Key Takeaways

VINE soared 115.29% to a 6-month high of $0.157 before slightly retracing to $0.151 by press time. A whale bought 22.4 million tokens for $3.19 million, despite losing $125k on the PUMP trade.

Vine Coin [VINE] soared 115.29% in the last 24 hours until press time, hitting a 6-month high of $0.157 before slightly retracing to $0.151.

Over the same period, its Trading Volume surged by 245%, reaching $639 million, while its market cap jumped 113% to $155 million.

The significant increase in volume, accompanied by a corresponding rise in market capitalization, reflects growing on-chain activity and increased capital inflow.

But what triggered the uptick?

Elon Musk’s Vine revival speculation

Significantly, VINE rallied following Elon Musk’s speculation over the app’s revival. On his official X account, Musk posited,

“We’re bringing back VINE but in AI form.”

These claims inspired investors to rush into the market and scoop up Vine tokens. As a result, the VINE’s demand soared across all market participants, especially whales.

Whale joins in on the fun

This increased speculation inspired a whale who had exited the market at a loss to make a comeback.

According to Lookonchain, the whale withdrew 17,082 Solana [SOL] tokens worth $3.19 million to purchase 22.4 million VINE.

This whale returned to the market despite losing $125k days ago, trading pump tokens. When whales return to the market after previously recording losses, it signals conviction in the market.

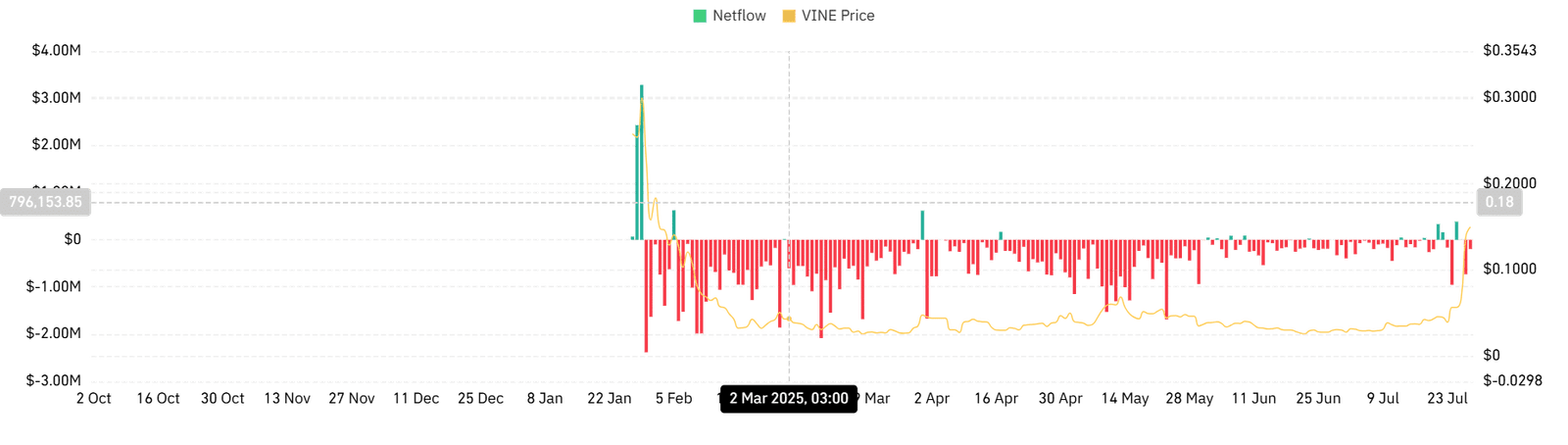

Amid increased accumulation, the memecoin recorded two consecutive days of negative Netflow.

As of this writing, Vine’s Netflow had declined to -$387,000, a drop from- $730,000 the previous day, a clear sign of aggressive accumulation.

Derivatives are bullish too

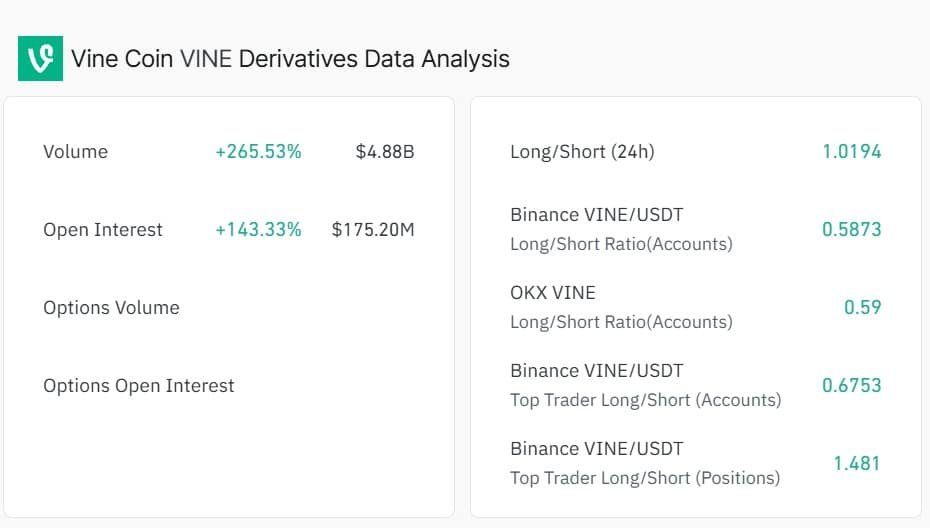

AMBCrypto’s analysis of the derivatives market unveiled that as whales turned to accumulation, others rushed to position themselves strategically.

According to CoinGlass, Vine’s Open Interest surged 143% to $175 million, and Volume jumped 265% to $4.88 billion. Usually, when OI and Volume surge in tandem, it reflects growing participation in the Futures market.

As a result, the memecoin’s Long/Short Ratio surged to 1.019, reflecting a higher demand for long positions. When demand for longs rises, it suggests that traders are actively betting on prices continuing to rise.

What momentum indicators say

According to AMBCrypto’s analysis, Vine rallied as speculative buyers, including whales, returned to the market.

As a result, the memecoin’s Relative Strength Index (RSI) surged to 92, touching overbought territory.

At the same time, the Positive Index (+DI) of the Directional Movement Index (DMI) hiked to 61, confirming strengthened upward momentum.

When momentum indicators are set in this manner, they signal strong upward momentum and its potential to continue.

That said, if buyers continue at the current pace, Vine will reclaim $0.20 and target the $0.23 resistance.

However, if speculation fades and demand disappears as it first emerged, the memecoin will crash and drop to $0.065.