Key Takeaways

Whale takes profit as SPX6900 surged to a new ATH. However, the overall profitability presents a different picture. Will SPX6900 now drop back to the trendline support for a continuation of the rally?

On the 20th of July, Onchain Lens reported a whale deposited about 2.53M SPX6900 [SPX] tokens into Bybit, amassing a profit of $4.46M as price traded around its new highs.

This whale had earlier received about 13.34M SPX, but was still holding more tokens with a value of more than $11M at the time of writing.

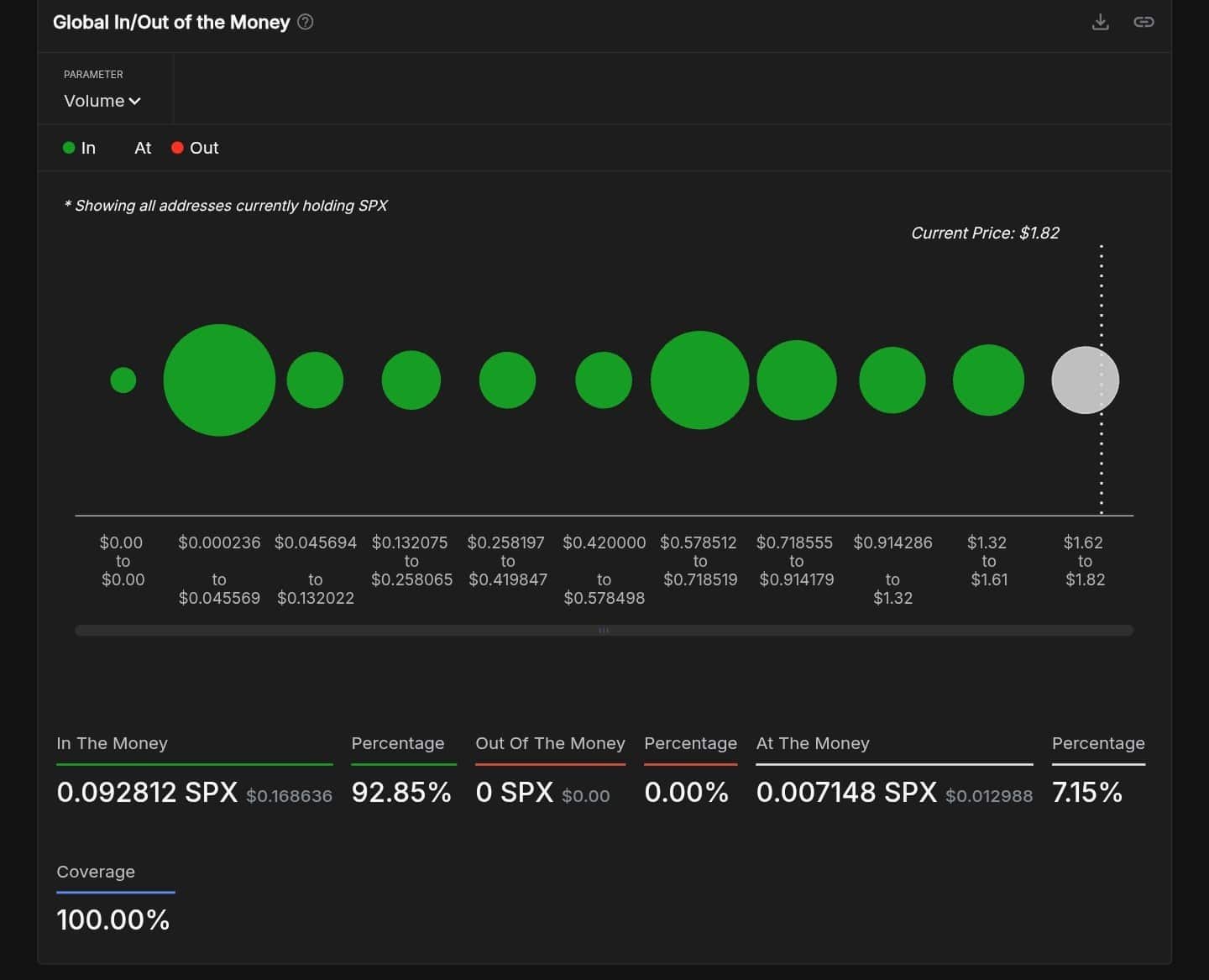

However, looking at the overall profitability of holders, IntoTheBlock data showed that the metric was in the 90th percentile. On the other hand, no on-chain traders were in loss, but 7% were at break-even.

Using a concentration of accumulation addresses showed the two most significant supports were between the $0.57-$0.72 and $0.00024-$0.05 where 2,140 and 1,790 addresses bought SPX.

The latter seem to have accumulated during its earliest period. The most recent supports were between the $1 and $1.32 zones.

While most of the holders are staying profits, the sentiment seems to be far from being over.

The current holders are likely to hanger on tighter for more gains, and their notable numbers could help in keeping the memecoin as the best-performer in this cycle.

This follows as 74% of traders have held for a period between one month and one year, but only 3% had it longer than a year.

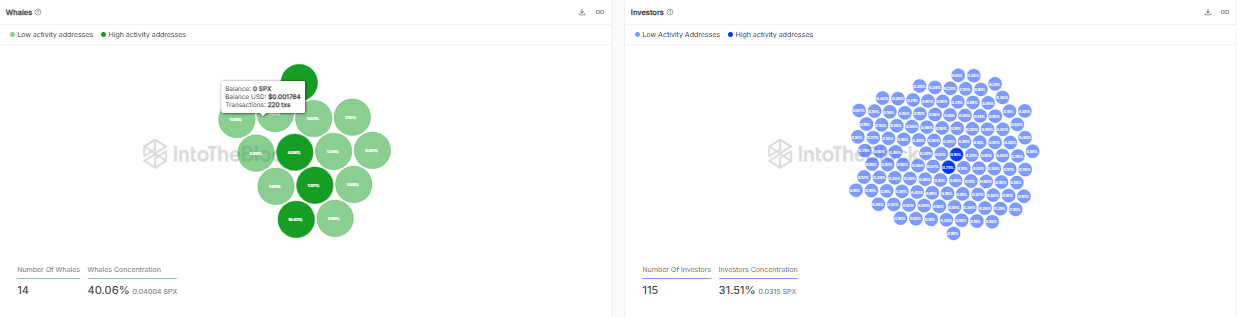

Meanwhile, the 14 whales accounted for 40% of all addresses that held more than 1% of the tokens total supply. Investor were only about 31.51% representing 115 participants.

That in mind, where could price action of SPX be headed?

Will the trend pause after new ATH?

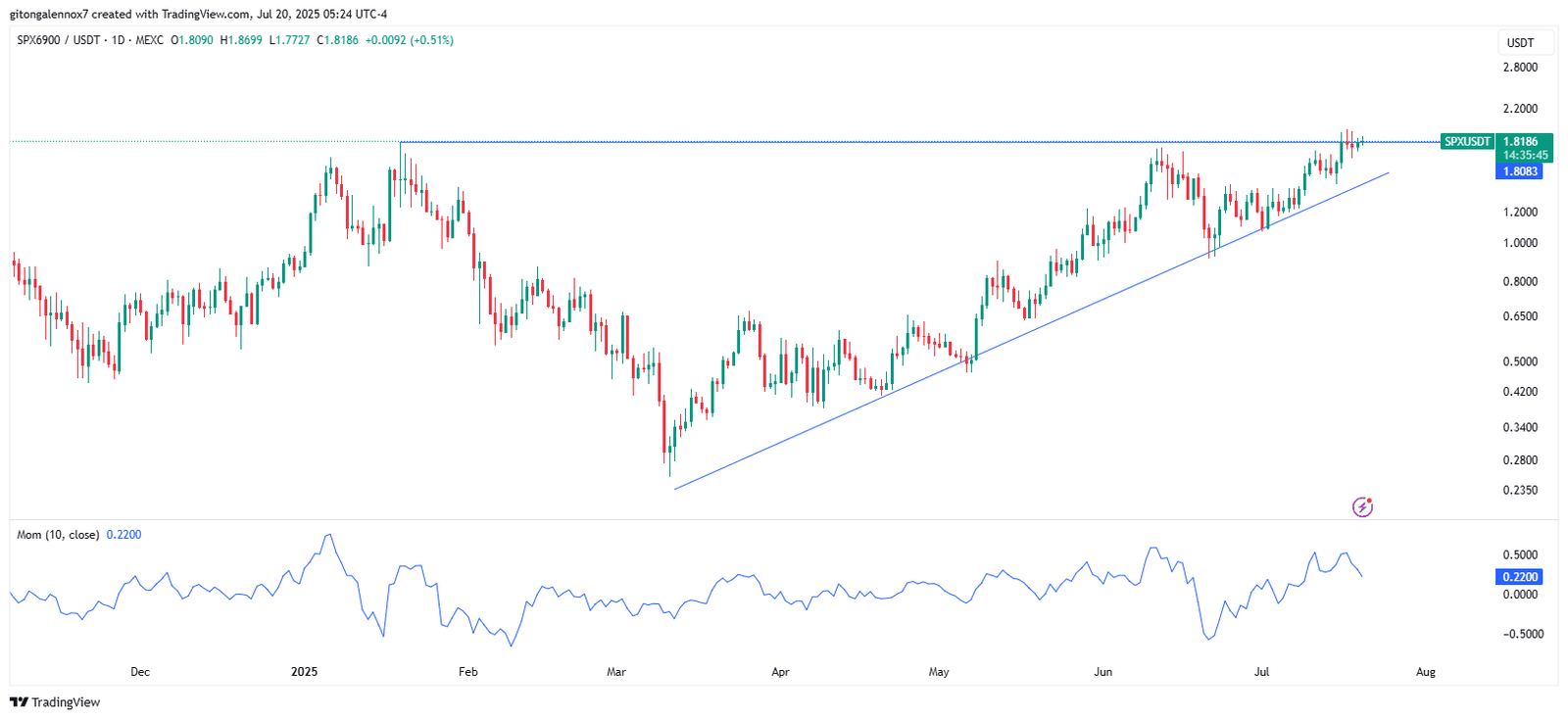

Technically, SPX6900 looks super bullish, with the price action having respected a rising trendline support since the 11th of March. Every time the memecoin has hit this trendline, it has resulted in a bounce.

The memecoin seems to be completing a triangle pattern, hinting another bounce toward the support could result in a breakout.

However, the momentum indicator has started to fade following the slow movement at the area around the ATH at $1.83.

On the flipside, SPX6900 could break below the ascending triangle. This would turn the price action bearish in the short-term.

The shift in structure could be heightened by continued selling, especially if major whales started offloading. To wrap it up, SPX is still bullish at the moment, but that could change.