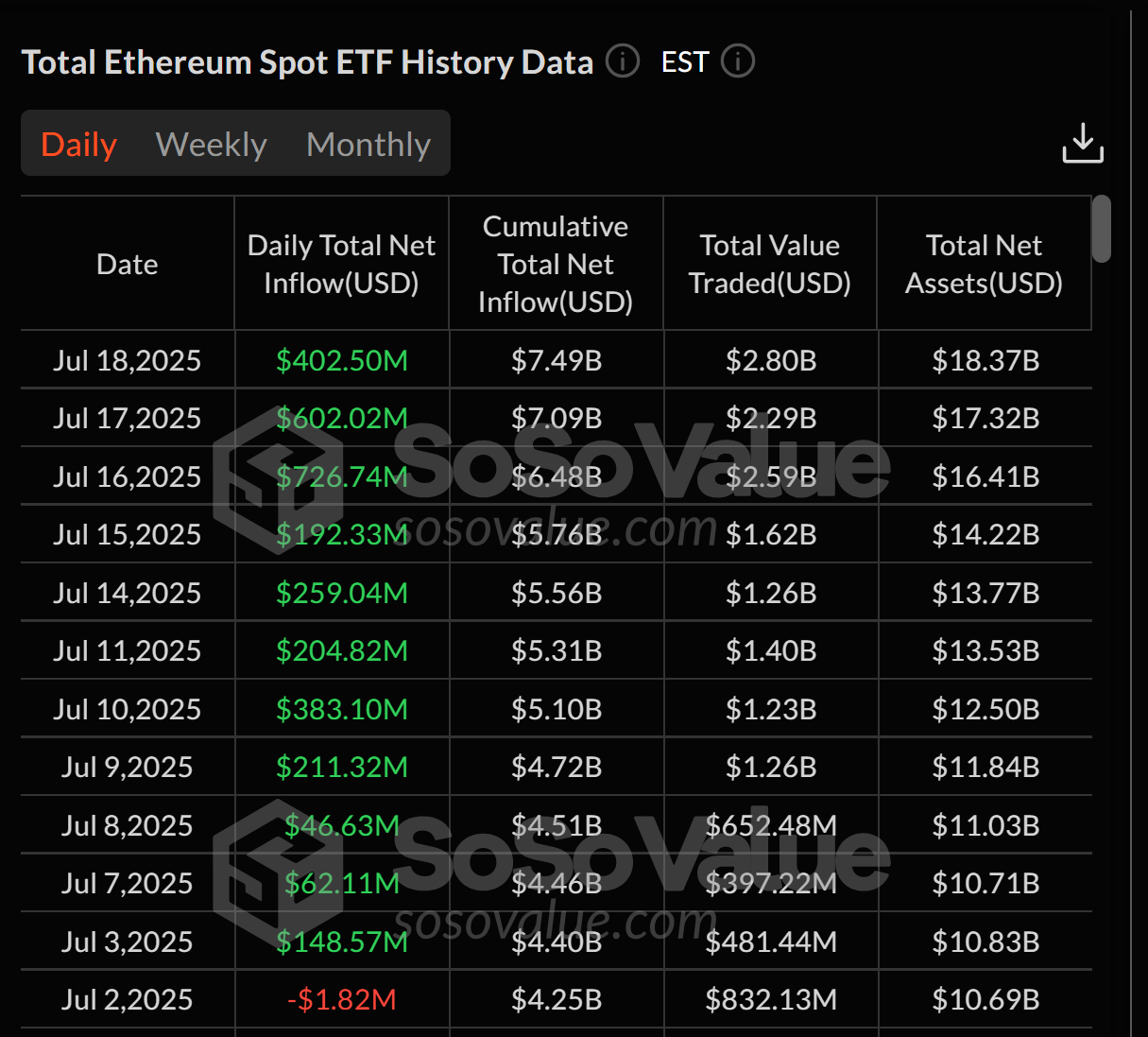

Spot Ether (ETH) ETFs have also seen significant inflows over the past two weeks. On Friday, Ethereum spot ETFs recorded a net inflow of $402.50 million, contributing to a cumulative total net inflow of $7.49 billion.

During an 11-day inflow streak, July 16 marked the peak for Ether ETFs with a record $726.74 million net inflow, the highest daily gain since their launch. July 17 also saw robust inflows of $602.02 million.

Magazine: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments — Trezor CEO