Stablecoin-issuer Tether has become the 18th-largest holder of United States Treasurys globally, surpassing the holdings of South Korea, according to a recent attestation report.

On Thursday, Tether said in its attestation report for the second quarter of 2025 that it holds $127 billion in US Treasury bills. The company said it has $105.5 billion in direct US Treasury exposure and $21.3 billion held indirectly.

Tether’s current holdings show a $7 billion increase from the first quarter. On May 19, the stablecoin issuer reported having $120 billion in T-bills, overtaking Germany’s holdings to take the 19th spot.

According to US government data, the company’s current holdings exceed South Korea, which has $124.2 billion. It’s also inching closer to the next country, Saudi Arabia, which holds $127.7 billion in T-bills.

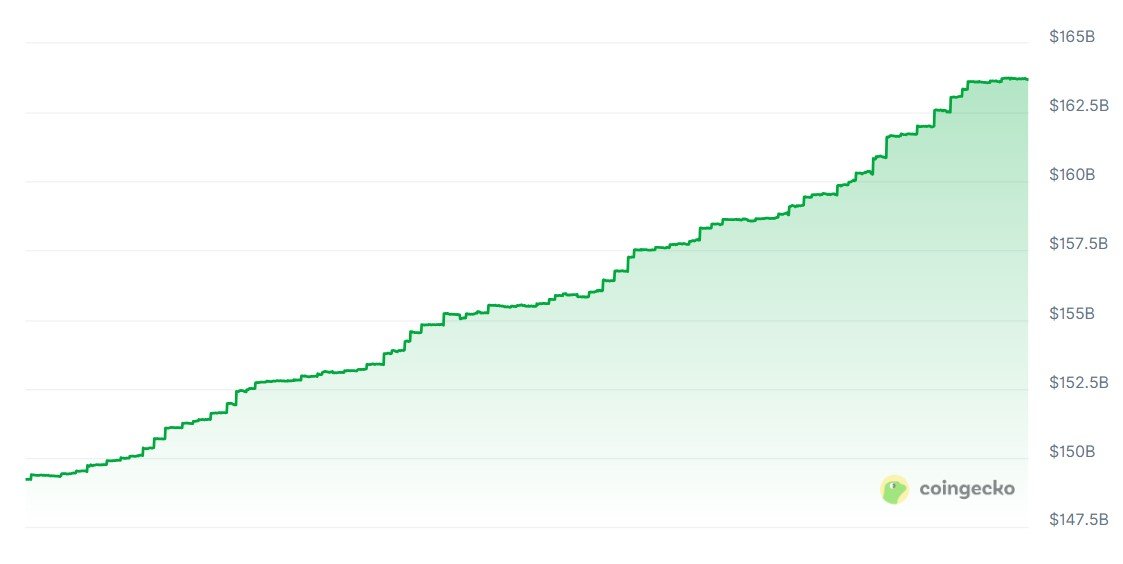

Tether’s market cap surged 19% in 2025

Tether’s current exposure means that it holds more US government debt than several advanced economies like Norway, India and Brazil. This is an unprecedented position for a private company in the digital asset space.

The increase in Tether’s US Treasury holdings comes amid a broader expansion of its USDt (USDT) stablecoin operations.

CoinGecko data shows that on Jan. 1, the stablecoin had a total valuation of $137 billion. At the time of writing, the USDT market cap is $163.6 billion, up nearly 19% year-to-date.

The data also shows that $26 billion in USDT has been issued year-to-date, highlighting the rising global demand for dollar-backed stablecoins.

The massive Treasury portfolio boosts market confidence in USDT’s reserve backing and positions Tether as a major participant in global monetary flows.

Related: From skeptic to supporter: JPMorgan CEO now a ‘believer’ in stablecoins, blockchain

Tether CEO says trust in Tether accelerated in 2025

Tether CEO Paolo Ardoino went on X to say “told you so,” sharing a meme to celebrate the company’s newest milestone.

In the attestation report, Ardoino said the company’s performance in the second quarter of 2025 shows that trust is increasing. “Q2 2025 affirms what markets have been telling us all year: Trust in Tether is accelerating,” he said.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears