Are you starting to dive deeper into cryptocurrencies and Bitcoin mining and hearing terms like Bitcoin hash rate that sound confusing? Well, it should not, because hash rate is a significant component that helps keep Bitcoin safe.

As Bitcoin mining develops from a niche industry into a powerful economy poised to grow even further, understanding the metrics like mining hash rate used in monitoring crypto mining is essential. This comprehensive guide will answer the question “What is hashrate”, why it matters, and its impact on miners’ profitability.

What Is Hash Rate in Crypto?

Before appreciating a reasonable hash rate for mining crypto, you must familiarize yourself with essential terms. A Bitcoin hash rate, or hashing power, measures the target hash used in mining and processing transactions in proof-of-work (PoW) blockchain networks.

As the world’s biggest proof-of-work blockchain, Bitcoin has millions of crypto miners distributed in almost every corner of the world. The network’s mining hashrate represents the total number of hash computations the miners can execute in one second or the size of the computational power of the whole blockchain.

Miners compete to crack cryptographic puzzles in the mining process, and the first to solve one earns a block reward and gets to add the next block to the blockchain. Hashing power, therefore, represents the speed at which a miner can guess the answer to the puzzle. The higher the miner’s machine’s hashing power, the greater the chance that the miner will guess the hashing and the more likely they could receive Bitcoin rewards.

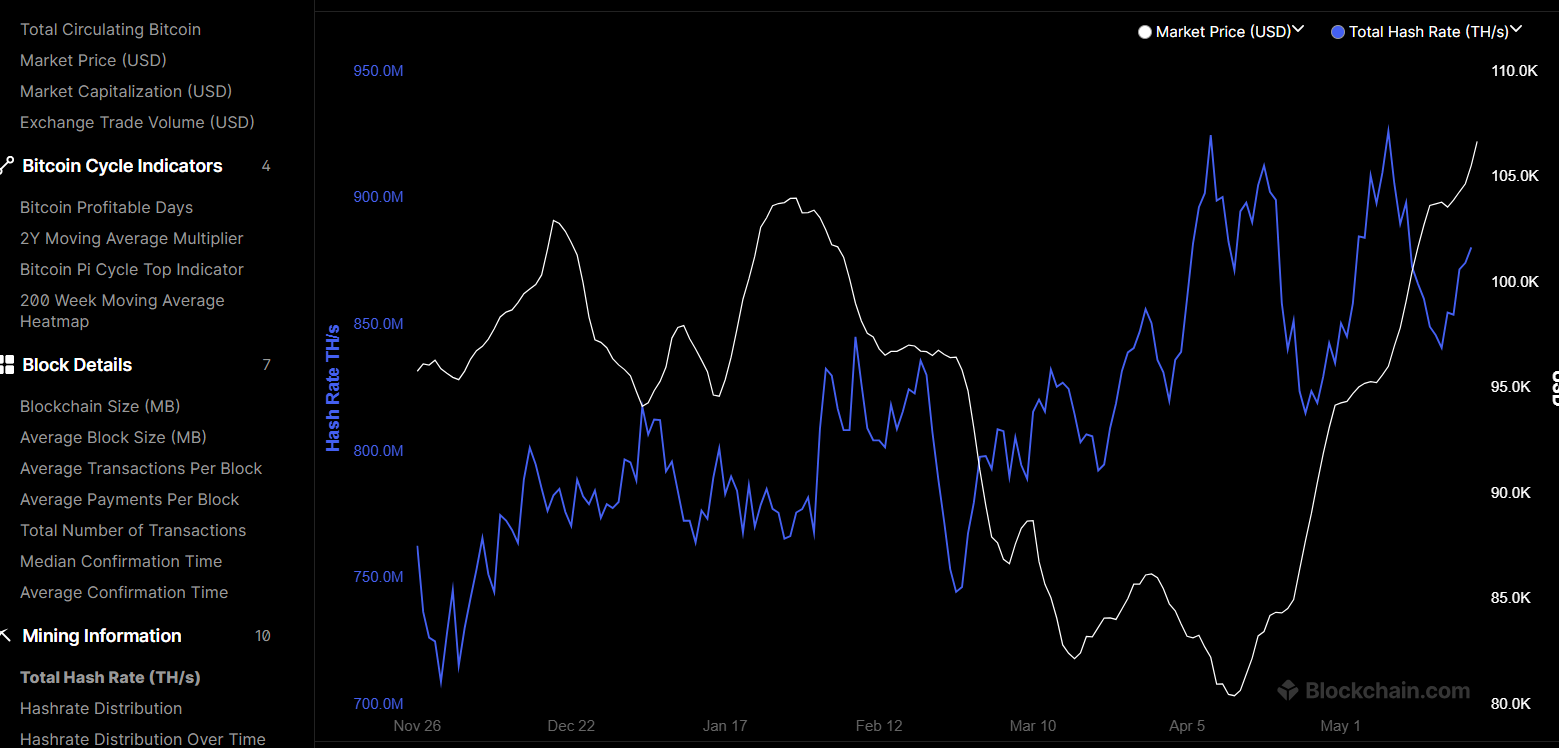

Source: Blockchain

How Do Hash Rates Work?

Hashrate is the primary measurement in the entire mining process for Bitcoin’s proof-of-work system and other cryptocurrency networks. The measurement system evaluates the number of guesses a mining computer can make per second when solving the “hash” on the blockchain network.

Hash refers to a fixed-length alphanumeric code representing a message, word, or data, and in crypto, it can be called a summary of digital data. Cryptocurrencies use unique hashing algorithms to generate hash codes with random alphanumerics denominated in hexadecimal notation. Every hash is generated by data from a block alongside a randomly adjusted number called a nonce via hashing algorithms such as Bitcoin’s SHA-256.

Cryptocurrency mining involves guessing different values for the nonce by generating a new hash every time. The speed at which a miner’s machine can make these guesses is called mining hashrate. For instance, if a Bitcoin mining rig can generate 1 trillion hashes per second, the machine’s hashrate will be denominated as 1 terahash per second (TH/S). It goes without saying that the higher the hash rate, the greater the chance that a miner will find the valid hash and win the block reward.

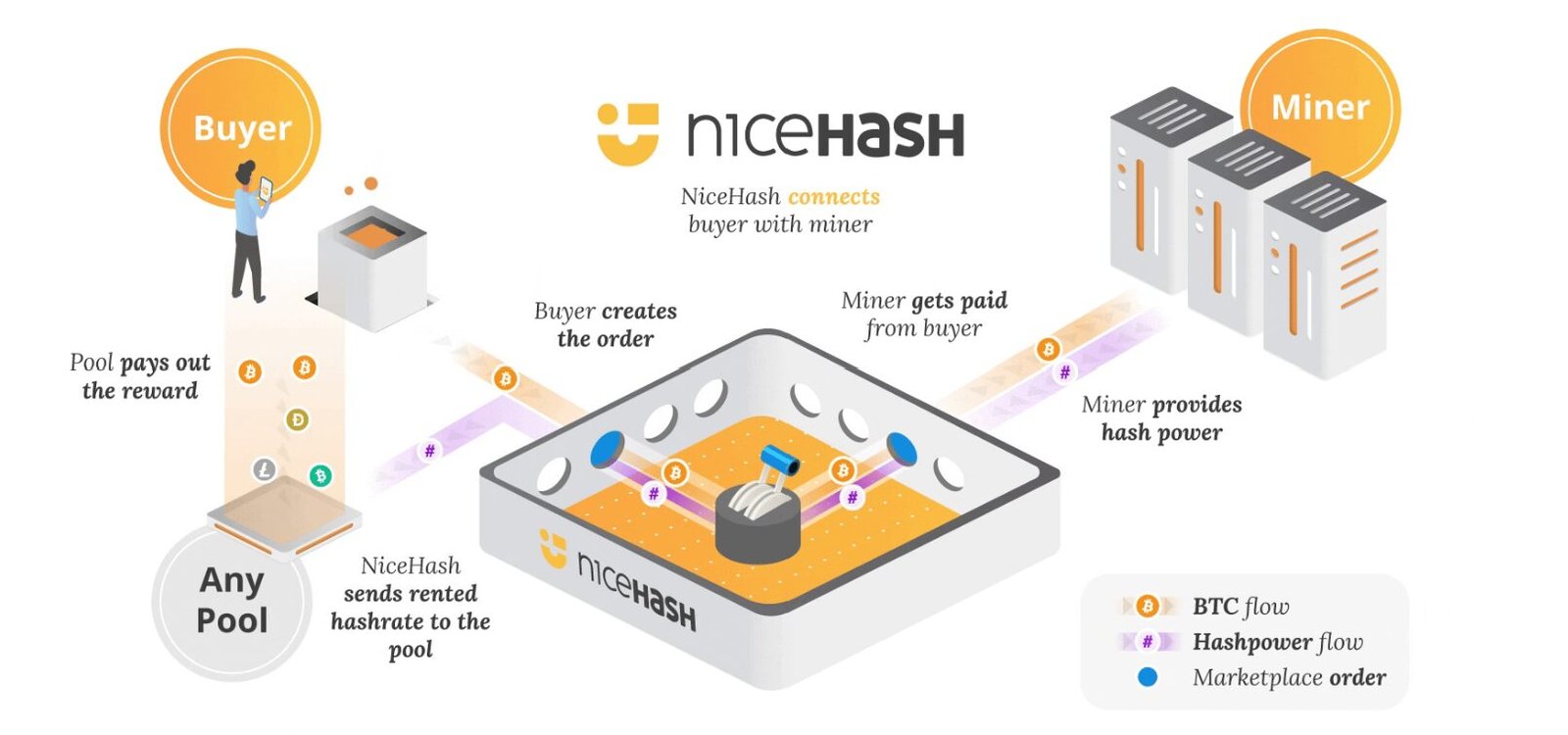

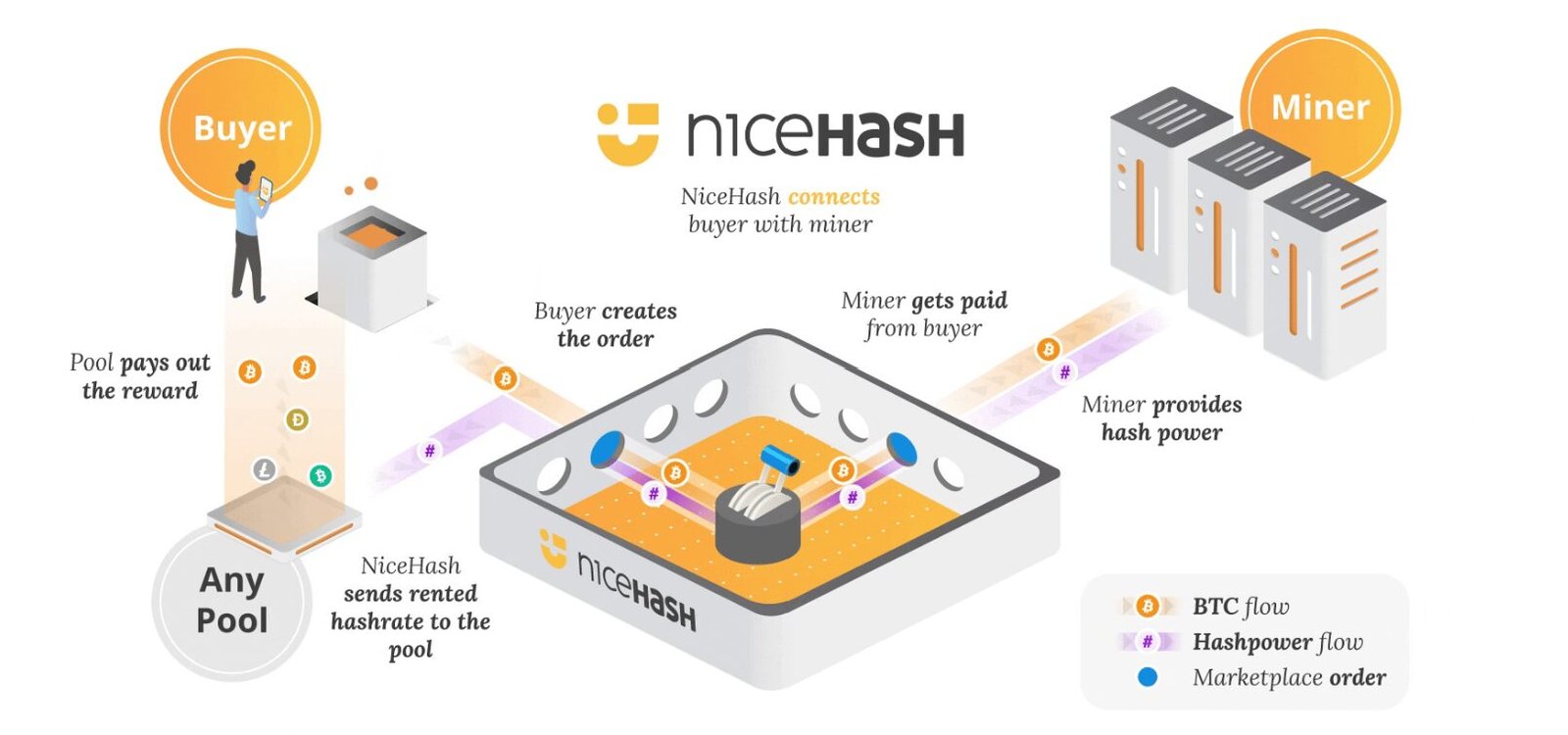

Source: Nicehash

How Hashrate Affects Difficulty and Security

The network automatically adjusts the difficulty level based on the total hashrate so that blocks are mined at a fixed rate, such as every 10 minutes for the Bitcoin blockchain. Moreover, a higher hashrate escalates the difficulty level, while a lower one reduces it. The crypto miner who finds the correct hash that solves the network’s difficulty puzzle earns the right to add a block to the blockchain. The miner is given the newly minted cryptocurrency and the transaction fees associated with the block they validated to reward their effort. The mining process is significant as it guarantees the blockchain network’s security and transaction integrity.

Since the relationship between hashing algorithms and mining difficulty plays a crucial role in success, miners invest in more powerful mining gear to boost their performance. They often turn to all the mining hardware available, especially specialized units like Application-Specific Integrated Circuits (ASICs), which manufacturers specifically design for mining cryptocurrencies like Bitcoin. These machines perform hash computations with much greater speed and efficiency, giving miners a significant advantage.

How is Hash Rate Calculated?

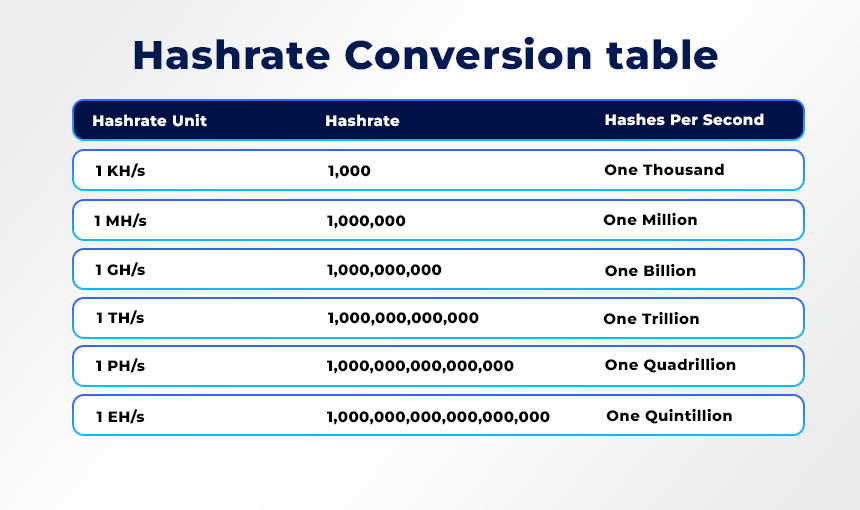

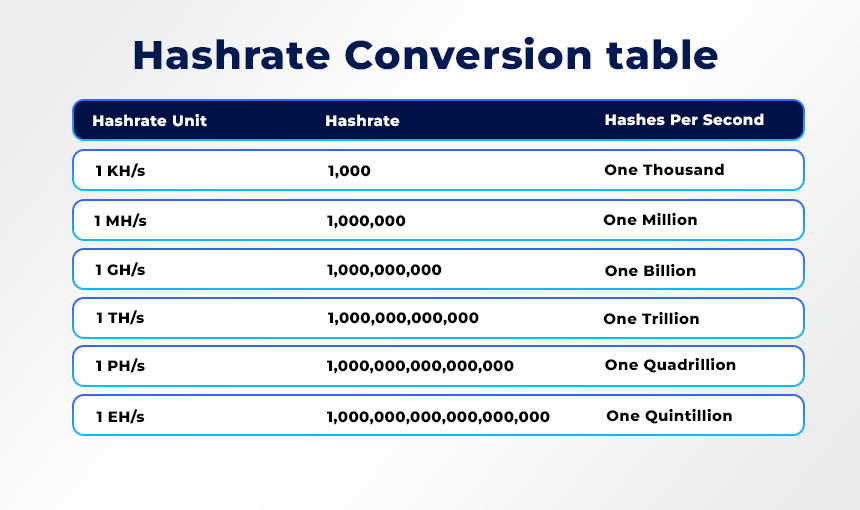

Bitcoin’s rate is measured by the number of hashes, also called “guesses” per second on the blockchain network. This processing capacity is typically expressed using units that increase in scale, starting from kilohashes (KH/s), followed by megahashes (MH/s), gigahashes (GH/s), terahashes (TH/s), petahashes (PH/s), and exahashes (EH/s).

However, since thousands of computers will try to make millions of guesses every single moment, huge networks like Bitcoin mostly measure hashing power in terahashes per second. So, based on the scale, hashing power can be expressed as:

- Kilo Hares per second (KH/s) – Thousands of guesses per second.

- Mega Hares per second (MH/s) – Millions of guesses per second.

- Giga Hares per second (GH/s) – Billions of guesses per second.

- Tera Hares per second (TH/s) – Trillions of guesses per second.

- Peta Hares per second (PH/s) – Quadrillions of guesses per second.

Source: Cryptominerbros

Why is Hashrate Important?

So after answering the question “What is hashrate,” why should you be concerned about hashing power and even invest time to calculate hashrate? The answer to this question can be found when you look at the potential advantages of a reasonable Bitcoin hash rate. The following factors explain why the hash rate matters to anyone interested in Bitcoin mining.

1. Blockchain Network’s Security

A higher Bitcoin hash rate translates to better network security, making it extremely expensive and challenging for an individual entity to execute a 51% attack. For example, overpowering Bitcoin’s current hashing power at over 870.87M in May 2025 would cost individuals billions of dollars, meaning that the current level of decentralization makes BTC remain trustworthy and resilient.

2. Mining rewards

The other benefit of higher hashing power is increasing a miner’s chance to mine a block and receive the block reward successfully. Considering there is cutthroat competition between miners to solve complex mathematical problems, those with more computing power have the technical advantage. Mining hardware like high-end GPUs and ASIC miners help process calculations faster and boost a miner’s chances of earning block rewards.

3. Energy consumption

There’s a close link between mining hashrate and energy consumption as far as cryptocurrency mining is concerned. Mining rigs and ASIC miners consume a lot of energy, directly impacting the miners’ operational costs and potential profitability. As a miner, you want to carefully calculate hashrate so you can carefully balance your energy expenses and the possible rewards you could end up receiving. Making such determinations has caused miners to explore renewable energy sources or relocate to destinations with lower energy costs to maximize profitability.

4. Mining difficulty

Mining difficulty refers to how hard it is to mine a new block on a blockchain network based on existing circumstances. The network automatically adjusts the difficulty level to keep block times consistent. It increases the difficulty when the hashrate rises, ensuring blocks aren’t mined too quickly. On the other hand, mining difficulty decreases as the hashrate drops, ensuring that the network maintains stability and security. In the case of the Bitcoin blockchain, the difficulty adjustment occurs recurrently, mainly after every 2,016 blocks for Bitcoin, helping to balance the network’s performance as miners join or leave.

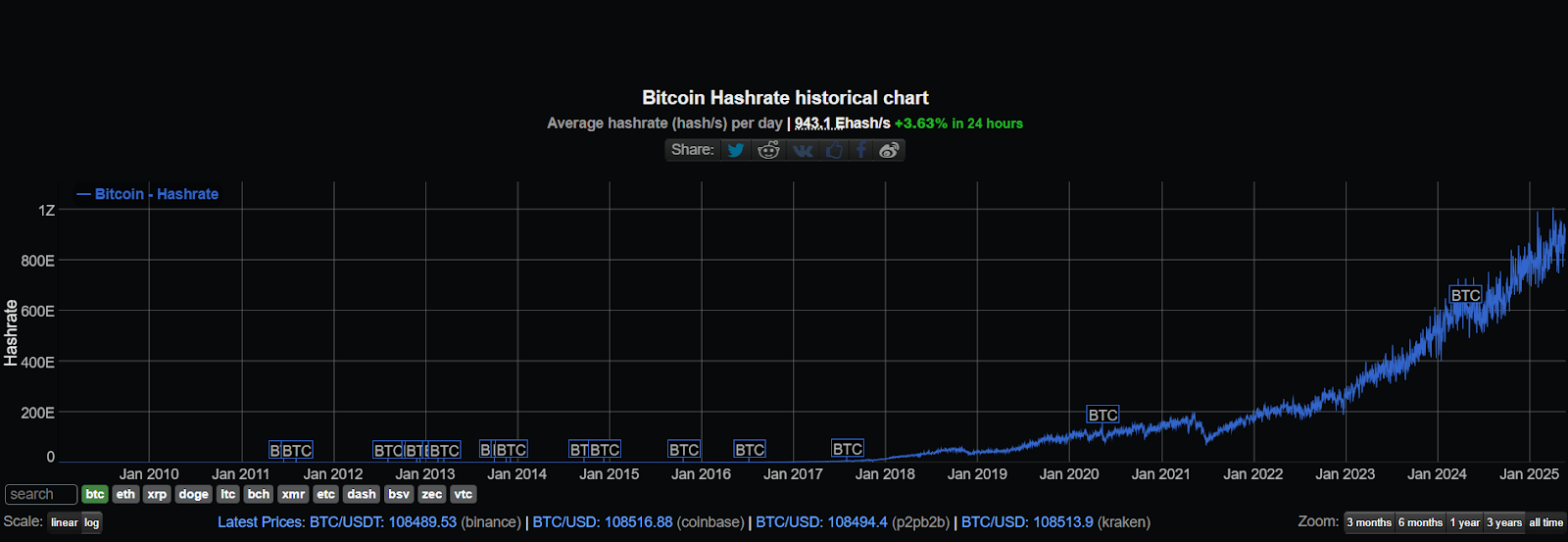

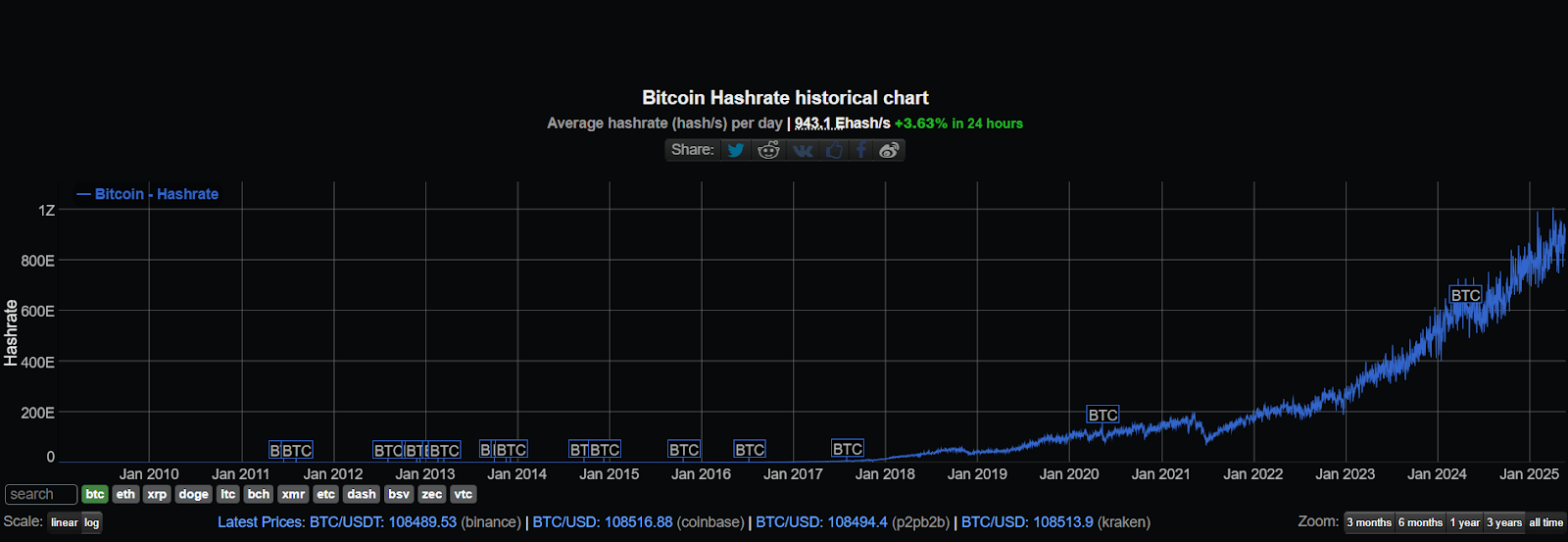

Bitcoin’s Hash Rate

The hashing power has grown so much that by 2024, the global computational power averaged above 911 EH/s, which would become a new record. The increases in mining hashrate highlight an integration of technological advancements, enhanced adoption, and growing profitability for BTC miners. Notably, renowned crypto mining hubs like Texas and Kazakhstan have played a significant role in boosting global mining capacity.

On the other hand, serious geopolitical and electrical consumption policies are also impacting hashing power dynamics. A perfect example is China’s 2021 mining ban that led to a temporary global hashrate dip before miners packed their bags and moved to more favorable regions. Such factors highlight the delicate balance between mining activities, energy access, and cryptocurrency regulation.

Current Bitcoin Hashrate

At the time of writing in May 2025, the Bitcoin hashrate, 870.87MH/s, is the global network hashrate, and an average mining difficulty of 121.66 T at the block height of 897,752.

History of Bitcoin Hashrate

Source: BitInfoCharts

Since its inception, the Bitcoin hash rate has grown tremendously. That’s because, at the beginning, miners could use an ordinary CPU to produce enough computational power. However, as Bitcoin’s popularity grew, more efficient GPUs were needed, and currently, only ASICs are the standard mining equipment.

From the modest hashrates of 2009, when using a standard CPU for Bitcoin mining was the norm, to 2010, when GPU mining emerged, the increase in the BTC network’s computational power has been on an upward trajectory. There was a significant leap in 2013 when ASIC miners came into the picture as the specialized devices advanced mining efficiency, and the result was a dramatic surge in the Bitcoin hash rate.

Additionally, Bitcoin halvings that occur every four years have also influenced hash rate trends. Despite the reduced block reward size, the hash rate has continually increased, pushed by more miners participating and technological advancements. The continuous improvement of ASIC miners has consistently delivered higher hash rates amid less energy consumption, enabling miners to maintain the delicate balance between increasing mining difficulty and profitability.

If you consider the history of the Bitcoin hash rate, you’ll notice that within a few months in 2021, the hash rate increased in line with BTC’s value surge. By the time the price of BTC hit $61,000 in August 2024, the hash rate was a little over 150 million TH/s. On Friday, January 3, 2025, the Bitcoin hashing power hit a record all-time high of over 1,000 EH/s, highlighting the network’s strength and growing mining activity despite uncertain economic times and tightening crypto regulations.

How Can Miners Optimize Their Hashrate?

As more and more miners join the backbone of securing and validating transactions on the blockchain, competition between them increases and the success rate of every participant remains their hashrate. Miners are always looking for ways to improve their profitability, and enhancing the hashrate is one of those strategies.

Below are some strategies you can employ as a miner to improve your odds at profitability:

1. Understand Hash Rate

We’ve learned that a higher hashrate translates to greater computational capacity, thus increasing your odds of hitting the jackpot. You must, therefore, keep learning to discover new methods to increase this rate and improve your efficiency and profitability.

2. Optimize Your Hardware Configuration

Optimizing your mining hardware setup could include investing in the latest ASIC or GPU rig tailored for your mining cryptocurrency. In addition to acquiring specialized devices designed to execute tailor-made mining algorithms, stay informed and make regular hardware upgrades to keep pace with technological advancements.

3. Implement Advanced Cooling Solutions

You could potentially increase the speed of your mining hardware by using overlocking techniques and cooling solutions. Mining hardware generates excess heat, necessitating advanced cooling solutions to prevent overheating and maintain stable operations at higher speeds. Learn about emerging technologies like liquid cooling or custom cooling setups and implement them as needed.

4. Participate in Mining Pools

Many competing miners are now joining mining pools to enhance their collective hashrate. Miners can increase their hashrate dramatically when they combine their computational power. When they successfully mine a block, they split the block rewards in line with the computational power they distributed.

5. Algorithmic Optimization

Different cryptocurrencies employ distinct consensus algorithms, each requiring unique mining configurations. Miners strategically switch from one digital asset to another based on mining difficulty and profitability. You can easily increase your hashrate by choosing crypto with favorable mining algorithms or seeking to optimize your mining software for selected algorithms.

6. Energy Efficiency and Sustainability

Consider switching to eco-friendly energy sources due to increasing global environmental concerns. Miners now use sustainable mining practices by using renewable energy sources like wind and solar power to reduce their carbon footprint. Consider using energy-efficient mining hardware that guarantees a higher hashrate per unit of energy consumed.

7. Continuous Learning and Adaptation

New technologies and algorithms emerge constantly in the dynamic cryptocurrency space. It is in a miner’s best interest to stay updated on new ways of optimizing their Bitcoin hash rate in line with emerging software updates, technological advancements, and algorithm changes that could enable them to fine-tune their setups for optimal performance. Endeavor to actively participate in mining communities and online forums so you can stay abreast with the latest techniques on effectively enhancing your hash rates.

Conclusion

Whether you’re a cryptocurrency miner, an investor, or a blockchain enthusiast, you need to understand how hashing power works because applying that knowledge directly affects your ability to earn block rewards.

As the crypto mining landscape anticipates fresh interest due to growing governmental and institutional interest in Bitcoin and other cryptocurrencies, your knowledge of mining hashrate will determine whether you will get a share of the pie or just be watching from the sidelines. Since understanding hashrate comes as a multifaceted role depending on whether you are an individual miner or an investor, it pays to continue learning about hash rates and how you can use the knowledge you acquire to your advantage as a mining expert now.

FAQs

What is a good hash rate for mining?

As far as hash rate is concerned, the term “good” as far as hash rate is relative as it depends on factors like the particular asset you’re mining, the hardware you’re using, and the difficulty level of the network. To use Bitcoin mining as an example, individual mining rigs with a 100 TH/s hashrate coming from an efficient ASIC miner can qualify to be competitive. On the other hand, if you’re mining on a smaller blockchain with lower difficulty, you’ll still do well with a lower hashrate. The bottom line is the profitability of a hashrate depends on how well you balance electricity costs and mining rewards.

What is Bitcoin hashrate?

Bitcoin hashrate refers to the amount of computational required to accomplish mining and secure the Bitcoin network and reflects how much computing power all the miners collectively contribute to the blockchain network.

Is a higher hashrate better?

Most experts agree that a higher hashrate improves the efficiency of a proof-of-work cryptocurrency network by making it more resistant to attacks. Since many miners are competing to mine blocks by solving the special mathematical function, there is less chance of malicious attackers successfully invading the network.

How much is 1 hash rate?

A hash rate of 1 is 1 hash per second (H/s), representing the computational power a blockchain network needs to validate transactions and solve cryptographic or mathematical puzzles. Depending on the level, the unit is called up using the prefixes kilo, mega, giga, or tera to quantify larger hash rates.

How much hashrate is needed to mine 1 BTC?

Several factors influence how much hashrate is needed to mine 1 Bitcoin. Typically, if you mine alone with a hashrate of 100 TH/s, it would take around 30 days to mine 1 BTC. However, in real-world scenarios where mining is highly competitive, the actual requirement can vary greatly. Therefore, it depends on factors such as network difficulty, mining pool efficiency, and hardware performance.

Where can I see current hashrates?

Different websites and platforms display real-time hashrate data for countless blockchain systems, especially those built on PoW networks. You could check out the current hashrates among these platforms:

- Blockchain.com: Charts and data for different cryptocurrencies.

- Minerstat: Network hashrate and hashrate distribution for Bitcoin.

- BitInfoCharts: Bitcoin hashrate data tracking and graphs

- YCharts: Bitcoin network hashrate historical data

- NiceHash: Insights into hashrates and CPU mining

- Hashrate.no: Hashrates data and potential earnings calculators

- HashrateIndex: Bitcoin hashrate data and potential ASIC miner profitability

- Koinly: For a list of websites that track hashrates

- Swan Bitcoin: Interactive Bitcoin hashrate graphs