Today in crypto, a new bill introduced in the US Congress seeks to ban public officials from profiting off digital assets. Despite rising tensions in the Middle East, global crypto funds shrugged off market volatility, with investors pouring over $1 billion into crypto products last week. Meanwhile, MicroStrategy’s Michael Saylor hinted at another potential Bitcoin purchase.

Democratic senator introduces bill to address Trump’s crypto ties

California Senator Adam Schiff and nine other Democratic lawmakers have introduced legislation to prevent what they called “financial exploitation of digital assets” by the US president and other public officials.

In a Monday announcement, Schiff and several Democratic senators said they had introduced the Curbing Officials’ Income and Nondisclosure, or COIN, Act, in response to US President Donald Trump’s connections to the cryptocurrency industry. The proposed legislation followed Trump’s disclosure of $57.4 million in income tied to World Liberty Financial (WLF), the crypto platform backed by members of his family.

“President Donald Trump’s cryptocurrency dealings have raised significant ethical, legal and constitutional concerns over his use of the office of the presidency to enrich himself and his family,” said Schiff. “That’s why I am introducing legislation to prevent the financial exploitation of any digital assets by public officials, including the president and the First Family.”

Members of Congress have previously attempted to push through legislation barring certain elected officials, including presidents and their families, from investing in stocks and other assets while in office. However, Schiff’s proposed bill could extend a prohibition on issuing, sponsoring or endorsing cryptocurrencies, memecoins, non-fungible tokens and stablecoins “180 days prior to and 2 years after” an individual’s time in office.

Crypto funds post $1.2 billion inflows despite market panic: CoinShares

Cryptocurrency investment products continued to attract strong investor interest last week despite major crypto assets like Bitcoin and Ether posting notable price drops.

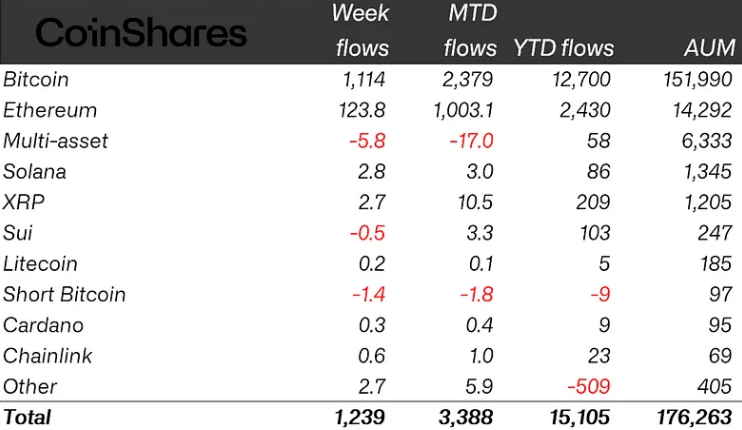

Global crypto exchange-traded products (ETPs) recorded $1.24 billion of inflows for the trading week ending Friday, CoinShares reported on Monday.

With the latest inflows, crypto ETPs continued breaking year-to-date (YTD) inflow records, setting a new historic high at $15.1 billion, said CoinShares’ head of research, James Butterfill.

Despite continued inflows, total assets under management (AUM) in crypto ETPs edged down from $179 billion in the previous week to $176.3 billion by the end of last week.

Bitcoin (BTC) ETPs saw a second consecutive week of inflows, totalling $1.1 billion, despite BTC prices dropping from around $108,800 on June 16 to $103,000 by the end of the week, according to CoinGecko.

The resisting growth in the Bitcoin ETP dynamics despite the spot price decline indicated that investors were buying on weakness, CoinShares’ Butterfill suggested.

“This sentiment was further supported by minor outflows from short-Bitcoin products, which totalled $1.4 million,” he added.

Ether (ETH) ETPs recorded their ninth consecutive week of inflows, netting $124 million last week and bringing the inflow run’s total to $2.2 billion.

“This marks the longest run of inflows since mid-2021, reflecting continued robust investor sentiment toward the asset,” Butterfill noted.

Saylor hints next Bitcoin buy as investor sues over Strategy’s Q1 loss

Michael Saylor has again hinted that Strategy would buy more Bitcoin, though the company formerly known as MicroStrategy and its top brass were hit with an investor lawsuit over its $5.9 billion first-quarter loss on its Bitcoin holdings.

Saylor posted a chart showing Strategy’s past Bitcoin (BTC) purchases to X on Sunday with the caption: “Nothing Stops This Orange.”

His past similar cryptic X posts have been the precursor to Strategy buying Bitcoin. The company has the largest Bitcoin holdings of all public companies at 592,100 BTC, worth around $59.7 billion, with Bitcoin trading just under $101,000.

However, it comes just days after Strategy and the company’s top executives were sued by an investor on Thursday, who claimed they breached their fiduciary duties before reporting a multibillion-dollar Bitcoin loss in its first quarter results.