- SUI has broken below a key support as bearish sentiment intensifies.

- Derivatives data shows declining interest and rising short positions.

- Network activity has dropped sharply, signalling weak fundamental support.

The price of Sui (SUI) has come under intense pressure in recent days, stirring concerns among traders and investors about the possibility of a deeper correction in the near term.

After what appeared to be a promising rally above the $4 mark, SUI has since reversed its gains and now flirts with a crucial support zone that could decide the token’s next major move.

Notably, SUI opened the week on a bearish note, and it has continued to drop, shedding over 5% in the last 24 hours to trade around $2.75. This marks a significant pullback from its recent high of $3.51.

Although the token still maintains an impressive 255% gain over the past year, its short-term momentum has notably weakened.

SUI price analysis signals caution

SUI recently broke down from a triangle pattern, triggering a wave of selling that has pulled the token back to a familiar support level at $2.78, which acted as a floor in late March.

A failure to hold this zone on a daily close could trigger a steep drop toward the $2.24 level, which aligns with the 23.6% Fibonacci retracement level from the all-time high of $5.35 and the year-to-date low of $1.71.

Adding to the concern, momentum indicators are flashing mixed but generally negative signals.

While the Relative Strength Index (RSI) is nearing oversold levels at 33.64, it has also formed a bullish divergence that some traders believe could signal a reversal.

However, the Moving Average Convergence Divergence (MACD) remains in bearish territory, showing no clear sign of upward momentum just yet.

SUI derivatives market shows a bearish market sentiment

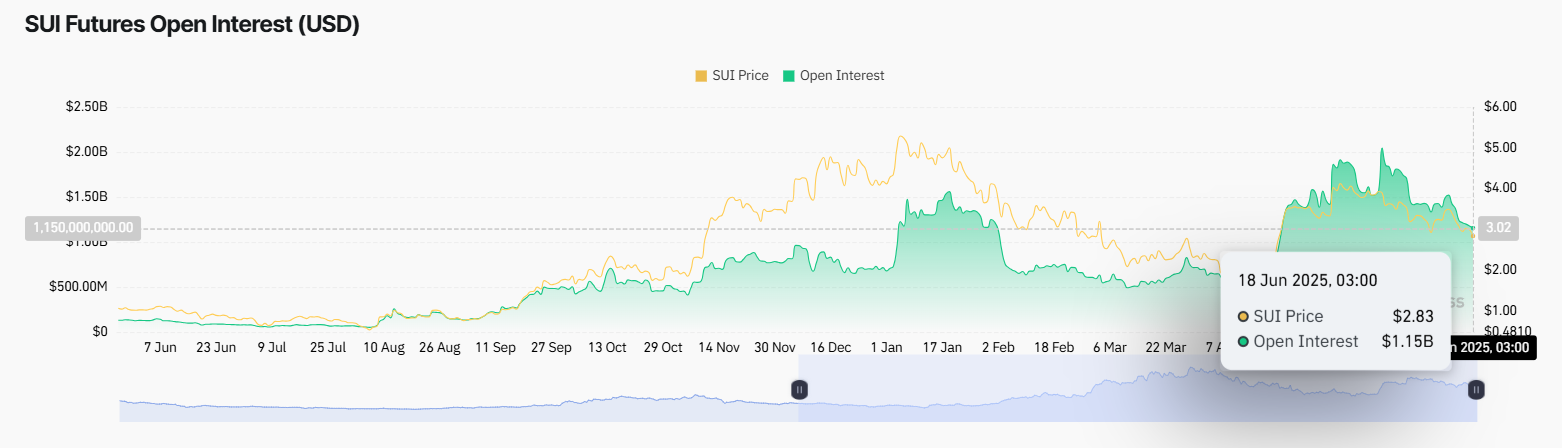

Data from Coinglass highlights a significant drop in Open Interest (OI) for SUI, which currently stands at $1.15 billion — the lowest in nearly two months.

This marks a 43% decline from its peak of $2.05 billion recorded in May, indicating a clear outflow of capital from the derivatives market.

The declining OI is accompanied by a falling OI-weighted funding rate, currently at 0.0060%, further suggesting reduced bullish enthusiasm.

Additionally, the taker buy/sell volume reveals that short positions now dominate, accounting for 55% of volume, compared to 45% for longs.

These figures point to a decisive shift in trader sentiment, with the long/short ratio at 0.8195 indicating a prevailing bearish bias.

Unless sentiment improves, the pressure on spot prices is likely to persist.

Head-and-shoulders pattern points to a $2.20 target

Technical analysts have noted the emergence of a head-and-shoulders pattern on SUI’s daily chart, adding weight to the bearish narrative.

According to market analyst NebraskanGooner, this classic reversal setup could push SUI down to the $2.20 region by early July.

The breakdown from the right shoulder coincided with a rejection at the 99-day simple moving average, highlighting a failure to maintain key technical levels.

$SUI (per request)

Rejected key resistance and now back below 99smma

Also looks like a head and shoulders breakdown which yields a measured target in the $2.20’s area. https://t.co/URt8sTIvo5 pic.twitter.com/vIC72brZ7O

— Nebraskangooner (@Nebraskangooner) June 17, 2025

The $3.00–$3.10 region, which previously served as support, now acts as a significant resistance barrier.

If bulls fail to reclaim this area in the coming sessions, the bearish pattern may continue to play out, putting further pressure on price action in the short term.

Fading network activity fuels more doubt

On-chain metrics also paint a bleak picture for SUI’s near-term prospects.

Daily transaction volumes on the network have plummeted from over 19 million to just 9 million, while daily active accounts have dropped from 1.66 million to around 320,000 according to data from SuiVision.

This sharp decline in network activity reflects waning interest and suggests that the earlier rally may have been driven more by speculation than sustained demand.

The loss of momentum in both price and usage underscores the difficulty SUI may face in mounting a swift recovery.

Despite a slight rebound in futures market exposure, with open interest still hovering around $1.2 billion, the broader outlook remains cautious.

Market participants appear to be waiting for clearer signals before committing to new positions.

What to look out for going forward

All eyes are now on the $2.78 support level. A successful bounce from this area could open the door for a move back to the psychological $3 level and possibly toward the monthly high of $3.55.

However, a breakdown followed by a failed retest could pave the way for a drop to $2.20 or even lower.

Looking further ahead, analysts like CoinLore forecast a potential price range of $3.77 to $5.80 by the end of 2025.

However, while this suggests room for long-term growth, the near-term path remains clouded by technical weakness and shrinking on-chain activity.

For now, until bulls reclaim key resistance levels and network fundamentals stabilise, SUI’s short-term outlook will likely remain fragile.

Traders should closely monitor both technical support zones and broader market sentiment before making high-conviction moves.