As tokenized stocks continue to narrow the boundaries between traditional assets and blockchain infrastructure, a growing debate has emerged: Are tokenized stocks a better alternative to exchange-traded funds (ETFs)? ETFs have long been the go-to instrument for retail and institutional investors seeking passive exposure to equities. However, tokenized stocks are now offering a compelling, blockchain-native alternative—one that is flexible, composable, and available 24/7.

ETF Fundamentals: Familiar, Regulated, and Liquid

Exchange-Traded Funds are widely regarded as one of the most successful financial products of the 21st century, offering investors diversified exposure to equities, bonds, or commodities with daily liquidity and tight regulatory oversight.

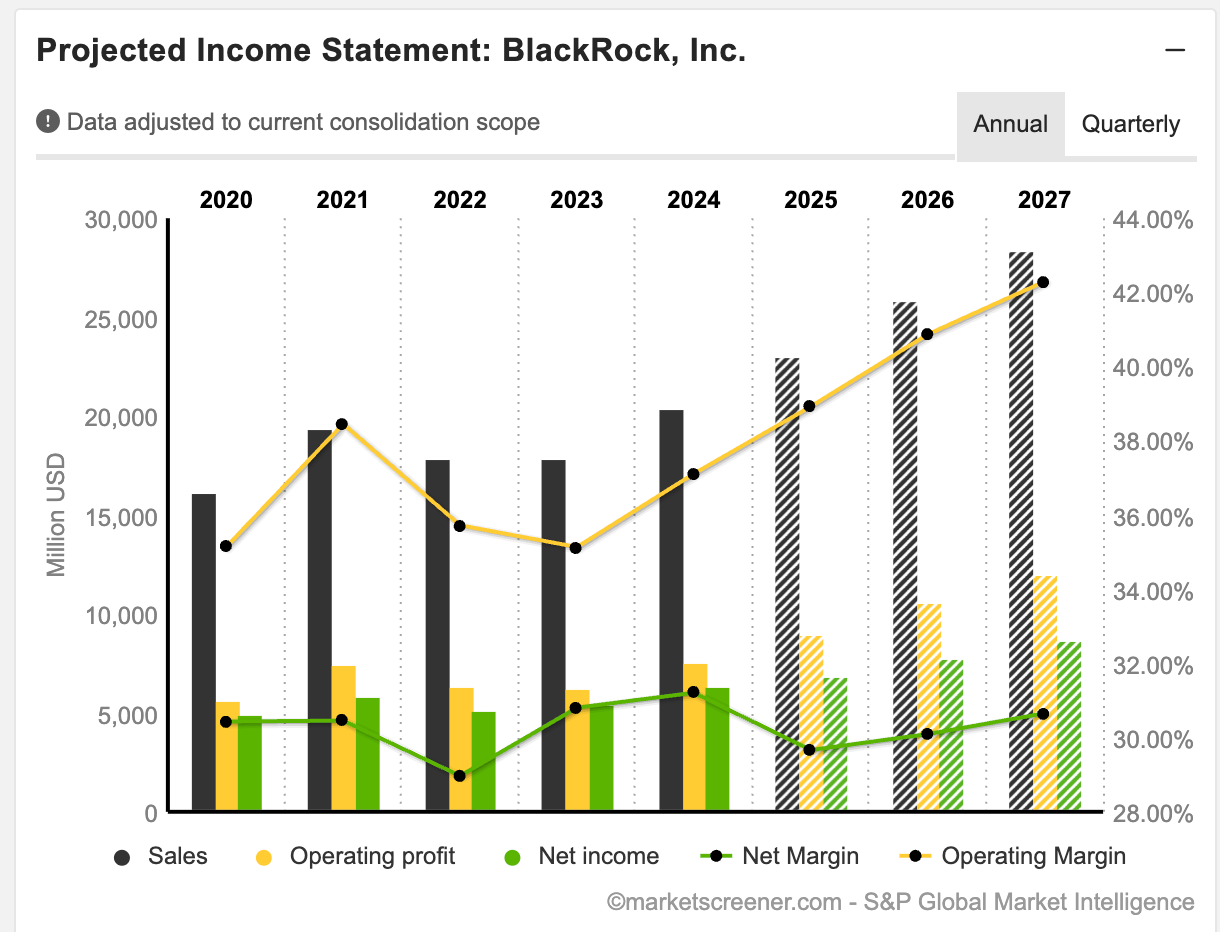

Managed under the 1940 Investment Company Act in the U.S., ETFs are required to disclose holdings daily, provide audited financials, and comply with stringent risk controls. BlackRock’s iShares, for example, dominates the space with over $3.3 trillion in global ETF assets as of Q2 2025, including sector-specific, country-focused, and thematic ETFs.

Source: Blackrock

These products are listed on major exchanges like NASDAQ or NYSE, allowing retail and institutional investors to access them through standard brokerage accounts. Their familiarity, SEC regulation, and tax-efficient structure make them ideal for traditional investors. However, they trade only during market hours and often include management fees.

While ETFs offer regulatory certainty and strong investor protection, they remain constrained by TradFi rails, limited composability, and no real-time settlement. In the case of BlackRock ETFs, investors are dependent on custodians and intermediaries and cannot use shares in DeFi applications or access them 24/7 — a key limitation as financial infrastructure becomes increasingly on-chain.

Tokenized Stocks Fundamentals: Programmable, Borderless, and 24/7

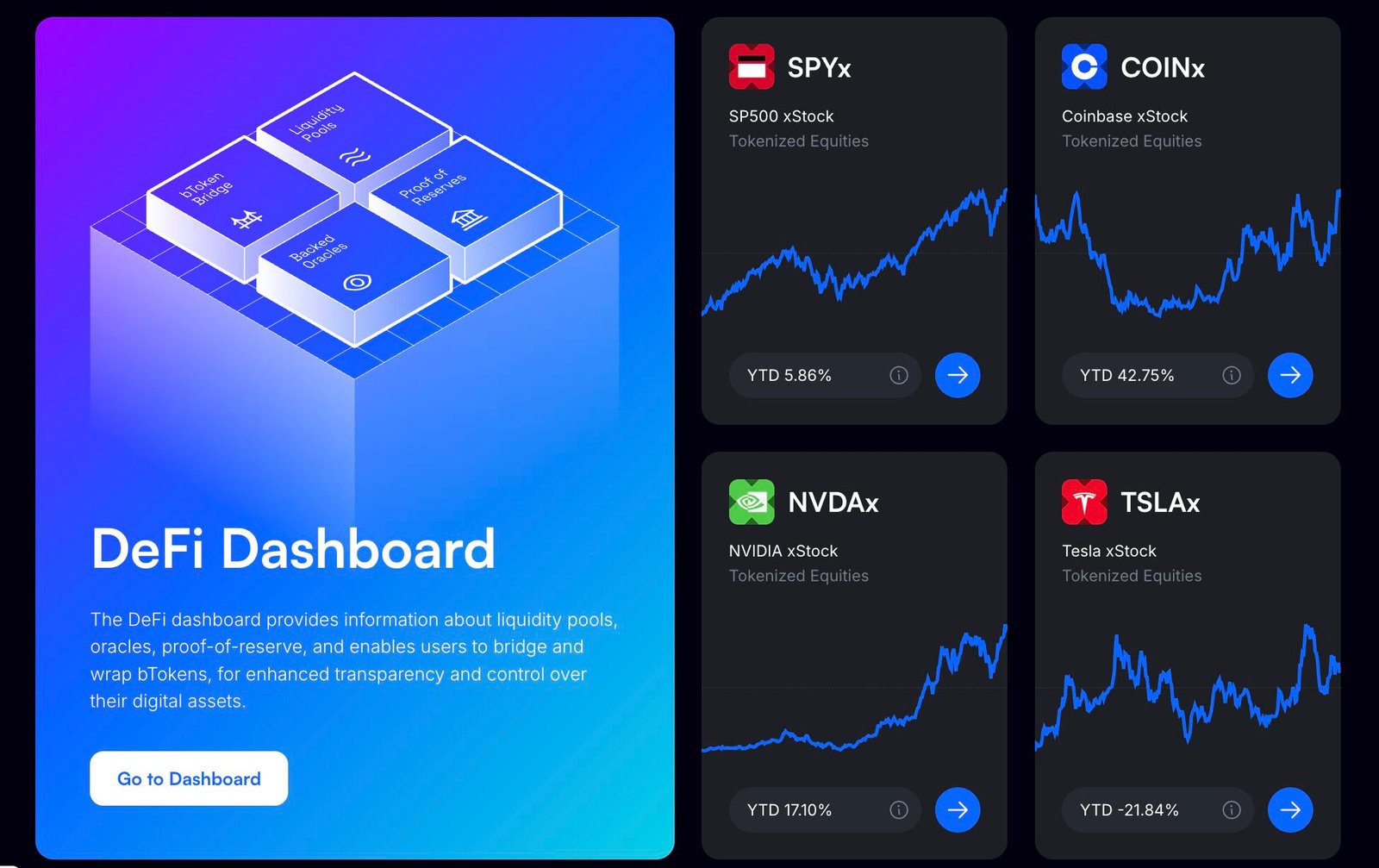

Tokenized stocks represent a new financial primitive—equities that are mirrored or wrapped onto blockchain networks, enabling decentralized, round-the-clock trading without intermediaries. These assets are typically backed 1:1 by underlying shares held in custody, with the token existing on-chain as a tradable representation. Projects like Backed Finance’s xStocks have pioneered this space, offering over 60 tokenized versions of U.S. equities (including Tesla, Apple, and NVIDIA) on blockchains like Ethereum and Avalanche.

Unlike ETFs, xStocks can be swapped permissionlessly on DEXs, used as collateral in lending protocols, or embedded into smart contracts. This gives them a level of financial composability and programmability that ETFs lack. However, tokenized stocks operate in a regulatory gray zone. While Backed Finance is licensed under Swiss law and follows MiCA-aligned frameworks in Europe, these products are generally unavailable to U.S. users and rely on offshore structures to function.

Liquidity is also a constraint — daily trading volumes for tokenized equities remain modest, averaging $100K–$300K per asset, far below ETF benchmarks, often spread across fragmented DeFi venues like Uniswap or Curve. Yet, their 24/7 trading window, fast settlement, and DeFi integration offer a glimpse into a more flexible future. In essence, tokenized stocks trade off regulatory clarity for open access and composability — presenting a compelling alternative for crypto-native investors.

For more: Tokenized Stocks: The Future of Equities on the Blockchain

Case Study: xStocks by Backed vs BlackRock ETF Products

In the race to modernize equity exposure, xStocks by Backed Finance and BlackRock ETFs represent two fundamentally different paradigms: one rooted in traditional finance and regulation, the other pushing the frontier of programmable, on-chain assets.

BlackRock, the world’s largest asset manager, operates within the well-understood regulatory structure of ETFs. Their products, such as the iShares Core S&P 500 ETF (IVV) or iShares MSCI Emerging Markets ETF (EEM), are backed by real assets, trade on centralized exchanges, and are available to nearly every brokerage customer globally. These ETFs benefit from decades of regulatory clarity, deep liquidity, and integration into the global financial system.

Source: IVV

For example, IVV alone sees an average daily trading volume of over $1.2 billion, and institutional investors often use ETFs as low-cost vehicles for index exposure. However, they operate only during stock market hours, cannot be used within DeFi, and are dependent on centralized custodians and intermediaries.

On the other side, xStocks by Backed Finance tokenize real-world equities like Apple (bAAPL), Tesla (bTSLA), and NVIDIA (bNVDA) on public blockchains such as Ethereum, Avalanche, and Base. Each xStock is backed 1:1 with the underlying share, held in custody by a regulated Swiss trustee. These tokens can be traded 24/7 on DeFi platforms, used as collateral, and integrated into smart contracts — something BlackRock’s ETFs simply cannot do.

Source: Backed Finance Homepage

xStocks unlock new financial use cases such as yield farming with equities, composable lending markets, and tokenized portfolio automation. However, xStocks are only available to non-U.S. users, and trade volumes are modest — typically ranging from $50K to $300K per day, with limited liquidity compared to ETFs. Moreover, because they are not listed on centralized exchanges, their price discovery relies on decentralized market makers or integrations with DEX aggregators.

The difference is more than just accessibility. It’s about what finance becomes. BlackRock ETFs represent a top-down, institution-first world where rules are clear, but flexibility is limited. xStocks, in contrast, offer a bottom-up, code-driven vision of capital markets that are open, composable, and constantly on — but still in regulatory limbo and early in adoption.

Critically, this divergence reflects the macro shift from paper-based finance to programmable finance. If tokenized equities like xStocks can scale liquidity, achieve regulatory alignment (like under Europe’s MiCA), and integrate with identity/compliance layers (such as zkKYC or smart whitelists), they could begin to rival ETFs in both adoption and versatility. Already, platforms like Kraken, Republic, and Robinhood EU are experimenting with similar tokenized offerings — a signal that even TradFi players are watching this frontier closely.

In conclusion, BlackRock ETFs win on compliance and scale, but xStocks win on composability and innovation. As regulation catches up and DeFi infrastructure matures, the gap may close — and tokenized stocks could reshape how investors, both retail and institutional, think about equity access in a 24/7 global economy.

| Feature | xStocks (Backed) | BlackRock ETF |

| Accessibility | Global, 24/7 | U.S.-centric, market hours |

| Regulation | Emerging / Swiss-compliant | Full U.S. SEC oversight |

| Tradability | DEX, OTC, on-chain | Broker platforms |

| Composability | Yes (DeFi, lending, etc.) | No |

| Custody | Self-custody or custodian | Broker custody |

| Yield integration | Yes (DeFi staking, LP) | No (passive index) |

As we see in the near future, DeFi will expand, and more investors as well as institutions from traditional markets are looking to integrate real-world assets into their on-chain portfolios. This gives tokenized stocks a unique growth angle, especially in emerging markets where access to broker-dealer networks is limited.

For more: Ripple USD (RLUSD) Stablecoin: Forging a Path for Institutional Digital Finance

The Bigger Picture: ETFs Tokenizing vs. Tokenized Stocks ETF-izing

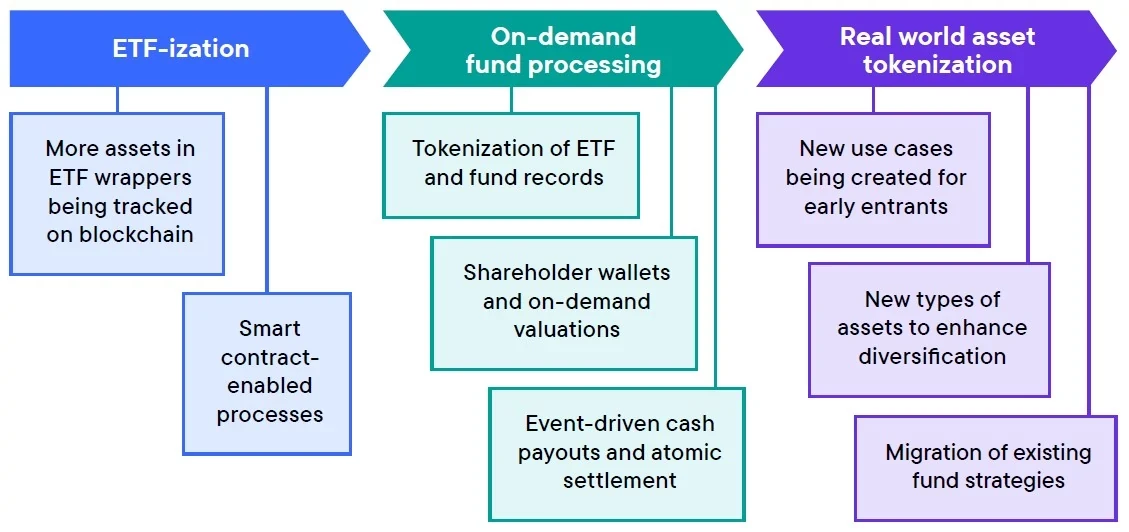

Interestingly, both sides of this spectrum are evolving. Traditional ETF issuers like Franklin Templeton and WisdomTree are experimenting with tokenizing ETFs themselves, issuing fund shares on blockchain infrastructure.

At the same time, tokenized stock issuers are adopting ETF-like qualities—offering wrapped products, risk disclosures, redemption mechanics, and asset baskets. The convergence is happening, but the ethos differs:

- ETFs on-chain: Regulated wrappers with blockchain plumbing

- Tokenized stocks: Native digital assets reimagining equity distribution and composability

This hybrid future could see BlackRock ETFs and xStocks co-exist—and even collaborate—depending on infrastructure and regulatory alignment.

Which Will Win in the Long Run?

There will be no specific or precise answer to this question. Both instruments will likely thrive in parallel:

- ETFs will remain dominant in regulated environments, pensions, and wealth management.

- Tokenized stocks will flourish in crypto-forward jurisdictions, borderless capital markets, and programmable finance ecosystems.

However, the trajectory of innovation heavily favors tokenized models:

- DeFi-native traders are choosing flexibility and composability.

- Institutions are slowly warming up to tokenized RWAs.

- Retail wants fractional, global, and always-on access.

As legal frameworks evolve and infrastructure matures, tokenized stocks could eclipse ETFs in use cases beyond passive exposure—especially where autonomy, speed, and interoperability matter.

Conclusion

ETFs and tokenized stocks represent two visions for the future of investing. One is grounded in legacy compliance and scale. The other is built on the promises of decentralization, programmability, and inclusivity. In the long run, the winner may not be one or the other—but a blended model where tokenized financial instruments offer the best of both worlds. For now, the lines are being drawn. But as investor behavior shifts and Web3-native assets gain legitimacy, tokenized stocks are poised to challenge—even redefine—the future of global equity markets.